Best Battery ETF UK to Watch

Battery ETFs are gaining more attention from investors as the world transitions to electric vehicles (EVs) and other battery-powered devices.

This guide reviews some of the Battery ETFs to watch as the world migrates to clean energy.

Popular Battery ETF UK 2022 List

Some of the popular ETFs have been listed down below:

- Global X Lithium & Battery Tech ETF

- L&G Battery Value-Chain Units ETF

- Global X Autonomous & Electric Vehicles ETF

- Amplify Lithium & Battery Tech ETF

- First Trust NASDAQ Clean Energy Smart Grid Infrastructure Index Fund (GRID)

Battery ETFs UK Reviewed

1. Global X Lithium & Battery Tech ETF (LIT)

Global X Lithium & Battery Tech ETF is one of the most popular battery ETFs, with over $5.08 billion in assets under management (AUM). LIT is the largest battery ETF in the world. It boasts exposure to over 40 companies interfacing with the lithium and battery sector.

25% of its holdings are in lithium mining giant Charlotte-based Albemarle Corp and Chinese mining giants Ganfeng Lithium Co. Ltd and Yunnan Energy. LIT offers exposure to the largest sectors, including materials (47.9%), industrials (27.4%), information tech (12.2%) and consumer discretionary (11.9%).

Following the surge in EV interest amid global climate change, the Global X Lithium & Battery Tech ETF has grown 96% in the past year with more growth opportunities. With such a dynamic exposure to promising materials like lithium and other precious metals, LIT currently changes hands at $88.70 and is up 0.38% in the last 24 hours. Investors in the battery ETF will have to pay 0.75% in fees.

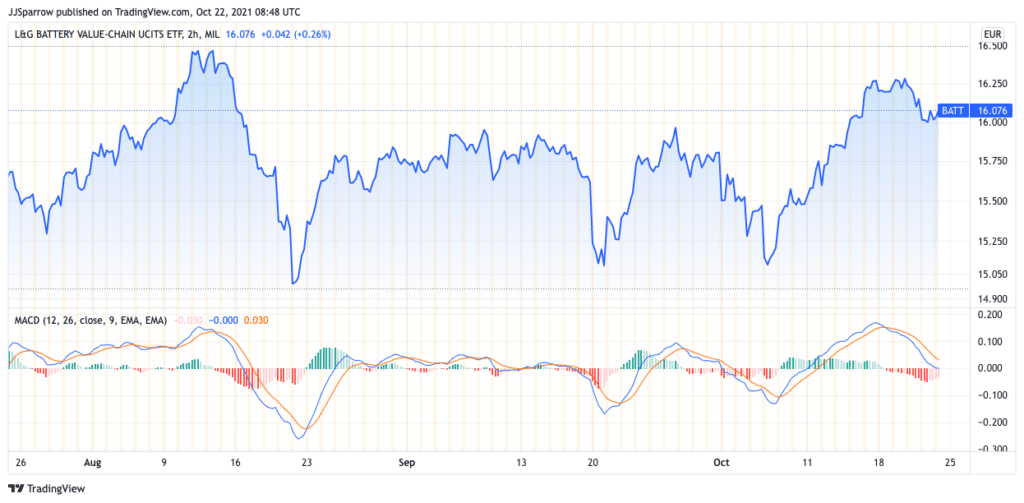

2. L&G Battery Value-Chain Ucits ETF

The L&G Battery Value-Chain Ucits ETF (herein noted as ETF) aims to track the performance of a basket of companies that produce electro-chemical energy storage tech and mining companies that manufacture metals used in making batteries. It directly follows the Solactive Battery Value-Chain Index coverage of these companies.

With over $842.6 million in fund size, the battery ETF offers full replication and a low management fee of only 0.49%.

Looking to capture the growth of battery tech, L&G Battery Value Chain Ucits ETF has posted over 82.17% in net assets volume against the benchmark index figure of 84.13%. This ETF grew 106.33% in the past three years.

L&G Battery Value-Chain Ucits ETF offers exposure to critical sectors like industrials (36.4%), consumer discretionary (29.2%), materials (18.9%), information tech (12%), and communication services (3.4%).

