Best Low Volatility ETFs UK to Watch

There are a number of factors, including minimum investment, its performance in recent months and any fees, which investors may choose to review before investing in any ETF. This guide will provide a look into some popular investments for a Low Volatility ETF Portfolio.

Key Takeaways on Low Volatility ETF

10 Popular Low Volatility ETF UK 2022 List

- Powershares S&P 500 Low Volatility ETF (SPLV)

- Invesco High Dividend Low Volatility ETF (SHPD)

- FlexShares Developed Markets Low Volatility Climate ESG UCITS ETF (QVFD)

- Invesco S&P MidCap Low Volatility ETF (XMLV)

- iShares MSCI Emerging Markets Min Vol Factor ETF (EEMV)

- iShares MSCI USA Min Vol Factor ETF (USMV)

- iShares Edge MSCI EAFE Minimum Volatility ETF (EFAV)

- BMO Low Volatility Canadian Equity ETF (ZLB)

- Legg Mason Low Volatility High Dividend ETF (LVHD)

- Invesco FTSE Emerging Markets High Dividend Low Volatility UCITS ETF USD (EMHD)

Low Volatility ETFs UK Reviewed

1. Powershares S&P 500 Low Volatility ETF (SPLV)

Containing some of the US’s largest companies, from Apple to ExxonMobil to IBM, this fund aims to focus on so-called “Blue Chip” stocks that are likely to offer significant returns, no matter the state of the market. While having dipped slightly in 2020, which was to be expected as a global pandemic hit, the ETF has gradually grown over the last year.

This ETF will give you exposure to some of the largest companies, while staying reasonably stable when the individual stocks may take a dip on negative profits or other news.

With only a 0.25% expense ratio, this low volatility ETF is reasonably affordable to hold, priced currently at $63.60, if you have a chunk of money to put into the market. Additionally, the stock pays a regular dividend.

2. Invesco High Dividend Low Volatility ETF (SPHD)

SPHD offers great opportunities for dividend investors, while staying pretty consistent in its value, otherwise, growing over time. In addition to being a low volatility ETF, SPHD is a monthly dividend payer.

In addition to the above-mentioned features, it is also a well-diversified fund, having fingers in many pies. With an 18.93% return in the last year, it has a low expense ratio of 0.3%, only slightly more expensive than SPLV.

3. FlexShares Developed Markets Low Volatility Climate ESG UCITS ETF (QVFD)

This clean energy ETF contains companies that are working towards making themselves more friendly to prevent climate change. Containing stocks such as Alphabet (Google’s parent company), Adobe, Microsoft and Johnson & Johnson, the fund has some big names in there. Whether these are truly companies who have either green initiatives or have divested from fossil fuels would require further research, however.

Currently, the ETF is priced at a 24.91, with an expense ratio of 0.29%, which remains competitive. The chart above shows how the ETF has performed over the last year.

4. Invesco S&P MidCap Low Volatility ETF (XMLV)

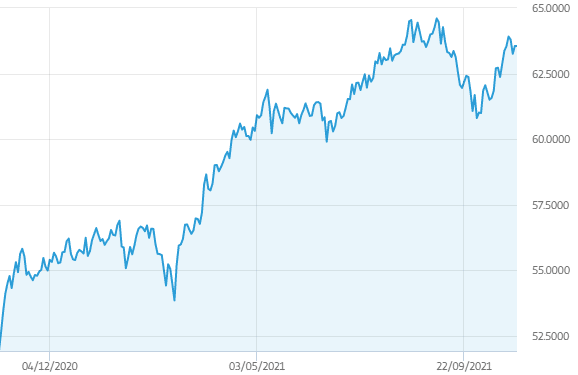

Tracking the 500 largest companies listed on the stock exchange in the United States, this low volatility S&P 500 ETF has performed well over the last year, without any major dips (see chart below). While tracking many different bigger companies that, in themselves, may have volatile stock prices, spread across five-hundred different stocks, this provides stable growth and low volatility.

Managed by Invesco, a well-known provider of ETFs, the fund doesn’t provide a dividend, however, would allow for steady growth in a portfolio. With a slightly lower expense ratio than the previous one, sitting at 0.25%, the fees for the ETF are relatively competitive.The price of the stock is currently at $55.14, a significant rise since this time last year.

5. iShares MSCI Emerging Markets Min Vol Factor ETF (EEMV)

While it can be interesting to invest in Emerging Markets, the issues that many investors face is the volatility caused by the very fact that the businesses in these ETFs are emerging and uncertain. They may not be your typical Blue Chip stock, of which users may expect to perform well.

However, by contrast, this low volatility ETF contains many of the stocks which may be thought to be in Emerging Markets without the uncertainty of individual stocks. Particularly focused on the Asia Pacific Markets, this ETF is currently priced at $62.97. With an expense ratio of 0.25%, the fund measures up against other funds like it.

