Best Trading Apps Ireland – Compare Top Apps with Lowest Fees

Nowadays most stock brokers offer a free trading app, making for a more convenient trading experience. But what are the best trading apps Ireland to use in 2023?

Mobile trading apps give you total control of your trading account no matter where you are. In this beginner’s guide, we’ll reveal the best trading apps Ireland of 2021, as well as the key metrics you need to consider when choosing the right one for your needs.

Key Points on Trading Apps in Ireland

Best Trading Apps Ireland 2023 List

Here’s a quick look at the best trading apps Ireland that made our list for 2023:

- Lightyear – One of the Best and Most Affordable Trading Apps in Ireland

- Libertex – Best forex trading app 2023

- Avatrade – Best stock trading app for beginners

- Fineco – One of the best trading apps Ireland 2023

- Plus500 – Best stock trading app with low fees

- Degiro – Best trading app Ireland for international shares

- Revolut – Leading free trading app

- Goodbody – Best trading app Ireland offering access to 1,000+ shares

- Davy – Best stock trading app with great research features

- Interactive Brokers – Best stock trading app with low trading fees

Wondering what the best stock brokers Ireland are? Read our comprehensive 2023 guide to find out.

Top Trading Apps in Ireland Reviewed

Learn how to start trading stocks and other assets using the best trading apps Ireland. In this section, we review the best trading apps across the board in 2023. Read on to learn more.

1. Lightyear – One of the Best and Most Affordable Trading Apps in Ireland

The trading app Lightyear allows users to invest in US, EU, and UK stocks at low commissions. ETF trades are free, and uninvested money can earn high interest. As of 2015, the company was launched, and Irish retail traders will be registered under the Lightyear Europe AS entity. With the Lightyear app, you can trade more than 3500 stocks and ETFs without hidden fees. Traders can access their investments via a simple mobile platform without dealing with the complicated fee structures associated with traditional brokers.

Tradable assets

In addition to stocks available via ADRs (American Depositary Receipts), EU and UK shares, Lightyear offers access to more than 3,000 international stocks, primarily on the US stock exchanges (NASDAQ and NYSE). Even though this allows retail investors to invest in some big companies without prohibitive FX fees, it does not offer funds, high-risk CFD trading, options, futures, cryptocurrency, or forex.

Payment Methods

Wire transfers and Bank cards are among the payment methods Lightyear accepts. Those on a budget will be pleased to know that there is no minimum deposit.

Withdrawals and deposits via wire transfer are fee-free. However, faster deposits via card incur a 0.5% fee after using the £ 500-lifetime allowance.

There is only one withdrawal method available, which is a significant disadvantage compared to competitors. The good news is that Lightyear does not charge any fees.

Depending on the currency and amount, your withdrawal may take up to three working days to be processed. Delays may also occur during bank holidays and weekends.

When requesting a withdrawal, click ‘Create Bank Account’ if you did not deposit by wire transfer. You can then add the details of your bank account.

Is Lightyear safe?

With permission to serve customers across the EEA, Lightyear Europe AS is a licensed EU investment firm licensed by the Estonian Financial Supervision Authority (Finantsinspektsioon).

Additionally, client funds are kept separately from business funds in the event of company insolvency.

A compensation scheme is available to customers during a business failure. For EU clients, this includes asset protection of €20,000 from the Estonian Investor Protection Sectoral Fund.

Lightyear Fees:

| Commission | 0% |

| Deposit fee | Variable |

| Withdrawal fee | Free |

| Inactivity fee | No |

| Account fee | N/A |

| Minimum deposit | None |

| Stocks markets | Invest in over 3,500 stocks and funds from Europe and the US |

| Tradable assets | Stocks and ETFs |

| Available Trading Platforms | Web-based trading platform, mobile trading app compatible with Android and Apple devices |

- There is a multi-currency account that allows to hold cash in multiple currencies between investments to avoid FX fees

- There are over 3,500 instruments available

- Uninvested cash earns high interest

- An excellent app that is easy to use

- Customer service options are limited

- There are no forums or community features

The provider of investment services is Lightyear Europe AS. Please read the terms before using our services and if necessary, seek qualified advice. When you invest, your capital is at risk.

