Speaking at the Economic Club of Chicago yesterday, Fed chair Jerome Powell warned that the US is on an “unsustainable” fiscal path amid rising deficits. He also cautioned that the Trump administration’s trade policies could lead to higher inflation and slower growth.

In response to a question on how much the US Federal debt can rise before it reaches unsustainable level, Powell said that “the federal debt in the United States is on an unsustainable path, but it has not yet reached an unsustainable level, and no one really knows how much further we can go.”

Powell cautions on unsustainable deficits

He added, “Over time, other countries (debt levels) have gone further, but we are currently operating with a very large deficit at full employment, and this is something we need to address as soon as possible, the sooner the better.”

Powell said that the deficit is not a “Federal Reserve problem” and alluded that politicians were taking the wrong approach by targeting discretionary spending, which he said not only contributes a small percentage of total spending but also its share in total spending has been gradually falling.

“The largest and fastest-growing portions are Medicare, Medicaid, Social Security, and now interest payments, so this is indeed where efforts need to be focused, and these issues can only be resolved on a bipartisan basis; neither side can find a solution without the involvement of both, so this is crucial,” added Powell.

The US budget deficit soared in the first half of the current fiscal year

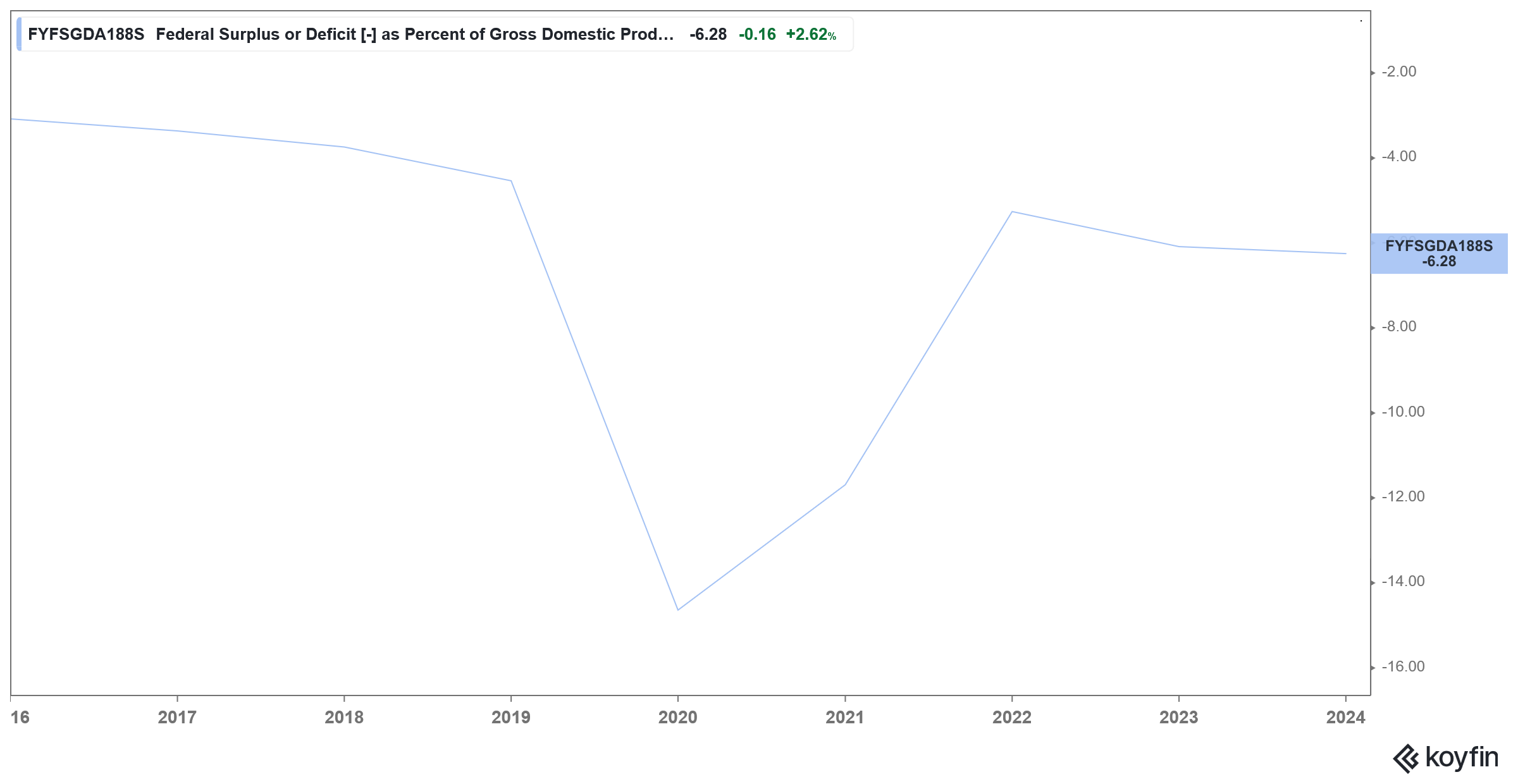

To be sure, the components mentioned by Powell indeed account for a big chunk of government spending. In the first six months of the current fiscal year, the US government’s budget deficit rose to $1.3 trillion, which is the second highest in history for the period. The only time the deficit was higher was in the fiscal year 2021 when the deficit jumped to $1.7 trillion in the first six months due to higher spending during the COVID-19 pandemic

The total government debt has surged to $36.2.1 trillion and has long surpassed the national GDP. The rising debt pile has led to a massive increase in interest expense, and the Treasury Department estimates that it will spend $1.2 trillion on interest payments this year.

Notably, the US fiscal deficit hit a record high of $3.13 trillion in the fiscal year 2020. The surge was understandable as the economy needed support during the pandemic. The deficit came down to $2.77 trillion in the fiscal year 2021. It fell further to $1.38 trillion in the next fiscal year, and while it was much below the previous year, it was significantly higher than in pre-pandemic times, when the deficit was contained below $1 trillion. However, in the fiscal year 2024, the budget deficit increases to $1.8 trillion.

Trump’s DOGE is trying to cut down on federal government spending

Many fear that the fiscal path that the world’s biggest economy has been pursuing since the COVID-19 pandemic is unsustainable, and the country needs to bring down its burgeoning fiscal deficit that has surpassed its national GDP.

Commenting on the budget deficit data, Maya MacGuineas, president of the nonpartisan Committee for a Responsible Federal Budget, “The numbers are undeniable. We are racking up debt at an alarming pace, and it’s unlikely to end any time soon. In fact, lawmakers seem hellbent on adding to that sum with trillions of unpaid-for tax cuts and spending increases.”

