Nvidia shares (NYSE: NVDA) are trading lower today amid reports that Huawei is testing its latest artificial intelligence (AI) chip, Ascend 910D, which is expected to be more powerful than Nvidia’s flagship H100 AI chips. These chips are successors to the 910B and 910C chips and are reported to enter mass production soon.

The chips could add yet another dimension to the tech/trade war between the US and China and could hit Nvidia’s fortunes in China. Nvidia faces restrictions on exports on sales of its advanced AI chips to China.

On multiple occasions, Nvidia has warned that its long-term competitiveness in China, which accounted for 20% of its data revenues before the ban, might be negatively impacted, and it would lose out on business in the country.

During the fiscal Q4 2025 earnings call earlier this year, Nvidia said, “as a percentage of total Data Center revenue, data center sales in China remained well below levels seen on the onset of export controls.”

Nvidia faces export control restrictions

Earlier this month, the Trump administration further tightened the restrictions on exports of advanced AI chips to China. The company would now need a license to export its H20 GPU to China. Notably, Nvidia developed these chips specifically for China after the Biden administration barred it from exporting its top-of-the-line AI chips to the Communist country.

In an exchange filing, Nvidia said that it would incur a charge of $5.5 billion in the current quarter related to the new export control restrictions.

Multiple brokerages slashed Nvidia’s target price following the new export control restrictions. In his note, Wedbush analyst Dan Ives wrote, “Nvidia is a key strategic asset for the US and the Trump Administration during this very tense period with China … and the White House is going to make sure its chips do not help Beijing in the AI Revolution.”

He added, “The Street will take this news with clear nervousness, worried these are the first shots fired in the tech battle between the US and China and Beijing/Xi are not just going to take this news and walk away.”

Ives, who has a $175 target price on Nvidia, said, “We will continue to see a major back and forth between the US and China as the market and the economy is caught in the middle with this tariff battle royale.”

Huawei’s new chip could challenge NVDA’s dominance

So far, Nvidia has had an almost monopoly in the AI chip market. However, Huawei’s latest GPU, if it indeed turns out to be as powerful as what the company is claiming, could be a major threat to Nvidia.

As for Huawei, it has faced US sanctions in the past as well. However, the Chinese tech giant previously managed a chip breakthrough despite crippling sanctions. The company’s new smartphones are an instant hit with Chinese consumers, and its soaring sales are coming at the cost of iPhone sales in the country.

Apple has been gradually losing market share in China as domestic smartphone companies, especially Huawei, whose business suffered a near-death blow due to the US sanctions, have come up with attractive offerings. Last year, Apple lost its market-leading position in the Chinese smartphone market to Vivo, with Huawei coming in a close third.

DeepSeek’s low-cost model

Meanwhile, it could be the second major blow to Nvidia from a Chinese tech company. Earlier this year, Chinese startup DeepSeek said that its AI model is offering a much better value proposition as compared to those from US giants like OpenAI, which happen to be big buyers of Nvidia chips. The news led to a sell-off in Nvidia as well as other tech shares.

