Best DeFi Platform UK in 2025 – Cheapest Option Revealed

Finance experts expect Decentralized Finance (DeFi) to be one of the hottest trends in 2025. Using blockchain technologies such as Bitcoin and Ethereum, DeFi removes the middleman from a range of financial transactions and lowers costs.

During the last two years, DeFi protocols have already locked up more than $66 billion worth of value – and that figure is only expected to increase as more DeFi platforms UK are introduced.

Best DeFi Platforms UK – List

Let’s dive straight into the best DeFi platforms you can get started with today:

- DeFi Swap – Overall Best DeFi Platform UK

- Crypto.com – Popular Trading Platform With An Integrated DeFi wallet

- BlockFi – One of the Most Popular DeFi Lending Platforms

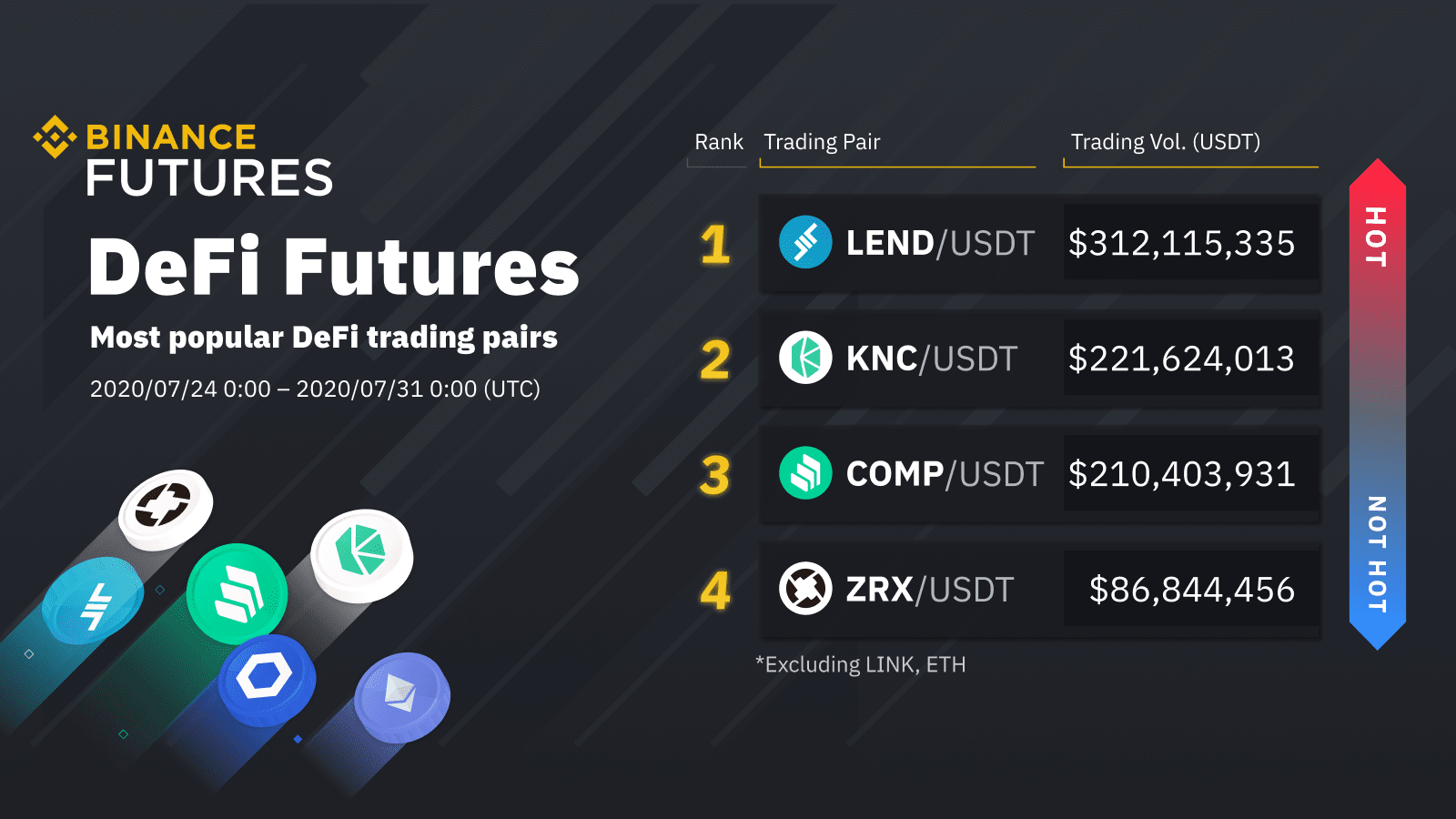

- Binance – The Best Trading Platform for DeFi Coins for Small-Cap Pairs UK

- Nexo – One of the Best DeFi Crypto Lending Platforms in the UK

- PancakeSwap – The Most Popular Decentralized Platform UK

- Uniswap – The Largest DeFi Exchange in UK

Best DeFi Platforms UK in 2025 Reviewed

Are you looking for more information about the best DeFi platforms to determine which one is best for you? First, let’s look at why each of these platforms stands out and why you should buy from them.

