How to Buy Halma Shares UK – With No Commission

Halma plc has been a public listed company for over 45 years, and throughout the years, it has managed to diversify its business and reinvent itself several times. Now, it is one of the largest companies in the UK with a market cap of nearly £9.4 billion as of May 2021 and annual revenues of £1.3 billion.

So, if you are thinking of buying shares of this huge holding company, this guide is for you. we’ll show you How to Buy Halma Shares UK, analyze the company’s strengths, and suggest top UK platforms that enable you to invest in Halma plc without paying any trading fees.

Step 1: Choose a Stock Broker

Halma shares are listed on the London Stock Exchange (LSE), and therefore, you need to find a brokerage firm that offers you to buy and sell shares in the UK. In general, there are many ways to buy shares in the UK, with one of the most popular and cost-effective of them is by Contract for Difference (CFDs). These are essentially derivative instruments that allow you to speculate on the price of an asset without exchanging the assets and paying high fees.

To help you find a good platform that supports this stock, below we analyze two FCA-regulated brokers to buy Halma’s shares.

Research Halma Shares

Before you make any investment, it’s best to conduct market research to get familiar with the company and know the risk involved in the investment you are about to make. As such, in the section of our guide, we are going to analyze Halma plc and help you decide whether it’s the right time to invest in this company.

What is Halma?

Nowadays, Halma is considered as a sort of conglomerate company, which means that it is a multi-industry company that has various sources of income and very often less risk. That said, it does have a strong focus on three sectors – Safety, Environment & Analysis, and Medical.

Halma is a FTSE 100 company and one of the few British firms that have a market capitalization of over £1 billion. It is trading under the ticker symbol ‘lon:hlma’.

In February 2021, Halma has announced the appointment of Dame Louise Makin as the next chair.

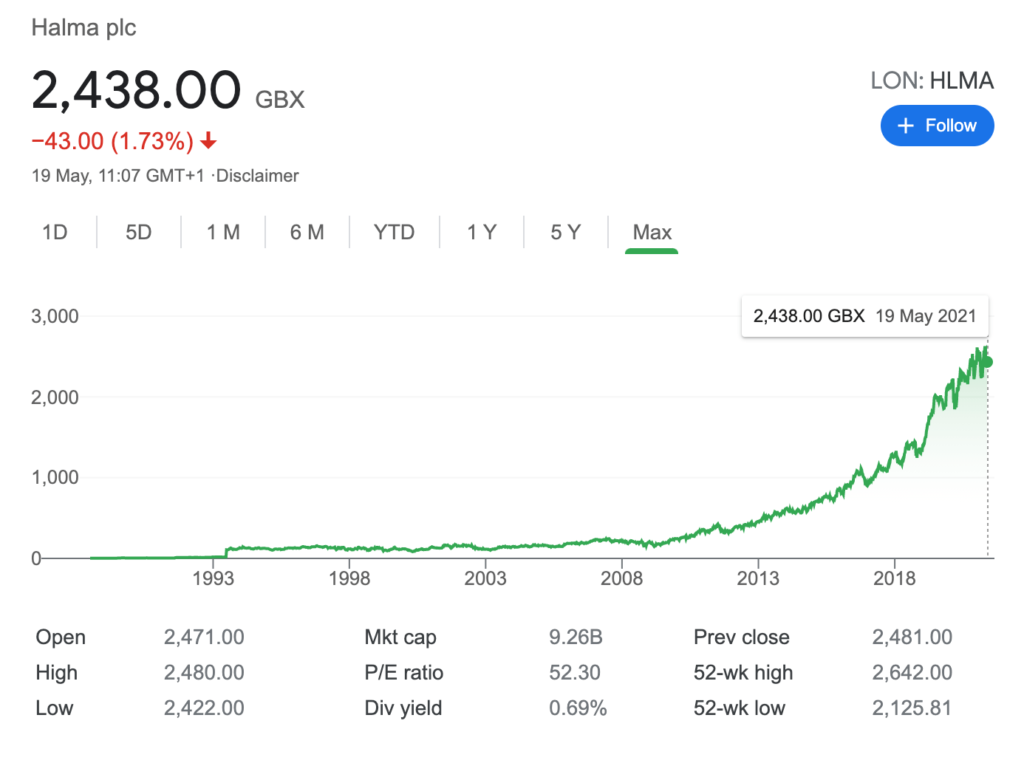

Halma Share Price

Over the last 30 years, Halma shares have clearly been on a long steady uptrend. Back in 1993, one share of Halma was trading at around 18p and for the next 15 years, the HLMA stock was trading at a fairly narrow range of 100p-200p. But, since 2008, the UK-based company has been growing exponentially in the UK and around the world. Its shares price followed suit, rising from around 200p in 2008 to the current price of 2428p.

