Best Bitcoin Alternative UK

There’s no questioning the fact that Bitcoin has been the top cryptocurrency in the market over the past decade. However, with many exciting platforms launching in the sector, there’s never been a better time to consider investing in different coins than BTC.

In this article, we’ll discuss the Best Bitcoin Alternative UK, highlighting the options available in the market today and showing you how to buy cryptocurrency right now – all from the comfort of your own home.

Key points on Bitcoin Alternatives

- There are hundreds of Bitcoin alternatives (called altcoins) available in the market, ranging from DeFi tokens to stablecoins.

- Since Bitcoin alternatives have smaller market caps than BTC, it’s essential to analyse them carefully and consider future prospects and trade availability.

- Investing in a Bitcoin alternative will require you to sign up with a reputable broker or exchange to make your investment.

- Our recommended trading platform to buy alternatives to Bitcoin is Coinbase.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

The Next Best Bitcoin Alternative

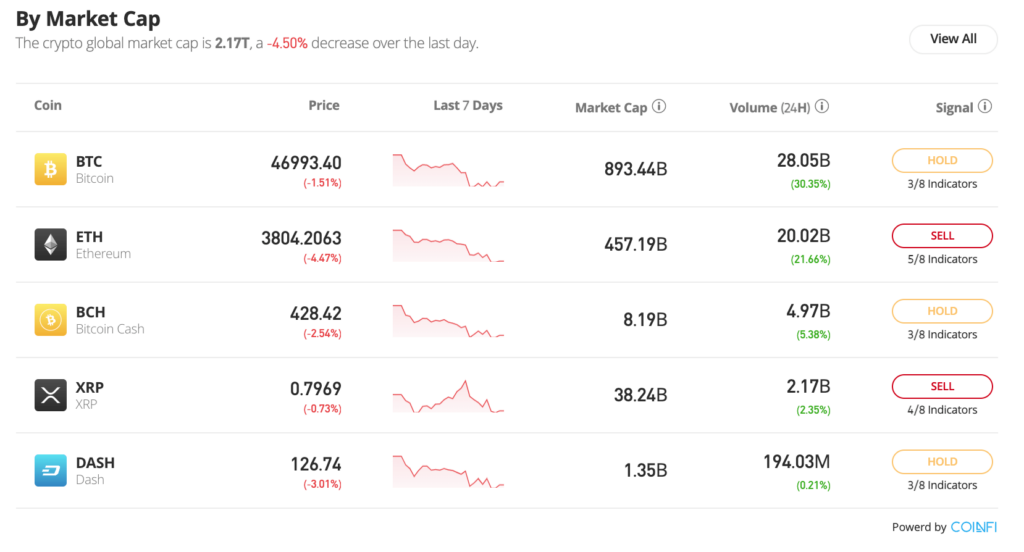

If you’re looking to buy cryptocurrency and are interested in alternatives to Bitcoin, then found below is our list of the top 10 coins on the market right now:

- Ethereum (ETH) – Overall Best Bitcoin Alternative

- Solana (SOL) – Super-Fast Bitcoin Alternative with Low Fees

- Chainlink (LINK) – Best Bitcoin Alternative to Hold Long Term

- Dogecoin (DOGE) – Meme Coin That Acts As an Alternative to Bitcoin

- Tether (USDT) – Best Bitcoin Alternative Stablecoin

- Cardano (ADA) – Exciting Bitcoin Alternative Smart Contract Platform

- Polkadot (DOT) – Innovative New Bitcoin Alternative for Interoperability

- Ripple (XRP) – Super-Fast Payment Network as Alternative to Bitcoin

- Binance Coin (BNB) – Valuable Exchange Token Offering a Bitcoin Alternative

You can buy all these cryptos on Coinbase with tight spreads and a range of payment methods. This means you can also buy Celo and Loopring with low fees and a top-rated crypto wallet.

A Closer Look at the Best Bitcoin Alternatives

If you’re looking to invest in a Bitcoin alternative, it’s important to understand the intricacies of the coin you’re looking to trade. Found below is our analysis of the alternatives to Bitcoin listed above, highlighting their use-cases and future potential.

1. Ethereum (ETH) – Overall Best Bitcoin Alternative

Our pick for the best alternative to Bitcoin is Ethereum. Many investors opt to buy Ethereum as it offers a very different service to the one that BTC provides. Put simply, Ethereum is an open-source blockchain platform that was designed by Vitalik Buterin back in 2013. The key concept behind Ethereum is that it allows developers to create decentralised applications (dApps) with smart contract functionality. Ultimately this leads to a whole range of use cases, including in the areas of decentralised finance (DeFi) and NFTs.

