Best Islamic Broker UK – Top Islamic Trading Account Revealed

Not long ago, Muslim traders faced a dilemma: most forex and CFD trading accounts involve overnight swap fees, but the Sharia law that governs Islamic behavior prohibited these types of charges.

Thankfully, many brokers have found ways around these fees and now offer Islamic trading accounts. These accounts don’t charge swap fees or interest fees on leveraged positions, so they fully comply with Sharia law.

In this guide, we’ll review the 3 best Islamic brokers in the UK that you can use to start trading today. We’ll also look more closely at how Islamic brokerage accounts work and how much trading forex with these accounts will cost.

-

-

Top 3 Islamic Brokers UK 2021

Finding the best Islamic broker can be hard. You have to trust that your forex broker has a system in place for consistently rolling over your trades without interest. Plus, you still need access to all the trading tools you’d expect from a standard brokerage account.

With that in mind, here are the 4 best Islamic forex brokers in the UK today:

- Plus500 – Best Selection of Forex Pairs for Islamic Trading – Sign Up Today

- AvaTrade – Lowest Spreads for Islamic Forex Trading – Sign Up Today

Best Islamic Trading Accounts UK Reviewed

1. Plus500 – Best Selection of Forex Pairs for Islamic Trading

Plus500 is another excellent choice for Islamic traders.

Plus 500 offers swap-free CFDs for 70 forex trading pairs, as well as for nearly 2,000 global stocks, 25 commodities, and 14 cryptocurrencies. So, this broker is a good choice if you want the widest possible range of forex and stocks to trade.

We also like Plus500’s approach to fees on Islamic accounts. The broker doesn’t charge commissions and there’s no monthly fee to keep your Islamic account open. You can even avoid Plus500’s inactivity fee simply by logging into your account every few months. Even better, the minimum deposit is just £75.

Spreads for the EUR/USD trading pair start at 0.6 pips.

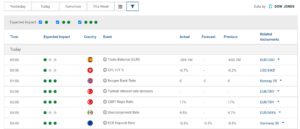

Plus500 has a very good trading platform, too. The broker’s proprietary charting software is highly customisable and includes several dozen technical studies you can use to analyse price action. There’s also an economic calendar that you can filter by expected market impact and country, and a news feed that covers the day’s trading-related events.

All of Plus500’s trading tools are available through a mobile trading app as well as on your desktop.

Plus500 is regulated by the UK’s FCA, and Islamic accounts are backed by the Financial Services Compensation Scheme for up to £85,000. Customer support is available 24/7 by email or live chat.

Pros:

- 70 swap-free forex trading pairs

- £75 minimum deposit for Islamic accounts

- Highly customisable charting platform

- Forex spreads start at 0.6 pips

- 24/7 customer support by live chat

Cons:

- Only offers CFD trading

- Limited forex and stock research

80.5% of retail investors lose money trading CFDs at this site

2. AvaTrade – Lowest Spreads for Islamic Forex Trading

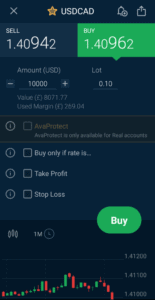

AvaTrade is one of the most affordable Islamic forex brokers in the UK. This forex and CFD broker charges just 0.3 pips for swap-free trading of the EUR/USD currency pair. On top of that, trading is 100% commission-free and you can open an account with just a £75 deposit.

AvaTrade has a selection of 55 currency pairs for trading, but it’s a little bit limited when it comes to other asset classes. The broker has around 600 stock CFDs, 19 stock index CFDs, and 17 commodity CFDs. All of these can be traded swap-free with an Islamic account.

One thing we love about AvaTrade is that you can choose between two trading platforms: AvaTrade’s own WebTrader platform or the widely used MetaTrader 4 platform. Having access to MetaTrader 4 is a huge plus for advanced forex traders since this software supports forex signals, forex robots, and algorithmic trading. It’s also extremely customisable.

You can trade with either platform on mobile, as well as get price alerts on the go. We especially like using the WebTrader app on mobile since it handles full-screen charts and order entry extremely well.

AvaTrade also offers good research tools. Your account includes access to a news feed and economic calendar. Even better, you can view trade ideas based on current setups in the forex market. AvaTrade also spotlights trade-related buzz on social media, although it’s not a social trading broker.