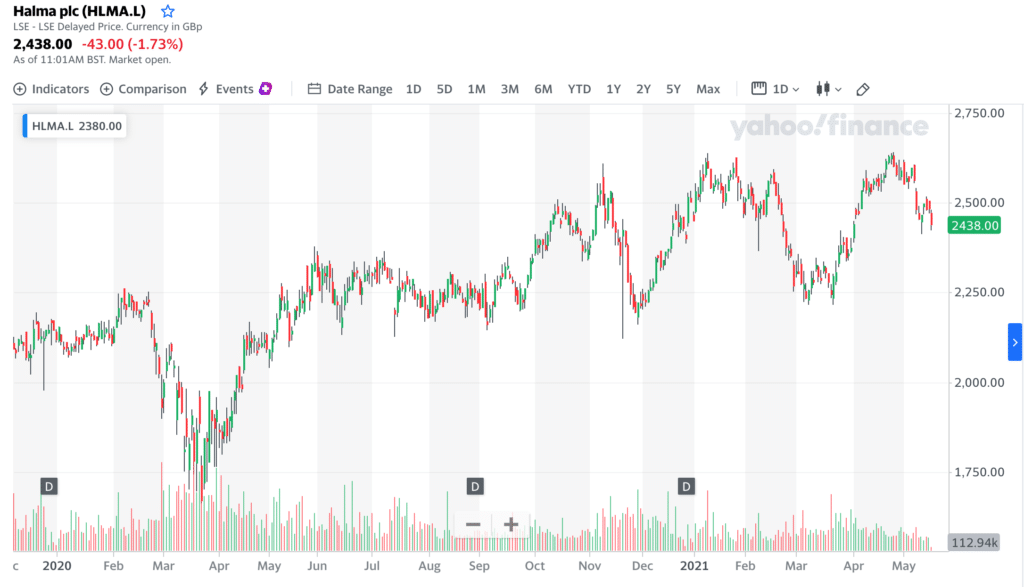

Looking at the previous year, Halma performed quite well during the COVID-19 crisis and as evident, it has a 1-year return of 10.37%. In 2021, however, the company’s stock price is so far unchanged.

As you can see in the chart below through the lens of technical analysis, Halma’s share price is trading on an upward trend line (and above the moving average line) and the next price target should be around 2950p.

In terms of the fundamentals, Halma has a Price/Earnings (PE) ratio of 52! This is a strong signal that investors currently expect higher future earnings and are willing to pay a very high price per share because they believe in the company’s future growth. The company also shows its strength in the EPS data it has released. For the fiscal year of 2020, it has reported a basic EPS of 48.66p, and adjusted EPS of 57.39p for the same year, an increase of 9% from 2019. Halma also expects earnings to keep growing as it forecasts an EPS of 52.3p for 2021/22, and 57.2p for 2022/23.

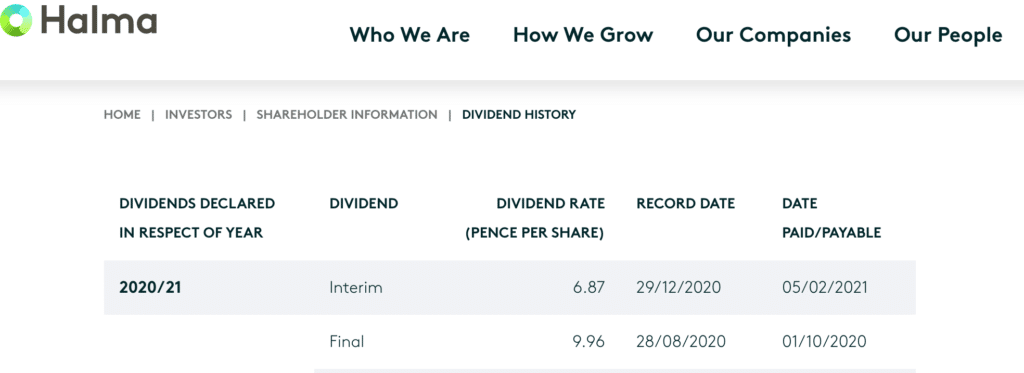

Halma Shares Dividends

If you are looking for a safe and stable dividend stock in the UK, then Halma is certainly it. The company pays a dividend to its investors two times per one calendar year and the dividend yield currently stands at around 6.7% in 2021.

Further, Halma has a long history of sharing its profits with shareholders, and the company’s payout ratio typically ranges between 33%-37%. Additionally, Halma states on its website that it has a dividend growth of over 5% for over 40 consecutive years. The good thing here is that this is not likely to change in the near future based on Halma’s ROE and the company’s policy of consistently increasing its dividend payouts. Looking ahead, Halma’s next ex-dividend date is expected to on 15 Jul 2021.

Are Halma Shares a Good Buy?

Even though Halma’s share price has been rising steadily over the last few years, it is important to check what are the key strength of this business and what is the upside potential for this stock. After all, the past performance of a company does not always reflect its future performance. As such, we are now going to take a closer look at the recent developments of Halma, the company’s key points, and how it performed during the coronavirus crisis.

