Plus500 vs Trading 212 – Which Broker is Best?

If you’re looking for a new do-it-all broker for stock, forex, and commodity trading, Plus500 and Trading 212 are two names that stand out in the UK. Both of these brokers have a strong following among traders, in large part thanks to their offerings of 0% commission CFD trading and very low fees.

That said, there are key differences between Plus500 and Trading 212 that set these brokers apart. Plus500, for example, offers options and crypto trading while Trading 212 does not. At the same time, Trading 212 has a commission-free account for long-term stock investing.

In this guide, we’ll compare Plus500 vs Trading 212 head-to-head to help you decide which platform is right for you.

-

-

What are Plus500 & Trading 212?

Plus500 and Trading 212 are both well-established CFD brokers in the UK.

Plus500 was founded in Israel in 2008 and is publicly traded on the London Stock Exchange. The broker boasts more than 200,000 active clients and more than 2,000 tradable assets covering a wide range of asset classes. Importantly, Plus500 is regulated by both the UK Financial Conduct Authority (FCA) and the Australian Securities and Investment Commission (ASIC), two of the most well-regarded financial regulators in the world.

Trading212 was founded in Bulgaria in 2004 and is now headquartered in London. The platform boasts more than 2,500 tradable assets. It is regulated by the FCA as well as Bulgaria’s Supervision Commission, which isn’t considered a top-tier regulator. Although Trading 212 is a few years older than Plus500, it has significantly fewer traders – around 40,000 by the latest tally.

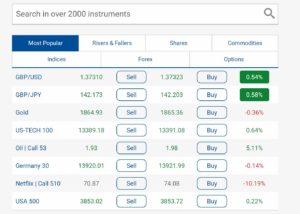

Plus500 vs Trading 212: Tradable Assets

Plus500 and Trading 212 both cover a lot of ground when it comes to what you can trade. Plus500 has over 2,000 assets in all, while Trading 212 has over 2,500.

Stocks and ETFs

If you want to trade stocks, you’ll find a huge selection on both Plus500 and Trading 212. Plus500 has a slight edge, with more than 1,900 stocks to Trading 212’s 1,700. More important, Plus500 gives you access to CFDs for 95 global ETFs, whereas Trading 212 only offers 28 ETFs to trade.

Both brokers have a global reach, so you’re not limited to trading only shares from the UK and US markets. You’ll find hundreds of shares from the Tokyo and Hong Kong stock exchanges, for example, as well as stocks from Australia, South Africa, Canada, and mainland Europe.

Notably, if you open an Invest or ISA account with Trading 212 instead of a CFD trading account, you get access to more than 10,000 global shares and funds.

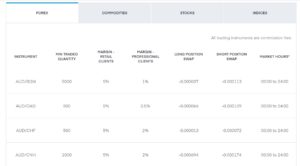

Forex

Trading 212 has over 150 forex trading pairs, compared to 70 at Plus500.

While this sounds like a big difference, it’s also a little deceptive. Both brokers carry all major and minor currency pairs, and the extra 80 forex pairs that Trading 212 carries are currency pairs that typically trade with low liquidity and high spreads. So, there’s not much practical difference between your forex selection with these two brokers.

Commodities

Plus500 and Trading 212 are evenly matched when it comes to commodity trading, with 25 and 26 CFDs, respectively. The only commodity that Trading 212 carries that Plus500 doesn’t is for cheese.

Stock Indices

You can also trade stock index CFDs with these two brokers. Plus500 has 26 indices available, while Trading 212 has 23. Both brokers’ selections cover all of the major global exchanges.

Options

One major difference between these two platforms is that Plus500 offers options trading through CFDs, while Trading 212 doesn’t offer options trading in any form. Plus500 has options contracts available for most US and UK stocks, as well as hundreds of international shares.

Cryptocurrency

You can also trade cryptocurrencies with Plus500 and Trading 212. Plus500 has 14 cryptocurrencies available, including Bitcoin, Ethereum, Litecoin, and Ripple, while Trading 212 has 16.

Leverage

Both Plus500 and Trading 212 allow you to trade CFDs with leverage. Since both platforms are regulated by the FCA, which sets maximum leverage limits for retail traders, there is no difference in how much leverage you can use when trading.

Plus500 vs Trading 212: Account Types

Plus500’s and Trading 212 have different focuses when it comes to the types of accounts you can open. Plus500 is strictly a CFD broker and only offers a single type of trading account that gives you access to all assets with 0% commission.

