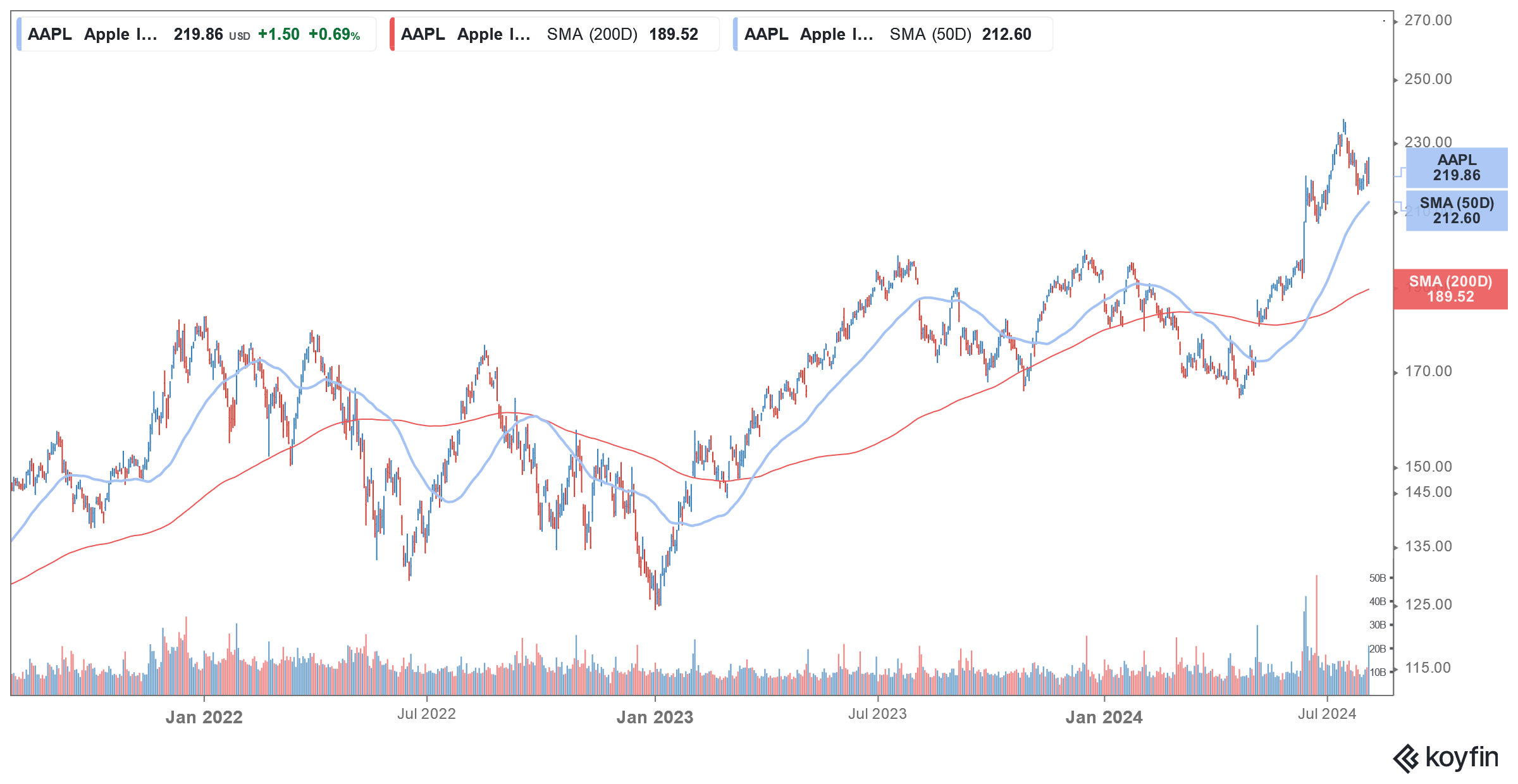

Apple (NYSE: AAPL) shares opened almost 9% lower in US price action today amid the rout in tech shares. The reports of Warren Buffett, whose Berkshire Hathaway was once the second-biggest shareholder of the company, trimming stake in Apple are not helping matters.

Fears over the so-called “yen carry trade” after Japan’s central bank raised rates, rising tensions in the Middle East, and concerns over the US economy entering a recession are among the reasons global share markets plunged today.