AvaTrade is regulated by the Central Bank of Ireland and the Australian Securities and Investments Commission. Customer support is available by phone, live chat, and email 24/5.

Pros:

- Forex spread start at 0.3 pips

- 100% commission-free trading

- Supports MetaTrader 4 trading platform

- Research tools including trade ideas

- 24/5 phone and chat support

Cons:

- Limited stock and index CFD selection

- Not regulated by the FCA

Your capital is at risk.

What’s Different About an Islamic Trading Account?

Standard trading accounts violate Sharia law, the law that governs the Islamic faith. That’s because Sharia law prohibits interest payments on deposited funds, also known as Riba.

In a normal forex transaction, interest payments happen every night. These payments occur because different currencies typically have different interest rates. These rate differences need to be accounted for when a CFD contract rolls over at the end of the trading day. Forex brokers make money by keeping part of the interest rate charges as a handling, or swap, fee.

That handling fee violates Sharia law, so Islamic accounts do away with it. At the end of the trading day, forex contracts and CFDs held in an Islamic accounts don’t go through the normal rollover process.

Instead, an existing CFD position is closed and then a new position is immediately reopened with a contract for the following day. This swap-free process is allowed under Sharia law and has been approved by leaders of the Muslim faith.

Islamic Brokers Fees Comparison

Swap-free forex trading satisfies Sharia law. But it also leaves brokers without an important piece of revenue that they typically get from forex trading.

So, most Islamic brokers place higher fees on other parts of trading. For example, some brokers charge fixed commissions on trades placed using an Islamic trading account. Others charge higher spreads for CFD trading with an Islamic account compared to a standard account. Many brokers also require a higher minimum deposit to open an Islamic account.

Still, these fees often aren’t that substantially different from those charged by standard brokerage accounts. Let’s take a closer look at the total fees charged by our top 3 Islamic forex brokers:

Minimum Deposit EUR/USD Spread Trade Commission Monthly Account Fee Inactivity Fee Plus500 £75 0.6 pips None None £10 after 3 months AvaTrade £75 0.3 pips None None £40 after 3 months Think carefully about what assets you plan to trade and how much you will be charged in spreads when choosing the best Islamic forex broker.

Conclusion

Muslim traders have special restrictions when it comes to forex trading because of Sharia law. Thankfully, many UK brokers have established special Islamic forex trading accounts to offer a swap-free trading alternative that doesn’t run afoul of the Muslim faith.

Islamic trading accounts often have different fees than standard trading accounts, so it’s important to know exactly what you’re getting when you sign up for an Islamic trading broker. The 3 UK forex brokers we reviewed all offer competitive fees, excellent trading platforms, and a wide range of forex pairs and CFDs for trading.

FAQs

Is forex trading halal?

Forex trading is considered halal, or approved, under Sharia law as long as there are no interest charges involved. Islamic brokers eliminate interest charges to make forex trading halal.

What is Riba?

Riba is the Arabic word for interest payments. Riba is prohibited under Sharia law, which is why Islamic accounts offer swap-free forex contracts.

How does swap-free forex trading work?

With an Islamic swap-free trading account, your forex contracts are closed at 11:59:59 pm each night. Your positions are then reopened at 12:00:01 am, a few seconds later, under contracts for the next day.

Are Islamic accounts more expensive than standard accounts?

Islamic accounts have a different fee structure than standard forex trading accounts. Whether they are more or less expensive depends on the exact spreads your broker charges for trading and how frequently you hold overnight forex positions.

Can I trade with leverage when using an Islamic account?

Yes, you can trade with leverage as you would normally when using an Islamic forex account. Most UK forex brokers offer leverage up to 30:1 for retail traders.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2025 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkCookie PolicyScroll Up

Plus500

Plus500

AvaTrade is one of the most affordable Islamic forex brokers in the UK. This forex and CFD broker charges just 0.3 pips for swap-free trading of the EUR/USD currency pair. On top of that, trading is 100% commission-free and you can open an account with just a £75 deposit.

AvaTrade is one of the most affordable Islamic forex brokers in the UK. This forex and CFD broker charges just 0.3 pips for swap-free trading of the EUR/USD currency pair. On top of that, trading is 100% commission-free and you can open an account with just a £75 deposit.