Best Irish Funds UK to Watch

The Irish funds industry is growing year on year, and it’s easy to see why. With an increasing number of the world’s largest funds choosing to be domiciled in Ireland, investing in Irish funds has become a potential trading prospect for investors across the globe.

In this guide, we discuss some of the Popular Irish Funds UK, and show you how you can invest with suitable broker of your choice.

Popular Irish Funds UK List

If you’re looking for a quick rundown of the popular Irish funds UK, look no further.

- iShares MSCI UK IMI ESG Leaders UCITS ETF

- Vanguard ESG Global Corporate Bond UCITS ETF

- Aviva PLC

- Vanguard ESG Global All Cap UCITS ETF

- Invesco Global Clean Energy ETF

- Invesco US Municipal Bond UCITS ETF

- iShares MSCI Pacific ex-Japan ESG Leaders UCITS ETF

- Baillie Gifford Worldwide Responsible Global Equity Income Fund

- Waverton Multi-Asset Income Fund

- Neuberger Berman Global High Yield Bond Fund

Popular Irish Fund to Watch

The Irish fund industry’s fast-growing nature is leading to more and more retail and institutional investors looking to place their capital in one of the leading Irish funds. However, with so many fund types to choose from and a wide range of fund providers, it can be challenging to decide which fund domiciled in Ireland to choose from.

To help you out, this section of the guide will analyse ten Irish funds which are available to trade in the UK. We’ll discuss each in detail, providing you with the necessary information you need to make an efficient investment decision.

1. iShares MSCI UK IMI ESG Leaders UCITS ETF

If you are looking for one of the popular Irish funds to invest in, then the iShares MSCI UK IMI ESG Leaders UCITS ETF is worth considering. This fund aims to invest ethically whilst still maintaining an attractive risk profile. Domiciled in Ireland, this fund is available for many investors throughout the United Kingdom and Eurozone due to the UCITS framework it abides by.

One of the exciting things about this fund is how new it is. Having been in operation for less than a month, this fund is already up over 3% in under two weeks. Looking at the fund’s assets, it mainly invests in UK equities from the financial services sector, with some funds being allocated to the consumer defensive sector and communications sector also. Although this fund is relatively new to the market, it represents a potential investment opportunity thanks to its ethical investment strategy and growth potential.

2. Vanguard ESG Global Corporate Bond UCITS ETF

If you’re looking to invest in one of the popular Irish investment funds, but wish to focus on bonds, then the Vanguard ESG Global Corporate Bond UCITS ETF represents a potential option. This fund invests in global corporate bonds from both developed and emerging markets funds, with maturities that are greater than one year. This approach aims to generate consistent returns and provide investors with a solid level of diversification.

After making a slight loss in 2018, this fund has produced positive total returns in the following two years, generating 10.26% and 6.65% in 2019 and 2020, respectively. Furthermore, the Vanguard ESG Global Corporate Bond UCITS ETF offers one of the lowest expense ratios on our list, clocking in at only 0.18% annually.

