Best Stock Brokers Ireland – with 0% Commission

If you’re looking to invest in stocks you’re going to need one of the best stock brokers Ireland. But with tons of top-rated trading platforms out there, how do you pick the best one for your needs?

In this guide, we’ll cover the best stock brokers Ireland that allow you to buy and sell stocks with 0% commission. We’ll also explore key metrics like fees, dealing charges, tradable assets, user-friendliness, and regulations.

Key points on stock brokers in Ireland

- There are a wide range of different stock brokers to choose from in Ireland, all differing in terms of fees, available stocks, and trading tools

- It’s important to compare the pros and cons of each broker to find the best one for you

Best Stock Brokers Ireland 2021 List

Looking for the simple answer? Here’s our list of the best stock brokers Ireland in 2021:

- Libertex – Top-rated Online Stock Broker with Low Spreads

- Avatrade – Best Stock Broker Ireland for Social Trading and Low Commissions

- Fineco – Leading European Stock Brokers Offering UK Shares from 2.95 € per Trade

- Plus500 – One of the Best Online Stock Brokers for Beginners

- Goodbody – Best Stock Brokers Ireland Offering Access to 1,000+ Shares

- Degiro – Trusted Online Stock Broker Covering International Shares

- Revolut – Best Stock Broker Ireland With Some Free Stock Trades

- Davy – Ranked Amongst the Best Stock Brokers Ireland for Useful Research Tools

- Interactive Brokers – Best Stock Brokers Ireland with Low Trading Fees

What are the best stocks to buy now in Ireland? Read our comprehensive guide to find out.

Top Stock Brokers in Ireland Reviewed

In this section of our best stock brokers Ireland guide, we’ll review ten of the top-rated and most-trusted stock trading platforms in 2021.

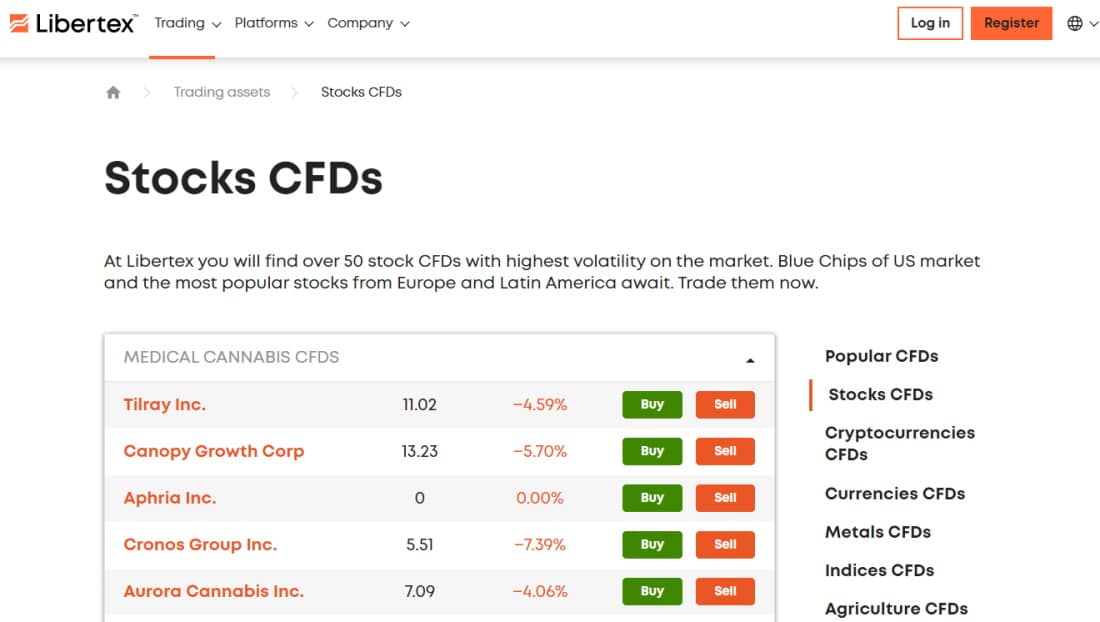

1. Libertex – Top-rated Online Stock Broker with Low Spreads

Libertex is a name that stands out if you’re interested in CFD trading and wish to bet on the fundamental prices of assets like forex, commodities, cryptocurrencies, ETFs, and more. However, is Libertex the best stock broker Ireland for your needs?