Due to Ethereum’s usability, many other cryptocurrencies have been designed and launched on the Ethereum blockchain as ERC-20 tokens. However, one of the most exciting things about Ethereum is its upcoming upgrade to ‘Ethereum 2.0’, which will see the platform move to a sharding approach. This will significantly increase Ethereum’s scalability and reduce fees – which have been a pain point for developers in recent years. Overall, Ethereum’s future in the crypto ecosystem is incredibly bright, making it our top Bitcoin alternative right now.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

2. Solana (SOL) – Super-Fast Bitcoin Alternative with Low Fees

Another of the best cryptocurrencies UK to consider is Solana. Like Ethereum, Solana is an open-source blockchain network that utilises the proof-of-stake protocol (PoS) to achieve consensus. However, what sets Solana apart is that it can complete many more transactions per second (TPS) than Ethereum. For example, Ethereum can handle between 15 to 45 TPS, whilst Solana can handle around 50,000! Furthermore, as Solana offers lower fees than ETH, it is a much cheaper option for developers.

Solana’s price is up over 12,000% this year alone, highlighting just how quickly the platform has burst onto the scene. The platform’s native token, SOL, is used for staking and can also be speculated on by investors. The future certainly looked bright for Solana, as DeFi Llama reports that Solana has the fourth-highest value locked amount of any blockchain in the world. In the future, as more developers opt to use Solana instead of other options, we’ll likely see price push higher – which is excellent news for investors.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

3. Chainlink (LINK) – Best Bitcoin Alternative to Hold Long Term

Chainlink is an excellent Bitcoin alternative cryptocurrency that has expanded rapidly in 2021. Much excitement has been building around the Chainlink network, as it offers a way to connect decentralised blockchains with the outside world. Put simply, Chainlink operates what’s known as an ‘oracle network’, which allows off-chain data to be sourced for on-chain smart contracts. As blockchains are decentralised, they need a service like this so that specific applications can receive the data they need (such as stock prices or news events) to run correctly.

At the time of writing, Chainlink has already secured over 600 partnerships, including lucrative ones like Google and Hedera Hashgraph. This platform is one of the best alternatives to Bitcoin as its native token, LINK, can be used for various purposes. Blockchain users who require data can pay in LINK to source it from oracles on the network, whilst retail investors can also purchase LINK to speculate on the platform’s growth. Overall, the innovative use-case for the Chainlink network will ensure it is future-proof – meaning it’s a great pick as a long-term investment.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

4. Aave (AAVE) – New Bitcoin Alternative in the DeFi Sector

One of the best crypto assets to consider in the DeFi sector is Aave. If you aren’t aware, decentralised finance (DeFi) is based on removing centralised authorities, such as banks, from financial transactions by leveraging blockchain technology. Aave is one of the top crypto investments in this area, as it offers a unique way for people to lend and borrow crypto – and receive higher returns than with traditional financial institutions. Users can borrow crypto stablecoins (such as DAI) at a low rate and then transfer their holdings into FIAT for use in the real world.

If you flip this on its head, users can also deposit stablecoins into the Aave protocol and earn a much better return on their investment. Notably, Aave is built on the Ethereum blockchain, so the protocol can leverage the power of this technology to ensure safety for users. The protocol’s native token, AAVE, is central to everything running smoothly, as it is used to vote on potential changes to the protocol and pay lenders. As more investors seek out higher yields than banks can offer, DeFi protocols such as Aave will likely become more popular, making them a great Bitcoin alternative to consider.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

5. Dogecoin (DOGE) – Meme Coin That Acts As an Alternative to Bitcoin

If you’re a newcomer to the world of crypto, you may wish to invest in Dogecoin. This Bitcoin alternative famously started as a joke between two software engineers but has since grown exponentially, having a market cap of nearly $23bn at the time of writing! Earlier this year, when Dogecoin hit all-time highs, the coin was up over 17,000% from where it started in 2021. Much (if not all) of this price increase was driven by social media hype from sites such as Reddit, along with mentions from famous figures, including Elon Musk.

Diving a little deeper, the use-case for Dogecoin is as a method of payment, which makes it similar to BTC – although transactions with Dogecoin are much faster to confirm than with Bitcoin. As Dogecoin’s value grew and the online community rallied behind it, the founders used this fame to develop the coin further, and DOGE can now be used as a method to tip people online. Ultimately, although this Bitcoin alternative doesn’t have the technology or potential applications that others on this list do, it does have the benefit of substantial social media backing – which means there’s always the potential for this coin to skyrocket again in the future!