3. Aviva PLC

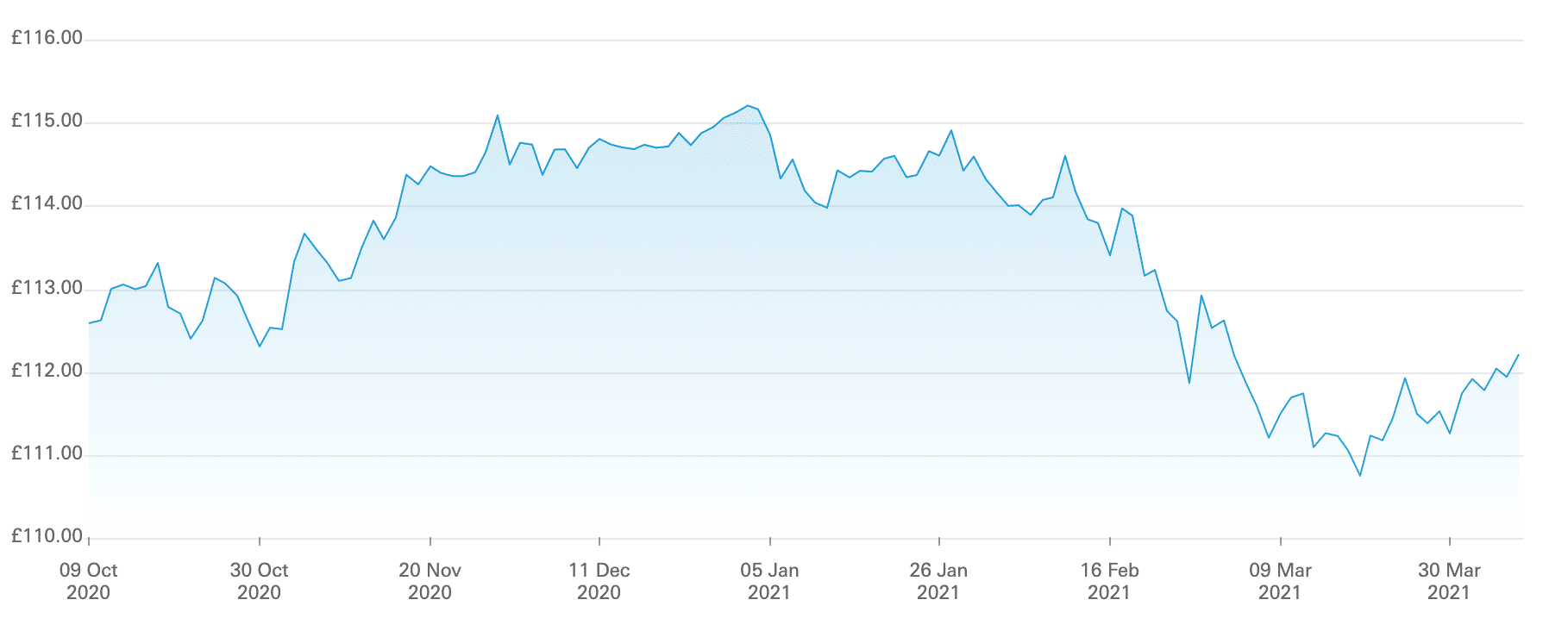

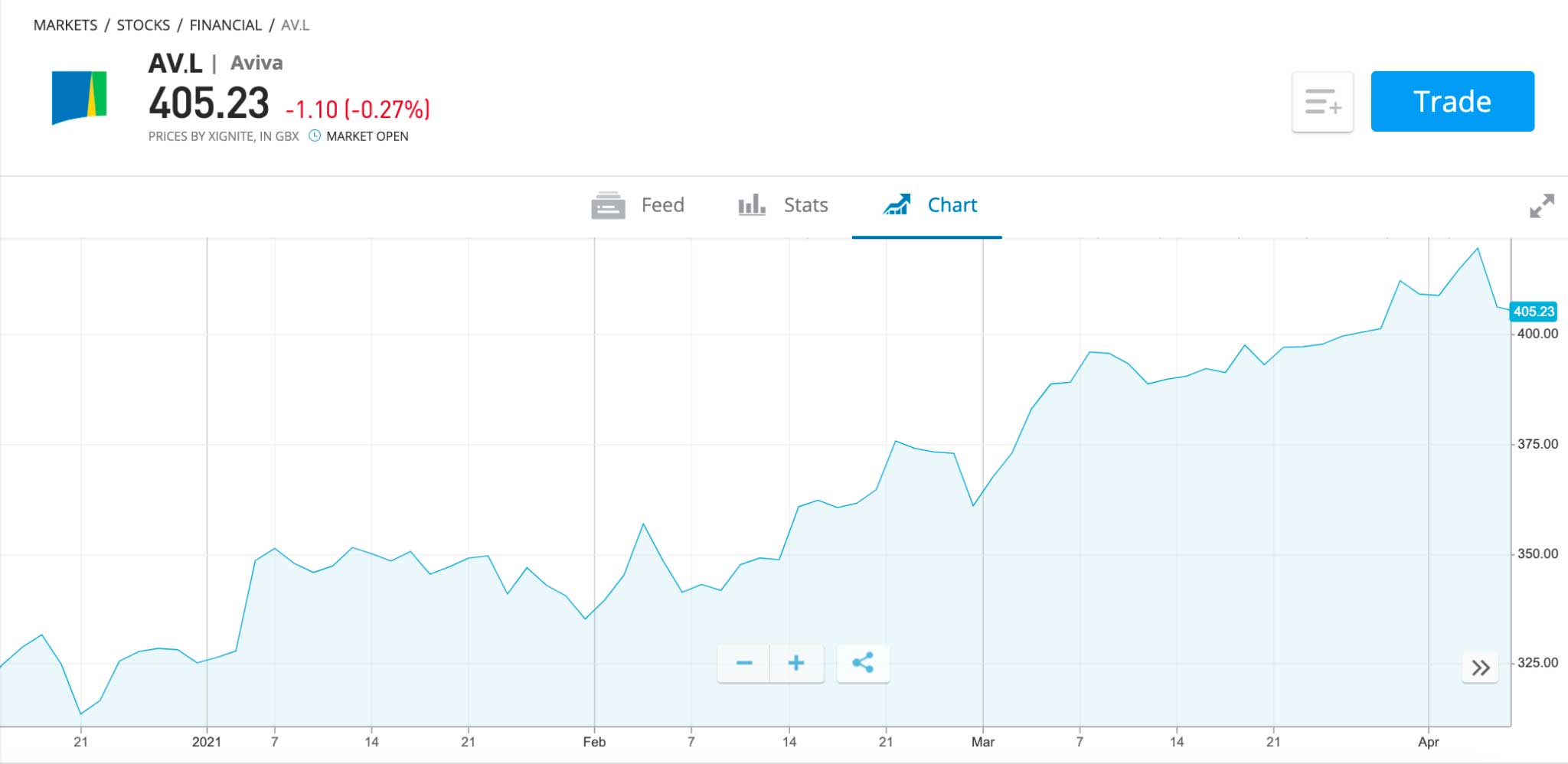

Although not technically a fund, if you are looking to gain indirect exposure to several Irish funds, then it could be worth considering an investment in Aviva. Aviva PLC is a British insurance company that invests in a wide range of assets, including many Irish funds. The Irish funds that Aviva mainly invests in are related to commercial property. So, although investing in Aviva will not mean you are directly investing in an Irish fund, it can give you some indirect exposure to the Irish fund market.

