How to Buy Manchester United Shares UK – With 0% Commission

Almost every person on the planet knows Manchester United, one of the most popular and biggest football clubs in the world. But, not many people know that Manchester United is a public listed company and it is possible to invest in this giant football club. So, in this guide, we’ll show how to buy Manchester United shares UK.

We suggest the best brokers that offer MANU shares, and analyze its share price performance, and the financial status of the ‘red devils’.

Step 1: Choose a Stock Broker

Since 2012, Manchester United is listed on the New York Exchange (nyse) under the ticker symbol MANU. This means that you’ll have to find a reputable stockbroker that operates in the UK and gives you access to the US markets.

1. XTB

XTB is a popular UK stock broker that offers trading on more than 2,100 shares and ETFs – all 100% commission-free. Furthermore, spreads at this broker start at just 0.015% for US-listed stocks, making it one of the cheapest options available for UK traders. XTB doesn’t require a minimum deposit to get started and the broker doesn’t charge deposit or withdrawal fees.

XTB’s custom-built stock trading platform – xStation 5, is also available for the web and mobile devices and it comes packed with research tools. You’ll find technical charts and dozens of studies to start, plus a market news feed that includes actionable trade ideas with annotated price charts. The platform also has a market sentiment gauge which allows users to easily see what other traders think about where a stock’s price is headed.

XTB’s platform also includes a stock and ETF screener, which can be really useful for traders. With this tool, users can easily scan the market for stocks that are taking off or that seem poised for a fall. Using the screener, it’s possible to create watchlists and narrow down your search to find better trading opportunities.

XTB is regulated by the UK FCA and CySEC and offers negative balance protection for all traders. In addition, the broker offers customer support by phone, email, and live chat, available 24/5.

76% of retail CFD accounts lose money.

2. AvaTrade

AvaTrade is a UK CFD broker that offers 0% commission trading on over 600 global stocks. The platform also carries dozens of exchange-traded funds (ETFs), stock indices, commodities, and forex pairs for trading. Notably, AvaTrade also offers trading on forex options – but it doesn’t offer stock options at this time.

AvaTrade has a few different trading platforms you may use to trade stocks. Like Pepperstone, this broker gives all traders access to MetaTrader 4 and 5.

Alternatively, the AvaTrade web trading platform and AvaTradeGO platform are available on iOS and Android devices as well . You get watchlists, a market news feed, and dozens of technical studies. On mobile devices, users can access full-screen charts and enter orders with just a few taps.

AvaTrade also has its own social trading app for iOS and Android, called AvaSocial. Although this isn’t integrated into AvaTradeGO, it’s simple to switch back and forth between sharing ideas and setting up trades. AvaSocial also enables copy trading, so you have the ability to mimic the portfolios of more experienced stock traders in just a few taps.

AvaTrade is regulated by the UK FCA and Australia’s ASIC. The platform requires a $100 minimum deposit to open an account and you may pay by credit card, debit card, or bank transfer. AvaTrader offers 24/5 customer service.

Your capital is at risk.

3. FP Markets

One of FP Markets’ standout features is its commitment to offering competitive pricing with tight spreads, ensuring that traders can maximize their profits. The broker also supports various trading platforms, such as MetaTrader 4, MetaTrader 5, and IRESS, allowing traders to choose the platform that best suits their trading style and needs.

FP Markets strongly emphasizes education and resources, providing traders with access to a wealth of educational materials, webinars, and market analysis. This dedication to trader education helps both beginners and experienced traders enhance their trading skills and make informed decisions.

Customer support at FP Markets is highly responsive and available 24/5, ensuring that traders receive prompt assistance whenever needed. Additionally, the broker is regulated by top-tier authorities like ASIC and CySEC, providing traders with a sense of security and trust.

In summary, FP Markets stands out as a reliable and versatile broker. It offers a robust trading environment supported by competitive pricing, excellent educational resources, and top-notch customer service.

Your capital is at risk

4. Pepperstone

Pepperstone is a popular UK stock brokers for traders who want to use MetaTrader 4 or 5. These popular trading platforms offer unparalleled tools for technical analysis, including the ability to create custom technical studies. You may also backtest trading strategies against historical price data to see how they are likely to perform.

