Best Renewable Energy Investment Funds UK to Watch

Over the past decade, the popularity of renewable energy has skyrocketed, with more and more companies researching greener ways to generate power. As such, renewable energy funds have become a way for users to diversify their funds worldwide.

This guide will review some of the Popular Renewable Energy Investment Funds UK for 2021.

Popular Renewable Energy Investment Funds UK List

The list below highlights ten of of the popular renewable energy funds UK. In the section that follows, we will dive into each of these funds in detail.

- VanEck Vectors Semiconductor ETF

- Invesco Solar ETF

- iShares PHLX Semiconductor ETF

- ARK Innovation ETF

- Renewable Energy CopyPortfolio

- BlackRock Sustainable Energy Fund

- VT Gravis Clean Energy Income Fund

- S&P Global Clean Energy Index

- Invesco WilderHill Clean Energy ETF

- Gresham House Energy Storage Fund

Popular Renewable Energy Funds UK Reviewed

Renewable energy funds are a type of mutual fund that is becoming increasingly popular worldwide thanks to their potential returns, but also due to the fact they offer an ethical investment opportunity. However, as is always the case when investing in a particular fund, you must do your due diligence and research your options thoroughly before making your investment.

In the section below, we provide an in-depth look at some of the popular renewable energy investment funds UK that were mentioned in the list above. Our analysis will cover each fund’s asset composition and performance, to effectively break down each of these assets.

1. VanEck Vectors Semiconductor ETF

Our first pick when it comes to the popular renewable energy investment funds UK is the VanEck Vectors Semiconductor ETF. This fund invests in a range of companies involved in the production of both semiconductors and energy-producing equipment. Semiconductors are vital when it comes to energy efficiency, as they allow the specific element (such as wind or solar power) to be transformed into usable energy. Furthermore, they also play a part in energy storage.

Looking at this fund’s performance, you can immediately see just how much capital growth it can generate for investors. It has returned over 30% in five of the last nine years, and even returned 64% in 2019 alone. Furthermore, this fund only generated a negative return in 2015 and 2018. Finally, since the beginning of the year, this fund is also up a healthy 10.31% overall. Combine this consistent performance with a low expense ratio of only 0.35%, it may be a cost-effective investment strategy for the future.

2. Invesco Solar ETF

Solar power has become increasingly popular across America and Europe over the last decade as an alternative way to generate electricity for both homes and businesses. The Invesco Solar ETF holds solar-based equities worth $4.12 billion, aiming to provide annual returns that are both consistent and significant. Some of this fund’s largest holdings are Enphase Energy, SolarEdge Technologies, and Sunrun Inc.

Due to the rise in popularity of solar power, this fund has seen some high returns in recent times. In the past year alone, the fund has returned 178.07% to investors and even returned 65.65% in 2019 too. However, it is wise to note that this fund does exhibit large amounts of volatility, often changing from a positive return in one year to a negative return in the next.

3. iShares PHLX Semiconductor ETF

Much like the first fund on our list, the iShares PHLX Semiconductor ETF aims to provide exposure to the growing semiconductor industry, specifically within the US marketplace. This offers a potential way for investors to get involved in the US market, where most of the large semiconductor firms are operating. These firms are becoming valuable to investors thanks to ESG (environmental, social, and corporate governance) factors, along with their growth potential.

This fund holds 30 of the high-performing semiconductor equities within the US and has provided impressive returns over the past couple of years – it even returned 52.93% in 2020, which is admirable considering the scale of the Coronavirus pandemic.

4. ARK Innovation ETF

If you’re looking to invest in one of the popular UK renewable energy funds UK, the ARK Innovation ETF may be a potential option thanks to its potential for growth but also its diversification benefits. This fund invests in ‘innovative’ companies related not just to renewable energy but also other areas such as DNA technologies and Fintech. As such, it provides a diversified asset that looks to capitalise on shifts in the global landscape.

This fund generated a remarkable return for investors in 2020, returning 152.52% for the whole year. Furthermore, it has produced a positive return in four of the last five years and even returned 87.38% in 2017. These returns can be attributed to the fund manager’s intelligent stock picks combined with the disruptive nature of the fund’s equities. With a modest expense ratio of 0.75%, this fund may be a cost-effective option for investors.