Libertex was established in 1997 and has been providing CFD trading services to its clients ever since. This award-winning trading platform has more than two decades of financial market and online trading experience, with just under 2.2 million clients worldwide, including both casual traders and active seasoned investors.

What tradable assets does Libertex offer?

To begin with, trading on Libertex is not the same as traditional investing in the sense that you do not own the underlying asset. Instead, you trade CFD derivatives on the fundamental price of an asset like forex, stocks, ETFs, options, and more. A contract for difference, also known as a CFD, is a sort of financial derivative that allows you to trade market price movements without owning the underlying product, as previously stated.

This means you’ll be able to trade forex CFDs, crypto CFDs, stock CFDs, commodity CFDs, stock indices CFDs and more with this best stock broker Ireland.

What fees does Libertex charge?

The fact that you don’t have to pay the bid-ask spread is the most remarkable selling point of this online stock broker. It’s rare for CFD brokers to absorb the market spread, as spreads are usually levied when commission rates begin at 0%. To put it another way, the spread is the difference between an asset’s buy and sell prices.

Libertex’s free trading platform charges a commission because it offers zero spreads when trading CFDs. Depending on the underlying asset, the commission starts from 0%. When you click on an asset, you can see all of the commissions on the CFD specification page or in the trading terminal.

There are also no deposit fees, and the withdrawal fees vary depending on the payment method you use. For example, withdrawing funds with PayPal incurs zero deposit fees while withdrawing via a credit/debit card incurs a fee of €1.

Is Libertex safe?

Libertex is a trading platform used by Indication Investments Ltd., a Cyprus investment firm authorised by CySEC (the Cyprus Securities and Exchange Commission) and operating under CIF licence number 164/12.

When it comes to customer funds, CySEC regulations mandates that brokers keep all client funds in separate bank accounts. If Libertex were to go bust, the investment protection scheme will cover you up to €20,000.

Libertex fees – Breakdown

| Commission | 0%-0.5% for stocks |

| Deposit fee | Free |

| Withdrawal fee | €1 for credit/debit card, 1% for Neteller, free for Skrill |

| Inactivity fee | €10 per month after 6 months |

| Account fee | None |

| Minimum deposit | €10 |

| Stock Markets | With a Libertex brokerage account, you’ll have access to 50+ stock CFDs with the highest market volatility and liquidity. These include the blue-chip stocks of the US markets and major stocks of companies listed on European and Latin American markets. |

| Tradable assets | CFDs, forex and crypto CFDs, stock CFDs, commodity CFDs, stock indices, ETF CFDs, Options CFDs, |

| Trading Platforms | Libertex gives you access to its native web-based trading platform and mobile trading app, as well as MT4 and MT5. |

Pros

Cons

86% of retail investor accounts lose money when trading CFDs with this provider.

2. AvaTrade – Best Stock Broker Ireland for Social Trading and Low Commissions

AvaTrade is a popular FX and CFD broker that was founded in 2006 and is authorised by many financial regulators, including the Australian Securities and Investments Commission (ASIC) and the Central Bank of Ireland (CBI). Users of Avatrade can trade forex, CFDs, and cryptocurrencies without paying any commission.

UK-based clients can download the top-rated MetaTrader 4 and MetaTrader 5 platforms for Windows and iOS operating systems. Alternatively, you can use the Web-based version and a mobile trading app for Apple and Android devices, to trade minor, major, and exotic currency pairs.

What tradable assets does AvaTrade offer?

