The US lost its last top credit rating after Moody’s cut the country’s sovereign credit rating one notch to Aa1 from Aaa. The rating agency joins its peers in slashing the US credit rating amid concerns over unsustainable US fiscal debt and the rising cost of financing the deficit.

“This one-notch downgrade on our 21-notch rating scale reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns,” said Moody’s in its report.

Moody’s downgrades US sovereign debt

Moody’s projects that the federal deficit will widen to nearly 9% of GDP by 2035. This expansion is primarily attributed to rising interest payments on ever-growing national debt, rising government spending, and relatively low revenue generation.

Moody’s also highlighted the political gridlock among US lawmakers, noting that “successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs.” The inability to achieve meaningful fiscal consolidation, despite a growing national debt that has surpassed $36 trillion, has been a key concern for rating agencies. Moody’s specifically pointed out that extending the Trump administration’s 2017 tax cuts would add an estimated $4 trillion to the federal primary deficit over the next decade.

Meanwhile, even as Moody’s downgraded the US sovereign credit rating, it changed its outlook from “negative” to “stable,” indicating that it does not foresee another downgrade in the near term.

It acknowledged the US’s “exceptional credit strengths such as the size, resilience and dynamism of its economy and the role of the U.S. dollar as global reserve currency.” However, it cautioned that a rapid deterioration in the country’s debt metrics or a sudden loss of market confidence could trigger further negative rating actions.