5. Renewable Energy CopyPortfolio

Although this is not technically a ‘renewable energy fund’, the Renewable Energy CopyPortfolio is worth mentioning due to the many features it offers. The Renewable Energy CopyPortfolio is a tailor-made portfolio investment and research team and is designed to provide exposure to companies that are developing ways to generate clean energy. This CopyPortfolio contains a number of large-cap firms involved in various environmentally friendly activities, such as solar power generation, recycling, battery charging, and clean transportation.

6. BlackRock Sustainable Energy Fund

If you are in the market for long term capital growth, the BlackRock Sustainable Energy Fund is a potential investment option. This fund invests at least 70% of its capital into companies involved in clean energy projects and avoids companies engaged in sectors related to the production of coal, gas, and oil. Through the fund’s investments into these clean energy companies, it aims to maximise capital growth for investors over the mid to long term.

Having been in operation since 2001, this popular investment fund has experienced some returns in recent years, generating 25.2% and 45.8% returns for investors in 2019 and 2020 respectively. Holding a mixture of assets from the US, UK, and Europe, the BlackRock Sustainable Energy Fund also offers investors a diversified asset that provides exposure to various geographical areas.

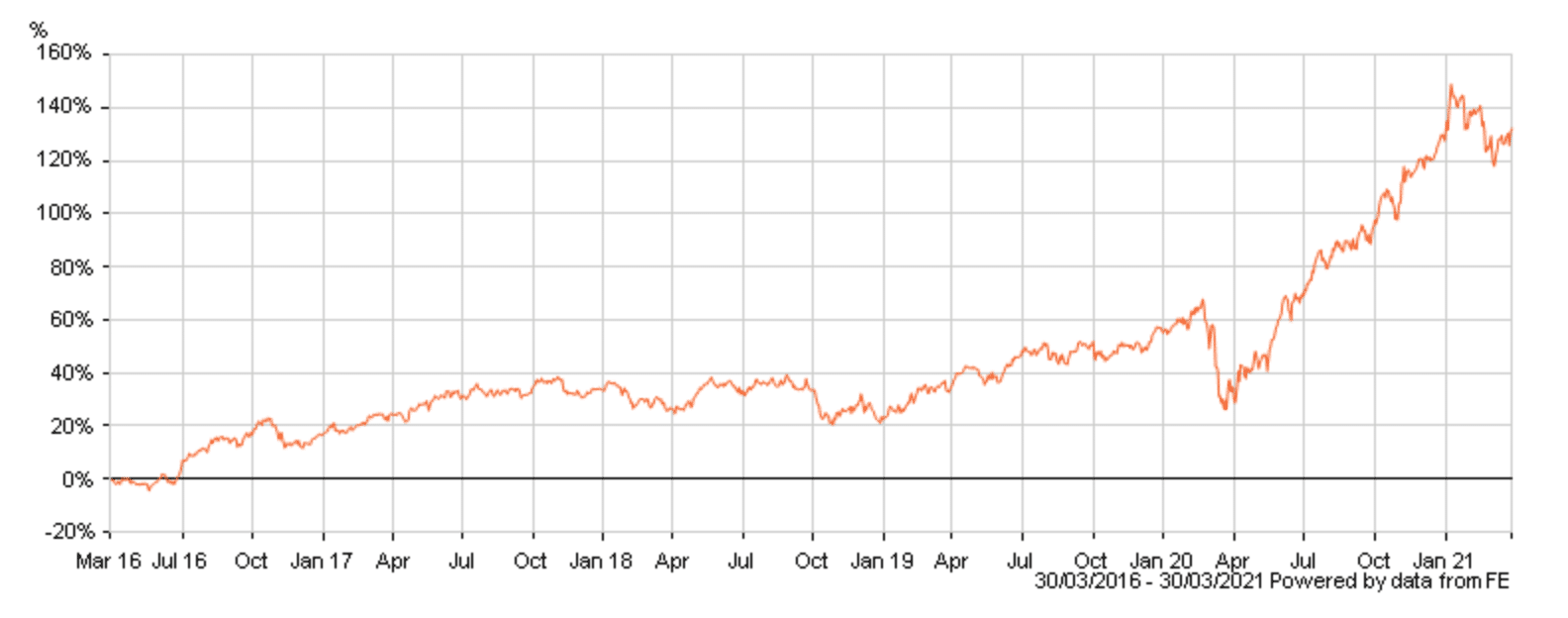

7. VT Gravis Clean Energy Income Fund

As most renewable energy firms tend to reinvest their profits back into the company rather than provide dividends, the majority of renewable energy funds tend not to offer a significant yield to investors. However, if you are in the market for a passive income, then the VT Gravis Clean Energy Income Fund is one of the few renewable energy funds that offers a high price yield.