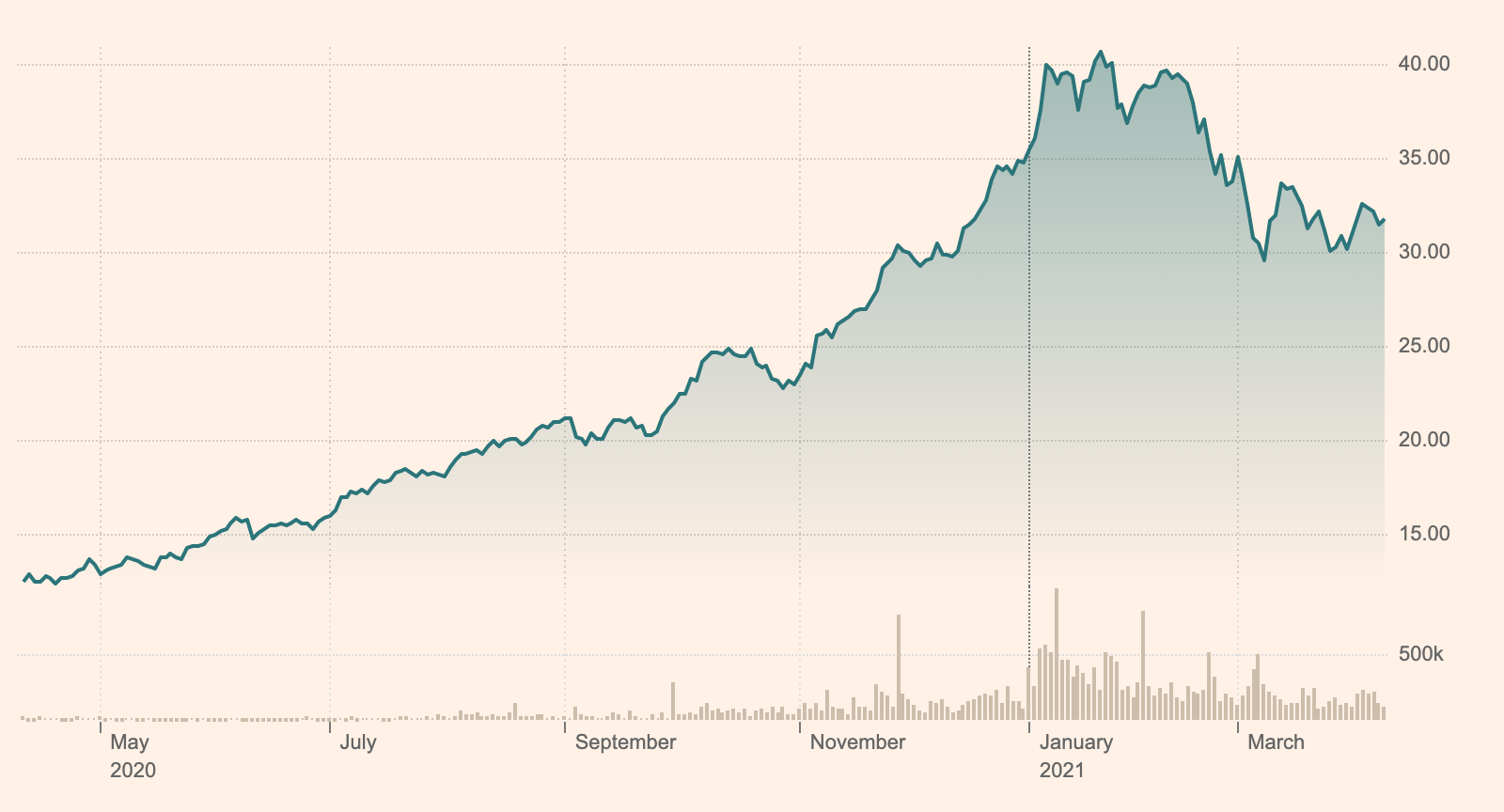

Looking at Aviva’s returns, the stock is currently up nearly 25% since the start of January, meaning if you’d invested £1000 in this stock, you would have made about £250 in returns. Furthermore, reviewing the price chart, a clear upward trend can be seen, highlighting that Aviva seems to recover well each time their stock price suffers a minor dip.

4. Vanguard ESG Global All Cap UCITS ETF

There is a growing number of investors who are placing greater emphasis on ethical investing when it comes to asset management. Funds that invest ethically employ strict criteria on the assets that they invest in, screening them for any harmful elements related to the environment, society, or corporate governance. One of the popular Irish funds to invest ethically is the Vanguard ESG Global All Cap UCITS ETF.

This fund invests in large-, mid-, and small-cap stocks worldwide and excludes any companies that display poor ethics. Furthermore, this fund is very new to the market, having been incepted less than a month ago. However, it has already produced returns of over 3% in the short time that it has been operational, highlighting the potential it may have.

5. Invesco Global Clean Energy ETF

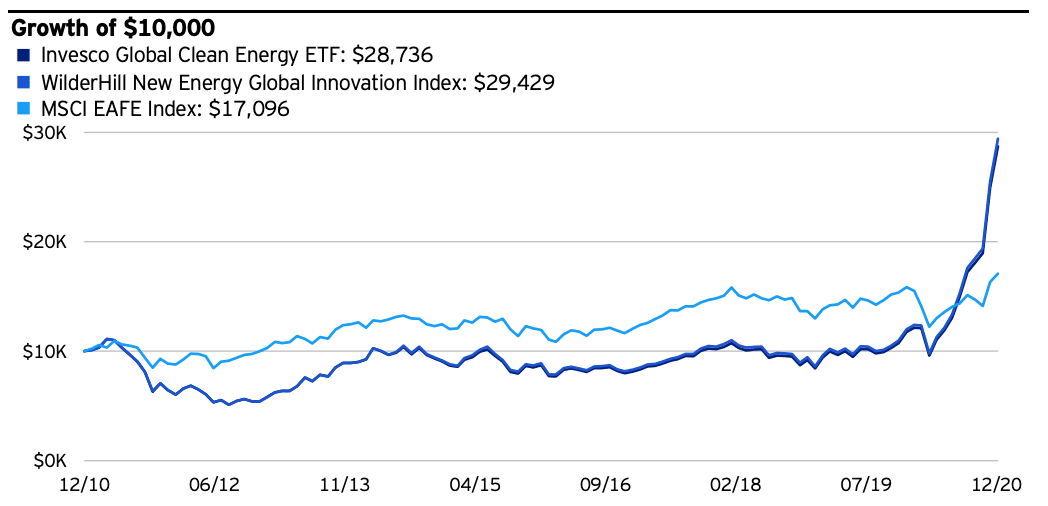

One of the popular renewable energy funds domiciled in Ireland is the Invesco Global Clean Energy ETF. This fund comprises companies that operate within the renewable energy sector, including firms involved in solar power, wind power, and other clean energy sources. A recent report from Deloitte stated that this sector is set to experience significant growth over the next decade, which could provide incredible returns opportunities for funds such as this – and with over $425 million of assets under management, this fund is one of the major players in the industry.