This broker also offers a few extra tools that are built specifically for MetaTrader. For example, there’s a correlation heatmap so investors will be able to see whether the stocks you’re invested in typically move at the same time. There’s also an alarm management tool that lets you create custom alerts based on price changes, trading volume, and more.

Pepperstone carries thousands of share CFDs from the US, UK, Europe, and Australia. The broker’s charges vary based on the market you’re trading – US shares trade commission-free, while UK shares carry a 0.10% commission. So, this broker can be slightly more expensive than some of its peers.

Pepperstone is regulated by the UK FCA and the Australian Securities and Investments Commission (ASIC). The platform doesn’t require a minimum deposit to open an account, which is a major plus if you’re not ready to commit hundreds of pounds to trading just yet.

Your capital is at risk.

5. PrimeXBT

PrimeXBT is an innovative stock broker that caters to a diverse range of traders, from beginners to seasoned professionals. Known for its versatility and user-friendly interface, the platform offers an array of features designed to enhance the trading experience across multiple asset classes.

One of the standout aspects of PrimeXBT is its wide range of available markets. Users can trade in cryptocurrencies, forex, commodities, and indices all from a single account. This flexibility allows traders to diversify their portfolios and take advantage of different market opportunities without needing to switch between platforms.

PrimeXBT offers a suite of trading tools and advanced charting options to help traders make informed decisions. The platform integrates customizable indicators, drawing tools, and multiple timeframes, enabling users to tailor their charts to suit their individual trading strategies. Additionally, PrimeXBT provides leverage trading options, which can amplify potential profits for experienced traders.

The platform’s trading interface is sleek and intuitive, designed to make navigating the markets straightforward. Opening, managing, and closing trades can be done with ease, while the performance of live trades can be tracked in real-time. PrimeXBT also offers an innovative feature known as Covesting, which allows users to follow and replicate the trades of successful strategy managers, providing an educational and potentially profitable experience.

PrimeXBT also prioritizes the security and privacy of its users. The platform employs industry-standard security measures to safeguard user accounts and data, such as two-factor authentication and encryption. Customer support is available to assist traders with any queries they may have, ensuring a smooth and reliable trading experience.

In summary, PrimeXBT stands out as a comprehensive trading platform offering a variety of markets, robust tools, and an easy-to-use interface. Its emphasis on security, diverse asset offerings, and innovative features like Covesting make it an excellent choice for traders looking to explore and capitalize on global market opportunities.

Your capital is at risk.

6. Admiral Markets

Admiral Markets is a globally recognized online trading broker known for its comprehensive range of financial instruments and user-friendly platforms. With a presence in over 40 countries, the company has built a strong reputation for providing a reliable and secure trading environment for both beginner and experienced traders.

One of the standout features of Admiral Markets is its extensive selection of trading instruments, including Forex, stocks, commodities, indices, and more. This variety allows traders to diversify their portfolios and explore different markets with ease. The broker offers competitive spreads and flexible leverage options, catering to various trading styles and strategies.

Admiral Markets is also praised for its robust platforms, particularly MetaTrader 4 and MetaTrader 5, which are equipped with advanced charting tools, technical indicators, and automated trading capabilities. These platforms are available on both desktop and mobile devices, ensuring seamless trading experiences across all devices.

The broker places a strong emphasis on education, providing a wealth of resources such as webinars, tutorials, and market analysis to help traders make informed decisions. Additionally, Admiral Markets is regulated by several reputable financial authorities, ensuring a high level of trust and transparency.

Overall, Admiral Markets stands out as a top-tier broker, offering a comprehensive trading experience supported by excellent customer service and innovative tools.

Your capital is at risk

7. Trade Nation

Trade Nation is a well-established stock broker known for its reliability and comprehensive range of services. As an FCA regulated broker, traders can trust that their investments are in safe hands. Trade Nation offers a diverse selection of trading options, including stocks, CFDs, spread betting, and forex trading. One of the standout features of Trade Nation is its commitment to providing low-cost fixed spreads, starting from an impressive 0.6 pips for CFDs, ensuring traders can navigate the markets without any surprise fees.