This fund offers a yield of 3.04% to investors, meaning that if you looked at how to invest 5000 pounds into this fund, you could expect to receive a total of £170 in dividend payments each year. These payments are made quarterly, providing investors with a regular passive income stream to add to their portfolio. In addition, the fund has also performed well when it comes to annual returns too; it generated an impressive 34.3% for investors in 2019 and 27.1% for investors in 2020.

8. S&P Global Clean Energy Index

Standard and Poors (S&P) are popularly known for the S&P 500 index – but they also provide a clean energy index too. The S&P Global Clean Energy Index is designed to measure the performance of 30 of the world’s leading companies when it comes to generating clean energy. With net assets of $5.79 billion, this index fund aims to track some of the popular renewable energy firms in the world, including Plug Power Inc and Enphase Energy.

Looking at returns, this index fund generated an incredible 141.31% for investors in 2020. So, if you had invested £5000 at the start of the year, your position would be worth £12,065.50 at the end of the year. Furthermore, the S&P Global Clean Energy Index only charges a relatively small expense ratio of 0.46% annually – which, given the returns the fund makes, is nothing to be concerned about.

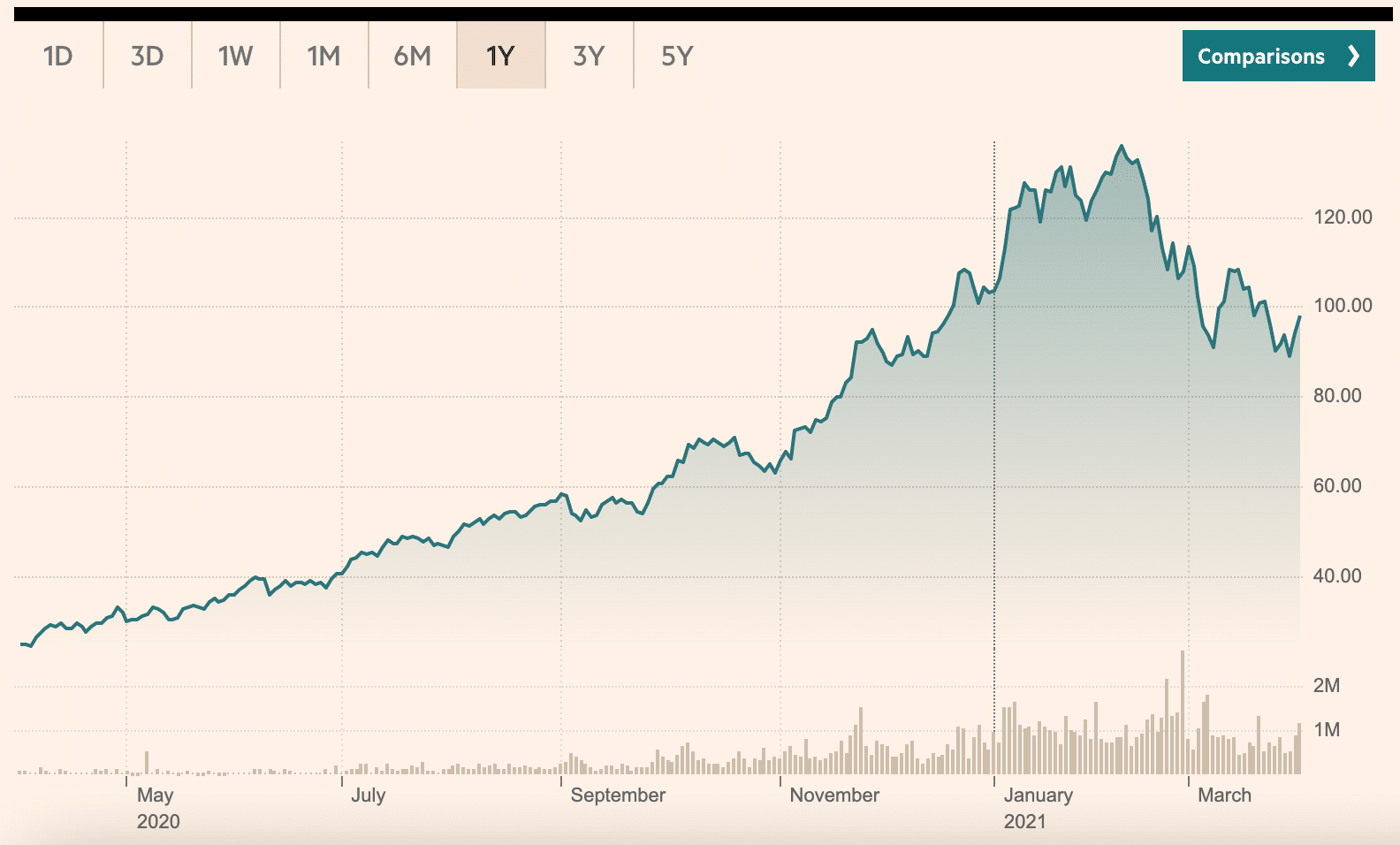

9. Invesco WilderHill Clean Energy ETF

If you are a particularly risk-seeking investor who is happy to invest in a higher-volatility renewable energy fund in order to potentially generate returns, then the Invesco WilderHill Clean Energy ETF might be worth considering. This fund invests in 69 of the US’s popular clean energy firms, predominantly focused on small-cap blend and small-cap growth stocks. Due to the nature of these stocks, this fund is high-risk but has the ability to generate incredible returns.

Looking at past performance, the fund has done exceptionally well in recent times, returning 189.89% to investors in the past year alone. Furthermore, it returned 61.85% to investors in 2019. However, as mentioned previously, this fund does exhibit high volatility; it has produced a negative return in four of the past eight years.

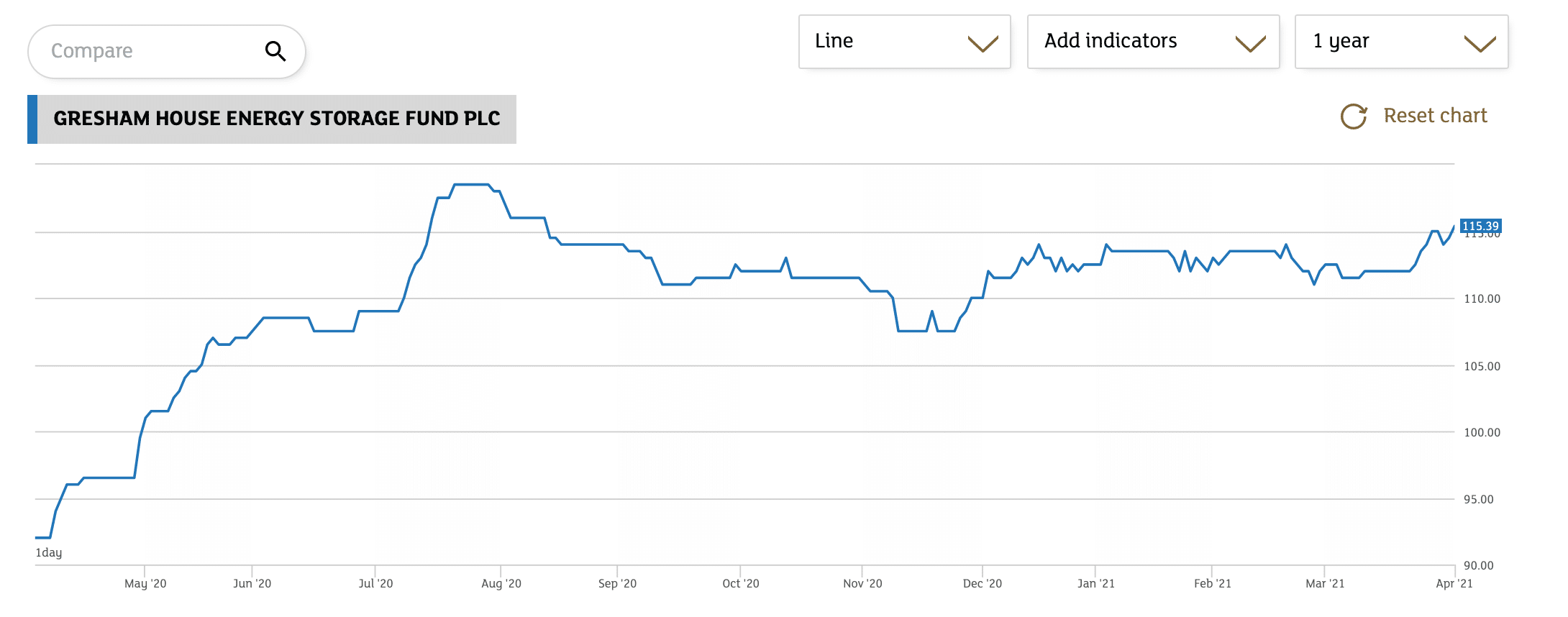

10. Gresham House Energy Storage Fund

The last fund we will analyse when discussing the popular UK renewable energy fund UK is the Gresham House Energy Storage Fund. This fund primarily invests in companies based in the UK that are involved in producing renewable energy, mostly related to batteries. The fund seeks to provide investors with both long-term capital growth and consistent dividend payments.