Trading 212 offers three account types: CFD, Invest, and ISA. The CFD account is virtually identical to Plus500’s trading account. It offers 0% commission CFD trading and is not tax-advantaged in the UK.

The Invest and ISA accounts are designed for stock and ETF investing. With these accounts, you buy shares and funds outright instead of trading CFDs. You do not have access to forex, commodity, index, or cryptocurrency trading, but you do get an expanded selection of stocks and funds. The Invest account is not tax-privileged, while the ISA account is tax-free within certain bounds for UK traders.

Plus500 vs Trading 212: Fees & Commissions

One of the things that makes Plus500 and Trading 212 so popular in the UK is that both brokers are 100% commission-free. That’s true for Trading 212 regardless of whether you’re trading CFDs or buying shares and ETFs outright.

However, trading with these two brokers isn’t completely fee-free, and Plus500 ends up being much cheaper for most UK traders. The biggest charge you’ll run into is the spread, which is the difference between the bid and ask price for an asset.

Plus500 has some of the lowest spreads available in the UK. You can trade the S&P 500 index CFD for 0.5 points or the popular EUR/USD forex pair for 0.7 pips. The spread for US and UK stocks is between 0.20% and 0.50%, with most shares at the lower end of that range.

By contrast, Trading 212 charges a spread of 1.9 points for the S&P 500 index CFD and 1.4 pips for the EUR/USD forex CFD. That means you pay 2-4 times more per trade with Trading 212 than Plus500. Most US and UK shares trade with a comparable spread to Plus500, in the range of 0.20% to 0.50%. However, it’s not hard to find international shares and penny stocks that trade with spreads closer to 10%.

It’s also important to know about Plus500 and Trading 212s’ account fees. Both brokers charge nothing for deposits and withdrawals.

Trading 212 doesn’t have an inactivity fee, even for CFD trading accounts. Plus500 has an inactivity fee of $10 per month after 3 months of inactivity. However, you can avoid this fee simply by logging into your account – you don’t actually need to place a trade.

Commission S&P 500 Spread EUR/USD Spread Account Fee Deposit & Withdrawal Fees Inactivity Fee Plus500 0% 0.5 points 0.7 pips None None $10 per quarter Trading 212 0% 1.9 points 1.4 pips None None None Overall, we think Plus500 is the clear winner when it comes to pricing. Spreads for forex and index trading are much more favourable, and Plus500 is competitive with or cheaper than Trading 212 for all stock and ETF trades. The inactivity fee can be annoying, but it’s easy to avoid.

Plus500 vs Trading 212: User Experience

We had good experiences working with both the Plus500 and Trading 212 trading platforms. Both are modern and streamlined to help you find the trading tools you need.

That said, we found Plus500’s trading platform to be more convenient to get started with. The default layout enables you to search for assets, monitor a price chart, and place a trade all in one screen.

The multi-panel layout is customisable, which makes it easy to dive into a full-screen chart for deeper analysis. It was also nice to be able to click on any asset and get more information about it, including market sentiment and up-to-the-minute trading stats.

Trading 212’s platform is also very customisable, but it’s not as convenient from the outset. You’ll need to do some work manipulating the panels if you want to be able to scroll through assets and check price charts on the same screen. The layout is also more crowded with menu items, which can be a little overwhelming even after you get used to the software.

Once you get the platform set up to your liking, however, it’s just as capable as Plus500’s trading platform. You can easily move between watchlists, check on market sentiment for the asset you’re analysing, and place trades without leaving your charts. We also liked the search function, which offers a broader list of possible results than just exact matches to your text.

Plus500 vs Trading 212: Mobile App

Plus500 and Trading 212 each offer mobile trading apps for iOS and Android.

Once again, the simplicity of Plus500’s trading platform pays off. We found that it is simpler to navigate between functions like charting, news, and trading without having to deal with multiple menus and screens. Another plus is that you can launch basic charts on the same screen as your watchlist, allowing you to check price action for every asset you’re monitoring.

The Trading 212 app packs in a lot of features that Plus500’s app doesn’t include, such as education and portfolio management tools for long term investing. However, if your main goal for using the app is to trade, these features can get in the way of the user experience. We found that it took more work to load charts and place trades, with more menus and screens to sift through to find the information needed.