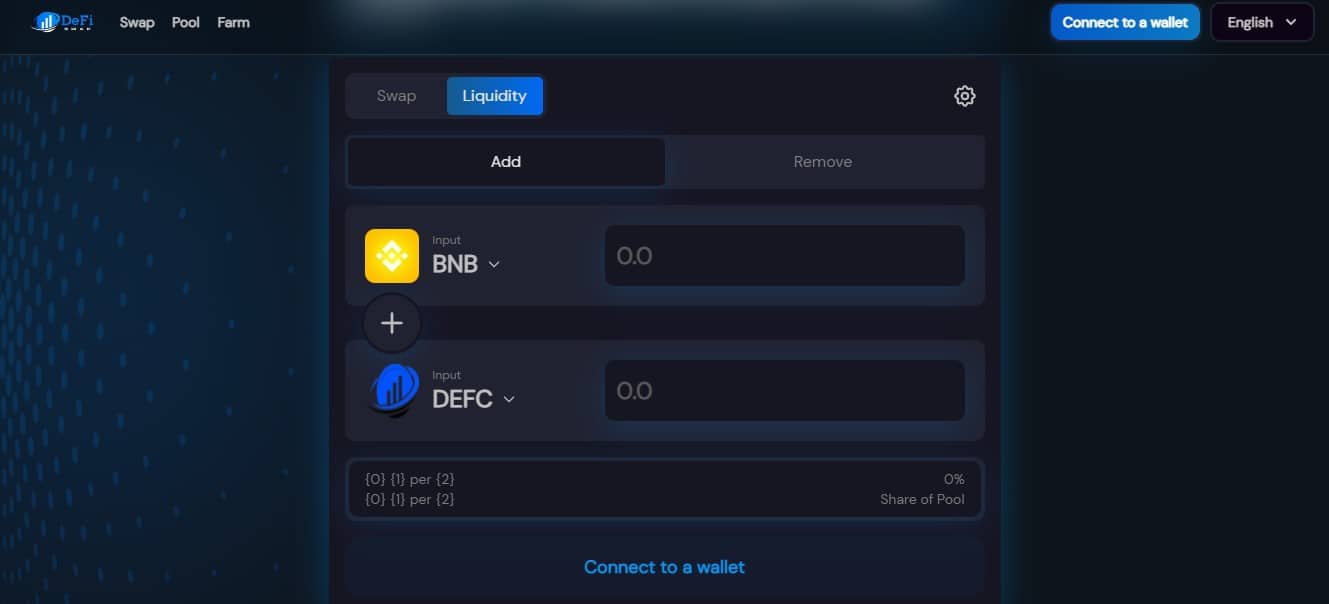

1. DeFi Swap – Overall Best DeFi Platform UK

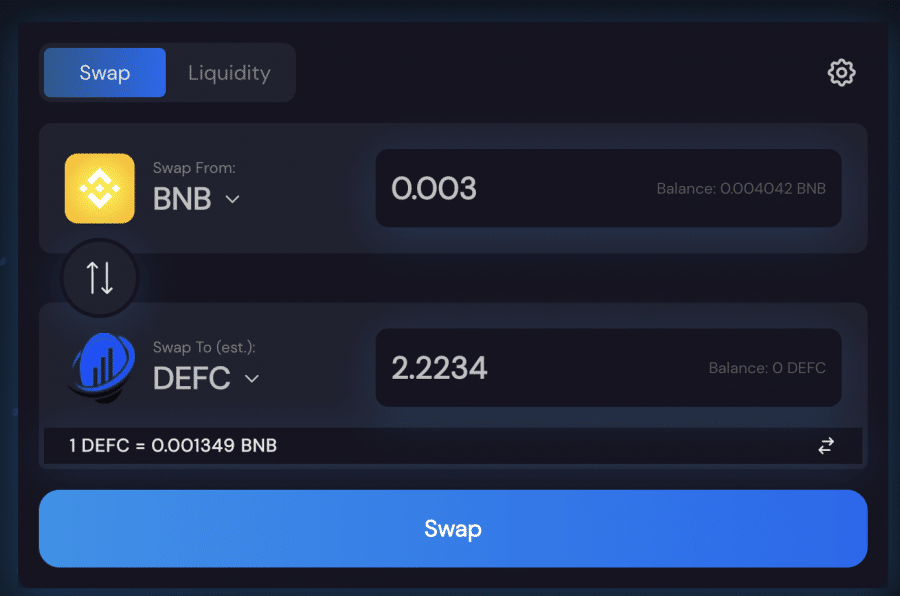

It’s considered one of the best DeFi platforms UK on the market, but it’s also the best DEX exchange, making it the best DeFi exchange right now. DeFi Swap is a DEX that offers staking, token swapping, and yield farming services. DeFi Coin (DEFC), its native token, is required to operate the platform.

It’s easy to get started with DeFi Swap through the online portal, which can be accessed from your browser. Due to the platform’s use of the Binance Smart Chain (BSC) network, you can purchase Binance Coin and then exchange it for a supported token on DeFi Swap. DeFi Swap currently supports over 50 popular tokens, including DAI, USDC, USDT, and ANKR.

Returns can be generated through the exchange’s liquidity pools. This type of liquidity pool offers a fixed rate of interest on your holdings of digital currencies by utilizing smart contracts. A ‘yield farming’ strategy can prove to be highly profitable over time since DeFi interest rates are higher than traditional bank accounts.

Additionally, DeFi Swap allows users to lock up their tokens for a specified period, paying interest. Despite the fact that this process is similar to liquidity pools, your holdings will remain locked up until the lock-up period has expired.

Furthermore, DEFC holders can earn passive income through the token’s innovative taxation system. Due to all of these factors, this year was the year that DeFi Swap won the award for best DeFi exchange. It charges 10% on purchases and sales, and halve of that goes to other holders as a ‘dividend.’

In the DeFi Swap Telegram group, over 6000 users frequently interact.

| Fee | Amount |

| Crypto trading fee | 10% when selling DEFC |

| Inactivity fee | N/A |

| Withdrawal fee | N/A |

Pros:

Cons:

Cryptoassets are highly volatile unregulated investment products. No EU or UK Protection.

2. Crypto.com – Popular Trading Platform With An Integrated DeFi wallet

A leading cryptocurrency exchange, Crypto.com was founded in 2016 and offers a fast and secure platform to trade cryptocurrencies. As a result of a strong marketing team and the work of several developers, Crypto.com has grown rapidly over the past years. In addition to offering more than 250 different currencies, those who hold enough Crypto.com’s token (CRO) can get reasonable fees and discounts.