Over the past year, the fund has returned a solid 24.57% to investors, comfortably beating the returns produced by the FTSE 100 index. Furthermore, the Gresham House Energy Storage Fund offers a high yield of 6.11% to investors, distributed every three months.

What are Renewable Energy Investment Funds?

Renewable Energy Investment Funds are a type of fund that invests in companies immersed in the production of renewable energy. This energy can come in many forms, but solar energy, wind energy, hydro energy, and even geothermal energy are the main ones. These energy types are becoming increasingly popular due to the low impact they have on the environment compared to other types, such as coal and gas.

Due to the increasing popularity of renewable energy over the past two decades, firms that operate within the sector have experienced a notable rise in both size and volume. Companies such as Vestas Wind Systems and Canadian Solar are striving to change the way people and businesses use energy, intending to reduce carbon emissions and tackle climate change. Looking at the stats, it can be seen that these firms are already doing a fantastic job – renewables accounted for 30% of global electricity generation in 2020.

The incredible potential for growth within the renewable energy sector has seen an increase in the number of renewable energy funds in existence. The popular renewable energy investment funds UK aim to focus on firms that have both strong balance sheets and solid cash flows, as these firms are better poised to grow over the mid to long term. Furthermore, these funds also tend to invest in firms who reinvest their profits back into the business rather than distribute it as dividend payments.

Features of Renewable Energy Funds

As touched on previously, renewable energy funds are becoming increasingly popular with a wide variety of investors. In this section, we discuss three of the main factors that may affect your investment decision in renewable energy funds.

