How To Buy Berkeley Group Shares UK with 0% Commission

COVID 19 decimated the real estate market. With widespread closures across multiple industries, many property developers took a big hit. UK property developer Berkeley Group was no different. It suffered a huge hit to share prices, which tanked 40% in March 2020 in the wake of the pandemic. However, recovering an impressive 30% since its March lows, investors are realising the potential of Berkeley Group shares.

However, in order to buy Berkeley Group Shares, you must set up a share dealing account with a broker to connect you to the London Stock Exchange. In this article, we take you through a step-by-step guide to how to buy Berkeley Group shares, including the best brokers, share price history, and how to open a brokerage account.

Step 1: Find a UK Stock Broker That Offers Berkeley Group shares

When selecting a broker to trade Berkeley Group shares, it is important to consider fees and commission.

When selecting a broker to trade Berkeley Group shares, it is important to consider fees and commission.

In addition to this, you may want to consider the payment options available and also if the brokerage is FCA Regulated.

Berkeley Group shares have been listed on the London Stock Exchange for over 30 years, so are available from most UK brokers. Below you can find our choice for the top brokers to buy Berkeley Group Shares.

Step 2: Research Berkeley Group Shares

Berkeley Group shares have offered some great historical returns, as well as an attractive dividend. Before investing in any stock it is important to conduct the necessary research. We have conducted some of our own research below to give you some better insight before investing in Berkeley Group.

Berkeley Group Share Price History

Berkeley Group is a veteran in the London Stock Exchange. Having been listed for over 30 years, the share price has risen over 6000% in value! That means if you had invested £1000 in 1990 it would now be worth over £60000. Being a property developer, the Berkeley Group share price is heavily reliant on the housing market. We can see this by the huge boom that shares saw between 2006 and 2007, rising over 50% in that period.

However, in the wake of the 2008 financial crash – where the housing market largely collapsed – Berkeley saw its share price tumble by 60% from its peak. From here the firm was able to recover for the next several years, with share prices rising almost 500% to 2015. Between 2015 and 2016 share prices fell 30% but again continued to rise (over 120%) throughout the next 5 years.

However, this all changed when the pandemic hit. The housing market was hit pretty hard by the pandemic along with most other sectors. As firms shut their doors to consumers, rent payments were missed and property developer revenues declined. We can see this by the huge tanking of almost 40% of Berkeley Group’s share price. Though share prices have since recovered 28%, there seems to be a greater problem at the heart of the housing market.

The pandemic recovery has lead to a boom in the demand for housing, which has been magnified by ultra-low mortgage rates and increased consumer sentiment towards the housing market. Due to the pandemic’s restrictions freezing property production, there has been a 53% decrease in the amount of housing constructed. This has created a demand that is far outweighing supply and could lead to a housing bubble, which if it boils over could have a drastic effect on both Berkeley Group shares and the economy as a whole.

