American investment bank Goldman Sachs reported this morning record-shattering revenues and earnings during the first quarter of 2021, aided by the strong recovery that financial markets saw during the twelve months that followed the pandemic crash of February-March 2020.

The bank, headed by David M. Solomon, managed to double its revenues during the three-month period ended on 31 March, with Goldman’s top-line landing at $17.7 billion compared to $8.74 billion the firm brought in a year ago.

Although revenues across all business units jumped during the period, the market-making segment of the company was the most favoured in absolute terms as it brought an additional $2.2 billion in revenues during these first three months of 2021 compared to last year, while the investment banking unit also booked a $1.8 billion jump in revenues as a result of higher equity underwriting activity.

Furthermore, the bank released $70 million in reserves for credit losses as a result of improving financial conditions around the globe a year after the health emergency started. During the same period last year, the bank had provisioned nearly $937 million as most financial institutions expected a sharp increase in defaults.

Goldman’s higher revenues led to a total of $6.04 billion in compensation and benefits distributed to employees and associates – almost twice the amount the bank paid a year ago. However, operating expenses accounted for only 53.3% of Goldman’s total revenues compared to 73.9% during the first quarter of 2020.

As a result, Goldman’s net earnings were propelled to $6.84 billion during this quarter, or nearly 6 times the amount it earned during the same period in 2020. Correspondingly, earnings per share jumped to $18.8 per share – the highest quarterly EPS reported by the bank in the past 10 years at least and possibly in its entire history.

These results blew pasts analysts’ estimates for the quarter, as Wall Street expected revenues of around $12.6 and $14.3 billion and EPS between $7.7 and $12.7 per share.

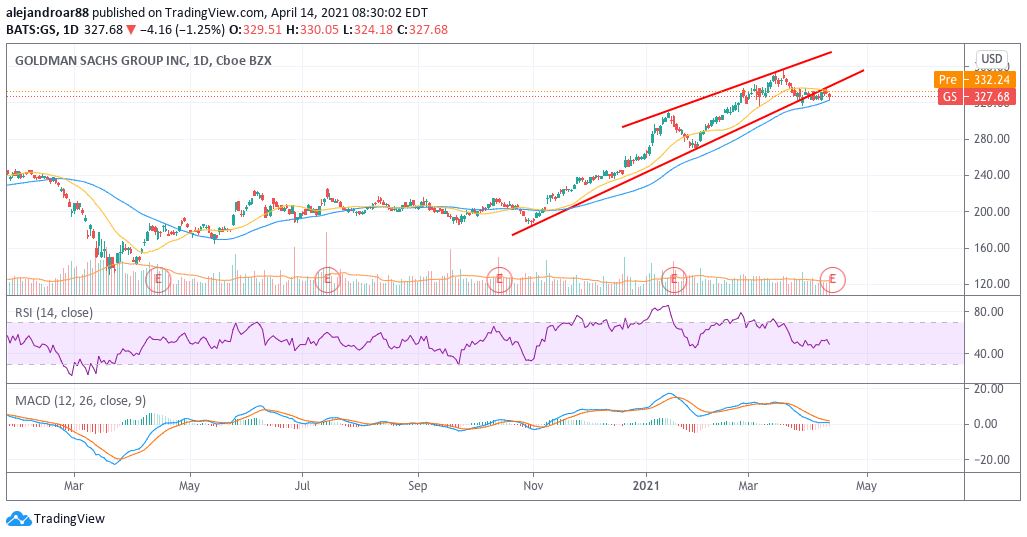

Shares of Goldman Sachs are reacting positively to the news, jumping 1.6% so far in pre-market stock trading action at $332.75 per share.

Goldman’s record-breaking results could lift the entire financial sector

The financial sector was already having a great year before these results came in, with the SPDR Financial Sector Trust ETF (XLF) posting a 19% gain since 2021 started while accumulating a 31% advance since the Pfizer (PFE) vaccine headline hit the streets in November last year.

Meanwhile, Goldman’s performance seems to have outpaced its peer, as the investment bank shares accumulate a 54% gain since November along with a 25% year-to-date jump.

Similar to Goldman, JP Morgan reported a big jump in quarterly revenues and earnings, with the bank’s net income rising 399% at $14.3 billion compared to the same period last year on managed net revenues of $33.12 billion.

What to expect after Goldman Sachs’s earnings?

Goldman’s management team will be having their customary earnings call today at 9:30 a.m. (ET) to discuss the bank’s results.

The management’s outlook and comments about this unexpected positive performance will possibly set the tone for the price action today as analysts will be seeking explanations for these record-shattering results.

Any indications that these results are just a one-off thing could alleviate the upward momentum that the stock is seeing in pre-market action, while comments about potentially long-lasting tailwinds for the business might result in a short-term jump in share prices as Goldman’s valuation remains quite conservative.

As of yesterday, Goldman’s forward price-to-earnings multiple sat at 10 as the bank’s earnings growth has remained quite volatile in the past 10 years at least.

However, steadier forward-looking estimates based on industry-specific tailwinds could result in both multiple expansion and upward earnings revisions that will positively impact Goldman’s share price in the coming weeks and months.

Question & Answers (0)