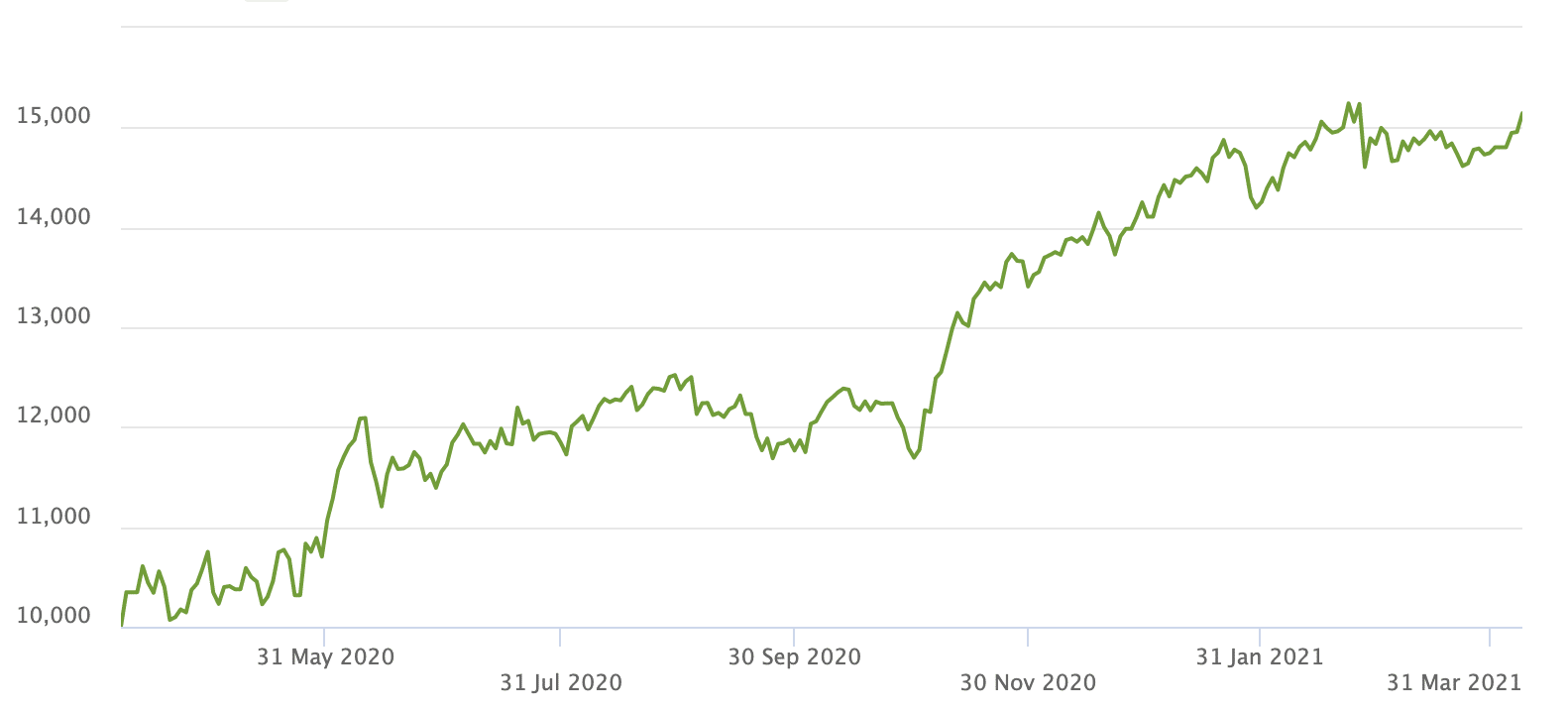

A significant benefit of this fund is the type of returns it can generate. In 2020 alone, the Invesco Global Clean Energy ETF returned 144.13% for investors – which is incredible when you consider the scale of the Coronavirus pandemic. What’s more, the fund even returned 39.66% in 2019. With a modest expense ratio of 0.75%, many investors will see this fund as an attractive opportunity to gain exposure to the renewable energy sector.

6. Invesco US Municipal Bond UCITS ETF

Another new addition to the selection of popular Irish funds is the Invesco US Municipal Bond UCITS ETF, which is Europe’s first ETF that provides exposure to high-yield US bonds. Typically, US bond funds in the market will focus predominantly on investment-grade bonds such as Treasuries, which are one of the popular low-risk investments but provide small returns. Higher yield municipal bonds, such as those employed within this fund, are slightly riskier – but tend to generate more significant returns on the upside.