With an AvaTrade trading account you’ll be able to buy and sell more than 55 forex pairs, and a whole host of CFDs. These include stock index CFDs, stock CFDs, ETF CFDs, commodity CFDs, bond CFDs, and more.

AvaTrade also provides social trading via two trusted third parties, ZuluTrade and DupliTrade. Both these financial services allow you to copy other traders’ strategies. ZuluTrade has a minimum deposit of $500, while DupliTrade requires a deposit of at least $2,000 to get started.

What fees does AvaTrade charge?

AvaTrade offers low CFD and competitive forex fees. With zero commissions, this means that the fees are included in the bid-ask spread. When it comes to non-trading fees, these are also considerably low as there are no deposit fees, withdrawal fees, or account fees. On the flip side, there is a $50 inactivity fee charged every quarter after three months of inactivity.

Is AvaTrade safe?

AvaTrade is regulated by several financial authorities including the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) in South Africa, the Japanese Financial Services Agency (FSA), just to name a few.

How are client funds protected?

EU-based clients are protected by the Central Bank of Ireland. You can expect up to €20,000 in compensation should the broker go out of business. Additionally, AvaTrade also offers negative balance protection, meaning you can never lose more money than you deposited.

AvaTrade fees – Breakdown

| Commission | 0% |

| Deposit fee | None |

| Withdrawal fee | None |

| Inactivity fee | $50 after 3 months of inactivity and a $100 administration fee after one year. |

| Account fee | None |

| Minimum deposit | $100 |

| Stock Markets | AvaTrade provides access to 625+ stock CFDs |

| Tradable assets | Forex, CFD trading – index CFDs, stock CFDs, commodity CFDs, Bond CFDs, ETF CFDs. |

| Trading Platforms | WebTrader, MT4 and MT5, AvaOptions, AvaTradeGo, AvaTrade also provides access to social trading via two third-party platforms, DupliTrade and ZuluTrade. |

Pros

Cons

71% of retail investor accounts lose money when trading CFDs with this provider.

3. Fineco – Leading European Stock Brokers Offering UK and Irish Shares from 2.95 € per Trade

Launched in 1999, Fineco Bank is one of the leading European Stock Brokers that’s listed on the Italian Stock Exchange. It is regulated by the Bank of Italy and the Commissione Nazionale per le Società e la Borsa (Consob), as well as the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

Fees and commissions

Fineco Bank offers low-cost stock and ETF trading, as well as no fees for inactivity or withdrawals. Forex fees, on the other hand, are above average, and holding positions overnight (financing rates) is also costly.

The trading fees at Fineco Bank are mixed, with cheap fees for stocks, ETFs, futures, funds, bonds, and most CFDs and high fees for FX and options. On the other hand, we found Fineco’s cost structure to be very transparent.

For UK-based traders the commission is a flat fee that varies depending on the type of stocks you choose to trade. For example, stocks listed on US exchanges cost $3.95 per trade, while stocks listed on the London Stock Exchange (LSE) cost 2.95 € per trade.

Pros

Cons

66.01% of retail investor accounts lose money due to CFD trading with this provider.

4. Plus500 – One of the Best Online Stock Brokers for Beginners

Plus500 does not charge a fee for withdrawals. There is an inactivity fee of $10 per month after three months of inactivity. However, it is only applied if you don’t use the platform. There is 0% commission to pay when trading with this broker, as everything is built into the spread.

There are roughly 16 base currencies to choose from, and you’ll find a range of payment methods at your disposal. These include credit/debit cards, bank transfers, and e-wallets. The Plus500 web-based trading platform is user-friendly and well designed. You’ll also have the option to set up two-factor authentication, for added account security.

Pros

Cons

5. Goodbody – Best Stock Brokers Ireland Offering Access to 1,000+ Shares

Based in Dublin, this award-winning stock broker is a leading financial services provider. It’s been serving and growing its client relationships for more than a century. According to the Goodbody website, “We are a full service, investment-led business offering wealth management, asset management and investment banking services.”