A Network of Diverse Businesses Around the World

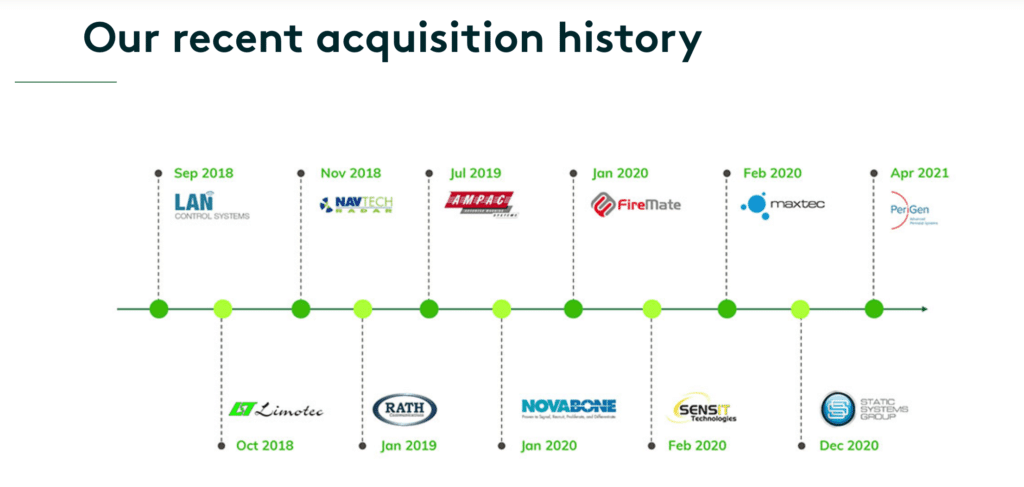

Above all, the main reason why Halma is such a strong company is the diversity of the products and services the company offers. Essentially, Halma is a holding company with approximately 45 companies around the world operating in different sectors. Simply put, Halma has a different approach in making sure it partners only with individuals and organizations who share the same business ideology. This means that Halma is acting like a conglomerate in some ways, and constantly sells companies, and makes new acquisitions.

Solid Operational Performance During the Covid-19 Pandemic

Despite a minor bump in the road around May-June 2020, Halma has delivered a resilient performance during the Covid-19 crisis and even increased its dividend in July last year. And, even though the company’s revenue and adjusted profit declined by 5% last year, the company still has a robust balance sheet with net debt of just £315.0 million and a free cash flow of £249 million.

Acquisition of PeriGen, Inc/One Third Spin-Out

In April 2021, Halma has announced the acquisition of PeriGen, Inc., a technology company that develops software that alerts parents with an early problem of their unborn babies. The software uses artificial intelligence to provide the PerWatch surveillance, the PerWatch Vigilance, and the PeriWatch Command Center. PeriGen, which was acquired by Halma for $58M, has total revenues of $20 million and a return on sales of 18%-22%.

In the same month, Halma has also announced the spin-put of OneThird, a food technology start-up that helps to prevent food waste through data-driven quality prediction.

Halma Shares Buy or Sell?

Clearly, one of the main reasons that every rational investor asks these days is whether it is the time to buy or sell stocks. The reason for that is the growing concerns of an upcoming stock market bubble that will burst in the near future.

Having said that, Halma seems to be one of the best UK stocks to buy right now, even in the case of a market crash. Throughout the years, Halma has developed a business model that succeeds to generate steady growth and increasing revenues. And, quite remarkably, for the full-year results for the 12 months to 31 March 2020, Halma has reported record revenue and profitability for the 17th consecutive year. Further, the fact that Halma takes climate change and environmental sustainability seriously is another factor to consider when analyzing this company. Just a day ago, Halma has been named by the Financial Times and Statista as one of Europe’s Climate Leaders.

So, all things considered, if your time horizon is short and you think the market is expected to crash or at least correct soon – then, consider selling Halma is a fair decision. Otherwise, in our view, Halma is a great long-term stock to buy right now.

How to Buy Halma Shares UK – Conclusion

To sum up, Halma plc is definitely a stock to consider adding to your portfolio. This company has a good business model, a positive purpose, an excellent bussiness model, and a stable dividend that consistently increases by 5% every year.

FAQs

Should I buy Halma Shares?

Well, there are several reasons why you should buy Halma shares. First, Halma is the most admirable company in the United Kingdom due to its goals to invest in renewable energy and companies that aim to solve key problems in the world. Other than that, Halma is a diverse company with various sources of income and its business model seems to work very well. Finally, perhaps the most convincing reason to buy Halma shares is the PE ratio of 52 that shows the high expectations of investors towards the future of this company.

How much are Halma shares worth?

At the time of writing, Halma plc shares are trading at 2438p.

Who owns Halma?

Halma is a public listed company and thus, it is owned by shareholders. Some of the main mutual fund owners of Halma include Covéa Actions Europe, American Funds EuroPacific Growth Fund, and MFS International Intrinsic Value Fund. The main institutions that own Halma include Capital Research & Management Co. (World Investors), Mawer Investment Management Ltd., and MFS International (UK) Ltd.

What services does Halma provide?

Halma provides safety equipment products in the following sectors: infrastructure surveillance sensors (34.9%), healthcare equipment (25.9%), environmental analysis equipment (24.3%), and industrial security equipment (14.9%).

Where is Halma based?

Halma plc is based in Amersham, England. It has additional offices in London, Bristol, the United States, China, and India.