Chinese EV (electric vehicle) companies have released their March delivery reports. Here are the key takeaways from their reports.

Xpeng Motors’ EV deliveries top 30,000 for the fifth consecutive month

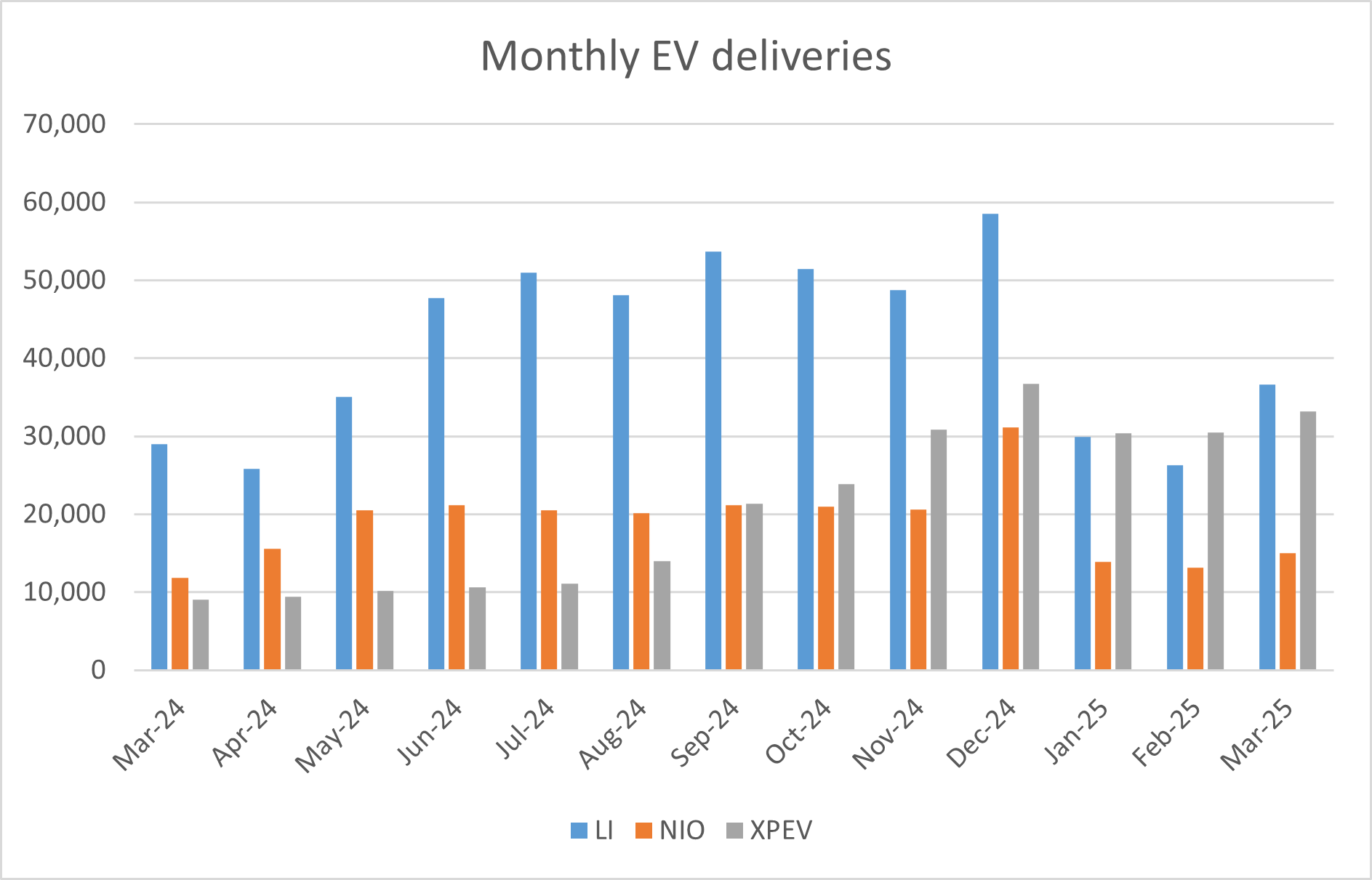

Xpeng Motors delivered 33,205 EVs in March, which is 268% higher YoY. It delivered 94,008 vehicles in the first quarter of 2025 which is 331% higher than the corresponding quarter last year. While the rise is admittedly coming from a lower base, as the company’s deliveries were quite subdued in the first half of 2024, the numbers are nonetheless quite reassuring.

Xpeng Motors’ EV deliveries have been quite robust

Moreover, the company’s deliveries have topped 30,000 for the last five consecutive months, thanks to strong demand for its Mona MO3. Xpeng Motors’ cumulative EV deliveries at the end of March were 684,407.