Crypto.com allows you to connect multiple digital wallets simultaneously to one account. You can store cryptocurrencies in several different ways, so it is an ideal place for those interested in investing in cryptocurrencies. As an example, the DeFi wallet demonstrates this best. It is also possible for users with the app to earn rewards through the use of tokens or coins, similar to those used in decentralized financial applications based on blockchain networks.

Due to the fact that Crypto.com only requires a dollar deposit in order to open an account, it is one of the easiest crypto platforms to use to trade cryptocurrencies. Additionally, the platform provides crypto trading and derivative products for those looking to leverage their position on the platform.

Check out our full Crypto.com review for more information.

| Fee | Amount |

| Crypto trading fee | 0.04% maker and taker fees |

| Inactivity fee | Free |

| Withdrawal fee | According to the currency withdrawn. 0.0004 for ETH |

Pros:

Cons:

Cryptoassets are highly volatile unregulated investment products. No EU or UK Protection.

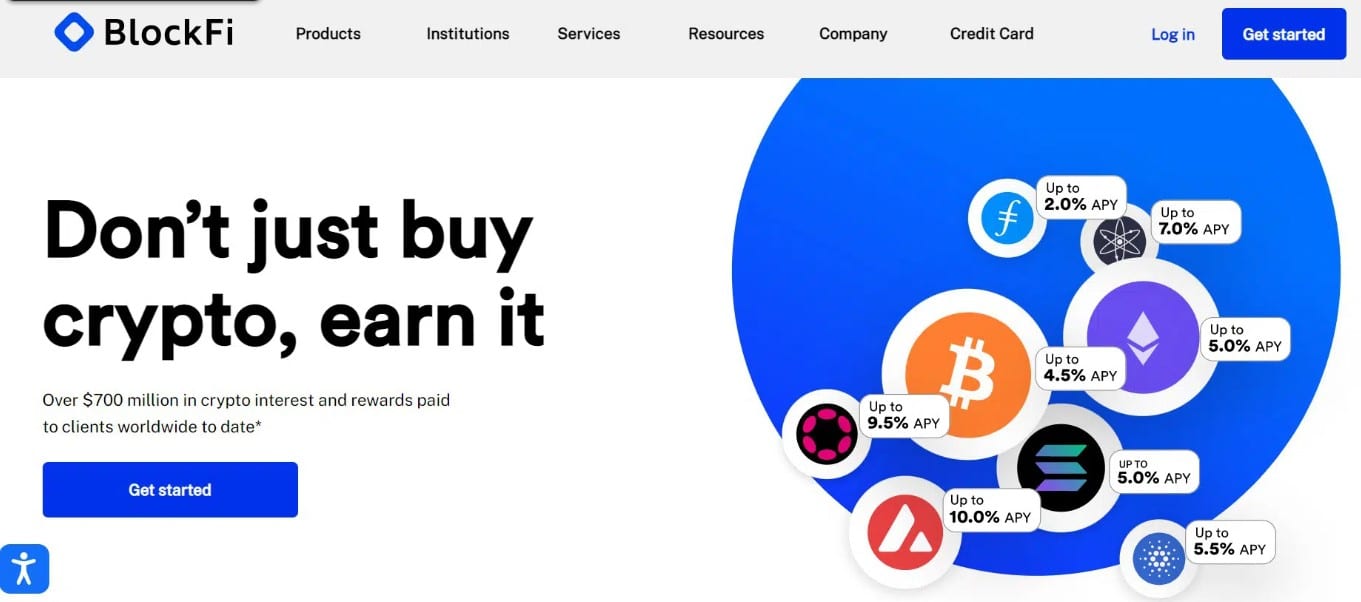

3. BlockFi – One of the Most Popular DeFi Lending Platforms UK

BlockFi was founded in 2017 in New Jersey by Zac Prince and has since earned over $700 million in cryptocurrency interest and rewards to clients worldwide; the company is known for its crypto interest account and crypto loan services.

Visa cards from this company are accepted almost everywhere, including in the UK. You can earn up to 1.5% back in Bitcoin or more than ten other cryptocurrencies for every dollar spent with the card. Additionally, the program offers 2% back on all purchases over $50,000 (£38,435.75) per year, limited to heavy shoppers.