Tech shares crash

In the US markets, there was a sell-off on Friday also after Amazon disappointed markets with its Q2 earnings and Intel missed both topline and bottomline estimates. While Apple topped both revenue and profitability numbers for the June quarter and provided an upbeat commentary on the current quarter, the shares ended almost flat on Friday amid the broad-based selling in tech shares.

Notably, the valuations of US tech shares have risen over their historical averages, in part because of optimism towards their artificial intelligence (AI) features. However, markets have now started questioning the massive investments that tech giants have been making in building their AI infrastructure.

Apple shares crash

Apple too has been highlighting its AI capabilities and unveiled “Apple Intelligence” at the Worldwide Developer Conference (WWDC) in June. It also announced a partnership with ChatGPT and the announcements helped dispel the fears that the Tim Cook-run company lagged tech peers in its AI efforts.

Multiple brokerages raised Apple’s target price after that event and the bullishness continued after the company’s fiscal Q3 2024 earnings release last week.

Meanwhile, AAPL – which is usually seen as a safe bet in the tech industry – is among the biggest losers today. Along with the broad-based tech sell-off, investors are also apprehensive about the company after Berkshire Hathaway revealed that the conglomerate has trimmed its stake in Apple by almost half.

Warren Buffett sold Apple shares in Q2

Berkshire’s Q2 earnings report showed that the company sold Apple shares in Q2 and held only $84.2 billion worth of shares at the end of June. Notably, Berkshire trimmed its Apple shares by 13% in Q1, which Buffett said was due to tax reasons. The company is sitting on a massive gain on its Apple investment and would stand to lose if capital gain taxes rise in the US as the federal government strives to cut the country’s burgeoning fiscal deficit.

“It doesn’t bother me in the least to write that check and I would really hope with all that America’s done for all of you, it shouldn’t bother you that we do it and if I’m doing it at 21% this year and we’re doing it a little higher percentage later on, I don’t think you’ll actually mind the fact that we sold a little Apple this year,” said Buffett at this year’s shareholder meeting.

For context, Buffett started investing in Apple way back in 2016 and gradually built the stake into the largest holding in Berkshire’s portfolio of publicly traded securities. The “Oracle of Omaha” as Buffett is popularly known has kept adding to Apple shares until the third quarter of 2018.

Berkshire has gradually trimmed its stake in AAPL

He however, sold shares in the final quarter of 2018 which looked surprising as the stock crashed that quarter as then President Donald Trump stepped up the heat in his trade war with China leading to pressure on shares of companies that have a significant presence in the world’s second-largest economy.

Buffett continued to sell Apple shares in 2019 and 2020. In fact, Berkshire sold about $11 billion worth of Apple shares in the back half of 2020 which was no small sum even by Berkshire’s standards.

Meanwhile, thanks to the Apple stake sale and strong operating income, Berkshire’s cash pile spared to a new record high of $277 billion,

Most of the cash is parked in short-term US government treasuries which means that the conglomerate now holds more US government securities than the Federal Reserve.

Is Buffett selling Apple only for tax reasons?

Meanwhile, there are apprehensions that Buffett has sold Apple only for tax considerations given the quantum of stock sales. The nonagenarian has been a net seller of shares for seven consecutive quarters which means that he bought fewer shares than he sold. In Q2, the company sold a record $75 billion worth of shares. With Buffett finding no opportunities to park Berkshire’s ever-soaring cash pile, many investors see a warning sign for markets.

Apart from Apple, Berkshire has also been trimming its stake in Bank of America since July. The proceeds from that transaction would however only show up in its Q3 report. The company was Berkshire’s second-largest holding after Apple.

Notably, last year, Buffett exited banks like Wells Fargo, Goldman Sachs, and JPMorgan Chase. The conglomerate held nearly a 10% stake in Wells Fargo and was among its biggest shareholders. Historically, Buffett has tried to keep Berkshire’s stake in banks below 10% to avoid regulatory scrutiny.

He however made an exception for Bank of America and took regulatory approval to hike the stake beyond 10%. Berkshire invested $5 billion in the company’s preferred shares in 2011 and gradually increased the stake. Buffett had also invested in Goldman Sachs during the 2008-2009 financial crisis even as he passed over struggling names like Lehman Brothers.

Buffett has also scaled back buybacks

With Buffett, who is among the best value investors of all time, selling shares so rapidly, the concerns over stock markets getting overheated are getting further ignited. Berkshire repurchased only $345 million worth of its shares in Q2 which is significantly below what we saw over the last few years.

Question & Answers (0)