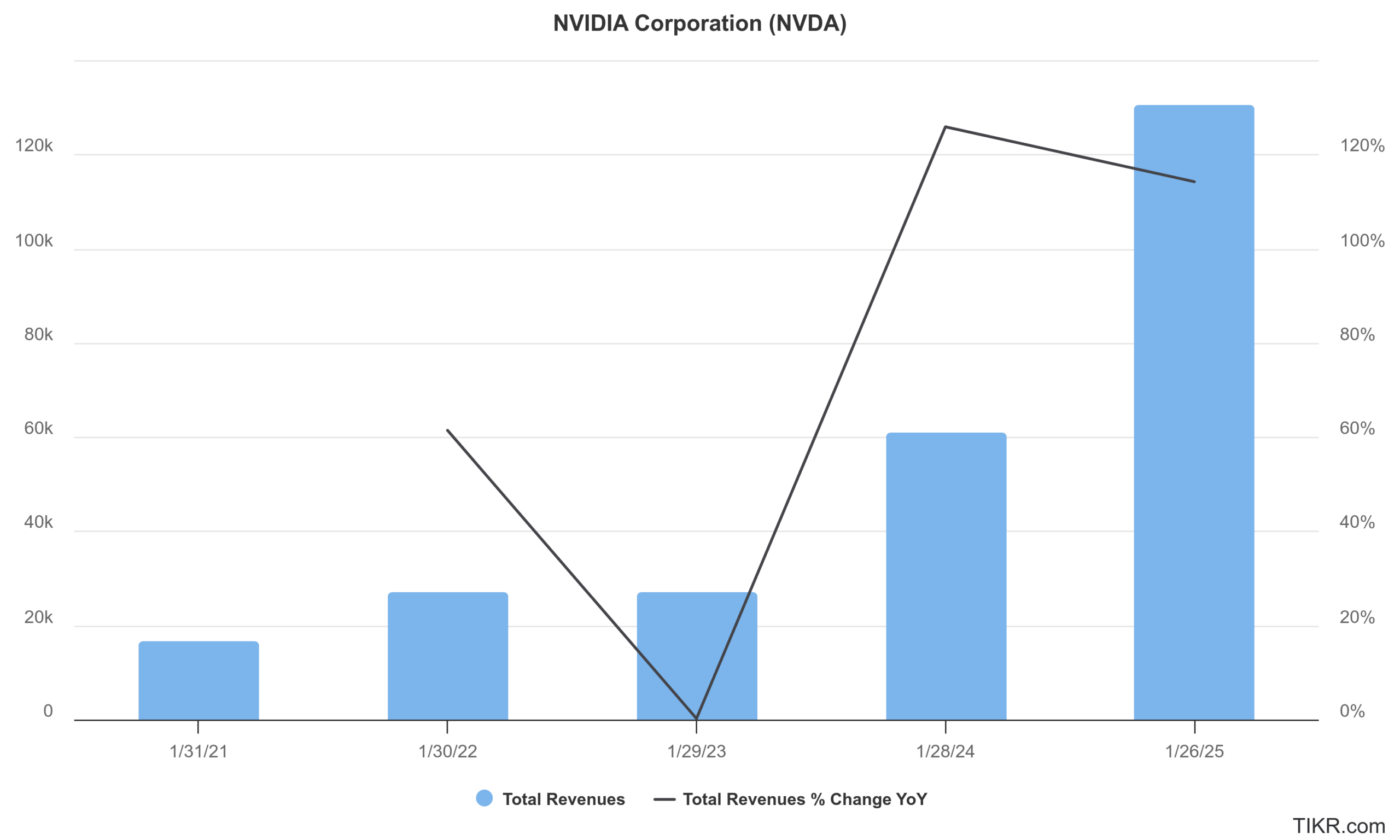

The company’s AI chips have been in high demand and have led to a sharp rise in its revenues and profits. Nvidia’s revenues have been growing at a stellar pace and have jumped 6x between fiscal year 2020 and 2024. Not many companies of NVDA’s size have been able to grow their topline by that quantum.

However, there are now concerns over the sustainability of these revenues as DeepSeek’s open-source model is offering models that are comparable to those offered by Western companies at a fraction of the price.

Nvidia will release its fiscal Q1 earnings next month

Nvidia will release its fiscal Q1 2026 earnings next month. During the previous earnings call, it guided for revenues of $43 billion in the current quarter at the midpoint, which was ahead of the $41.8 billion that analysts were

Revenues of Nvidia’s Data Center segment that sells AI chips rose 93% YoY in fiscal Q4. In the full year, the segment’s revenues rose 142% to $115.2 billion. The Data Center segment is now by far the biggest segment for Nvidia and dwarfs the revenues of all other segments, including Gaming, which was once the company’s largest segment.

During the quarter, Nvidia began shipping its Blackwell chips, which are the company’s most recent AI chips. It generated revenues of $11 billion from Blackwell during the quarter and said that it was the fastest ramp-up in the company’s history.

Analysts have lowered NVDA’s target price

Several analysts have lowered Nvidia’s target price this month. Last week, Deutsche, which has a hold rating on Nvidia, lowered its target price by $10 to $125.

“While ests being de-risked for China and the resulting valuation being at a meaningful discount vs historical averages is incrementally appealing, uncertainties surrounding the sustainability of AI-related capex appear to be rising given the current trade war,” it said in its note.

Meanwhile, Nvidia shares are extending their decline today as reports of Huawei developing a chip rivaling its AI chips have come as yet another blow to the Santa Clara-based company.

Question & Answers (0)