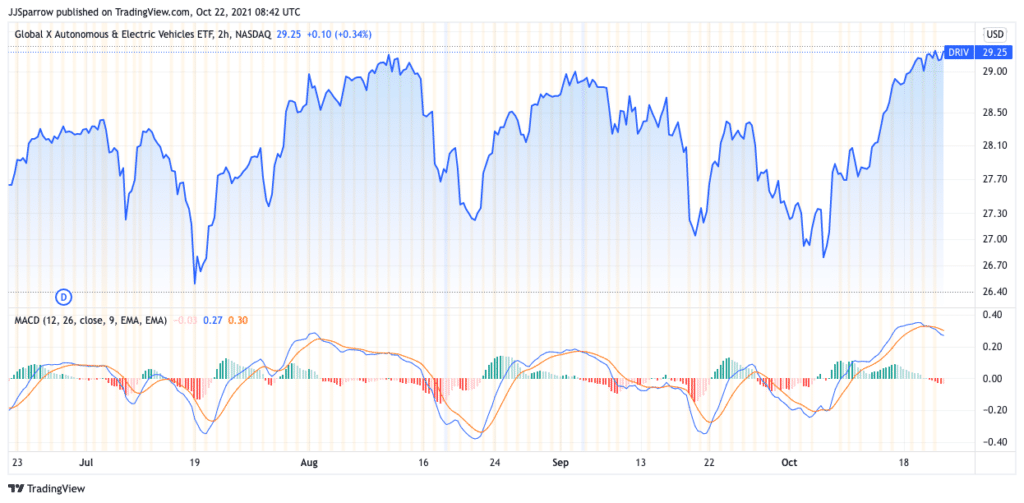

3. Global X Autonomous & Electric Vehicles ETF (DRIV)

DRIV is a high-performing battery ETFs in the industry currently, though it is not a pure-play ETF on lithium and battery stocks. It has an expense ratio of 0.68%, which is pretty reasonable for a battery ETF like Global X Autonomous & Electric Vehicles ETF.

Aside from interfacing with battery tech, DRIV offers broad exposure to tech giants, automakers, semiconductor companies, and EV suppliers. It has over $1 billion in AUM with key holdings in 76 companies, including Alphabet, Microsoft, NVIDIA, and Apple.

Auto-giants like Tesla and Toyota make up the biggest position of the ETF’s holdings. DRIV tracks the performance of the Solactive Autonomous & Electric Vehicles Index.

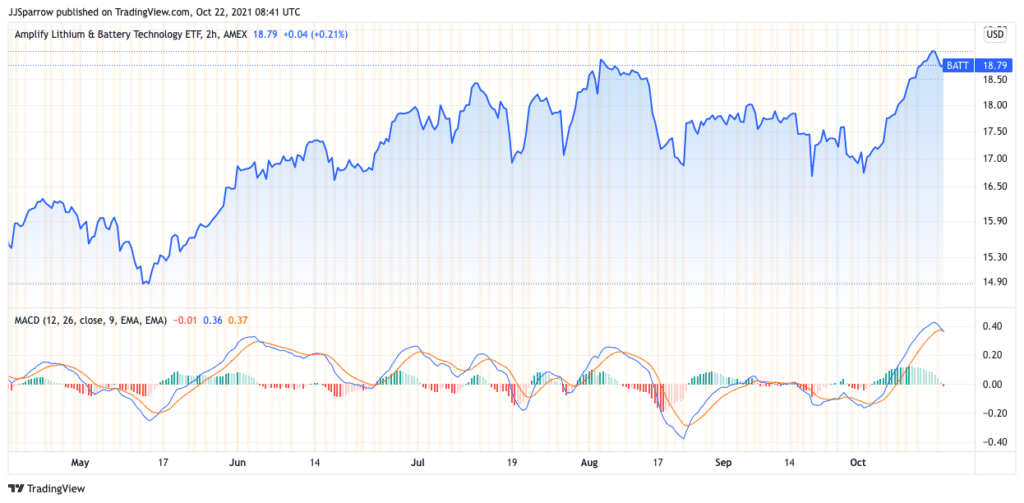

4. Amplify Lithium & Battery Tech ETF (BATT)

Based on the EQM Lithium & Battery Technology Index, BATT aims to track the performance of companies focused on the development, production, and use of lithium battery technology. It offers exposure to popular US EV automaker Tesla with a 7% stake.