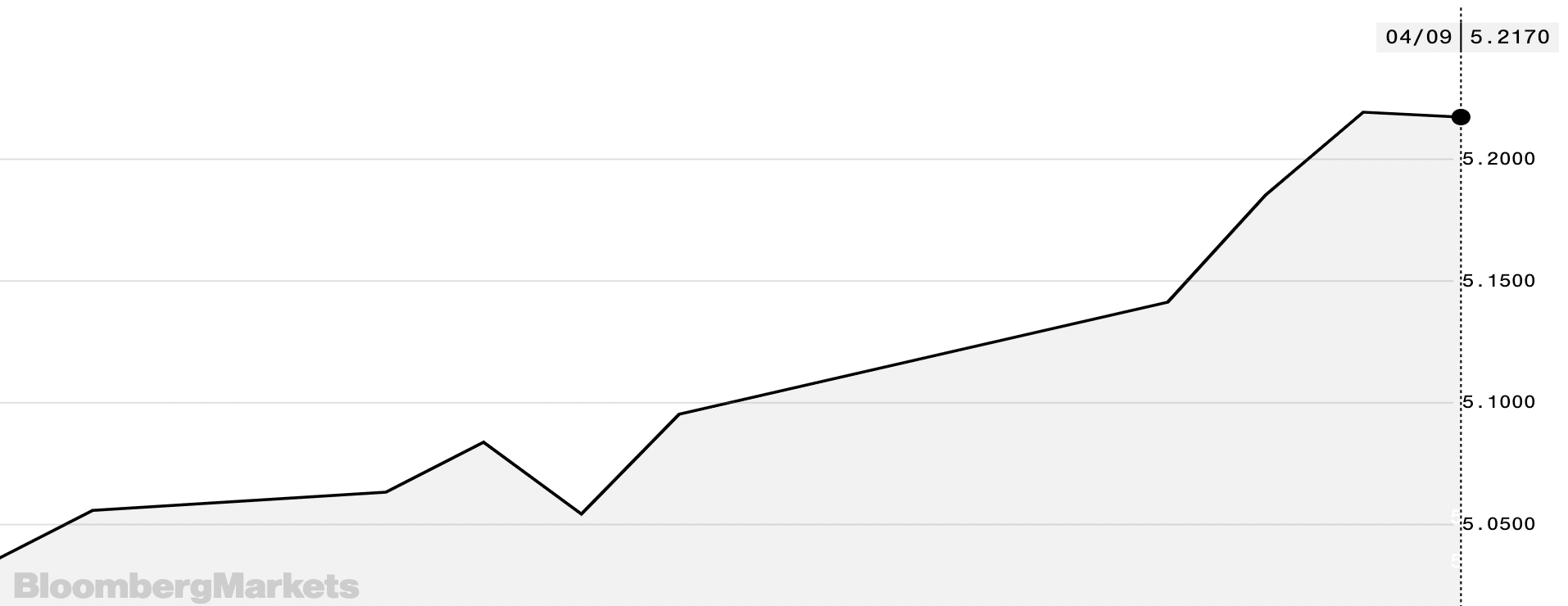

Domiciled in Ireland and traded on the London Stock Exchange, this fund has only been in operation for under two months, and you can see from the price chart that it has already exhibited quite substantial volatility. However, with investment-grade bond yields still relatively low, there is a potential chance that investors may start to gravitate towards municipal bonds throughout the year, thereby improving this fund’s performance. Finally, with a relatively inexpensive expense ratio of 0.28%, this fund is easily accessible for many investors.

7. iShares MSCI Pacific ex-Japan ESG Leaders UCITS ETF

This fund aims to provide exposure to a wide range of countries across the Asia-Pacific region, excluding Japan. By investing in stocks of many firms located in these countries, this fund looks to provide long-term capital growth to investors, all whilst increasing portfolio diversification in a geographic sense. In terms of specific countries, this fund invests predominantly in Australia, Hong Kong, New Zealand, and Singapore.

Looking at recent performance, this fund has generated a positive return in four of the last five years. It has even shown potential to generate market-beating returns, producing 25.84% for investors in 2017 and 18.19% in 2019. Furthermore, it has an affordable expense ratio of 0.2% per annum, making it one of the lowest on our list.

8. Baillie Gifford Worldwide Responsible Global Equity Income Fund

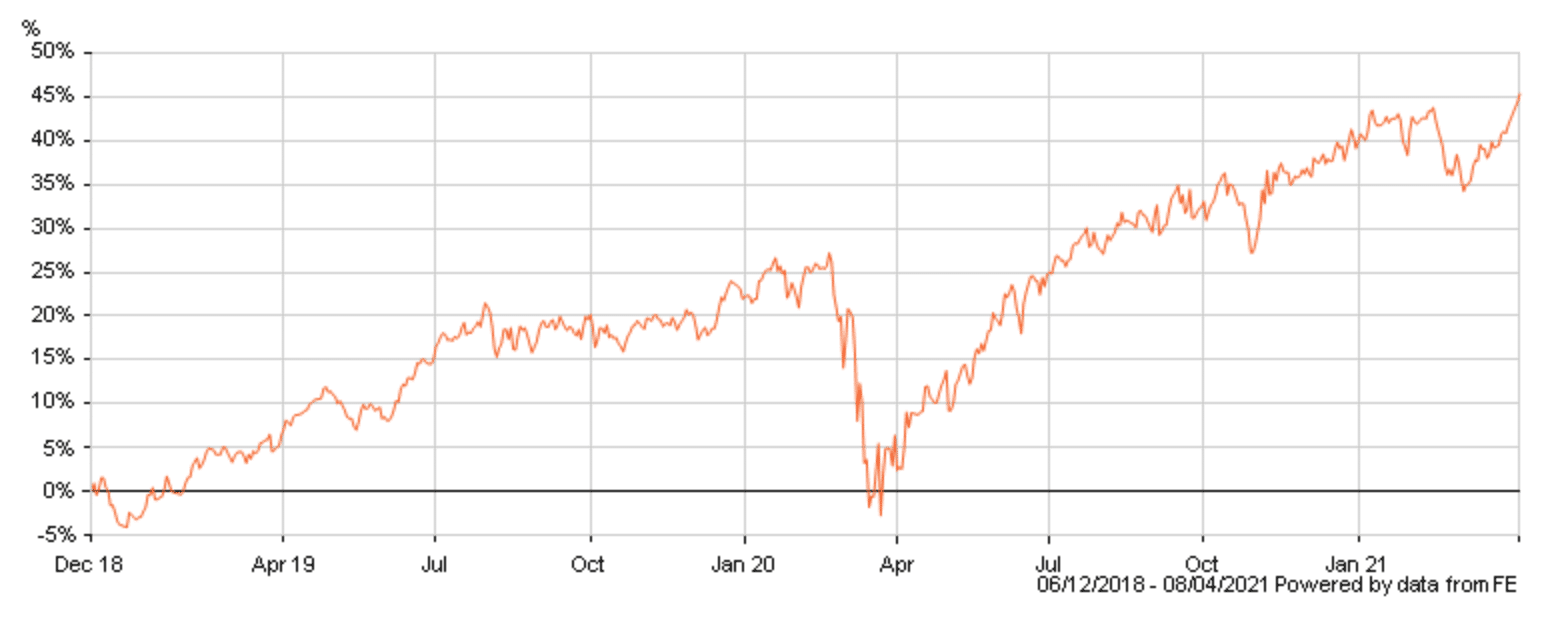

Suppose you’re looking for one of the popular high yield investments to facilitate a passive income stream. In that case, the Baillie Gifford Worldwide Responsible Global Equity Income Fund could be a potential option. By investing in a range of equities across various sectors, this fund aims to produce solid capital growth and current income across a rolling 5-year period. Furthermore, this fund invests in multiple countries, including Taiwan, the US, and Australia, which adds an element of diversification to its assets.

