Berkshire Hathaway, under the leadership of Warren Buffett, has been steadily and strategically expanding its investment in Japan. The “Oracle of Omaha” has been increasing stakes in Japanese companies while selling US shares for 11 consecutive quarters.

Warren Buffett adds positions in Japanese shares

The conglomerate has focused its capital on five of Japan’s largest sogo shosha (general trading houses): Itochu, Marubeni, Mitsubishi Corp., Mitsui & Co., and Sumitomo Corp, and the collective investments have now surpassed $30 billion.

The investment fits well within Berkshire’s long-term framework, as these trading houses operate across diverse global sectors, including energy, commodities, logistics, and technology. They are viewed as sound, well-managed companies that trade at relatively modest valuations compared to their U.S. peers, offering attractive opportunities for stable returns, including significant dividends. Furthermore, the use of yen-denominated bonds to finance the purchases has been a classic Buffett move, limiting currency exposure while capitalizing on Japan’s historically low-cost debt environment.

Timeline of Buffett building stakes in Japanese companies

Berkshire Hathaway began its initial, undisclosed purchases of shares in the five trading houses in 2019. This quiet accumulation phase lasted for over a year, allowing the conglomerate to build a significant position before market disclosure.

In August 2020, Berkshire Hathaway publicly announced, via its subsidiary National Indemnity Company, that it had acquired slightly more than a 5% stake in each of the five companies. At the time, the combined value of these initial holdings was around $6.3 billion. Buffett pledged to cap the ownership at 9.9% in any single company unless specifically approved by the investee’s board.

In 2023, Berkshire announced it had increased its stake in each of the five trading houses to an average of 7.4%. This move, which was financed in part by issuing low-interest yen-denominated bonds—a key part of the strategy—signaled its long-term conviction.

In his annual letter to shareholders this year, Warren Buffett confirmed that Berkshire was seeking to increase its ownership further. Critically, he revealed that the Japanese companies had agreed to “moderately relax” the original 10% ceiling on the stakes, opening the door for future, larger purchases.

Berkshire now owns more than 10% in Mitsubishi Corp. and Mitsui & Co

Berkshire disclosed it had raised its stakes again, with holdings ranging from 8.5% to 9.8% across the five firms. This brought the positions right up to the spirit of the initial 9.9% cap, just before the new, relaxed limit would be tested.

Meanwhile, in August, Mitsubishi Corp. disclosed that Berkshire’s stake, calculated on a voting rights basis, had risen to 10.23%, marking the first time the conglomerate had exceeded its original self-imposed limit in one of the firms. Subsequently, in September, Mitsui & Co. confirmed that Berkshire’s holding had also increased, exceeding the 10% threshold to reach approximately 10.1%.

Buffett has been on a share-selling spree

While Buffett has gradually added to stakes in Japanese companies, he has been on a share-selling spree stateside. Berkshire Hathaway was a net seller to the tune of $3 billion in Q2 2025. It was the 11th consecutive quarter when the Warren Buffett-led conglomerate net sold stocks. The company ended June with a cash pile of $344.09 billion, which is slightly below the $347.7 billion that the company reported at the end of March.

To gauge the size of that cash pile, consider the fact that Berkshire now owns over 5% of all outstanding U.S. Treasury bills.

Responding to a question over the burgeoning cash pile, during this year’s annual shareholder meeting, Buffett said, “We have made a lot of money by not wanting to be fully invested at all times.”

Berkshire exited BYD last month

Notably, Japan seems to be an exception, and Berkshire has exited several international shares, including India-based Paytm, over the last couple of years. Last month, Berkshire disclosed that it has fully exited Chinese electric vehicle giant BYD, a holding that grew from a modest initial investment into one of the conglomerate’s most profitable international wagers.

The divestment, which began in 2022 and concluded recently, brings to a close a 17-year-long partnership that was a testament to the foresight of the late Charlie Munger, Warren Buffett’s long-time business partner.

Berkshire’s journey with BYD began in 2008, when the company was a relatively unknown battery manufacturer. At the urging of Charlie Munger, Berkshire invested $230 million for 225 million shares, acquiring a 10% stake in the Shenzhen-based company. While the move seemed out of character for Buffett’s typical investment playbook, Munger defended it, calling BYD founder Wang Chuanfu a “damn miracle.”

That assessment proved remarkably accurate. Over the next decade and a half, BYD’s shares surged by thousands of percent, as the company transformed into a global powerhouse in electric vehicles and batteries. The original $230 million investment swelled to a peak value of nearly $9 billion, delivering an extraordinary return that underscored the brilliance of the initial call.