Others are lithium miners Contemporary Amper and BHP Group Ltd with 6.92 and 5.57%, respectively. Additional holdings under the scope of BATT are in Yunnan Energy, Ganfeng Lithium Co and Albemarle Corp.

However, BATT is the smallest battery ETF and boasts only $200 million in net assets value (NAV). It has an expense ratio of 0.59% and currently trades at $19.02.

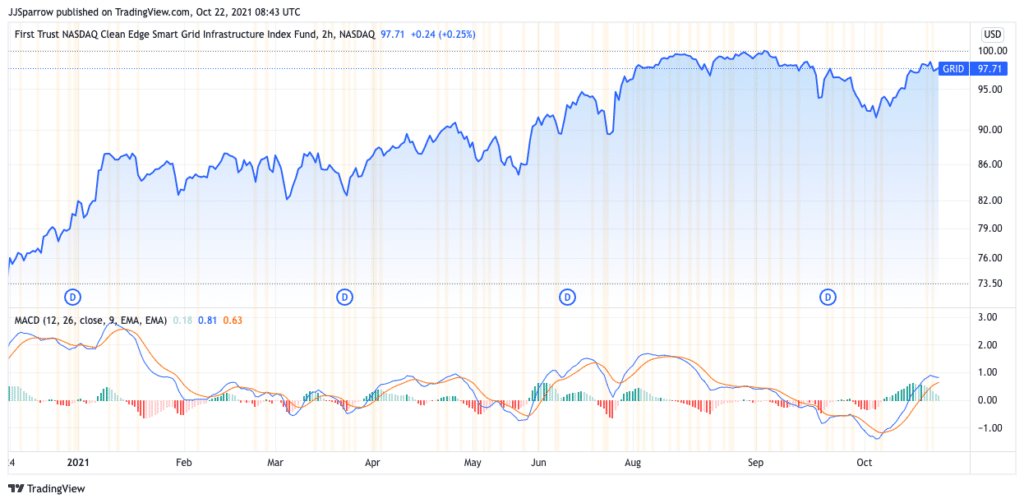

5. First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID)

Known simply as GRID, this battery ETF tracks the NASDAQ OMX Clean Edge Smart Grid Infrastructure Index. It does not offer diversification, and a large chunk of the funds (about 90%) is invested in the stocks in the underlying index.

GRID only boasts a little bit more NAV than BATT and has over $373 million in AUM. It has shown remarkable growth so far this year and has a year-to-date return of 12.9%.

The expense ratio is pegged at 0.7%, and the asset has since shot up in value and trades at $97.96. In terms of exposure, GRID has holdings in Texas-based power infrastructure company Quanta Services, Inc.

What are Battery ETFs?

Finding popular ETFs is never an easy task. Moreso, the popular Battery ETFs. Battery ETFs are similar to popular Platinum ETFs or Gold ETFs that we’ve covered. These investment products track the performance of an index or a sector.

Battery ETFs are exchange-traded funds that track the performance of global companies focused on the development, production and subsequently marketing of battery tech and EVs. They also cover software providers, semiconductor suppliers, component and part manufacturers, battery producers, and lithium miners.

With mobility being a critical area of focus currently, more interest is being paid to environmentally-friendly mobility options, which are expected to move the new global economy.

Battery ETFs have since spiked in value, with LIT stock growing over 90% year-to-date (YTD). The International Energy Agency (IEA) report estimates that consumers spent over $120 billion in EV purchases in 2020, reflecting a 50% increase from the 2019 estimate.

More automobile companies plan to go fully electric in the coming years, including Volvo, Jaguar, Ford, and even General Motors.