For holding cryptocurrencies in your account, it charges a fee of 0% and offers an interest rate of 11.74% to 21.74%. Those who live in the UK and intend to use the crypto card will find it beneficial that they do not have to pay for currency exchange.

Bitcoin enthusiasts can receive 0.25% cashback in Bitcoin for all eligible trades, up to $500 per month. Additionally to the Refer-a-Friend program, you will receive $30 in Bitcoin for every referral.

In particular, BlockFi offers a cryptocurrency credit card that allows you to use a larger amount of money while paying the bill in dollars and receiving cryptocurrency rewards. For this reason, a crypto debit card is a good option if you don’t wish to spend more than what you have in your crypto fund.

Additionally, you will need to create an account before receiving the BlockFi Rewards Visa Signature Credit Card and will have access to manage the card after that.

| Fee | Amount |

| Crypto trading fee | N/A |

| Inactivity fee | N/A |

| Withdrawal fee | Varies depending on asset |

Pros:

Cons:

Cryptoassets are highly volatile unregulated investment products.

4. Binance – The Best Trading Platform for DeFi Coins for Small-Cap Pairs UK

If you plan to do day trading or swing trading, Binance can be your best friend. It is because the crypto exchange provides you with access to hundreds of tradable pairs of cryptocurrencies.

Rather than buying and storing them for several years, it is a highly conducive environment for actively trading digital currencies. It’s often the largest cryptocurrency platform in terms of daily trading volume and liquidity even though Binance only launched in 2017.

The platform has facilitated over $17 billion worth of cryptocurrency trades in the 24 hours prior to writing this guide. Besides offering one of the largest number of cryptocurrency trading markets, Binance is also known for its competitive fees.

As an example, if a trade order for a $1,000 buy or sell position costs just $1 in commission, the commission would be just 0.10%. You will even be able to reduce your fees if you trade large volumes. By holding BNB coins, a native cryptocurrency of the Binance platform, you can also reduce your trading commissions.

Alternatively, Binance will cost a bit more if you plan to fund your account with a UK debit card. Because of this, 2% of the transaction amount will need to be paid. In spite of the cheaper fee than Coinbase’s 3.99%, make sure to remember that eToro charges only 0.5%.

However, the Binance trading suite itself is packed with tools and features that will please even the most seasoned professional. You are also able to connect your API with a third party provider so you can access a full set of chart reading tools, technical indicators, etc. Automated trading strategies and robots are possible using this option.

Binance does not have a license from the British Financial Conduct Authority, so it is unregulated from a safety point of view. The company is known for its security and customer care, however. In the unfortunate event of a hack from an external source, SAFU (Safe Asset Fund for Users) is a convenient emergency insurance fund to cover the loss.

Check out our full Binance review for more information.

| Fee | Amount |

| Crypto trading fee | Commission, starting from 0.1% |

| Inactivity fee | Free |

| Withdrawal fee | 0.80 EUR (SEPA bank transfer) |

Pros:

Cons:

Cryptoassets are highly volatile unregulated investment products.

5. Nexo – One of the Best DeFi Crypto Lending Platforms in the UK

Nexo is an exchange platform and crypto lending platform powered by DeFi technology that allows you to trade, borrow, lend or spend cryptocurrencies.

In 2017, Nexo was founded by three investors with over a decade of experience in European financial institutions. The platform’s goal is to bring a full spectrum of professional financial services into the world of cryptocurrencies and digital assets. In a market where there are more than one million users and over $12 billion worth of assets being managed, the exchange boasts of being the largest and most trusted lending institution in digital finance.

The Nexo platform supports the buying, borrowing, and lending over 20 cryptocurrencies and fiat currencies, including USD, EUR, and GBP. Users can earn between 6% and 12% interest on their idle savings, depending on the type of account. Cryptocurrency loans are also available at rates as low as 5.9%.