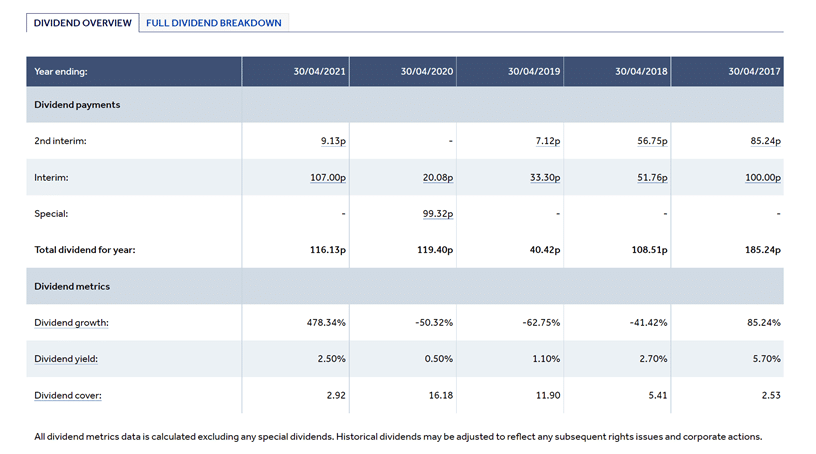

Berkeley Group Dividend History

Berkeley currently pays a 2.48% dividend. This is a healthy dividend and a great way to earn some passive income from your portfolio. Looking more closely at the dividend history, we can see that during 2018, 2019, and 2020, the dividend was actually decreasing by around 1% per year. In the second half of 2020, Berkeley froze its dividends similar to many other UK firms that were hit hard by the pandemic. However, a special dividend of 99p was issued back to investors to make up for this missed payment. In 2021, the usual dividend resumed which is great news for investors.

Is Now A Good Time To Buy?

Although the Berkeley Group share price has recovered well since the pandemic, it is still over 15% below its all-time high price reached in February 2020. This gives me confidence that the firm is on a good upward trajectory, will a great deal of room still to grow. The future of the share price is largely reliant on the UK housing market.

As explained earlier, there seems to be a large demand for housing outweighing supply. This is great news for firms like Berkeley Group as it means any housing/property developments they do construct in the coming months are likely to be snapped up.

Considering this, it seems that now would be a good time to purchase Berkeley Group shares. The firm seems to have recovered from the pandemic and seems on track for future growth. However, there are always risks to consider when purchasing a firm like Berkeley who is so heavily reliant on an external market. If the housing market takes a hit then the Berkeley Group Share price will also dip accordingly. Under current states, however, the housing market seems in a strong position for Berkeley to capitalize on.

Step 3: Buy Berkeley Shares UK

Now you have set up and funded your account you can begin to purchase Berkeley Group shares for your portfolio. To do this, simply search for Berkeley Group in the onscreen search bar.

Once you have found your shares, navigate to the trade button in the top right corner of the screen. This will open up a subsequent order form which you must fill in before executing an order. It will ask you how many shares you want to purchase, as well as offering stop loss and other risk control options. Once this has been completed, simply click the ‘Set Order’ button and your position will be opened.

Berkeley Group Shares – Buy or Sell?

So, in summary, are Berkeley shares a buying opportunity? We would say so. The Berkeley Group share price was performing exceptionally before the pandemic struck, and post-covid there still seems to be room to grow. Berkeley’s share price rises and falls largely in line with the housing market and as explained above, the pandemic recovery seems to have spurred supply for property.

That being said, investing in any share so closely tied to a market carries risk. If the housing market were to collapse, similar to the situation in 2008, the Berkeley Group share price would likely take a large blow. However, since the 2008 financial crash, there have been a plethora of new regulations put in place to ensure no such event occurs again.

In addition to this, Berkeley’s resilience during the pandemic highlights its effective management in the face of adversity. We can see this effective management through the fact that Berkeley didn’t need any shareholder bailouts throughout Covid.

Another reason we are bullish about the future of the Berkeley Group share price is the strong earnings reported by the company. The latest results show a pre-tax profit of 518m, up 2.9% year on year. In addition to this, net cash and forward sales were only slightly lower than before the pandemic, sitting at £1.1bn and £1.7bn respectively. The consistently strong financials of the company, coupled with the stable housing market leave the Berkeley Group share price in a great position to grow further.

Berkeley Group’s share price has also risen 400% since 2006. This is more than double the return of the next best FTSE 100 property builder. Whilst past performance shouldn’t be an indication of future returns, it does highlight the exceptional trajectory the share price has been on. Coupled with the healthy dividend yield, the future share prices could offer some great returns.

eTorp – Buy Berkeley Group Shares UK With 0% Commission

In summary, we have had a closer look at the Berkeley share price history, its dividend history, and whether it is a buying or selling opportunity.

The Berkeley Group share price has offered some great historical returns for investors and we believe this trajectory can continue forward in years to come. The only drawback of Berkeley is the fact that it is so reliant on the housing market, however, we have seen that post-pandemic, housing demand has been increasing rapidly which is great news for the firm. The financials of the firm coupled with the dividend yield are also very attractive.