Notably, President Trump formed Department of Government Efficiency (DOGE) headed by Elon Musk to advise him on cutting government spending. While previously, Musk touted that DOGE could cut spending by almost $1 trillion, the White House says that it is targeting annual savings of $150 billion.

Powell warned about deficits previously as well

Meanwhile, Powell has warned about higher budget deficits previously also. In his interview with CBS 60 Minutes last year, Powell said, “The U.S. federal government is on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy.”

He added, “I think the pandemic was a very special event, and it caused the government to really spend to ward off what looked like very severe downside risks. It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.”

While Powell said that the Fed’s role is not to “judge” the fiscal policy, he warned, “we’re effectively — we’re borrowing from future generations. And every generation really should pay for the things that it, that it needs. It can cause the federal government to buy the things that it needs for it, but it really should pay for those things and not hand the bills to our children and grandchildren.”

Buffett also sounded an alarm over higher budget deficits

In this year’s annual letter, Warren Buffett also sounded an alarm over higher fiscal deficits and said, “Paper money can see its value evaporate if fiscal folly prevails. In some countries, this reckless practice has become habitual, and, in our country’s short history, the U.S. has come close to the edge.”

Ray Dalio, who has been quite vocal about the need to address the burgeoning national debt and budget deficit, believes that the US needs to cut the deficit to around 3% of GDP versus the 7.2% that it currently stands at.

Speaking with CNBC’s Sara Eisen at CONVERGE LIVE in Singapore, the Bridgewater founder said the US would need “to sell a quantity of debt that the world is not going to want to buy.” He added, “That’s a big deal. You are going to see shocking developments in terms of how that’s going to be dealt with.”

Powell also spoke about the repercussions of Trump’s policies

In his speech yesterday, Powell also talked about the impact of Trump’s economic policies, particularly the tariffs. The Fed chair said, “The announced tariff increases so far have been much larger than expected. The economic impact may also be so, which will include higher inflation and slower growth. Short-term inflation expectation indicators based on surveys and markets have risen significantly, with survey participants pointing to tariffs.”

Notably, several economists raised the odds of a US recession amid Trump’s reciprocal tariffs. In his annual letter, JPMorgan CEO Jamie Dimon said, “Whatever you think of the legitimate reasons for the newly announced tariffs – and, of course, there are some – or the long-term effect, good or bad, there are likely to be important short-term effects.”

While Trump walked about on the reciprocal tariffs and replaced them with a flat 10% tariff on all countries, the US has increased tariffs on some Chinese goods to as high as 245% while sparing tech items like smartphones and computers. The tit-for-tat tariffs from China have added fuel to the fire in the US-China trade war.

Question & Answers (0)