Check out our full Nexo Review for more information.

| Fee | Amount |

| Crypto trading fee | N/A |

| Inactivity fee | N/A |

| Withdrawal fee | Up to 5 free withdrawals per month |

Pros:

Cons:

Cryptoassets are highly volatile unregulated investment products.

6. PancakeSwap – The Most Popular Decentralized Platform UK

Among the decentralized exchanges on Binance Smart Chain, PancakeSwap is by far the most popular. Using BEP-20 coins and Binance Coin (BNB), clients can exchange BNB securely without relying on centralized services. Using smart contracts, PancakeSwap functions as a decentralized exchange where there is no middleman.

Everyone can view the PancakeSwap smart contract code, which is open-source. This despite the fact that the team comprises more than a dozen members, including two co-leads and several software engineers.

Platform was first launched in September 2020, with the number of customers and the range of features it offers increasing significantly since then. CAKE is PancakeSwap’s primary utility currency. The platform is becoming an ecosystem aligned around CAKE.

In the expanding PancakeSwap ecosystem, you can use Cake as PancakeSwap’s native token. Farming yields, stakes, and playing the PancakeSwap lottery are the platform’s major features, as are voting on governance proposals using its community governance site.

| Fee | Amount |

| Crypto trading fee | 0.25% |

| Inactivity fee | N/A |

| Withdrawal fee | Only with CAKE |

Pros:

Cons:

7. UniSwap – The Largest DeFi Exchange in UK

UniSwap ranks among the largest decentralized crypto exchanges. It makes it convenient to exchange cryptocurrency tokens, and you don’t need to create an account to use it. Uniswap’s liquidity pools also allow you to earn interest on your crypto holdings. However, the exchange charges high fees.

As the name implies, UniSwap is an automated market maker (AMM) type of exchange. In order to set prices and execute trades, AMMs use smart contracts (programs written on the blockchain). Due to their decentralized nature, these exchanges are not governed by a central authority. Known as DeFi, they provide decentralized financial services.

Each transaction is charged a small fee distributed among the pool’s liquidity providers (the people who have deposited their crypto in the pool). The relationship is mutually beneficial. UniSwap offers crypto trading through its liquidity providers, and its liquidity providers make money by taking a cut of the exchange’s transaction fees.

| Fee | Amount |

| Crypto trading fee | 0.3% |

| Inactivity fee | N/A |

| Withdrawal fee | 0.00053 BTC |

Pros:

Cons:

Best DeFi Platforms UK Compared

Let’s analyze the best DeFi Platforms UK Fees.

| Platform | Trading Fee | Inactivity Fee | Withdrawal Fee |

| DeFi Swap | 10% when selling DEFC | N/A | N/A |

| Crypto.com | 0.04% maker and taker fees | Free | According to the currency withdrawn. 0.0004 for ETH |

| BlockFi | N/A | N/A | Varies depending on asset |

| Binance | Commission, starting from 0.1% | Free | 0.80 EUR (SEPA bank transfer) |

| Nexo | N/A | N/A | Up to 5 free withdrawals per month |

| PancakeSwap | 0.25% | N/A | Only with CAKE |

| UniSwap | 0.3% | N/A | 0.00053 BTC |

What is a Defi Platform?

This term describes a range of financial applications that use cryptocurrency or blockchain to disrupt financial intermediaries.

The technology behind the digital currency bitcoin, the blockchain, is a system in which multiple parties may hold copies of the transaction record so that it isn’t controlled by just one party. That is important because human gatekeepers and centralized systems can slow down and complicate transactions while allowing users less direct control over their money. The DeFi blockchain allows for more complex financial transactions than simple value transfers.

In contrast to legacy payment methods such as Visa and PayPal, digital assets like Bitcoin do not involve middlemen. For example, whenever you use your credit card to pay for coffee at a cafe, the financial institution controls the transaction, keeping authority over it and recording it in its ledger. Bitcoin, however, does not rely upon these institutions.