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

6. Tether (USDT) – Best Bitcoin Alternative Stablecoin

Tether occupies an exciting role in the crypto ecosystem and is extremely valuable to all stakeholders. Tether is called a ‘stablecoin’, meaning that it has been designed to always be worth $1. Unlike other cryptos, Tether is mainly used as a medium to avoid the volatility that many coins face. As Tether is pegged to the dollar, users can convert their FIAT into USDT and then use that USDT to buy other cryptocurrencies. Tether is hosted on the Ethereum blockchain and is controlled by Bitfinex, one of the world’s largest exchanges.

According to CoinMarketCap, USDT has a market cap of over $76bn, making it the fourth-largest crypto in the world at the time of writing. Tether regularly has a trading volume of over $60bn daily, as investors worldwide use it to reduce the volatility of their investments. Furthermore, businesses globally now accept USDT as a payment method, allowing them to preserve value better than volatile alternatives. So, although this Bitcoin alternative isn’t as exciting as others, it is an extremely valuable digital asset in the realm of crypto trading.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

7. Cardano (ADA) – Exciting Bitcoin Alternative Smart Contract Platform

As one of the best cryptos under £1, ADA is a coin that rarely goes unnoticed by the crypto-enthusiast community. Cardano is an open-source blockchain platform that utilises a unique PoS mechanism to achieve consensus, called Ouroboros. Cardano was founded by Charles Hoskinson, who co-founded Ethereum, and was initially launched in 2017. Although Cardano offers similar use-cases to Ethereum, the platform is heavily backed by peer-reviewed literature and has a stellar development team behind it. Due to this, Cardano is seen as a ‘safer’ option for enterprises to use, as it has academic credibility that others do not.

Much of Cardano’s hype is based on its potential applications for smart contracts, which are agreements that do not require a centralised authority to complete. Furthermore, Cardano’s network can handle over 250 transactions per second (TPS) – much higher than Ethereum. Finally, Cardano is a much greener alternative to platforms that utilise a proof-of-work (PoW) mechanism due to its unique consensus algorithm. Overall, Cardano is slowly growing to become one of the market’s most exciting platforms – and one that offers a viable Bitcoin alternative to crypto investors.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

8. Polkadot (DOT) – Innovative New Bitcoin Alternative for Interoperability

Blockchain platforms like Ethereum and Cardano operate individually, meaning developers need to decide which platform suits their needs best. Polkadot aims to solve this potential problem by offering a way for separate networks to communicate and connect. Investors who buy Polkadot get exposure to this exciting protocol, which will ensure that decentralised applications can maximise their utility and usability.

Polkadot achieves this feat by using ‘parachains’, which allow other blockchain networks to run parallel to Polkadot and utilise its PoS consensus protocol. Furthermore, networks that opt to use Polkadot can still retain their autonomy and choose how to update their code and which applications to run. DOT, the native token of the network, can be used by holders to vote on changes – with more use cases planned for the future. Although DOT’s price has fallen by around 52% in recent months, there’s never been a better time to invest in this Bitcoin alternative at an attractive price point!

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

9. Ripple (XRP) – Super-Fast Payment Network as Alternative to Bitcoin

If you’re experienced in cryptocurrency trading UK, you’ll likely have heard of Ripple. Ripple offers a much different service to Ethereum and Cardano, as it is a payment settling system that functions in real-time. Banks now use this system worldwide to move money much faster than ‘traditional’ methods – for example, Ripple can process around 1000 transactions per second and finalise payments in seconds. Furthermore, Ripple is much cheaper, meaning people can send cross-border payments cost-effectively.

The native token of the Ripple network, XRP, is what you’ll be investing in if you wish to gain exposure to Ripple’s success. XRP is used as a temporary settlement layer between currencies, allowing quick conversion and low fees. Ultimately, the potential for Ripple and XRP is enormous, as the network offers a much more streamlined way to send payments around the world – although it’ll probably take a while before legacy institutions are comfortable using the network full-time. So, if you’re looking for a great Bitcoin alternative, Ripple is also worth considering.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

10. Binance Coin (BNB) – Valuable Exchange Token Offering a Bitcoin Alternative

The final Bitcoin alternative we’ll discuss today is Binance Coin. As the name states, Binance Coin is controlled by Binance, the world’s largest cryptocurrency exchange. This digital currency has a maximum supply of 200 million tokens, and a portion of the supply is ‘burned’ every quarter – reducing the supply and increasing BNB’s value. Initially, the sole use of BNB was to allow users of the exchange platform to trade with lower fees, although more use cases have sprung up since then.

