Chinese electric vehicle (EV) companies have reported their deliveries for June. Here are the key takeaways from their reports.

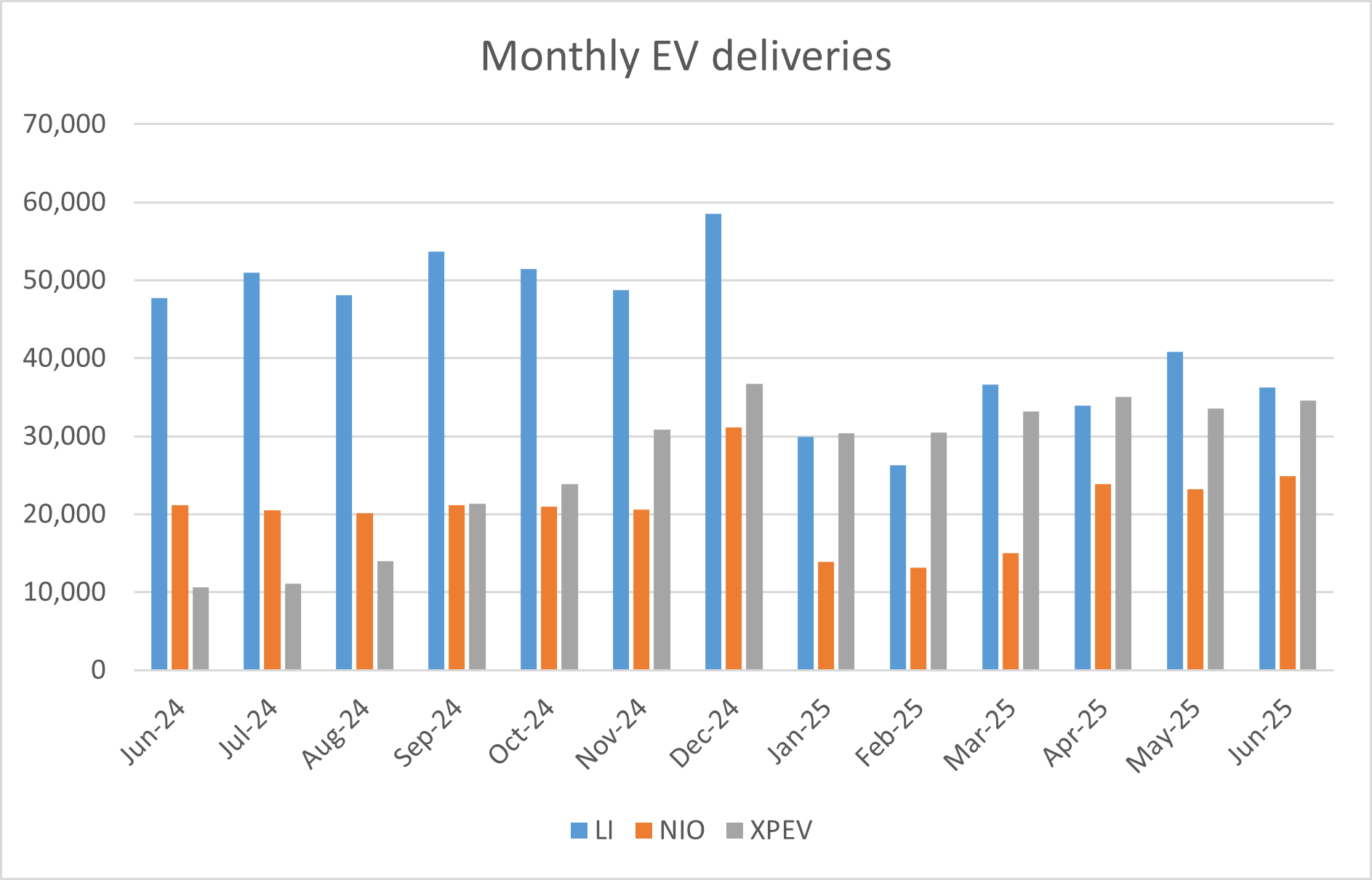

Xpeng Motors delivered 34,611 EVs in June, which was 224% higher YoY. Moreover, the company’s deliveries have topped 30,000 for eight consecutive months, thanks to strong demand for its Mona MO3 and P7+.

Xpeng Motors reported record EV deliveries in Q2

It delivered 103,181 vehicles in the second quarter of 2025, which is a new quarterly high. During their Q1 2025 earnings call, Xpeng Motors said that it expects to deliver between 102,000 and 108,000 vehicles in the second quarter, and the final number came in towards the low end of its guidance.