Wall Street analysts have also taken note of Xpeng Motors’ stellar performance and last month Citi upgraded the shares to a buy. In its note, Citi said, “Upgrade to Buy considering strong volume growth in 2025/26E on robust order intake and new model launches, 2026E earnings turnaround and potentially extra growth drivers on AI/Robotics.”

Brokerages are upbeat on Xpeng Motors

Meanwhile, Citi joins the growing list of brokerages that have turned bullish on Xpeng Motors over the last six months. Bank of America raised the Chinese EV company’s target price from $18.60 to $27 last month while maintaining its buy rating.

Citi expects the Chinese EV company to deliver 400,000 vehicles in 2026. Xpeng Motors said that it expects volumes to double this year which implies deliveries of around 380,000 this year.

Xpeng plans to launch new models this year, which are expected to spur its deliveries. It is also looking to launch extended-range electric vehicles (EREVs), which are quite popular as they come with a generator that can extend the battery’s range. Launch of new vehicles is expected help spur Xpeng Motors’ volumes this year.

Nio reported a YoY rise in EV deliveries

Nio reported EV deliveries of 15,039 in March which was 26.7% higher YoY. In Q1, its EV deliveries rose 40.1% to 42,094 while its cumulative deliveries rose to 713,658. Nio started delivering its ET9 in late March but did not provide its sales breakdown in its release. It however said, “As the epitome of NIO’s full-stack technologies and industry-leading innovations, the ET9 sets a new benchmark for executive smart electric vehicles.”

Nio shares fell last week after the company raised $517 million by issuing new shares. The share sale came at depressed price levels which spooked markets. Notably, while Xpeng Motors posted positive free cash flows in the back half of the year, Nio is still burning cash and needs cash infusion for its operations.

Li Auto’s March deliveries

Li Auto delivered 36,674 vehicles in March 2025 which is 26.5% as compared to the corresponding period last year. The company delivered 92,864 vehicles in March which was 15.5% higher than Q1 2024. Li Auto’s cumulative deliveries reached 1,226,736 at the end of March.

Zeekr Group delivered 40,715 vehicles in March. Of these, the Zeekr brand accounted for 15,422 vehicles while Lynk & Co brand delivered 25,293 vehicles.

BYD reported a strong increase in March deliveries

BYD’s total deliveries rose 25% to 377,420 units in March which helped it deliver more than 1 million units in the first quarter of the year. The company’s March deliveries were 59.8% higher YoY but they fell 34.3% as compared to the December quarter. The sequential fall in deliveries is not surprising as China’s economic activity is subdued in the first quarter due to the Lunar New Year holidays.

BYD sold a record 72,723 cars in global markets last month. While several regions have imposed tariffs on EV imports from China, the country’s exports have remained strong, in part due to shipments of hybrid cars.

Tesla CEO Elon Musk has been all praise for Chinese EV companies and the country’s EV ecosystem. During Tesla’s Q4 2023 earnings call last year he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

He added, “The Chinese car companies are the most competitive car companies in the world. So, I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established.”

BYD’s EV deliveries are expected to surpass Tesla

Notably, BYD’s annual revenues surpassed $100 billion last year as the Chinese auto giant beat Tesla on yet another benchmark. While BYD’s annual deliveries are over twice that of Tesla it is expected to surpass the US EV giant in battery electric vehicle shipments also.

While Tesla is yet to release its Q1 deliveries, data showed that its China sales fell to a two-year low in February. The company is incidentally offering a three-year interest-free loan in China for buying the refreshed Model Y until April 30.

While Tesla had a rough start to 2025, BYD has continued to race ahead. Notably, BYD which once mocked at, has emerged as a serious competitor to Tesla. Last month, BYD unveiled a new technology that can charge an electric car in only five minutes.

BYD’s charging technology that’s named “Super e-Platform” technology is capable of peak charging speeds of 1,000 kilowatts and will allow cars to achieve a range of 400 kilometers in only 5 minutes.

Previously in February, BYD released an assisted driving system named “DiPilot” in partnership with DeepSeek. The Chinese AI (artificial intelligence) startup created waves with its low-cost AI model, which performed better than models from OpenAI and Meta Platforms on some parameters. BYD would offer assisted driving for free and would become the only automaker offering these features in cars priced below $10,000.

Notably, BYD offers budget EV models that start below $10,000 while the starting price for Tesla’s cheapest Model 3 is over $30,000 in yuan.

Meanwhile, after encouraging deliveries in March, shares of Chinese EV companies including Nio, Xpeng Motors, and Li Auto are trading higher in US premarket price action even as futures point to a weak opening for US markets today.

Question & Answers (0)