On the whole, the Plus500 mobile app felt like a convenient version of the web experience: seamless, familiar, and fast. The Trading 212 mobile app felt more crowded: we were able to dive into charts and place trades, but it required ignoring or navigating past many of the components of the app.

Plus500 vs Trading 212: Trading Tools, Education, Research & Analysis

Plus500 and Trading 212 are packed with tools to help you trade successfully. Let’s take a closer look at what these two platforms and where they differ.

Technical Charting Order Types Analysis Tools Education Plus500 90+ indicators Market, limit, stop-loss, trailing stop, guaranteed stop Economic calendar, news feed, price alerts Demo account, video library Trading 212 70 indicators, Elliot wave analysis Market, limit, stop-loss, one cancels the other Economic calendar, news feed, price alerts, index analysis Demo account, video library Charting

As you would expect, the charting packages built into the Plus500 and Trading 212 platforms are extremely comprehensive. Both offer multiple chart formats, including line, candlestick, and Heikin-Ashi charts, as well as time intervals ranging from one minute to one month (neither offers tick-by-tick or 30-second intervals).

Plus500 has over 90 technical indicators available, giving it a significant edge for price action trading and other technical strategies.

Trading 212 has several dozen indicators, along with drawing tools for Elliot wave analysis that Plus500 lacks.

Neither platform enables you to add your own custom indicators. However, you do have a fair amount of leeway in tweaking parameters. You can also save groups of indicators to preset chart templates for future use.

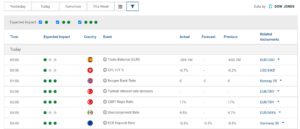

Research and Analysis Tools

Plus500 and Trading 212 include all the basic research tools you need, including news feeds and economic calendars. Both economic calendars display the expected impact of events on the market, but we especially liked that Plus500’s calendar allows you to filter events by impact.

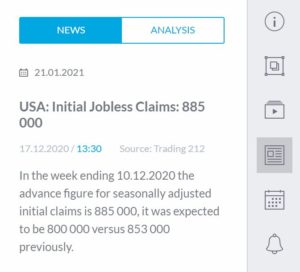

Trading 212 includes an analysis feed alongside its news feed, with short snippets of market-wide analysis. This is primarily useful for forex and index traders, since the analysis doesn’t cover individual stocks in detail.

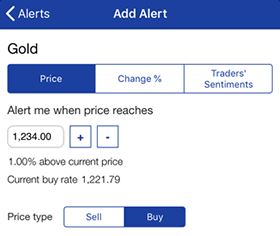

Both platforms also have a market sentiment gauge, which shows the percentage of traders buying an asset versus the percentage selling it. You can also set alerts, in Trading 212 based on price or in Plus500 based on price, percent change, or market sentiment.

Order Types

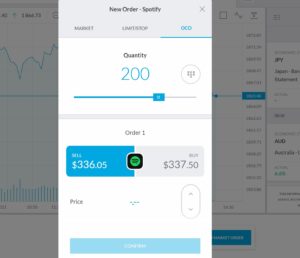

We were impressed by the selection of order types available at the two platforms. Of course, both include market orders, stop-loss orders, and limit orders. You can also add a stop-loss or take profit price to any market or limit order.

In addition, Plus500 offers trailing stop orders and guaranteed stop orders. Guaranteed stop orders give you a guaranteed exit floor for your trade in exchange for a higher spread, allowing you to know exactly how much you could lose from any trade.

Trading 212 doesn’t have trailing or guaranteed stops, but it does offer one cancels the other orders. These orders allow you to set up two trades simultaneously, and one is cancelled if the other is executed. So, you can leave open trades for multiple possible positions using the same available funds in your account.

Education

Trader education isn’t a strong suit for either Plus500 or Trading 212. Both platforms offer demo accounts as well as small libraries of videos.

The videos go in surprisingly different directions. Plus500’s library is focused on the technical details of trading, like slippage and rollovers. Trading 212’s videos focus on beginner questions like how to start investing.

Plus500 vs Trading 212: Demo Account

Both Plus500 and Trading 212 offer demo accounts so that you can try out the trading platforms. You’ll need to create an account with Plus500 in order to access the demo platform, while anyone can try out Trading 212’s demo without creating an account.

Each account is unlimited, both in terms of time and resets. The Plus500 account starts you out with $40,000 and resets automatically when your account drops to $200. The Trading 212 account starts with $50,000 and can be reset at any time. There are no limits on what assets you can trade, and you can also practice trading with leverage.

