Chinese electric vehicle (EV) companies have released their January 2026 deliveries. Here are the key takeaways from the report that comes amid fears of a prolonged slowdown in the world’s biggest market for electric cars. Also, China withdrew some EV subsidies this year, which are expected to negatively impact sales this year.

NIO’s EV deliveries nearly doubled on a yearly basis

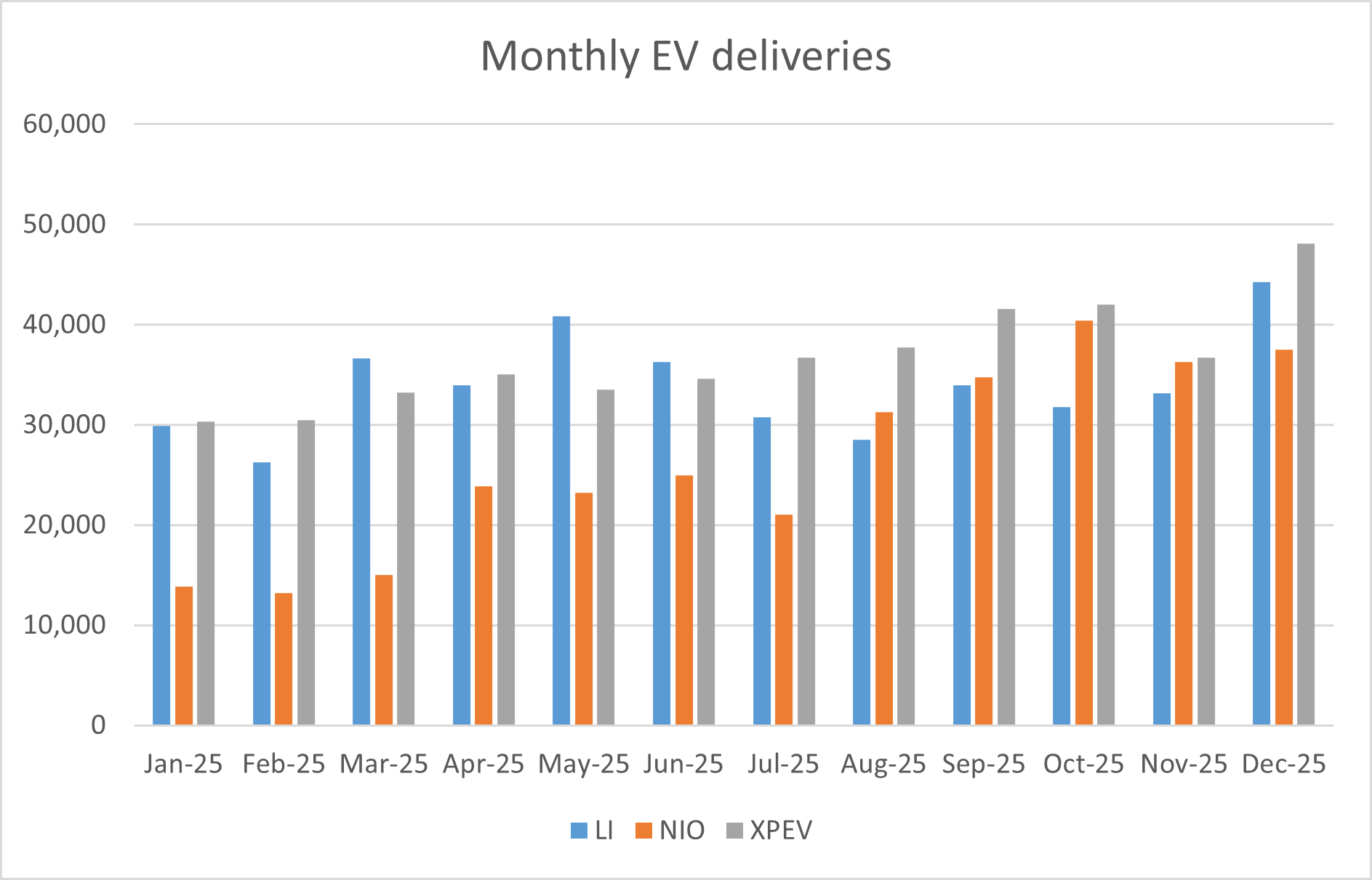

NIO delivered 27,182 vehicles in January 2026. While this represents a seasonal 43.5% decrease from the record-breaking December 2025 (48,135 units), it is a staggering 96.1% increase compared to January 2025.

The delivery results highlight the distinct roles of NIO’s three current brands. NIO, which is the company’s namesake premium brand, delivered 20,894 vehicles. The flagship brand remains the powerhouse, with the revamped ES8 alone accounting for roughly 85% of these deliveries.

Deliveries of the ONVO brand were 3,481 vehicles. Targeted at the mass-market family segment, ONVO saw a month-over-month dip as government subsidies began to taper. Firefly, which is the affordable sub-brand, reported 2,807 vehicles in January.

Despite the seasonal “January lull” typical of the Chinese auto market, NIO management remains optimistic, targeting 40% to 50% annualized delivery growth over the next two years.