In terms of yield, you may receive 2% per annum by investing in this fund. To provide an example, if you invested £5000, you would receive £100 each year in income payments (minus any fees you have to pay). Although this doesn’t seem like much, this yield has the potential to grow depending on how well the fund performs.

9. Waverton Multi-Asset Income Fund

Multi-asset funds are a specific type of fund that invests in multiple asset classes, such as bonds, equities, and real estate. Through this strategy, these funds aim to create a diversified portfolio that can produce consistent growth. The Waverton Multi-Asset Income Fund is one of these funds – based in Ireland, this fund seeks to invest in various assets to create both capital growth and current income.

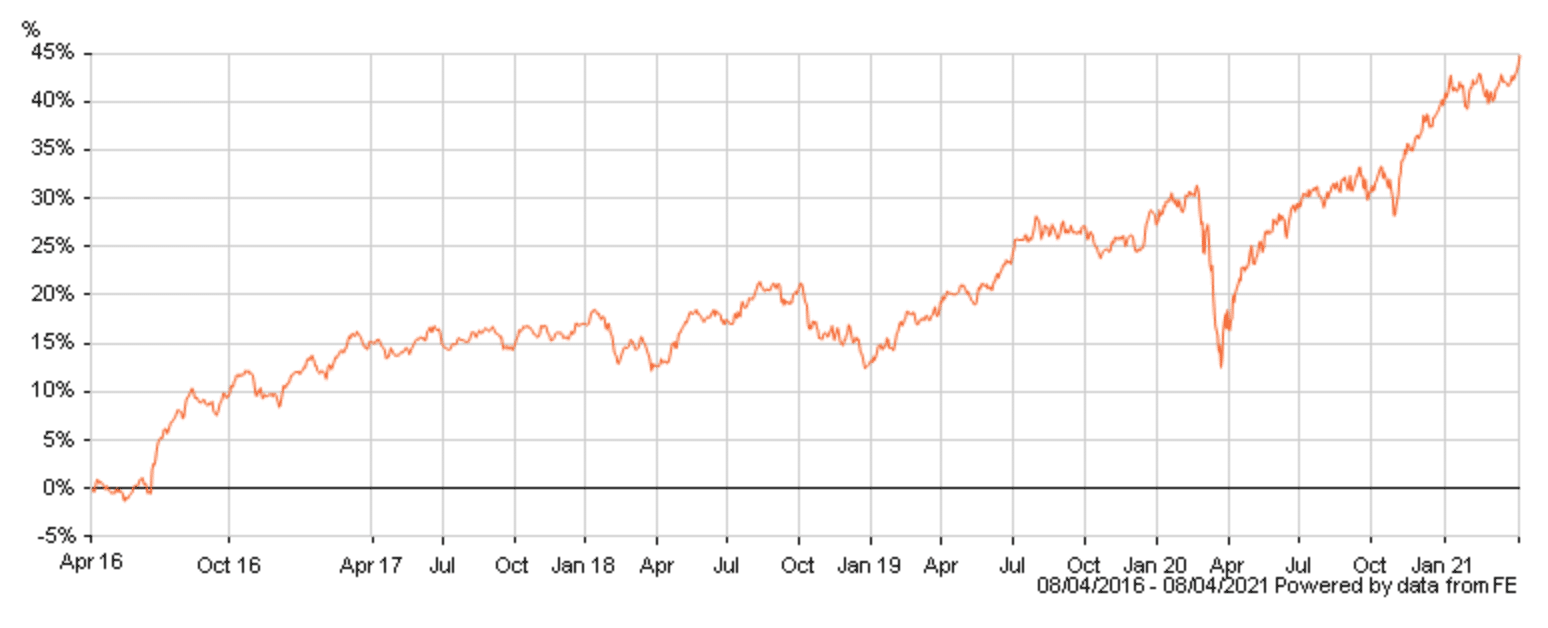

Over the past year alone, the Waverton Multi-Asset Income Fund has returned an impressive 21.50% to investors. Furthermore, the fund has generated a positive return in three of the last five years, with the other two years being very slightly negative. Also, the fund offers a solid price yield of 2.56% to investors, distributed quarterly.

10. Neuberger Berman Global High Yield Bond Fund

The last fund on our list of the popular UK Irish funds is the Neuberger Berman Global High Yield Bond Fund. This fund is domiciled in Ireland has been regulated by the Central Bank of Ireland since 2016. With 93% of its assets being made up of fixed-income instruments, this fund looks to provide annual returns by reinvesting any interest payments back into the fund.

The fund has produced a positive return in three of the last four years, generating 10.75% and 2.34% in 2019 and 2020, respectively. Furthermore, the fund is also up 1.14% since the beginning of the year, with the potential for this figure to grow even further. Finally, it has an a low expense ratio of 0.2% per year, which allows it to be accessible to investors looking for a cost-effective option.

What are Irish Funds?

Irish funds are defined as any fund that is domiciled in the country of Ireland. These funds can be from various classifications, such as bond funds, equity funds, multi-asset funds, or any other type. Typically, Irish funds will be based in Dublin and regulated by the Central Bank of Ireland.

When examining Irish funds, the critical point to note is that they do not exclusively invest in Irish countries. Instead, their name is purely derived from the country they are domiciled in. According to a recent report by the Irish Funds Industry Association, over 1000 fund managers from 50+ countries have assets administered in Ireland.