Goodbody offers 1,000+ shares covering 10 different global markets. As one of the best stock brokers Ireland, you can rest assured that your share dealing account with Goodbody is safe, secure, and transparent when it comes to fees and charges. The account minimum is €5,000.

On its user-friendly trading platform, you’ll be able to buy and sell shares and select exchange-traded funds (ETFs) via your tablet or mobile, as well as follow and manage your investment portfolio on the go.

Pros

Cons

6. DEGIRO – Trusted Online Stock Broker Covering International Shares

DEGIRO is a discount online stock broker based in Germany and the Netherlands. It was founded in 2008 in the Netherlands. In early 2021, DEGIRO joined with flatexDEGIRO Bank AG, forming Europe’s largest online execution-only broker with a proprietary banking licence. DEGIRO is regulated by the UK’s Financial Conduct Authority.

The trading fees are typically calculated as a fixed fee as well as a percentage of the traded volume. For example, the cost for trading stocks listed on UK markets is 1.75 € plus a commission of 0.014%. DEGIRO also has competitive non-trading fees which include no account fees, and zero inactivity, deposit or withdrawal fees.

When it comes to payment methods you’ll be able to choose between bank transfers and e-wallets. In terms of tradable assets, DEGIRO offers everything from stocks and ETFs to bonds and futures. CFDs and forex trading are not available with this best stock broker Ireland.

Pros

Cons

7. Revolut – Best Stock Broker Ireland With Some Free Stock Trades

Launched in 2015, Revolut is a rapidly-growing fintech startup that specialises in banking and payment services. Revolut Trading Ltd, the company’s commission-free stock trading service, was established recently in 2019.

The US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) are among the top regulators that authorize Revolut. The Securities Investment Protection Corporation (SIPC) insurance protects clients’ assets up to $500,000 (including $250,000 for cash claims). The UK’s Financial Conduct Authority also regulates Revolut.

There are three account types to pick from with each charging varying fees for stock trading. For example, if you opt for the standard account you’ll get one free stock trade per month. Once you’ve used up your free trade for the month, Revolut charges 1 € per trade.

Revolut has a limited asset portfolio, as you’ll only be able to buy and sell stocks listed on US exchanges, cryptocurrencies, and some precious metals.

Pros

Cons

8. Davy – Ranked Amongst the Best Stock Brokers Ireland for Useful Research Tools

Established in 1926, Davy Select is one of the best stock brokers Ireland that’s based in Dublin. The Central Bank of Ireland is in charge of regulating this stock trading platform. Davy Select is Davy Group’s execution-only brokerage subsidiary, which offers a wide range of wealth management services.

In contrast to other European stock brokers, Davy Select has above-average stock and ETF commissions. For instance, UK and Irish stocks are charged 0.5% of the total trade value plus a €14.99 commission per trade. If you choose to trade stocks listed on US and German exchanges this will cost 0.06% of the overall trade value as well as a €25 settlement fee per trade.

When it comes to payment options the only supported method is via bank transfer. While the non-trading fees are also low, there is an inactivity fee of 50 EUR per quarter. You’ll also be able to trade stocks, ETFs, funds and bonds.

Davy Select offers a user-friendly web trading platform with secure two-factor authentication and transparent fee reporting. The platform, on the other hand, is not customizable, and there is no mobile trading app.

Pros

Cons

9. Interactive Brokers – Best Stock Brokers Ireland with Low Trading Fees

Interactive Brokers, one of the best stock brokers Ireland, was founded in 1978. Several financial regulators throughout the world regulate this online stock broker, including top-tier ones such as the UK’s Financial Conduct Authority (FCA) and the US Securities and Exchange Commission (SEC).

The stock trading fees at Interactive Brokers are volume-tiered. This means it’s calculated per share or as a percentage of the total trade value. For example, if you choose to trade stocks listed on UK markets, you’ll incur a commission of 0.05% of the trade value.