Binance Coin can now be used as a payment method in various merchants worldwide, which is similar to BTC. What’s more, Binance allows users to invest in initial coin offerings (ICOs) on its platform by using BNB, which provide scope to achieve incredible returns. You can even use BNB to take out loans at specific crypto-lending sites. Ultimately, as the crypto market continues to grow and Binance attracts more users, the price of BNB will naturally increase – which makes it a viable alternative to Bitcoin to consider.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

How to Choose Bitcoin Alternatives

If you’re wondering how to buy cryptocurrency UK, there are certain things to keep an eye out for. Below are five key factors to consider when choosing which Bitcoin alternative to invest in.

Use Cases

The use-case of the crypto you’re interested in is crucial, as it can help future proof it from other developments. Platforms such as Ethereum have many use cases, which means that they should still be viable years (or even decades) from now.

Let’s have a look at how the use-case of a new crypto could revolutionize existing industries. If you decide to buy Chiliz, for example, you’d gain exposure to the world’s first blockchain-based sports fan rewards platform. Then with your CHZ token holdings you could exchange them for Fan Tokens which in turn can be used to receive rewards and promotions.

Technical Analysis

Much like when forex trading UK, you’ll need to analyse the price chart to see if your investment is viable. Keep an eye out for areas of support or resistance where price could reject, and use indicators like EMAs or RSI to inform trading decisions.

Availability

If you opt to invest in a new Bitcoin alternative, you need to make sure it’s available to trade. Smaller coins tend only to be offered by large exchanges (such as Coinbase), whilst those with high market caps will also offered by providers such as Coinbase.

Development Team

The best Bitcoin alternatives tend to have a solid and experienced development team behind them. By investing in a coin with a good development team, you can have confidence that the team will do its best to improve the platform and increase its value – which is essential from an investment perspective.

Regulatory Threat

Finally, it’s wise to consider the potential regulation of any coin you invest in. DeFi cryptos are particularly susceptible to this, as regulators are still trying to figure out how to control them. So, if you are worried about this regulation, it may be worth steering towards ‘safer’ options.

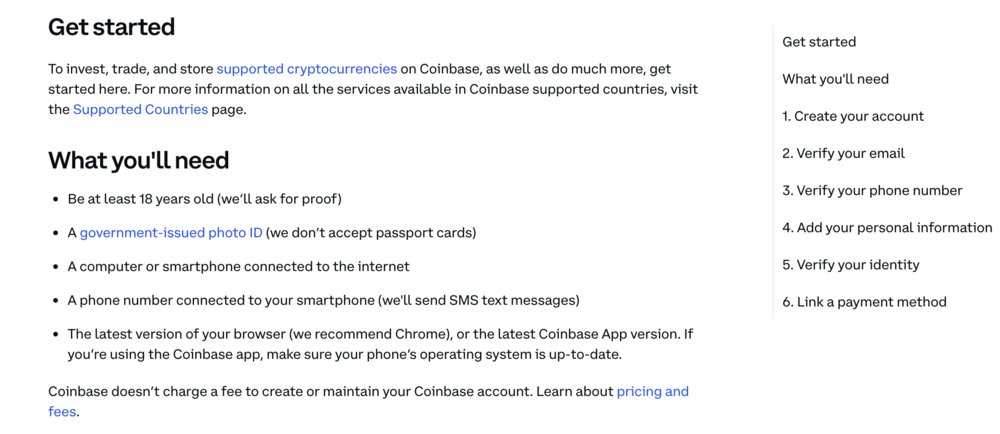

How to Buy Bitcoin Alternatives

Lastly, let’s discuss the process of investing in Bitcoin alternatives. Presented below are the five quick steps needed to invest in these coins with Coinbase – our number one crypto trading platform.