One of the main reasons that Ireland is an attractive country to domicile a fund is tax efficiency. In some countries, funds will be subjected to heavy taxation, which can erode a large portion of the profits they make. However, Ireland offers quite attractive tax rules for funds – they do not have to pay Irish tax on their income and capital gains. This means that more money is freed up to distribute as dividends or to reinvest back into various assets.

With the Irish funds industry growing each year, more large providers such as Vanguard and Invesco are choosing to launch funds in Ireland. In addition to this, the regulation brought about by Brexit is making Irish funds more attractive to European investors, specifically those operating under the UCITS framework. Due to this, the Irish funds industry’s outlook is encouraging, and we could see more fund providers base themselves in Ireland over the coming years.

Features of Irish Funds

There are many features to look at before investing in Irish Funds. In the section below, we will discuss some key features and factors that may affect your investing decision in some of the popular Irish Funds UK.

Wide Variety of Fund Types

With more and more funds choosing to base their operations in Ireland, this has provided a breadth of investment options for investors to choose from. Some of the popular bond funds providers are launching funds in Ireland, with equity funds providers following suit. Furthermore, even more, fund types are springing up across Ireland, including multi-asset funds and fixed-income funds.

As the pool of potential Irish funds increases, it provides many fund types to choose from. This ensures there is an investment management option for every investor type. It also leads to more diversified funds being available, which can help optimise your risk/return ratio.