Big companies participate in more than just direct purchases. In addition to loans, insurance, crowdfunding, derivatives, and betting, they also deal in other financial applications. The primary advantage of DeFi is that middlemen are removed from all transactions. Among the most disruptive DeFi applications are:

- Crypto Loans

- Crypto Yield Farming

- Crypto Lending

- Crypto Savings Accounts

- Crypto Staking Platforms

Before becoming widely known as decentralized finance, open finance was widely known as the concept of decentralized finance.

Are DeFi Platforms Safe?

Because DeFi technology is new, negative outcomes can occur. New companies may not succeed with decentralized finance (start-ups fail frequently), and programming mistakes can create lucrative opportunities for hackers. A failed DeFi project can result in the loss of all your funds.

Although DeFi trading platforms generally do not provide recovery options for lost funds, deposits with traditional financial institutions are covered by the Federal Deposit Insurance Corporation (FDIC). In addition, when a traditional financial transaction fails, consumers can complain to the Consumer Financial Protection Bureau (CFPB), but this option does not exist if a deceptive DeFi victimizes them.

The development of another type of DeFi application that addresses these shortcomings is an interesting advancement. By pooling their cryptocurrency as collateral, individuals who wish to protect themselves from other smart contracts can obtain decentralized insurance. Those covered by cryptocurrency pools pay premiums to the contributors.

How to Invest In DeFi Platforms UK

You can invest in an excellent DeFi Platform like DeFiSwap in some easy steps.

Step 1: Setup Crypto Wallet

Create a wallet with Trust Wallet or MetaMask. Keep your phrase private! Don’t share it with anyone! Don’t forget to copy the contract to the right!

- Search for “DeFi Coin” by tapping the icon in the top-right. If it doesn’t appear, tap “Add Custom Token.”

- To change Ethereum to Smart Chain, tap “Ethereum” next to Network at the top. After that, copy and paste the contract address from this page into the Contract Address box.

- The name of the coin should be DeFiCoin, and the symbol should be DEFC. Decimals will be 9.

- The DeFi Coin should now be added to your wallet once clicking “Done” at the top!

Step 2: Purchase BNB

Then tap “Buy” in the trust wallet’s top right corner of “Smart Chain.” Be prepared to provide documents to prove your identity, as this step may require KYC verification.

Keep in mind:

- Contact your bank if the transaction does not go through.

- Your order may take a while to process after you have purchased it.

Step 3: Connect to Wallet to DeFi Swap

The DApps (or “Browser” for iPhones) are at the bottom of the main screen after you have cleared your transaction. Open Safari and type trust://browser_enable into the URL bar if you cannot see the Browser button at the bottom of the Trust wallet.

Locate PancakeSwap in the DApps section or browser, and open it. Connect your Trust wallet in the top-right corner. Click on the “Exchange” box

Set the slippage to 15% by clicking the icon. Let’s say you want to give it the best chance possible to clear and extend the deadline. By default, 20 minutes should be sufficient.

Step 4: Swap Tokens

All you need to do now is specify the number of tokens you want to trade. In addition, you can also enter how much money you are willing to risk on the Defi coin in question.

In either case, your order will be executed instantly once you confirm it at Pancakeswap. Moreover, Pancakeswaap will not charge you anything for trading Defi coins!

Cryptoassets are highly volatile unregulated investment products. No EU or UK Protection.

Best DeFi platform UK – Conclusion

Trading DeFi is poised to transform global financial services similarly to how fintech paved the way for online banking and online transactions that we are familiar with today. In spite of this, it is important to remember that blockchain and decentralization aren’t a panacea for all problems. For this emerging technology to go mainstream, proper use cases must be identified that can truly benefit from it.

Are you interested in trading DeFi? Visit DeFi Swap. By staking the platform’s native DeFi Coin, you can earn up to 75% APY and get started in no time. Simply connect your wallet and begin earning interest.

Cryptoassets are highly volatile unregulated investment products. No EU or UK Protection.

Frequently Asked Questions on Crypto Lending

Does crypto grow in a UK defi platform?

Can I withdraw money from UK DeFi platform?

What is the purpose of a DeFi platform UK?