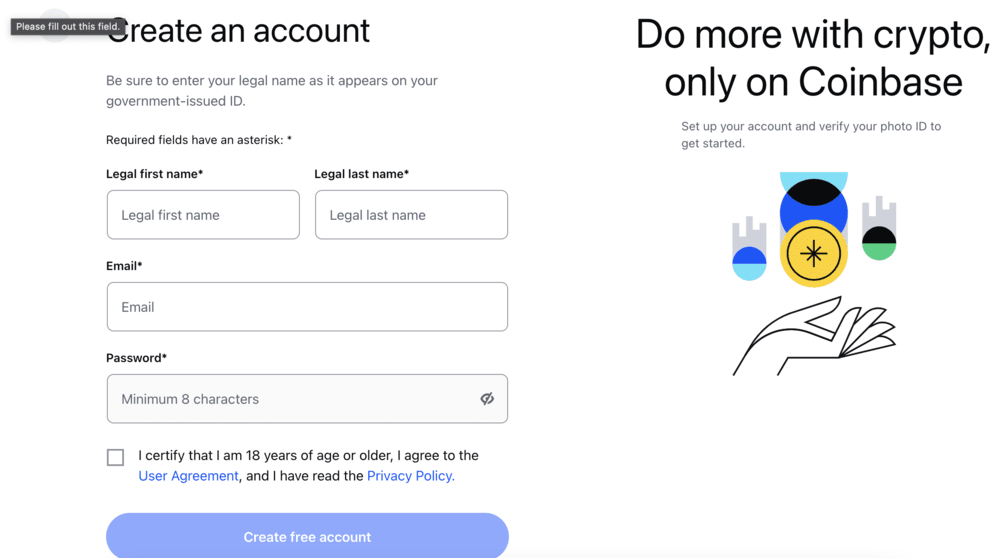

Step 1 – Open a Coinbase Trading Account

The first step is to open an account with Coinbase.

The onboarding process is straightforward and requires some personal information, such as name and email.

Step 2 – Verification

As part of the standard KYC (know your customer) regulations, you’ll need to upload copies of your passport and a recent bank statement as proof of ID and address.

You will also need a phone number.

This is to help prevent money laundering and identity theft.

Step 3 – Deposit Funds

The next step involves funding your Coinbase brokerage account. As we’ve already discussed you can deposit funds using a variety of payment methods.

There are no deposit fees to pay and e-wallet transfers are processed instantly.

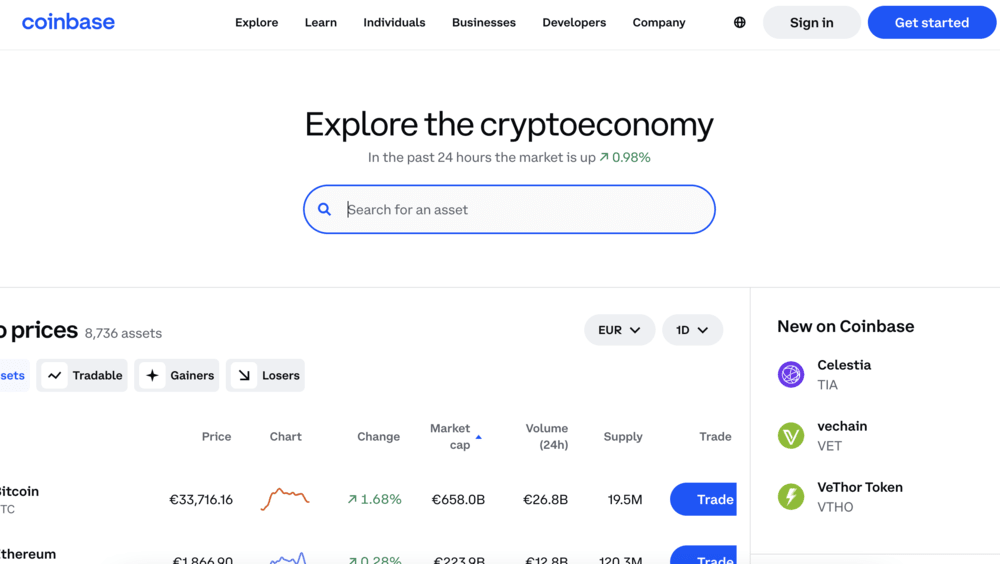

Step 4 – Search For And Purchase Crypto

The final step is to buy your crypto of choice. The easiest way is to type it into the search bar.

You will be taken to an order page to input how much crypto you want to buy, then click on ‘Open Trade’ to have it sent to your wallet.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Coinbase – Best Broker to Buy Bitcoin Alternative UK

In summary, this guide has covered Bitcoin alternatives in detail, highlighting the best options on the market and their future potential. By reviewing the list presented earlier, you’ll have a solid understanding of your options in the market – ensuring you make an effective investment decision.

If you’d like to invest in Bitcoin alternatives today, we’d recommend using Coinbase, as it is a safe and secure platform.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.