2. Libertex – Best forex trading app 2023 with low spreads

Libertex is one of the few best trading apps Ireland we’ve seen that doesn’t charge a bid-ask spread. Spreads are at the heart of brokerage costs, therefore making this one a game-changer. For those unsure, the market spread is the difference between the buy and sell prices of the underlying asset.

If the spread is 1 percent, for example, you will be at a 1 percent loss as soon as you place an order. Although Libertex charges commissions, they are usually between 0 and 0.5 percent. As a result, Libertex may be the best option if you’re seeking a free trading app.

Tradable assets

It’s worth noting that Liberex is more than just a low-cost trading app. This CFD broker, on the other hand, allows you access to a wide range of popular assets and markets. Stock CFDs, commodities CFDs, Forex CFDs, and cryptocurrencies CFDs are just a few examples. Libertex has several research and analytical tools as well. This best trading app Ireland also has heaps of educational materials that are ideal for beginners.

Is the Libertex free trading app safe?

Experienced forex traders will be pleased to learn that you can access MT4 at Libertex. It’s as simple as downloading the MT4 app and logging in with your Libertex credentials. Libertex has a long history of providing online trading services, dating back to the late 1990s. Additionally, this free trading app is fully regulated by CySEC.

Libertex Fees

| Commission | 0%-0.5% for stocks CFDs |

| Deposit fee | Free |

| Withdrawal fee | €1 for credit/debit card, 1% for Neteller, free for Skrill |

| Inactivity fee | €10 per month after 6 months |

| Account fee | None |

| Minimum deposit | €10 |

| Stock Markets | With a Libertex brokerage account, you’ll have access to 50+ stock CFDs with the highest market volatility and liquidity. These include the blue-chip stocks of the US markets and major stocks of companies listed on European and Latin American markets. |

| Tradable assets | CFDs, forex and crypto CFDs, stock CFDs, commodity CFDs, stock indices, ETF CFDs, Options CFDs, |

| Trading Platforms | Libertex gives you access to its native web-based trading platform and mobile trading app, as well as MT4 and MT5. |

- Low spreads and low commission CFD trading

- Supports 2FA for extra account protection

- One of the best trading apps with low fees

- Well designed free trading app

- Fully regulated by CySEC

- Only offers CFD trading

- 10 EUR inactivity fee after 180 days

86% of retail investor accounts lose money when trading CFDs with this provider.

3. Avatrade – Best stock trading app for beginners

AvaTrade is a trusted Forex and CFD broker that was established in 2006 and is regulated by many financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Central Bank of Ireland. With an AvaTrade brokerage account you can trade FX, CFDs, and cryptocurrencies with no commissions.

Clients in the United Kingdom can download the top-rated MetaTrader 4 and MetaTrader 5 platforms for Windows and iOS. You can also trade minor, major, and exotic currency pairs using the Web-based version and free trading app.

Tradable assets

You can buy and sell more than 55 currency pairs and a variety of CFDs with an AvaTrade trading account. Stock index CFDs, stock CFDs, ETF CFDs, commodities CFDs, bond CFDs, and more are available.

AvaTrade also offers social trading through ZuluTrade and DupliTrade, two reputable third parties. Both of these financial services enable you to mimic the strategies of other traders. To get started, ZuluTrade has a minimum investment of $500, whereas DupliTrade requires a minimum deposit of $2,000 to get started.

Fees

AvaTrade offers an inexpensive way to buy and sell CFDs and forex. The fees are included in the bid-ask spreads. Additionally, there are no deposit fees, withdrawal fees, or account fees, thus non-trading fees are also quite inexpensive. On the other hand, after three months of inactivity, a $50 inactivity fee is charged every quarter.

Is AvaTrade a secure platform?

The Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Japanese Financial Services Agency (FSA) are just a few of the financial regulators that authorize AvaTrade.

If the broker goes out of business, you may be entitled to up to €20,000 in compensation. AvaTrade also provides negative balance protection, which means you can never lose more money than you put in.

