FuboTV shares are surging nearly 7% in pre-market stock trading action at $27.5 per share this morning after the company announced yesterday that it completed a partnership with The Cordish Companies to launch a sports betting service in Pennsylvania.

According to the announcement, the New York-based video streaming company, which specializes in broadcasting live sports events and sports-related shows will be integrating a gaming module to its live sports offering with the service reaching four states initially through its subsidiary Fubo Gaming.

Pennsylvania is the third largest market for sports betting by revenue in the United States as indicated by data from Gaming Today with an estimate of $6 million in revenue produced in the state by mobile sportsbooks in May 2021 alone.

Meanwhile, in terms of total revenues, Pennsylvania was accountable for producing nearly $200 million in sports betting revenue last year, with the mobile segment accounting for at least 70% of that figure.

This agreement with The Cordish Companies will enable Fubo Gaming to access this promising market via sports betting and iGaming features although the launch of Fubo Sportsbooks in Pennsylvania is still subject to securing regulatory approval.

This latest agreement comes to join other partnerships FuboTV has already secured for its sports betting unit including one for New Jersey and another one for Indiana after striking deals with Caesars Entertainment (NJ) and Casino Queen (IN).

Investors appear to be reacting positively to the news as it brings FuboTV closer to incorporating a whole new revenue stream that could quickly become a major driver of the firm’s future financial performance.

How have FuboTV shares performed so far this year?

FuboTV shares are under water for the year after surging at some point by 87% during the short-squeezing frenzy of February while the stock recently experienced another 20% uptick on the back of a record-shattering first quarter of the year.

Meanwhile, FUBO delivered an eye-popping 214% gain last year as its value proposition and subscriber numbers started to pop to a point that investors could not help but notice.

During the first quarter of 2021, FuboTV managed to push its revenues to $119.7 million, up 135% compared to the previous year, while the company added 303,000 new subscribers to its platform compared to the same period in 2019.

Meanwhile, advertising revenue for Fubo accounted for 10.5% of the company’s top-line results at $12.6 million – slightly more than half of what the firm produced in advertising during the full year 2020.

The management team provided guidance for the second quarter of 2021, with the company expecting to see its revenues landing at around $122 million for a 174% year-on-year jump, while subscribers are expected to end the period at 605,000 for net additions of 15,000 compared to the previous quarter and 318,874 more than it had by the end of the second quarter of 2020.

Moreover, revenues for the full year 2021 are forecasted to land at $530 million, which is a little more than two times what the firm brought in 2020, with total subscribers expected to end the year at approximately 850,000.

What’s next for FuboTV?

Based on the firm’s current market capitalization of $3.86 billion – including this morning’s pre-market uptick – FuboTV shares are trading at 7 times the firm’s forecasted sales for the year while the company has not yet produced a quarterly positive adjusted EBITDA.

Although this valuation multiple seems a bit stretched, it is important to note that FuboTV has been managing to grow its sales at a speed that could justify such a high P/S ratio. In the past 5 quarters, sales have moved from $7.3 million to $119.7 million at a compounded quarterly growth rate of 42%.

Meanwhile, if Fubo ends the year with revenues of $530 million as the management expects, that would result in an annual jump of over 100%. Assuming that the company can continue to grow its top-line results at a slower rate of 70%, which seems highly likely at this point especially if advertising revenues keep growing and sports betting revenues start to weigh in, chances are that by 2023 sales could land at around $1.5 billion.

If we assume a conservative P/S ratio of 5, which seems plausible for a firm displaying this kind of growth, Fubo’s valuation could jump to $7.5 billion or approximately two times the current market capitalization of the stock.

Based on these projections, FuboTV appears to be a buy at current levels as long as the management can deliver on its promises.

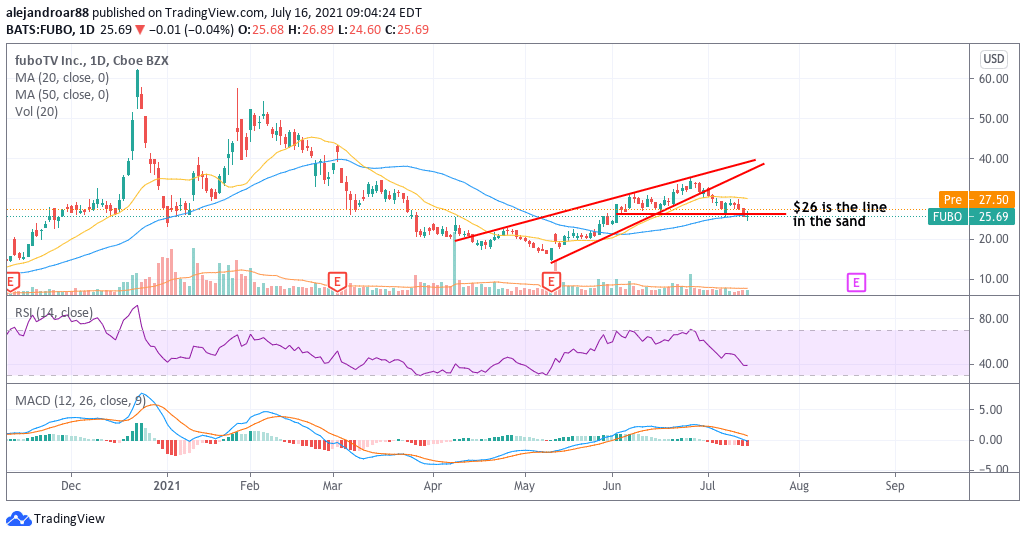

Meanwhile, from a technical standpoint, today’s pre-market uptick is taking place at a moment when the stock just broke slightly below a key support level.

Momentum readings are particularly depressed for Fubo ahead of its 10 August Q2 2021 earnings report but the situation could now turn around if market participants get excited about this upcoming sports betting feature.

The price action in the following days will determine if this development will be strong enough to reverse the current downtrend while the upcoming earnings announcement is also a key catalyst to watch as FuboTV must prove that it can live up to its promises.

For now, the outlook is bullish and the $26 level remains the line in the sand for any upcoming retracements.

Question & Answers (0)