In addition to its impressive range of services, Trade Nation offers compatibility with popular trading platforms, including MetaTrader 4 (MT4) and TN Trader. MetaTrader 4 is renowned for its user-friendly interface and advanced charting capabilities. It is a preferred choice for many traders due to its extensive range of technical indicators, customizable charts, and automated trading options through Expert Advisors (EAs). With Trade Nation’s integration of MT4, traders can access a seamless trading experience with all the familiar features they rely on for their trading decisions.

Trade Nation has developed its proprietary trading platform, TN Trader, catering to traders who prefer a platform tailored to the broker’s offerings and user experience. TN Trader boasts a user-friendly interface and is equipped with a suite of tools, including advanced charting, analysis tools, and real-time market data. It is an excellent option for traders who prefer a platform specifically designed to complement Trade Nation’s services and trading conditions.

Trade Nation also provides regulated signals software that can be used to guide stock trading decisions. As well as this, users can also access a variety of educational resources and analysis tools that can be used to improve trading strategies and make informed stock trading decisions. Users can practice different strategies with the free demo account.

75% of retail investor accounts lose money when trading CFDs with this provider.

8. IUX.com

IUX.com boasts competitive spreads, a key factor for maximizing your profit potential. They also advertise high leverage, which can amplify gains (and losses) for experienced traders comfortable with calculated risks. The MT5 platform is a user-friendly and powerful tool, providing advanced charting functionalities and a robust set of technical indicators to help you make informed trading decisions.

IUX.com understands that every trader has unique needs. That’s why they offer a variety of account types, allowing you to select the option that best suits your capital and trading style. This level of flexibility ensures you can enter the market with confidence, knowing your account is set up for your specific goals.

If you’re looking for a forex broker that prioritizes your trading experience, IUX.com is definitely worth considering. Their diverse platform, competitive offerings, and focus on trader empowerment make them a compelling choice for those seeking to navigate the forex market.

Your capital is at risk.

9. Fineco Bank

Fineco Bank is also popular with UK investors as it allows you to get started with a small investment of £100. If you do feel comfortable investing on a DIY basis, Fineco Bank offers multiple research tools and ongoing market commentary.

When it comes to safety, Fineco Bank is heavily regulated. Your funds are protected by the FSCS and the broker holds that all-important FCA license.

| Commission | Starting from £0 commission on FTSE100, US and EU Shares CFDs, market spread only and no additional markups. |

| Deposit fee | Free |

| Withdrawal fee | $0 |

| Inactivity fee | None |

| Account fee | None |

| Minimum deposit | £0 |

| Stocks markets | Access to 13 stock markets |

| Tradable assets | CFDs, Forex, Commodities, Stocks and ETFs, indices, mutual funds, bonds, options, futures, |

| Available Trading Platforms | Web-based trading platform, mobile trading app, desktop trading platform |

Your capital is at risk.

Step 2: Research Manchester United Shares

Before you go out to purchase Manchester United shares, it would be best if you research more about this football club. As such, you need to take a look at the financials and the future plans of Man United, the dividend payout, and the share price performance over the last years.

With that in mind, the section below will help you get as much information as possible on Manchester United share price and the current financial status of the club

What is Manchester United?

But Manchester United is not only a football club that competes in the Premier League and in other European leagues like the Champions League – but it is also the fourth largest most valuable football club in the world in 2021 after Barcelona, Real Madrid, and Bayern Munich.

Old Trafford, also known as the “theatre of dreams”, is Manchester United’s stadium since 1910 and has around 76,000 seats since 2006 when the football club has expanded the stadium. Old Trafford is the second-largest stadium in the UK after Wembley and the 34th largest stadium in the world.

Presently, Manchester United is primarily owned by the Glazer family after Malcolm Glazer took hold of a majority stake in the football club in 2005.