AvaTrade fees – Breakdown

| Commission | 0% |

| Deposit fee | None |

| Withdrawal fee | None |

| Inactivity fee | $50 after 3 months of inactivity and a $100 administration fee after one year. |

| Account fee | None |

| Minimum deposit | $100 |

| Stock Markets | AvaTrade provides access to 625+ stock CFDs |

| Tradable assets | Forex, CFD trading – index CFDs, stock CFDs, commodity CFDs, Bond CFDs, ETF CFDs. |

| Trading Platforms | WebTrader, MT4 and MT5, AvaOptions, AvaTradeGo. AvaTrade also provides access to social trading via two third-party platforms, DupliTrade and ZuluTrade. |

- Process of opening an account is quick and easy.

- There are no fees for deposits or withdrawals.

- Research tools that are simple to use.

- CFD trading fees are low.

- Regulated by the Central Bank of Ireland.

- Above average inactivity fee

- Only offers access to CFDs, forex, and cryptocurrencies

71% of retail investor accounts lose money when trading CFDs with this provider.

4. Fineco – One of the best trading apps Ireland 2023

Fineco Bank is one of the best trading apps Ireland that’s listed on the Italian stock exchange. The fact that you can trade both real shares and stock CFDs is something we particularly like about the broker. As a result, Fineco Bank caters to both short-term and long-term trading strategies.

You can buy stocks listed on UK markets via the free trading app for 2.95 € per trade via its share dealing service. This online broker also gives you access to a mix of global markets in addition to UK stocks. The trading costs will vary slightly depending on which exchange you want to gain exposure to.

Payments and Regulations

Nonetheless, all traditional share purchases will be subject to a 0.25 percent annual fee. If you want to go long or short on stock CFDs, this best stock trading app allows you to do so commission-free. You’ll also have access to leverage and the ability to short-sell your chosen stock.

If you want to trade other assets, Fineco Bank provides CFDs on forex, indices, bonds, and much more. In terms of compatibility, the free trading app is free to download on iOS and Android devices. When it comes to deposits, the minimum amount is only 100 €. The Fineco Bank stock trading app is licenced by the FCA, so there should be no concerns about safety.

- There are no commissions or inactivity fees.

- Tools for portfolio management are included.

- Outstanding fundamental analysis and commentary.

- Tracking the performance of investments is made simple

- Low commissions for stock trading

- Only accepts bank transfers

- Annual management fee of 25%

66.01% of retail investor accounts lose money due to CFD trading with this provider.

5. Plus500 – Best stock trading app with low fees

Plus500 is a CFD broker based in the United Kingdom that is well-known for its low fees. It has variable spreads that are among the most competitive. It also does not charge any commissions or fees for deposits or withdrawals.

This best stock trading app offers a diverse set of instruments, including a large selection of stocks from around the world. The Plus500 free trading app allows you to trade stocks, ETFs, indices, forex, commodities, and options.

Payments and Regulations

One of the best features of Plus500 is that it provides an unlimited demo trading account, allowing you to use the paper stock trading app and spend as much time as you want familiarizing yourself with the platform. It also accepts a wide variety of payment methods, including e-wallets like PayPal.

Plus500 is a UK-licensed broker that is listed on the London Stock Exchange, which makes it extremely safe and secure. The platform is simple to use, but if we had any criticisms, they would be that Plus500 has fewer trading tools and features than other top-rated trading apps such as Libertex.

- Fast account opening process

- Outstanding customer service

- Low non-trading fees

- All fees are built into the tight spreads

- Low minimum deposit of $100

- Only offers CFD trading

- Limited research tools

6. Degiro – Best trading app Ireland for international shares

DEGIRO is a low-cost online stock broker with headquarters in Germany and the Netherlands. It was established in the Netherlands in 2008. DEGIRO and flatexDEGIRO Bank AG merged in early 2021 to form Europe’s largest online execution-only broker with a proprietary banking licence. DEGIRO is governed by the Financial Conduct Authority in the United Kingdom.

Trading fees are typically calculated as both a fixed fee and a percentage of the traded volume. Trading stocks on UK markets, for example, costs 1.75 € plus a 0.014 percent commission. DEGIRO also has low non-trading fees, such as no account fees and no inactivity, deposit, or withdrawal fees.