Interactive Brokers offers 23 account base currencies, which is ideal for traders looking to buy and sell assets in different currencies. Furthermore, while there are no deposit fees to pay, the deposit methods are limited to just bank transfers.

With no account fees, no inactivity fees, and no withdrawal or deposit fees to pay, Interactive Brokers is one of the leading discount brokers across the board. If you’re looking to diversify your portfolio, you’ll be spoilt for choice. This online stock broker covers over 75 stock markets and more than 13,000 ETFs.

Pros

Cons

Stock Brokers in Ireland Comparison

Here’s a complete breakdown of the key fees and metrics you need to know about all ten of our featured brokers.

| Best Stock Brokers Ireland | Number of Stocks | Pricing Structure | Fee for trading Amazon stock | Account fee |

| Libertex | 50+ stock CFDs | Commissions | -0.0003% | None |

| AvaTrade | 625 stock CFDs | Low spreads | 0.13% | None |

| Fineco Bank | 540+ stock CFDs | Commissions | $3.95 | None |

| Plus500 | 1,900+ stock CFDs | Spreads | 0.75% | None |

| Goodbody | 1,000+ shares | Commission | 0.5% per trade plus €25 on US stocks | 0.75% per year |

| DEGIRO | Covers 50+ exchanges | Commission | €0.50 + $0.004 per share | None |

| Revolut | 850 stocks listed on the NYSE and NASDAQ exchanges | Commission | Standard account gives you one free stock trade per month, after that it costs 1 € per trade. | None |

| Davy | Covers 30 exchanges | Commission | 0.06% of trade value + €25 flat settlement fee | None |

| Interactive Brokers | Covers 78 stock markets | Commission | $0.005 per share | None |

What is a Stock Broker?

A stock broker is a third-party financial service that acts as a middleman between a buyer and a seller of a financial asset such as a stock or ETF. For a fee or commission, they facilitate the trade. Traders and investors can now trade stocks online using the best stock brokers Ireland, thanks to technological advancements.

Continue reading to discover more about online brokers, including how to choose the best one for your trading needs.

Types of Stock Brokers

If you’ve done any research related to stock trading, you’ll know there’s the traditional method of buying and selling real stocks, and then there’s CFD trading. Let’s cover the different types of stock brokers in 2021.

Traditional Broker

A traditional stock broker allows you to gain ownership of actual stocks. This means that you’ll become a shareholder in a company, eligible for dividend payouts and voting rights depending on the stock.

CFD Stock Brokers

A CFD stock broker facilitates contracts for difference trading. CFDs are leveraged, speculative instruments that allow you to gain exposure to the stock markets without taking ownership of the underlying assets. You’ll be able to go long or short depending on where you believe the market will go, and you’ll also have the option to use leverage as a way of stretching your investing capital.

How We Rank the Best Stock Brokers

- Range of stocks – To diversify your investment portfolio you’ll need to have access to a wide range of stocks.

- Fees – With so many online stock brokers to choose from, we’ve pinpointed the top-rated stock brokers with the lowest fees and commissions. T

- Regulation and security – The safety of your online brokerage account is one of the most important metrics we use to rank the best stock brokers Ireland.

- Trading tools – Whether you’re a beginner or an experienced investor, trading tools can make the world of a difference when it comes to building an effective trading strategy.

- Platform quality – Choosing the best stocks to buy in Ireland is just the tip of the iceberg. You’ll want to opt for a user-friendly trading platform that makes buying and selling stocks a seamless process. The best stock brokers Ireland that we’ve reviewed in this guide all offer cutting-edge online trading platforms that make stock trading accessible to all types of traders.

- Customer service – Having access to 24/7 customer support is a key metric you’ll want to consider when choosing the best online stock brokers.

Best Stock Brokers Ireland – Conclusion

If you’re looking to buy and sell the best stocks in Ireland you’re going to need the best stock broker to do so. But with so many options out there picking the best one is easier said than done.

That’s why we’ve reviewed a bunch of the best stock brokers in Ireland that you can use right now.