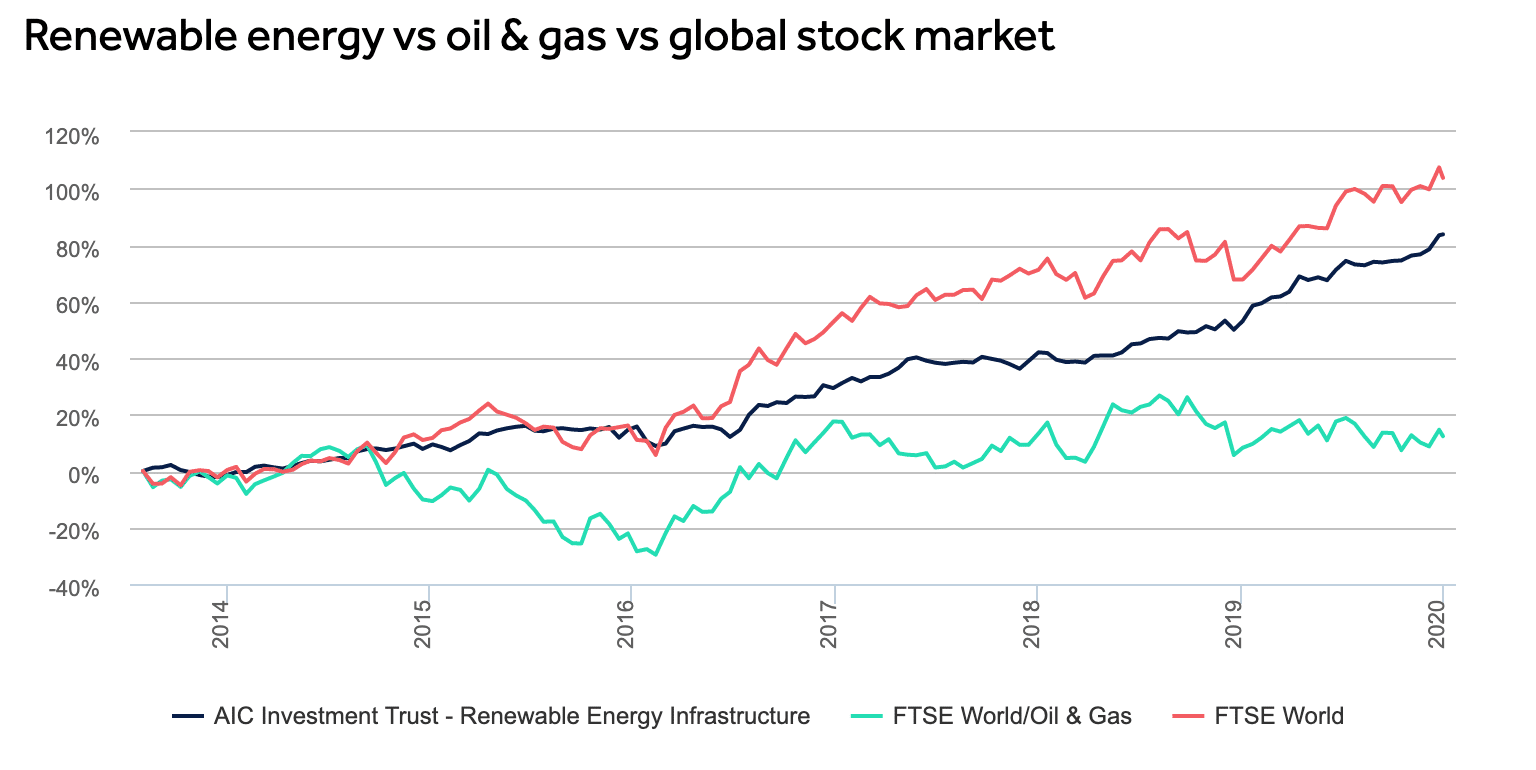

Market-Beating Returns

As you would have noticed earlier in this guide, the level of returns that these funds are capable of is astronomical compared to some of their peers. It is not uncommon for renewable energy funds to return over 100% in a calendar year, with some returning nearly 200% in certain years.

However, these market-beating returns are not always the case; the smaller nature of renewable energy funds means that returns tend to be more volatile. Looking at the image below, you can see that renewable energy returns are outpacing oil & gas returns overall but are still below the global stock market over the long term. So, although renewable energy funds are undoubtedly capable of producing market-beating returns, it is wise to remember that these funds’ inherent risk means that negative returns are a genuine possibility.

Exposure to a Growing Market

Another reason to invest in renewable energy funds is that they provide an avenue to gain exposure to a prospering market. Taking the UK as an example, the renewable energy market is projected to grow at a compound annual growth rate (CAGR) of more than 9% between now and 2026. Furthermore, the renewable energy market is expected to value $1.5trillion worldwide by 2025.

These stats highlight the potential scale that this market is expected to reach, which is why many investors are looking to get involved at the ground level. The popular renewable energy funds UK provide a cost-effective approach to gaining exposure to this market, and with the societal shift towards cleaner energy, these funds are expected to continue to increase in popularity.

Provides an Ethical Investment Strategy

The third reason that renewable energy funds UK present a potential opportunity is because they are considered one of the popular ethical investments available in the marketplace. It is common knowledge that fossil fuel usage has a detrimental impact on the sustainability of business operations in the modern age. Due to this, alternative energy sources are becoming more popular thanks to their low impact on the environment and their renewable nature.

Energy technology based on solar power and offshore wind farms is leading the way when it comes to renewable energy, as they do not pollute the atmosphere in the same way that oil and gas does.

Popular Renewable Energy Funds Brokers

Now that you’ve had a glimpse at a selection of the popular renewable energy funds UK, and you understand some features of the industry, it is time to discuss some of the populr stock brokers that allow users to invest in Renewable Energy Funds.

In the section below, we discuss two of popular brokers that allow users in the UK to invest in Renewable Energy Funds.

How to Invest in Renewable Energy Investment Funds

Now that you have all the necessary information to inform your investment decision, it is time to show you the exact process you need to follow. This section will provide a step-by-step guide that shows you how to invest in renewable energy funds UK.

Users can follow these steps after choosing a suitable broker, that may assist them in their investing process.

Open Your Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Verification Process

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Invest in Renewable Energy Funds

Once your account has been funded, proceed to search for any Renewable Energy Funds you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

With companies becoming increasingly aware of the need to update their operations due to climate change, the renewable energy sector is in a prime position, and may be a potential way for users to diversify their funds However, like any asset class, there is risk involved in every trade.

This is why users should properly research and analyse the assets before opening a trade.