Payment methods

When it comes to payment methods, you’ll have the option of using bank transfers or e-wallets. DEGIRO provides tradable assets ranging from stocks and ETFs to bonds and futures. This best trading app Ireland does not offer CFDs or forex trading.

- One of the leading trading apps for beginners

- Regulated by a range of financial authorities

- Intuitive mobile trading app

- No deposit fees

- Regulated by BaFin

- Cheap non-trading fees

- Credit and debit cards are not accepted payment methods.

- Forex and CFD trading is not available

7. Revolut – Leading free trading app

Revolut has been approved by the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Client assets are protected up to $500,000 (including $250,000 for cash claims) under the Securities Investment Protection Corporation (SIPC) insurance. Revolut is regulated by the Financial Conduct Authority in the United Kingdom.

Account types

There are three account types to choose from, each with different stock trading fees. If you choose the standard account, for example, you’ll get one free stock trading every month. Revolut charges 1 € per transaction once you’ve used up your free trade for the month.

You’ll only be able to purchase and sell equities listed on US exchanges, cryptocurrencies, and some precious metals with Revolut’s limited asset portfolio.

- Wide range of payment methods to choose from

- Regulated by US SEC, FINRA, and UK’s FCA

- Offers one free stock trade per month with the standard account

- Low non-trading fees

- No minimum deposit

- Trading fee structure lacks transparency

- Limited product portfolio

8. Goodbody – Best trading app Ireland offering access to 1,000+ shares

Tradable assets

Goodbody offers over 1,000 different shares across ten distinct worldwide markets. As one of Ireland’s best stock trading app, you can trust Goodbody to keep your share trading account safe, secure, and transparent when it comes to fees and costs. The account must have a minimum balance of €5,000.

You’ll be able to buy and sell shares and some exchange-traded funds (ETFs) via your tablet or mobile device, as well as follow and manage your investment portfolio on the go, thanks to its user-friendly free trading app.

- Access to 1,000+ shares across 10 international markets

- Top-rated customer service

- User-friendly mobile trading app

- Listed on the Euronext Dublin and London Stock Exchange

- Regulated by the Central Bank of Ireland, and the FCA.

- €5,000 account minimum

9. Davy – Best stock trading app with great research features

Davy Select has above-average stock and ETF commissions compared to other trading apps. For example, for UK and Irish equities, the commission is 0.5 percent of the total trade value + €14.99 per trade. If you want to trade equities on US and German markets, you’ll have to pay 0.06 percent of the whole trade value plus a €25 settling fee per trade.

Payment methods

When it comes to payment methods, the only option that is accepted are bank transfers. While the non-trading fees are relatively minimal, there is a 50 EUR inactivity fee charged per quarter. You’ll be able to trade stocks, ETFs, funds, and bonds, among other things.

Davy Select provides a user-friendly trading platform that includes secure two-factor authentication. On the other hand, the platform isn’t customisable, and there’s no mobile trading app.

- Great customer support

- Regulated by the Central Bank of Ireland

- Offers a wide range of account types

- Zero deposit fees

- No withdrawal fees for clients based in Ireland

- High stock trading fees

- Limited payment methods

- High inactivity fee

- $600 minimum deposit

10. Interactive Brokers – Best stock trading app with low trading fees

Interactive Brokers has a volume-tiered fee structure for stock trading. It’s calculated per share or as a percentage of the overall trade value. If you trade equities listed on UK exchanges, for example, you’ll pay a commission of 0.05 percent of the trade amount.

Payments and fees

Interactive Brokers supports 23 account base currencies available, which is great for traders who want to buy and sell assets in a variety of currencies. Although there are no deposit fees, the deposit options are limited to only bank transfers.

Interactive Brokers is one of the most popular stock trading apps since there are no account fees, no inactivity fees, and no withdrawal or deposit fees to pay. You’ll be spoiled for choice if you want to diversify your portfolio. This online stock broker offers over 75 stock markets and over 13,000 exchange-traded funds (ETFs).

