Discovery and AT&T shares are surging in pre-market stock trading action this morning after the two media giants announced a merger between WarnerMedia – an AT&T unit – and the Discovery network to create a stand-alone company that will become a leading producer of entertainment and sports content.

In a joint statement released this morning, the two companies disclosed the terms of the deal, which include a total of $43 billion in proceeds for AT&T as a result of the spin-off that the company will receive in the form of cash, debt securities, and the retention of a portion of AT&T’s debt by the newly emerged business.

As a result of the business combination, AT&T shareholders will receive a total of 71% of the new company’s shares while Discovery shareholders will be entitled to the remaining 29% of the entity.

According to the statement, revenues are projected to land at $52 billion by the end of 2023 alongside an adjusted EBITDA of $14 billion and a free cash flow conversion rate of 60%.

As a result of the deal, the new standalone company is expected to unlock synergies valued at $3 billion in the form of annual savings.

The new company will offer a compelling value proposition to consumers, as it will own a library of more than 200,000 hours of “iconic programming” from different networks and channels including HBO, Warner Bros, CNN, Cartoon Network, and Animal Planet.

Meanwhile, the merged business will be led by David Zaslav, the current Chief Executive of Discovery, while the company’s Board of Directors will be comprised of 13 members – 7 of which will be appointed by AT&T. The name of the new entity has not yet been disclosed.

The two parties expect to close the transaction by mid-2022 subject to regulatory and shareholder approval.

A closer look at the numbers

The merger between WarnerMedia and Discovery (DISCA) comes as a result of a strategy to strengthen the value proposition of both networks to become a leading force in the growing streaming industry.

The combined number of subscribers of Warner’s HBO Max and Discovery streaming services would land at around 79 million versus 100 million subscribers Disney+ managed to retain by the end of the past quarter while Netflix (NFLX) remains the undisputed leader of the space by a long shot with a total of 208 million global subscribers.

Meanwhile, according to the statement released by the two companies, annual revenues for the newly-formed company are expected to display low single-digit growth in the following years while adjusted EBITDA and earnings per share (EPS) should display mid-single-digit compounded annual growth rates (CAGR).

Moreover, the new company expects to produce a solid dividend, with the annual payout ratio standing between 40% to 43% while free cash flows are expected to land at $20 billion per year.

There has been significant chatter about the deal in the past few days and numbers from the Financial Times estimate that the enterprise value of the newly-formed business should be around $150 billion. Based on those estimates, the firm would be valued at roughly 5 times its free cash flow while the dividend should continue to be very attractive.

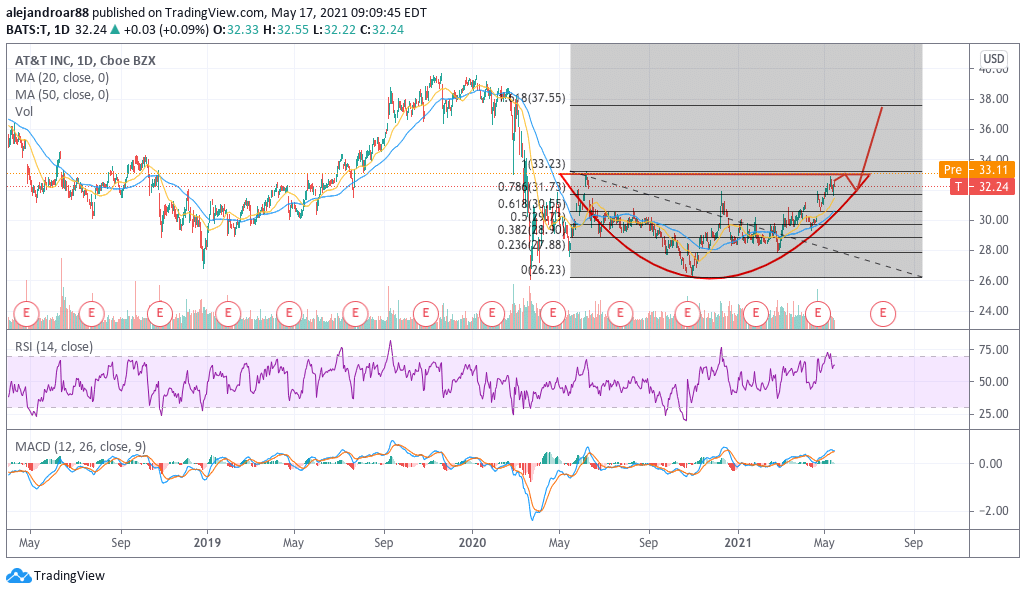

AT&T shares display an interesting technical setup

Today’s uptick in AT&T shares is pushing the stock to its post-pandemic highs of $33 a piece, which results in the formation of a rounding bottom pattern that could lead to a break above this level on short notice.

Although the pre-market action does not necessarily reflect how the stock will behave during the live session, analysts have greeted the deal in good spirits.

Keith Snyder from CFRA Research told Reuters this morning: “While further details have yet to emerge, the proposed horizontal combination would create a global content behemoth uniting Warner Media’s premier news and entertainment assets with Discovery’s industry-leading cache of non-scripted programming networks”.

If investors perceive that the likelihood of securing regulatory approval is quite high, chances are that this could be good news for AT&T as the firm will deleverage its balance sheet while also being able to focus on further growing its telecom business.

Question & Answers (0)