Buffett indicator is flashing a warning sign

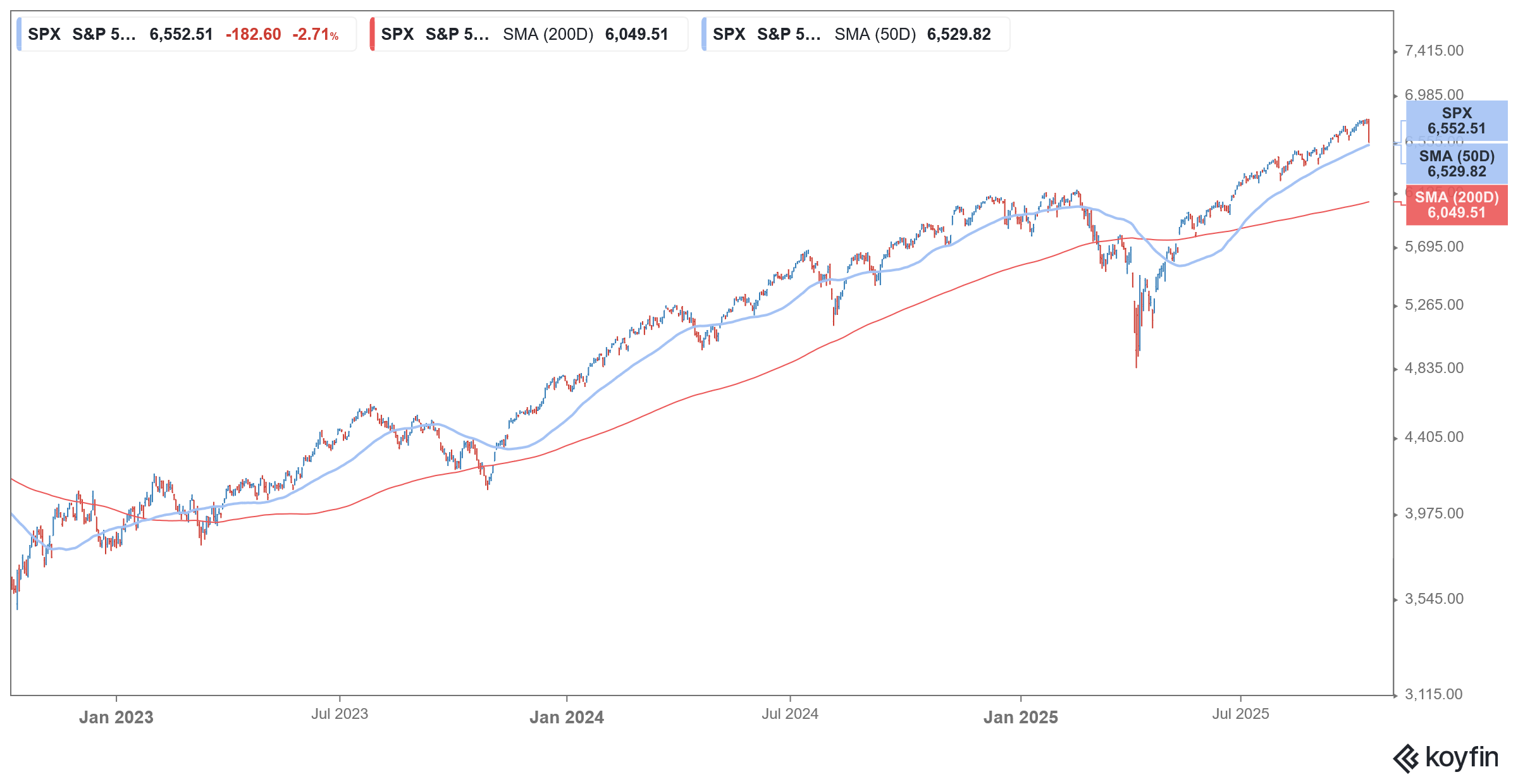

On more than one occasion, Buffett has alluded to US shares being overvalued. Notably, US share markets are trading near record highs and look on track to close in the green for the third consecutive year. However, the US market cap-to-GDP indicator has surpassed 200%, a level Warren Buffett once warned is like “playing with fire.”

Buffett has termed the ratio as “probably the best single measure of where valuations stand at any given moment.” It has averaged 85% since the 1970s, and a ratio above 100% is seen as a sign of overvaluation by some.

Berkshire hasn’t repurchased shares for four quarters

Meanwhile, it is not only broader markets that Buffett finds overvalued, and Berkshire hasn’t repurchased any shares for four consecutive quarters. The conglomerate spent over $50 billion repurchasing its shares between 2020 and 2021, and since then, the buyback activity has been quite tepid before coming to a halt in Q3 2024

However, Berkshire finally opened its coffers last month and announced a $9.7 billion cash deal to buy Occidental Petroleum’s petrochemical unit, OxyChem. Incidentally, while Buffett has been selling shares pretty much left, right, and center, he has increased his stake in Occidental Petroleum.

Notably, in 2022, Berkshire Hathaway received permission to increase its stake in Occidental Petroleum to 50% and Buffett has since been adding more shares gradually. Markets saw it as a sign that Berkshire intends to acquire the company eventually. However, during the annual meeting in 2023, Buffett denied that Berkshire intends to take full control of Occidental

Question & Answers (0)