GameStop shares fell almost 34% yesterday after it missed both the topline and bottomline estimates. However, the game doesn’t stop for the gaming retailer and it the shares are currently higher in premarkets today.

GameStop is among the bunch of the so-called meme stocks that are being pumped by the famous Reddit group WallStreetBets. AMC Theatres, Genius Brands, BlackBerry, Sundial Growers, and Nokia are among the other stocks that were pumped by the community.

WallStreetBets and meme stocks

The modus operandi for WallStreetBets hasn’t been difficult to comprehend. Firstly, it has targeted smaller companies whose share price is relatively difficult to influence as compared to mega-cap companies like Apple and Amazon.

Secondly, the group has looked at stocks that have a good story. So, for GameStop, it is the turnaround plan and pivot to online retail. Ryan Cohen getting board seats and playing an active role further boosts the company’s bullish thesis. As for AMC Entertainment, it is a reopening play.

How WallStreetBets chooses its targets

BlackBerry and Nokia are also turnaround candidates in their own rights and are also plays on 5G which is among the most prominent investing themes. For Tilray and Sundial Growers there is the story of possible marijuana legalisation in the US under the Biden administration. As for Genius Brands, it is a play on the multiple partnerships that it has either announced or expected to announce soon including with Marvel, a Disney subsidiary.

GameStop is the poster child of meme stocks

Meanwhile, GameStop has been the poster child for WallStreetBets. Leading influencers including Elon Musk and Chamath Palihipitya also threw their hat into the rings. Palihapitiya famously bought $115 calls on GameStop and even donated the profits to charity.

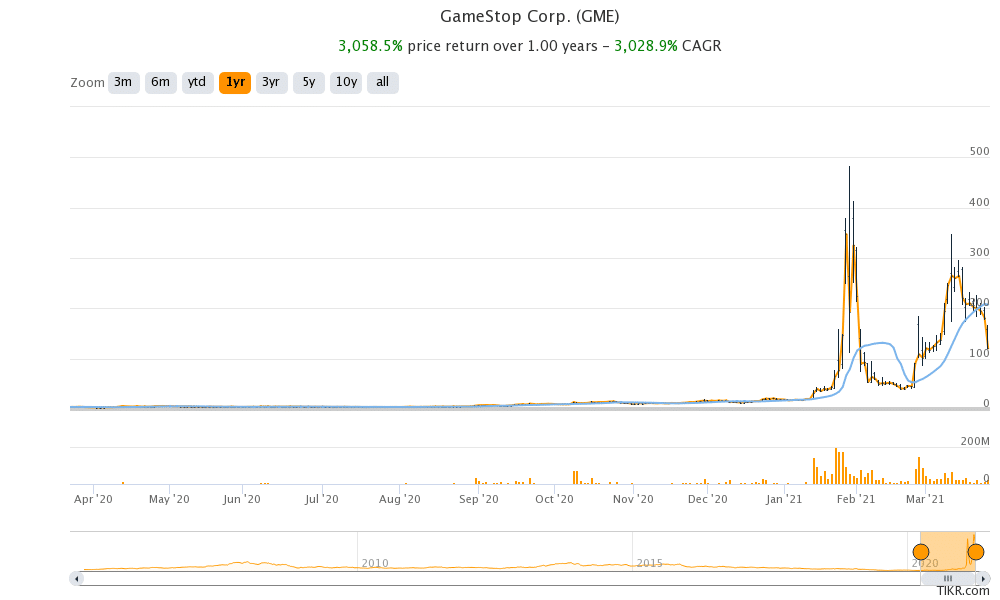

GameStop share went as high as $500 at one point in time but soon fell below $40, plunging over 90% from its peak. It soared again and went past $200, rising fivefold in a matter of days. Now, the stock is down almost half from those levels.

GameStop earnings

Now, looking at GameStop’s fiscal fourth quarter 2020 earnings, there were a lot of key takeaways. Firstly, the company posted higher comp sales after the last many quarters of decline. Secondly, it is expanding its target market.

“We are continuing the work to expand our addressable market by growing GameStop’s product catalog. This includes growing our product offerings across PC gaming, computers, monitors, game tables, mobile gaming and gaming TVs, to name only a few,” said the company in its earnings call. Finally, it hired a COO with a background in tech companies like Amazon and Alphabet. So far, so good.

GameStop’s earnings call halted abruptly

The earnings call for GameStop reached its full capacity, which reflects the enthusiasm among analysts. After all, it was the first time since the frenzied rally in GameStop started that analysts got a chance to question the management. However, the earnings call was ended abruptly without taking analyst questions. While Tesla’s CEO Elon Musk has expressed his disdain for analysts several times, it was GameStop’s turn this time.

Meanwhile, GameStop might look at issuing more shares as a regulatory filing showed. “{Since January 2021, we have been evaluating whether to increase the size of the ATM (at-the-market) Program and whether to potentially sell shares of our Class A Common Stock under the increased ATM Program during the course of fiscal 2021, primarily to fund the acceleration of our future transformation initiatives and general working capital needs,” said the company.

The company might want to thank WallStreetBets as the share offering would be at a much higher price than its previous offering because of the surge in the share price that was driven in part by WallStreetBets.

WallStreetBets and GameStop

To be sure, by triggering a short squeeze in stocks like GameStop, WallStreetBets followed a perfectly legit strategy. Short squeezes have been going on for a long and would continue to see them in capital markets. That’s the way the market function.

However, the issue with GameStop and many of the other meme stocks has been the kind of valuations that they attract. For instance, AMC Entertainment is valued at a double-digit PE multiple on the projected 2025 net earnings. This is despite the growing competition from streaming and the yet uncertain economic environment.

GameStop’s online sales are soaring

As for GameStop, its core market of gaming consoles continues to be cyclical. Also, gaming is moving online where the company does not have much presence. The company’s revenues have been falling year over year for the last three years. While the company has managed to post positive comp growth in the most recent quarter, its total sales are still falling.

Meanwhile, there is no denying that GameStop is a genuine turnaround candidate as it pivots towards online sales and expands its target market. Ryan Cohen’s involvement with the company further cements the bullish thesis as he rose to fame with Chewy that he cofounded.

Retail investors need to understand the risks with meme stocks like GameStop

The biggest problem with meme stocks like GameStop is that many retail investors are getting in without understanding the risk. Many retail investors who bought these meme stocks near their all-time highs would find it hard to recoup their capital in the near term, let alone making a profit.

All said, the game continues for GameStop shares and it was up over 7% in US premarket trading today. Such bumps are not uncommon after a sharp fall. However, from a fundamental valuation standpoint, it is difficult to build a case for the stock now with an NTM (next-12 months) enterprise value to sales multiple of 1.65x which is over 10 times its historical average.

Question & Answers (0)