Meanwhile, the company’s first-half EV deliveries have already surpassed what it delivered in all of 2024. While the rise is admittedly coming from a lower base, as the company’s deliveries were quite subdued in the first half of 2024, the numbers are nonetheless quite reassuring. Xpeng Motors’ cumulative EV deliveries were 787,588 at the end of June.

In its release, Xpeng Motors said that in June, the monthly active user penetration rate of its XNGP reached 85% in urban driving. It added, “Most recently, XPENG was invited to present its advancements in foundational models for autonomous driving at the 2025 Conference on Computer Vision and Pattern Recognition (CVPR), the sole Chinese automotive company to receive this industry distinction.”

Notably, the company is believed to have among the most advanced autonomous driving capabilities among Chinese EV companies.

NIO reported strong growth in EV deliveries

NIO’s EV deliveries totaled 24,925 in June, 17.5% higher than the corresponding month last year. In Q2, its EV deliveries rose 25.6% YoY to 72,056, while the cumulative deliveries at the end of the quarter stand at 785,714.

In its release, NIO said, “The ET5 and ET5T ranked first among mid-size battery electric sedans in the China NEV-IQS study, while the EC6 claimed the top spot in the premium BEV segment in the China NEV-APEAL study. With superior product quality and exceptional user satisfaction, NIO has secured first place in its segment in J.D. Power’s quality research for seven consecutive years since 2019.”

BYD sold more BEVs than PHEVs in June

BYD’s NEV (new energy vehicle) deliveries rose to 382,585 in June, which is the highest monthly total this year. However, for the third consecutive month, the company’s delivery growth was below 1% sequentially.

Notably, BYD announced massive price cuts in May to spur sales. The price cuts, which lasted until June, were quite aggressive, and the company slashed the price of its Seagull hatchback by 20%. The model, which is the cheapest from BYD, would now cost just about 55,800 yuan (around $7,780). The biggest cut was for the Seal dual-motor hybrid sedan, whose price has been slashed by 34%.

Looking at BYD’s June sales mix, Battery Electric Vehicles (BEVs) accounted for 206,884 units. The company’s BEV sales rose a whopping 42.5% in June, while the monthly rise was a modest 1.2%.

Plug-in Hybrid Electric Vehicles (PHEVs) contributed 170,744 units, with sales falling 12.4% as compared to the corresponding month last year. It is the third consecutive month when BYD sold more BEVs than PHEVs. Prior to that, the company’s hybrid sales were ahead of BEV sales for many months.

Meanwhile, BYD’s international sales continue to soar and have more than tripled YoY to 90,049 units. June marked the seventh consecutive month in which BYD’s international sales hit a record high.

While several countries, especially the EU, have clamped down on EV imports from China to protect their domestic industries, Chinese EV companies haven’t pared back their ambitions and continue to target export markets aggressively.

BYD’s EV deliveries look set to surpass Tesla’s

In April, BYD sold more BEVs than Tesla in Europe for the first time ever, while the two were neck-to-neck in May. While the Elon Musk-run company has been in Europe for quite some time now and also has one of its Gigafactories in Berlin, BYD entered the region only in late 2022. Moreover, BYD cars face tariffs in the EU, while the EVs built by Tesla at its Germany Gigafactory are exempt from these tariffs.

BYD sold more EVs than Tesla in Q1, and while the US EV giant hasn’t reported its Q2 deliveries yet, in all probability, they would be less than BYD’s. BYD already sells more cars than Tesla and looks set to grab the title of biggest BEV seller in 2025.

Chinese EV companies offer models at very competitive prices, which has helped them grab market share in markets outside China. Musk has been all praise for Chinese EV companies and the country’s EV ecosystem. During Tesla’s Q4 2023 earnings call last year, he said, “Frankly, I think, if there are not trade barriers established, they will pretty much demolish most other companies in the world.”

Li Auto reported a fall in June deliveries

Zeekr delivered 43,012 vehicles in June. Of these, the Zeekr brand accounted for 16,702 vehicles while the Lynk & Co brand delivered 26,310 vehicles.

Li Auto delivered 36,279 vehicles in June, compared to 47,774 in the corresponding month last year. Its cumulative deliveries reached 1,337,810 at the end of June, which is the highest among emerging NEV companies in China.

Meanwhile, Li Auto’s deliveries have sagged over the last few months as its EV sales haven’t taken off. The company gets most of its revenues from sales of extended-range electric vehicles (EREVs), which come with a fuel tank to enhance the vehicle’s range.

Question & Answers (0)