- Heavily regulated by several financial authorities

- Huge range of tradable assets

- Covers 78 international stock exchanges

- Low non-trading fees

- Great research features

- Limited payment methods

- Desktop trading platform not suitable for beginners

Trading Apps in Ireland Comparison

We’ve gone over the best trading apps Ireland, but how do they compare in terms of prices and features? Let’s take a closer look.

| Best trading app Ireland | Available assets | Pricing Structure | Fee for trading Amazon stock | Fee for trading EUR/USD | Payment methods |

| Libertex | Stock CFDs, crypto CFDs, forex, commodities CFDs, ETF CFDs | Low commissions | -0.0003% | 0.0% commission and zero spreads | Credit/debit cards, e-wallets, bank transfers |

| AvaTrade | Currency pairs, stock index CFDs, stock CFDs, ETF CFDs, commodity CFDs, bond CFDs, cryptos | The fees are built into the spreads | Typical spread: 0.13% | Spread (retail): 0.9 pips | Credit/debit cards, e-wallets, bank transfers |

| Fineco Bank | Real stocks, ETFs, 50+ forex pairs, Mutual funds, Bonds, Options, Futures, CFDs | Commissions | $3.95 per trade for US stocks | Typical spread: 0.8 pips | Bank transfers |

| Plus500 | Forex pairs, stock index CFDs, stock CFDs, ETF CFDs, commodity CFDs, cryptocurrencies | There is no commission: everything is built into the spread | Typical spread: 0.75% | Typical spread: 0.01% | Credit/debit cards, e-wallets, bank transfers |

| Revolut | US stocks, cryptos, some precious metals CFDs | Variable Commission depending on account type | The standard account offers 1 free stock trade per month | N/A | Credit/debit cards, bank transfers, electronic wallets such as Apple Pay, and Google Pay. |

| DEGIRO | Does not offer CFDs and forex. Supports real stock trading, ETFs, mutual funds, bonds, options, futures | Low commissions | €0.5 + $0.004/share | N/A | Bank transfers, e-wallets |

| Goodbody | 1,000+ shares covering 10 global markets | Commission | 0.5% per trade | N/A | Via cheque or electronic transfer |

| Davy | Real stocks, ETFs, mutual funds, bonds | Commission | 0.06% of trade value plus a €25 settlement fee per trade | N/A | Bank transfer |

| Interactive Brokers | Real stocks, ETFs, forex, funds, bonds, options, futures, Stock CFDs, stock index CFDs, cryptocurrencies | Fixed-rate commissions, and tiered price plans | $0.005 per share | 0.20 basis point of the trade value | Bank transfer |

If you’re wondering how to buy shares in Ireland, read our in-depth beginner’s guide for everything you need to know.

How We Rank the Best Trading Apps

Range of assets

You should choose trading apps that cover the tradable assets you want to trade based on your risk tolerance and investing goals. You can hedge against volatile market conditions by diversifying your portfolio.

Fees

The best trading apps Ireland allow you to buy and sell a range of financial instruments with low fees and 0% commission. While the likes of Libertex, and AvaTrade have low spreads and commissions, bid-ask spreads and overnight financing fees still apply.

You’ll also want to consider non-trading fees. These include charges such as deposit fees, withdrawal fees, inactivity fees, and account fees. Therefore, you’ll also need to consider these types of fees before choosing the best trading app Ireland.

Mobile experience

Buying and selling assets via stock trading apps is something that’s become increasingly popular in recent years. The best trading apps Ireland allow you to manage your portfolio, trade assets anytime and anywhere, interact with other traders, and deposit funds with one swipe of a finger.