6. iShares MSCI USA Min Vol Factor ETF (USMV)

This ETF offers further exposure to, specifically, the markets in the United States. With many well-known companies, such as Accenture, PepsiCo and Merck & Co included in the mix of stocks in the fund.

The fund is currently priced at $77.56 a share. With an expense ratio of just 0.15%, it is one of the cheapest ETFs in terms of fees on this list. If your focus is on the US markets currently, this is a popular way to gain diversification into US markets. Above is a chart of the price over the last year.

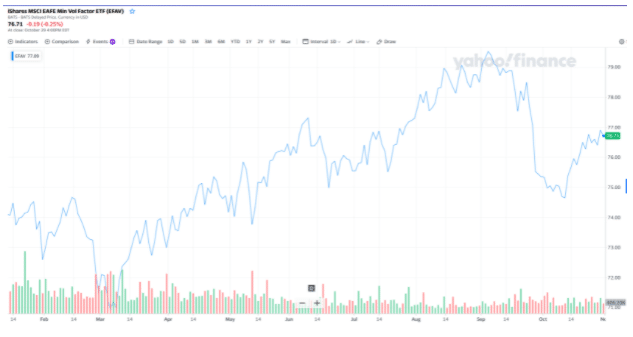

7. iShares Edge MSCI EAFE Minimum Volatility ETF (EFAV)

Much like the other Low Volatility ETFs that we have covered, the aim is to ride out the storm of stock market fluctuations. This one, by iShares, a well-known provider of ETFs, is currently priced at $77.04.

This fund has an annualised return of 12.52%, it is one of the lower returns. With holdings including Nestle, Unilever and National Grid, the fund contains some solid stocks and is definitely well-diversified.

8. BMO Low Volatility Canadian Equity ETF (ZLB)

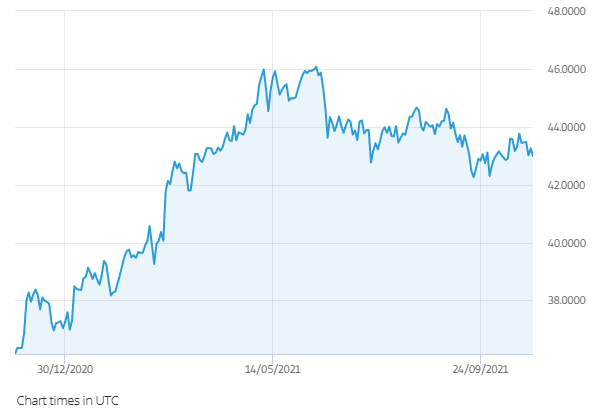

While there are many low volatility ETFs focused on the US, UK and Asian markets, very few have equities exclusively from the Canadian market. Offering an opportunity to tap into a seldom explored market, this BMO fund has a very steady price range, from $33.30 to $40.63 in the last year.

Currently priced at CAD $39.33, the ETF also pays a quarterly dividend, currently sitting at CAD $0.24/per share. It currently has a 0.39% expense ratio, higher than most others so far but maybe worth it for the growth and dividends. While not containing particularly well-known equities, with the exceptions of a few Canadian financial institutions, the ETF has produced a return of 22.75% over the last twelve months. Below, you can see a chart of its growth over the last year.

9. Legg Mason Low Volatility High Dividend ETF (LVHD)

Another Low Volatility High Dividend ETF, LVHD has climbed quite a bit in the last year, increasing the ETF’s value by around $10. The stock is currently priced at $37.37 and has returned 15.1% in the last twelve months.

The fund currently has an annual dividend over $1.05, which, multiplied by an increased holding. In addition, the fund contains many well-known and well-performing companies, from Pfizer to Proctor & Gamble to 3M.

10. Invesco FTSE Emerging Markets High Dividend Low Volatility UCITS ETF USD (EMHD)

Tracking a FTSE Emerging Markets Index targeted at Dividend Growth, the stock, which is listed on the London Stock Exchange, is currently priced at $28.92.

The ETF has an expense ratio of 0.85%. As such, whether you invest in this fund may depend on your own strategy. Nevertheless, it has had a 29.02% return in the last year.

What is a Low Volatility ETF?

A Low Volatility ETF (Exchange Traded Fund) is a fund that is designed with low fees and stability in mind. The ETFs contain, for the most part, a broad range of stocks which is meant to stabilise (and in some cases, grow) the value of their portfolio.

While some of the most popular ETFs for low volatility have a minimum amount that needs to be invested to purchase shares in these funds, the price of these particular types of assets are generally lower than $100

Low Volatility ETFs

If you choose to invest in low volatility ETFs, you may choose to do so with a reputable stock broker that offers low fees on trading, multiple asset classes to choose from and various tools & features that can assist you during your investment process.

In the sections below, we review a popular stockbrokers that let users invest in low volatility ETFs in the UK.

Conclusion

While there isn’t one perfect Low Volatility ETF, this article gives some suggestions. If you wish to research these ETFs, you should perform your own market research beforehand.