Fast-Growing Industry

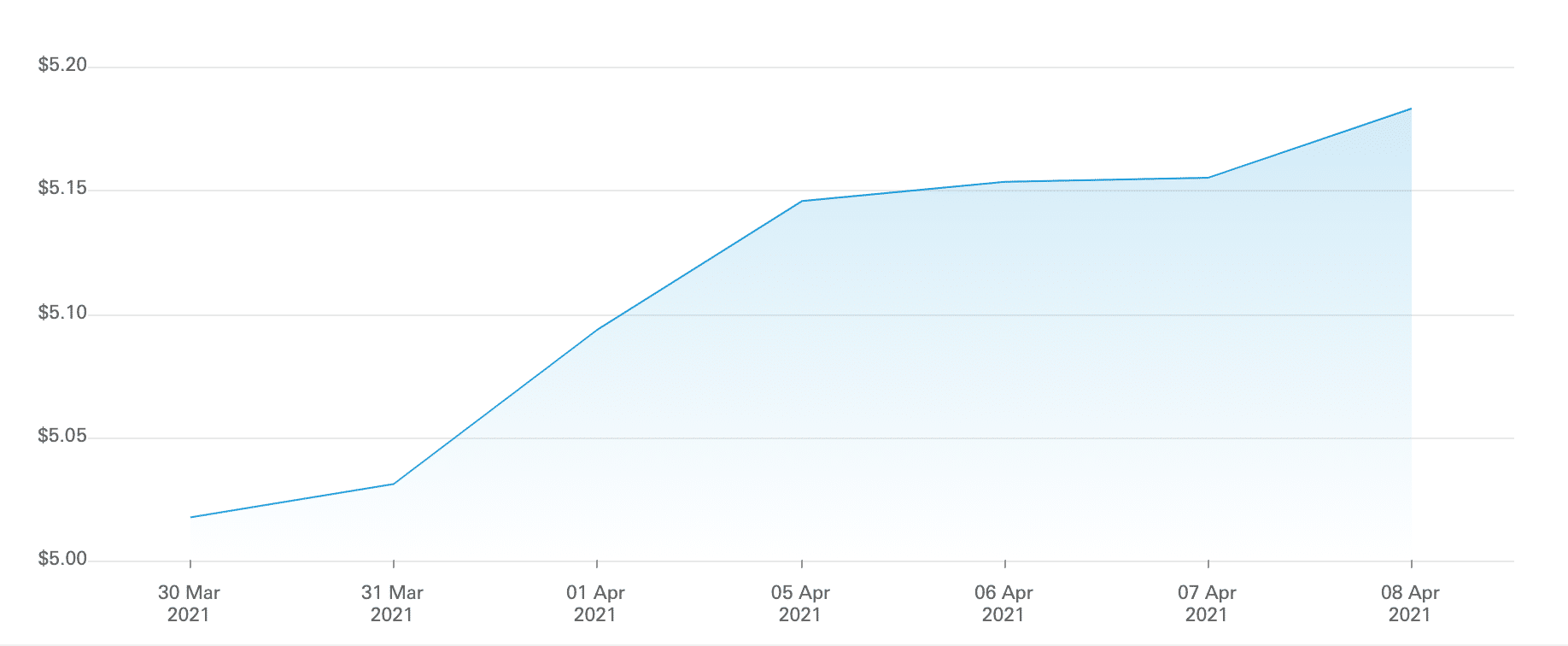

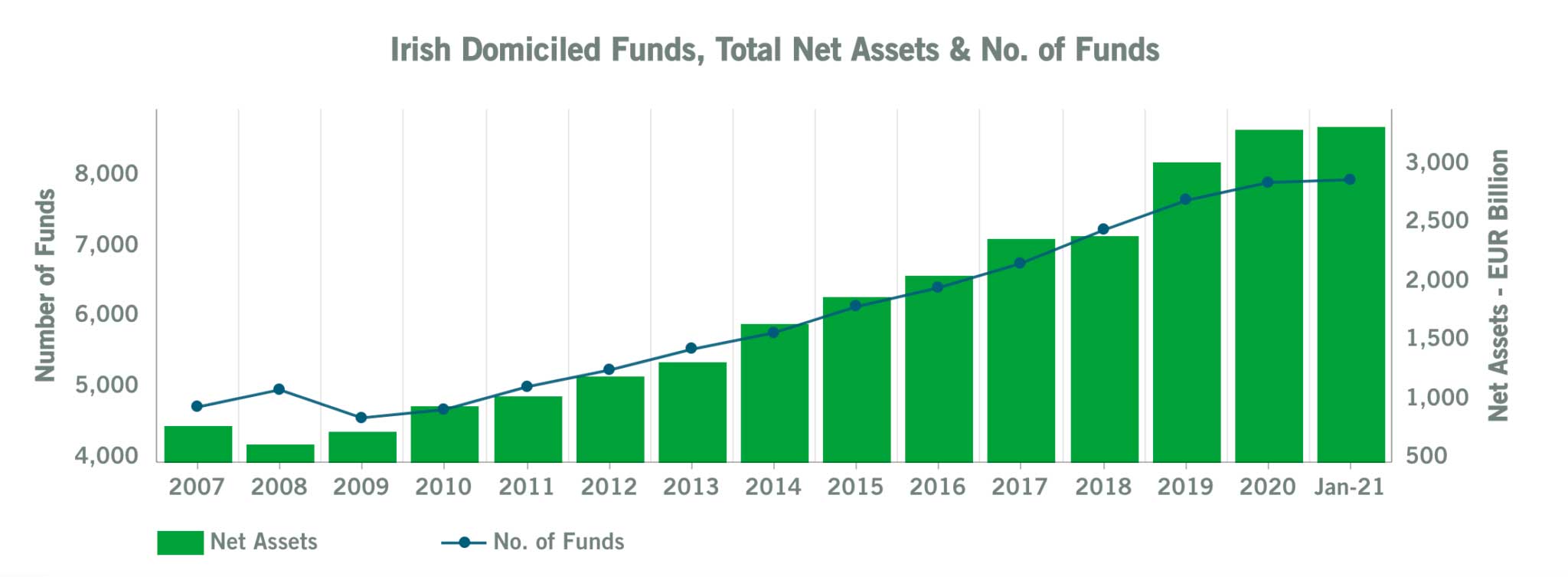

Another reason affecting your investing decision Irish funds is due to the industry’s ever-growing nature and the possibilities it can offer. A report by the Irish Times in 2020 stated that the Irish funds industry is expected to be worth €5.2 trillion by 2025 – that equates to around £4.5 million. What’s more, the sector’s growth is expected to provide more than 6000 jobs for the economy.

As more funds move to Ireland, it can benefit investors greatly, as each fund will have to ensure it is an attractive prospect compared to its competitors. In turn, that can mean asset managers will have to be at the top of their game to appeal to investors, leading to greater returns and increased income streams – as evidenced by the image above. Furthermore, as more funds join the industry, it could even drive expense ratios down as funds attempt to attract investors, leading to more cost-effective options.

Ethical Investing

Another reason to invest in the popular Irish funds is due to ethical considerations. Many collective investment funds basing themselves in Ireland are focusing on ESG factors, making sure they adhere to specific asset-picking criteria. Funds that do this tend to avoid investing in ‘morally incorrect’ companies, such as tobacco firms or oil firms.

With funds such as the iShares MSCI UK IMI ESG Leaders UCITS ETF deciding to base themselves in Ireland, it ensures that ethical investment options are available to a wide range of investors. What’s more, post-Brexit regulations are making these funds more accessible to investors all across the Eurozone.

Popular Irish Funds Brokers

Deciding on which broker to go with is a crucial part of the investing process. You must consider all of the options and choose one of the popular trading platforms, ensuring they are reliable and offer a simple fee structure.

In the section below, we discuss two of the popular UK brokers that allow users to invest in Irish Funds UK.

1. Fineco

If you’re looking to invest in some of the popular Irish funds, then Fineco is another option to do so. Although it does not offer a 0% commission structure, it does provide a cost-effective investment platform that can facilitate your investment into some of the popular Irish funds.

When investing in Fineco’s fund selection, you will not be charged any fees to initiate your investment. However, you will be charged a small annual fee to hold the fund based on your position size. Fineco will charge 0.25% per year on any position below £250k – so if you invested £1000 in one of the popular Irish funds, you would have to pay £2.50 each year in fees. You would also have to pay the expense ratio that the fund promoter charges for their management services.

In addition to funds, Fineco also offers a broad range of other assets to choose from. You can invest in 13 different stock markets with Fineco and can choose from over 5000 ETFs. Furthermore, there is also a wide variety of bonds, currencies, and even futures to choose from.

Finally, opening an account with Fineco is straightforward, and they do not require a minimum deposit amount. When you go to fund your account, this can only be completed via bank transfer; however, withdrawals can be executed through either bank transfer or credit/debit card.

Sponsored ad. Your capital is at risk.

How to Invest in Irish Funds

If you’ve decided you’d like to gain exposure to the Irish funds market, the section below will guide you through the entire process, after you choose a suitable broker that could help you in your investment process.

Open Your Account

Head over to the homepage of your chosen broker and begin the account set-up process. You will be required to fill in your personal details – including your full name, email address and mobile number. Create a username and password for the platform to continue.

Verifiy Your Identity

Most reputable brokers in the UK are regulated by the FCA – which is why users may be required to verify their accounts. To do this, simply upload proof of ID (a copy of your driver’s license or passport) and proof of address (a copy of a bank statement or utility bill). Once these documents have been uploaded, your broker should verify them in a couple of minutes.

Deposit funds

The next step is to deposit funds into your trading account. Most brokers may support 1 or more of the following payment methods:

- Credit card

- Debit card

- Bank transfer

- e-wallet

Choose your preferred payment option and deposit the funds into your account.

Invest in Irish Funds

Once your account has been funded, proceed to search for any Irish Funds you wish to purchase on your platform’s search bar. Fill in the amount you want to credit into the trade, and confirm your transaction.

Conclusion

This guide has discussed ten of the popular Irish funds that are available in the market today. With more and more of the world’s largest fund providers choosing to base their operations in Ireland, the Irish fund industry is one way to diversify your investments.

Users should ensure they conduct proper due-diligence and research before investing in any asset. Should you choose to invest in any Irish Funds in the UK, you may want to do so with the help of a suitable stock broker that will cater to your investing needs and requirements.