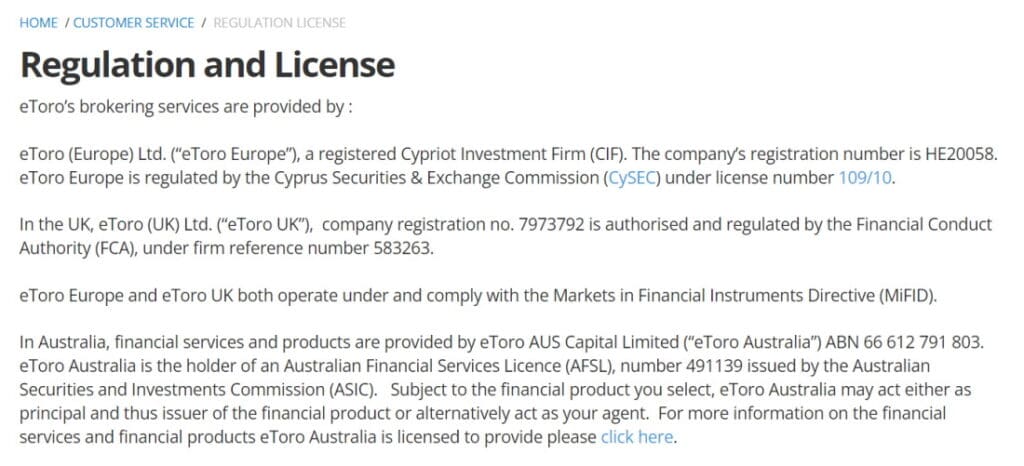

Regulation and security

Most trading apps are fully regulated and offer cutting-edge account protection. For example, thanks to the UK’s FCA, CySEC, and ASIC, Lightyear is one of the leading trading apps offering top-notch security. This includes two-factor authentication and biometric authentication. Moreover, the best trading apps make it their business to hold all clients’ funds in segregated bank accounts.

Trading tools

The most seasoned, experienced traders use trading tools to optimize their investing strategies. Furthermore, technical indicators, real-time quotes, market news, economic calendars, charts, past performance, fundamental data, are all tools in an expert’s trading arsenal.

As such, the leading trading apps act as identical versions of their desktop and web trading platform counterparts. This means you’ll have access to state-of-the-art trading tools while you’re out and about. The best stock trading apps allow you to buy and sell assets anywhere, at any time.

Platform quality

Some trading apps are better suited to more experienced traders. For example, MetaTrader 4 is an advanced trading platform ideal for seasoned forex traders and day traders. That isn’t to say that beginners can’t use the platform, however, there are better options out there if you have little to no trading experience.

Customer service

The best customer services allow you to track the progress of your open tickets, save records of your solved issues, browse through FAQs, and submit questions. With that in mind, we found that Lightyear offers great customer support that’s fast and reliable. You can contact Lightyear’s customer service team via live chat, or its online ticketing system where you receive feedback by email.

How to Get Started with an Irish Trading App

If you’re ready to start trading with the best trading app Ireland, we’ll guide you through the process from start to finish.

Step 1: Download and Install the Trading App

First and foremost, visit the official website and download its innovative trading app. This way you’ll be able to trade and invest any time, anywhere, and switch between your laptop, desktop, tablet and mobile smartphone with ease.

Step 2: Open Account and Upload ID

The next step involves creating a new brokerage account by entering your details and choosing a username and password.

In Regulated brokers, you’ll need to go through the KYC process to verify your account. The verification process is simple and fast, just upload copies of your passport and a recent bank statement as proof of identity and address.

Step 3: Deposit Funds

Funding your account is also very straightforward. If you want your funds to be credited to your account instantly you’ll need to use a credit card, debit card, or e-wallets such as PayPal or Skrill. Alternatively, bank transfers typically take between 3-5 business days.

When it comes to non-trading fees, there are no deposit fees to pay. However, there is a small $5 withdrawal fee.

Step 4: Buy Stocks

With your account now verified and funded, you can start trading assets such as stocks and ETFs. You can either browse through the selection of financial instruments, or you can use the search bar at the top of the dashboard to find exactly what you’re looking for. But what are the best stocks to buy now in Ireland?

We’re looking to buy Apple stocks in this example. You will be presented with an order box after tapping on the ‘Trade’ option. Enter the amount you want to invest in USD. We’re interested in buying $50 worth of AAPL shares, as you can see in the sample below.

Last but not least, tap on the ‘Open Trade’ button to execute your trade.

Best Trading App Ireland – Conclusion

Trading apps let you buy and sell assets, manage your portfolio, and deposit funds from your mobile device. If you’re looking for a convenient way to trade stocks and other assets, the best trading apps Ireland might just be the answer.

Throughout this guide, we’ve covered the best trading apps you can use right now. Consequently, we found that Lightyear is the best stock trading app.

Lightyear – Best Stock Trading App Ireland

68% of retail investor accounts lose money when trading CFDs with this provider.