Xpeng Motors’ EV deliveries also fell in January

Xpeng Motors delivered 20,011 EVs in January, which was 34.1% lower than the corresponding month last year and 46.6% lower than December. Amid the slowdown in domestic sales, the company is now expanding to international markets and extended its global presence to 60 countries at the end of 2025.

Xpeng has been expanding its manufacturing footprint beyond China amid steep tariffs in several regions. Last month, it solidified its manufacturing plans in Malaysia by signing a definitive agreement with local industrial partner EP Manufacturing Berhad (EPMB).

EPMB (specifically its subsidiary PEPS-JV) will handle the local assembly of Xpeng Motors’ vehicles at its plant in Pegoh, Malacca. The JV plans to begin local assembly of Xpeng’s G6 SUV by March 2026 and XP MPV by May.

In Europe, Xpeng partnered with Magna Steyr to assemble the G6 and G9 SUVs in Graz, Austria. Serial production began in Q3 2025, allowing Xpeng to bypass European Union tariffs on Chinese-made EVs.

Xpeng Motors is establishing itself as an AI play

Meanwhile, Xpeng Motors is now establishing itself as an artificial intelligence (AI) play. Aeroht, which is the company’s flying car subsidiary, is moving toward a public listing and has reportedly filed for a confidential Initial Public Offering (IPO) in Hong Kong. The company was last valued at approximately $2 billion following a $250 million Series B round in mid-2025. This capital is being used to scale up its massive manufacturing facility in Guangzhou.

Li Auto’s deliveries continue to plummet

Li Auto delivered 27,668 cars in January, which was 7.55% lower than the corresponding month last year. It was the eighth consecutive month when the company’s deliveries fell on a yearly basis. The company is witnessing intense competition in the EREV (extended range electric vehicle) market with the entry of Xiaomi and Huawei. At the same time, its pivot to battery electric cars wasn’t successful.

Changes in Russian and Central Asian tax regulations in 2025 caused Li Auto’s volumes to drop from thousands to just a few hundred units per month. There are reports that Li Auto plans to close roughly 100 underperforming retail stores (mostly in high-rent shopping malls) to cut costs and pivot toward a more efficient “AutoPark” model.

BYD’s sales fell for the fifth consecutive month

BYD’s sales fell over 30% YoY to 210,251 units. January follows a downward trend that began in late 2025 and marks the fifth consecutive month of sales decline. This is largely attributed to the Chinese government scaling back trade-in subsidies for lower-priced models, which hit BYD’s budget-friendly lineup particularly hard.

Plug-in hybrids, which previously acted as BYD’s volume driver, saw a sharp 28.5% decline. This comes even after the launch of upgraded long-range hybrid versions designed to lure buyers back from traditional internal combustion engines.

While domestic demand faltered, BYD’s international footprint remains its strongest growth engine. Exports now account for nearly 48% of total sales, up significantly from the previous year.

BYD’s Global EV Sales Soar

Despite the slow start, BYD is pivoting its strategy toward localized production and higher-margin international markets.

“The 2026 overseas target of 1.3 million units remains the floor for our international ambitions,” stated Li Yunfei, BYD’s General Manager of Branding.

To achieve this 25% growth in exports, the company is banking on several major developments this year. These include

- New Manufacturing Hubs: The Hungary EV plant is expected to go online later this year, joining newly operational facilities in Brazil, Thailand, and Uzbekistan.

- Market Expansion: Following a dominant 70% market share in Mexico’s EV sector last month, BYD is eyeing entry into Canada and further strengthening its grip on Southeast Asia.

Canada lowered tariffs on Chinese EVs

Notably, Canada, which raised tariffs on Chinese EVs to 100% in 2024 following a similar move by the US, has cut them to the Most Favored Nation (MFN) tariff rate of 6.1%. However, the country has set an initial quota of 49,000 vehicles to fend off Chinese EVs from flooding its domestic markets. In an apparent reset of ties, the EU is also considering replacing tariffs with a price floor agreement.

Xiaomi’s deliveries fell ahead of the SU7 refresh

Xiaomi EV delivered over 39,000 units in January 2026, which is a dip from the record-breaking 50,212 units delivered in December 2025. While the broad-based slowdown in China’s EV sales is to blame, deliveries for the SU7 sedan particularly slowed as Xiaomi prepares for a major facelift model launching in April. Pre-orders for the 2026 SU7 opened on January 7, amassing over 100,000 orders in just two weeks, indicating that buyers are opting to wait for the newer tech.

Huawei delivered 57,915 vehicles last month, which was 65.5% higher than the corresponding month last year, even as deliveries fell 35.4% compared to December.

Huawei has set an ambitious target to deliver between 1 million and 1.3 million vehicles in 2026. To achieve this, the company is shifting from a “niche luxury” provider to a high-volume ecosystem. To achieve the growth, Huawei plans to launch or refresh 17 to 19 models throughout 2026 across its five partner brands. Recently, Huawei expanded its reach through a new collaboration with SAIC-GM-Wuling (under the Huajing brand), aiming to bring Huawei’s tech to more affordable price points later this year.

The rollout of the ADS 4.0 (Advanced Driving System) is a key selling point, featuring next-generation solid-state LiDAR and enhanced AI “God’s Eye” parking capabilities.

Question & Answers (0)