The US national debt has ballooned

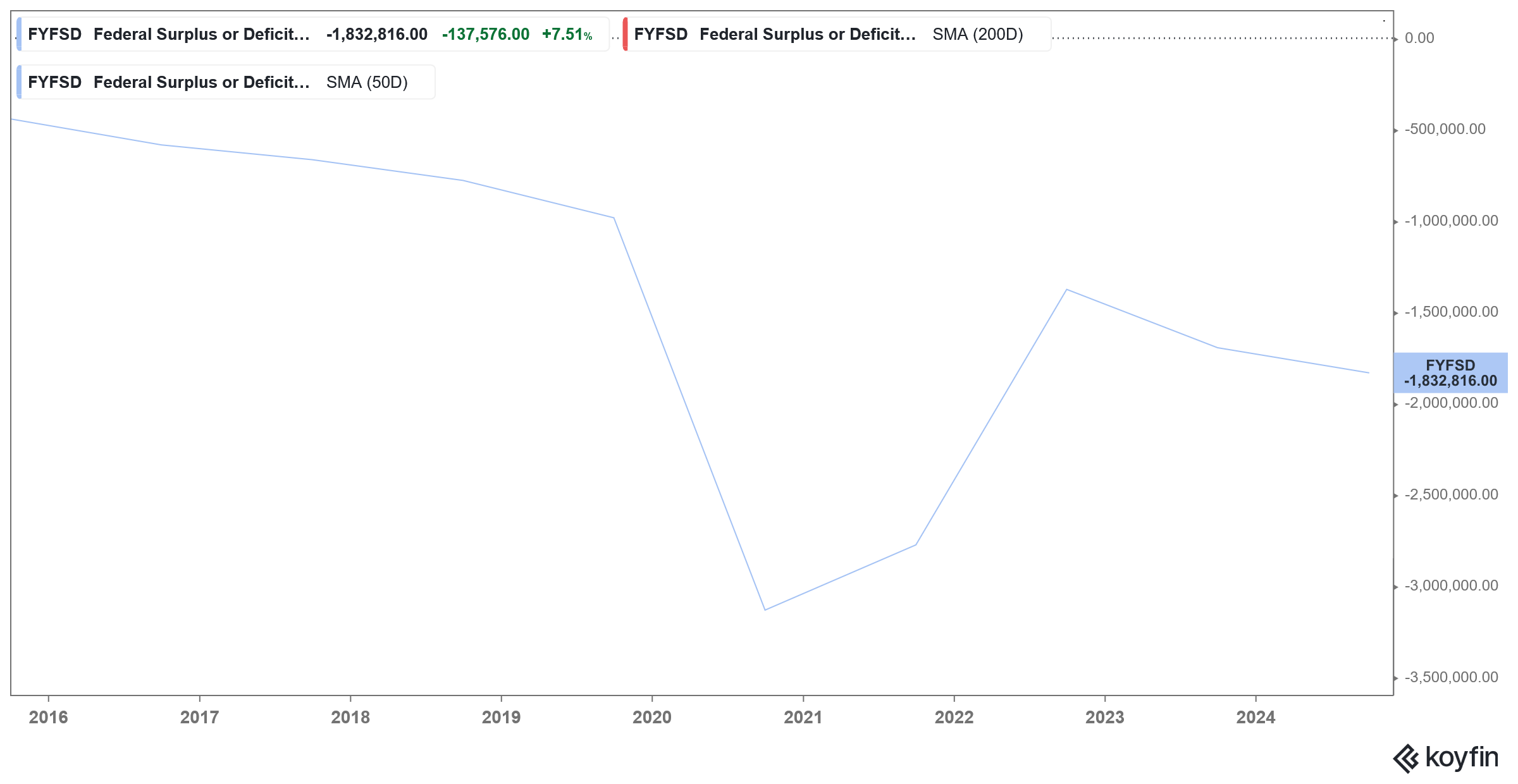

To be sure, credit rating agencies downgrading US sovereign debt is hardly a surprise considering the precarious fiscal position. In the first six months of the current fiscal year, the US government’s budget deficit rose to $1.3 trillion, which is the second highest in history for the period. The only time the deficit was higher was in the fiscal year 2021, when the deficit jumped to $1.7 trillion in the first six months due to higher spending during the COVID-19 pandemic

The total government debt has surged to $36.22 trillion and has long surpassed the national GDP. The rising debt pile has led to a massive increase in interest expense, and the Treasury Department estimates that it will spend $1.2 trillion on interest payments this year.

Notably, the US fiscal deficit hit a record high of $3.13 trillion in the fiscal year 2021. The surge was understandable as the economy needed support during the pandemic. The deficit came down to $2.77 trillion in the fiscal year 2022. It fell further to $1.38 trillion in the next fiscal year, and while it was much below the previous year, it was significantly higher than in pre-pandemic times, when the deficit was contained below $1 trillion. However, in the fiscal year 2024, the budget deficit increased to $1.8 trillion.

Warren Buffett has warned about unsustainable debt levels

Several leading economists and fund managers have warned about the soaring fiscal deficit and ballooning US national debt. At Berkshire Hathaway’s annual meeting earlier this month, chairman Warren Buffett warned that US debt has reached unsustainable levels.

“We are operating at a fiscal deficit now that is unsustainable over a very long period of time. We don’t know whether that means two years or 20 years, because there’s never been a country like the United States, but this is something that can’t go on forever,” said Buffett at the meeting, where, among others, he announced his retirement from the conglomerate.

He added, “And it has the aspect to it that it gets uncontrollable to a certain point that essentially you just give up on it. Paul Volcker kept that from happening in the United States, but we came close. We’ve come close multiple times, and we still have very substantial inflation in the United States, but it has never been runaway yet. And that’s not something we want to try and experiment with because it feeds on itself.”

Jerome Powell on rising US national debt

Notably, President Trump formed the Department of Government Efficiency (DOGE), headed by Elon Musk, to advise him on cutting government spending. While previously, Musk touted that DOGE could cut spending by almost $1 trillion, the White House says that it is targeting annual savings of $150 billion.

Meanwhile, Fed chair Jerome Powell, whom Buffett has praised on previous occasions, believes that politicians were taking the wrong approach by targeting discretionary spending, which he said not only contributes a small percentage of total spending but also its share in total spending has been gradually falling.

“The largest and fastest-growing portions are Medicare, Medicaid, Social Security, and now interest payments, so this is indeed where efforts need to be focused, and these issues can only be resolved on a bipartisan basis; neither side can find a solution without the involvement of both, so this is crucial,” said Powell while speaking at the Economic Club of Chicago last month.

US fiscal debt is approaching unsustainable levels

Powell warned about higher budget deficits on previous occasions also. In his interview with CBS’s 60 Minutes last year, Powell said, “The U.S. federal government is on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy.”

He added, “I think the pandemic was a very special event, and it caused the government to really spend to ward off what looked like very severe downside risks. It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.”

While Powell said that the Fed’s role is not to “judge” the fiscal policy, he warned, “we’re effectively — we’re borrowing from future generations. And every generation really should pay for the things that it, that it needs. It can cause the federal government to buy the things that it needs for it, but it really should pay for those things and not hand the bills to our children and grandchildren.”

All said, Moody’s downgrade of the US credit rating underscores the long-term fiscal challenges facing the world’s largest economy. While the immediate economic impact may be moderate as the downgrade wasn’t unexpected, it serves as a critical reminder of the importance of fiscal responsibility and the potential consequences of unchecked debt accumulation.

Question & Answers (0)