Plus500 vs Trading 212: Payments

Plus500 and Trading 212 each make funding your account as easy as possible. They both accept credit and debit card transactions as well as UK bank transfers and e-wallets like Neteller, Skrill, and PayPal. Trading 212 also accepts Google Pay, Apple Pay, Dotpay, and Giropay. Credit, debit, and e-wallet payments are processed instantly, whereas bank transfers take 2-3 days at both brokers.

Plus500 requires a minimum deposit of £100, whereas Trading 212 only requires a £1 deposit. Both brokers offer free deposits, although Trading 212 charges a 0.7% fee if you deposit more than £2,000 at a time.

Minimum Deposit Credit & Debit Cards? UK Bank Transfer? E-wallets Deposit Fees Plus500 £100 Yes Yes Neteller, Skrill, PayPal None Trading 212 £1 Yes Yes Neteller, Skrill, PayPal, Google Pay, Apple Pay, Dotpay, Giropay 0.7% for deposits over £2,000 Plus500 vs Trading 212: Customer Service

Both of these brokers offer standout customer service. The Plus500 and Trading 212 support teams are available 24/7 by phone and email, and we found that the representatives we talked to were helpful and knowledgeable. Plus500 has a slight edge in customer support since it also offers live chat as an option for getting in touch.

Plus500 vs Trading 212: Safety & Regulation

Both Plus500 and Trading 212 are regulated by the UK FCA, one of the world’s top financial regulators. In addition, UK clients receive negative balance protection and protection from the Financial Services Compensation Scheme, which reimburses you up to £85,000 if your broker goes out of business.

In addition to being regulated by the FCA, it’s also regulated by the Australian Securities and Investment Commission – another globally respected watchdog. Plus500 also trades as a public company on the London Stock Exchange, so it offers quarterly financial updates that offer insight into how reliable it is as a business.

Plus500 vs Trading 212: The Verdict

Plus500 and Trading 212 both have a lot to offer for UK traders. The two platforms offer a huge variety of assets to trade along with comprehensive trading platforms, mobile trading apps, and 24/7 customer service.

Plus500 offers option trading, which isn’t available at Trading 212, and we found the web and mobile trading platforms easier to use and customise. More important, Plus500 charges far lower spreads for forex and index trading, as well as for many international share CFDs. Active traders will find that over the long run, trading with Plus500 is much less costly than trading with Trading 212.

Trading 212 can be an option if you’re looking to invest in stocks and ETFs directly or if you want to open an ISA. At this time, Plus500 does not offer these investment accounts.

FAQs

What are the minimum deposits at Plus500 and Trading 212?

Plus500 requires a minimum deposit of £100. Trading 212 requires a minimum deposit of £1.

Can I open an ISA with Plus500?

No, Plus500 does not offer ISA accounts at this time. Trading 212 does offer an ISA, but it only supports stock and ETF investing.

How much leverage can I use when trading stock CFDs with Plus500 and Trading 212?

You can trade stock CFDs with leverage up to 5:1. This is the maximum leverage allowed by the UK FCA.

Does Trading 212 have an inactivity fee?

Trading 212 does not charge an inactivity fee. Plus500 does have an inactivity fee, but you can avoid it simply by logging into your account.

Is Plus500 or Trading 212 cheaper?

While your trading costs will depend on what assets you’re trading and how frequently, Plus500 is cheaper than Trading 212 in most cases. Both brokers are commission-free, but Plus500 charges much lower spreads for many assets.

Michael Graw

Michael Graw is a freelance journalist based in Bellingham, Washington. He covers finance, trading, and technology. His work has been published on numerous high-profile websites that cover the intersection of markets, global news, and emerging tech. In addition to covering financial markets, Michael’s work focuses on science, the environment, and global change. He holds a Ph.D. in Oceanography from Oregon State University and worked with environmental non-profits across the US to bridge the gap between scientific research and coastal communities. Michael’s science journalism has been featured in high-profile online publications such as Salon and Pacific Standardas well as numerous print magazines over the course of his six-year career as a writer. He has also won accolades as a photographer and videographer for his work covering communities on both coasts of the US. Other publications Michael has written for include TechRadar, Tom’s Guide, StockApps, and LearnBonds.View all posts by Michael GrawWARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up