Manchester United Share Price

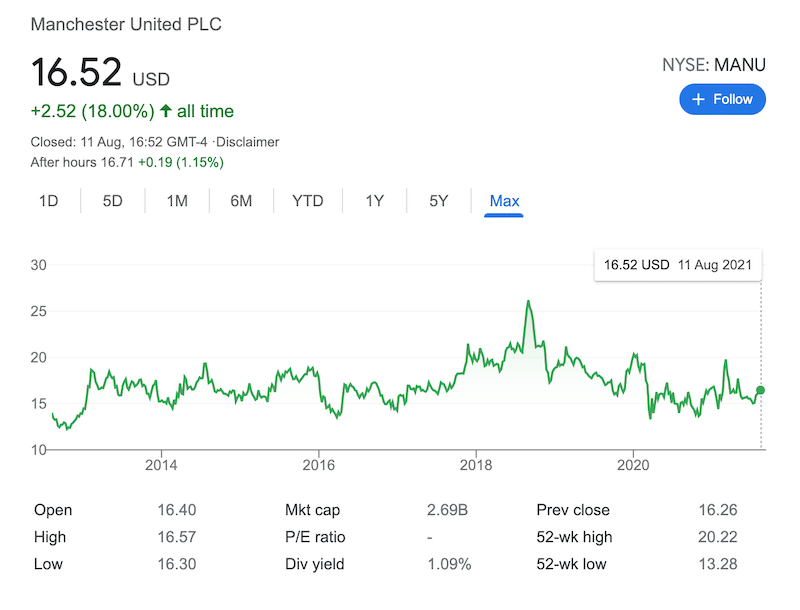

Shares of Manchester United are listed on the New York Stock Exchange since 2012 when the Glazers sold a portion of their ownership in Manchester United in an initial public offering (IPO) on the US stock market. The MANU stock was sold to the public at a price of $14 US dollar per share and since then, the Man United share price was trading at a fairly narrow range.

But while the Manchester United stock was trading steadily for the first six years, in 2018, it reached its record levels of $26.20 per share due to excellent earnings results and increasing demand from investors. However, since then, the MANU share price is trading at a downward trajectory, reaching the lowest level of $13.29 in March 2020 at the time the coronavirus pandemic has shut the sports world.

Nonetheless, Man United still has a market cap of nearly $2.7 billion, and a profitable financial operation despite the pandemic. Early on this year in March, the club reported its first profitable quarter after a year, with a net profit of £63.9m in the final quarter of 2020.

Manchester United Shares Dividends

Another key reason why Manchester United stock is considered attractive for purchase is that investors get an annual dividend of $0.18 per share, which represents a dividend yield of 1.10%. Notably, since 2016, Man United pays the same semi-annual dividend payout of $0.09, with a dividend yield that ranges between 0.95%-2.28%.

Manchester United ESG Breakdown

Nowadays, many investors are looking to invest in companies that are environmentally friendly and socially responsible. One way to find out if a company is indeed ‘ethical’ is by using the ESG score. In the case of Manchester United, the figures are as follows:

- Environmental – 63

- Social – 51

- Governance – 49

Overall, the club scores above the average and is considered a socially friendly business, which can be partly attributed to the recent news that Man United partners with a renewable energy group to create a more sustainable future.

Are Manchester United Shares a Good Buy?

Since the Covid-19 pandemic has disrupted the sports world, Manchester United’s share price fell quite drastically due to the loss of revenues and the uncertainty of the sports industry. Ultimately, the MANU share price dropped from around $20 per share to the lowest levels over the last five years of $13.29 per share.

However, it seems that the negatives are already priced at the Manchester United share price, including the news that the Glazer family plans to sell shares of Man United in a secondary offering. Presently, in the case of Manchester United, there is more good news than bad ones. First, the announcement that Man United is joining the Super-Premium tournament could provide the club with an extra €4 billion and a fixed payment of €264 million per year. Given the fact that Manchester United’s total revenue in 2020 was around £510, this is a major boost for the club.

Other positive factors include the increase by £4.1 million in cash and cash equivalents, the new sponsorship from TeamViewer, and the opening of the Theatre of Dreams” Experience Centre in Beijing. So, all things considered, we believe that Manchester United could be trading by the end of 2021 or in 2022 in pre-covid-19 levels at around $19 per share.

Buy Manchester United Shares with 0% Commission

To sum up, Manchester United is still one of the richest football clubs in the world and is the most valuable digital output sports club in the world, according to a report published by Horizm. Based on our analysts, the Manchester United stock price is expected to rise in the near future, due to the ease of lockdown restrictions and the boost in revenues from the participation in the new super league.