The National Highway Traffic Safety Administration (NHTSA) has opened a new and expansive investigation into Tesla’s Full Self-Driving (FSD) advanced driver-assistance system. The probe covers nearly 2.9 million Tesla vehicles equipped with the FSD software and follows multiple reports of the system causing vehicles to commit traffic safety violations.

NHTSA opens a new investigation into Tesla FSD

The new investigation was initiated in response to reports alleging that Tesla vehicles, while operating with FSD engaged, exhibited dangerous behavior that violated traffic laws. Here are the key concerns raised by the NHTSA

- Running red lights: Reports detail FSD-equipped vehicles approaching an intersection with a red traffic signal and continuing to travel through it, leading to collisions with other vehicles. NHTSA has logged at least six crashes involving this specific scenario, resulting in injuries.

- Driving against the flow of traffic: The agency is also examining incidents where the FSD system allegedly commanded a vehicle to execute a lane change into opposing lanes of travel or to cross double-yellow lines.

- Failure to remain stopped: Complaints also allege that vehicles failed to remain stopped for the duration of a red light or failed to fully stop at a signal.

This latest action adds to a series of ongoing federal inquiries into Tesla’s automated driving technology, signaling heightened regulatory scrutiny of the automaker’s software and its performance on public roads.

FSD has been quite controversial

Here, it is worth noting that the nomenclature FSD could be misleading, as it is not level 4 autonomous driving, and even Tesla advises drivers to keep their hands on the steering wheel all the time, even when it is on the Autopilot. There have been multiple instances of crashes involving Autopilot, and the NHTSA has previously been investigating several crash incidents when the autonomous driving feature was engaged.

Many have been critical of the safety aspects of Tesla FSD. In 2022, former US presidential candidate Ralph Nader called for a ban on FSD. Nader said, “I am calling on federal regulators to act immediately to prevent the growing deaths and injuries from Tesla manslaughtering crashes with this technology.” He said that the FSD is “one of the most dangerous and irresponsible actions by a car company in decades.”

Later, during the Super Bowl in 2023, Dawn Project released a 30-second ad criticizing FSD’s deceptive marketing. The video showed a Tesla Model 3 allegedly running on FSD and said, “Tesla Full Self-Driving will run down a child in a school crosswalk, swerve into oncoming traffic, hit a baby in a stroller, go straight past stopped school buses, ignore do not enter signs and even drive on the wrong side of the road.”

The video said that “Tesla’s Full Self-Driving is endangering the public with deceptive marketing and woefully inept engineering.” It also posed the question of why the regulator allowed FSD in the first place.

FSD is a key driver of TSLA’s valuation

Tesla commands a market cap of nearly $1.5 trillion. No automaker has even come close, and the company’s market cap is above the combined market cap of all leading automakers put together. Bears see Tesla as overvalued, citing comparisons with legacy automakers who have a much lower market cap while they deliver a lot more vehicles.

However, those who are bullish on Tesla see it as a tech company. FSD is among the businesses that have a high margin and can drive Tesla’s growth. The company’s CEO, Elon Musk, has also said on multiple occasions that the software part of the business would drive the real value in the long term.

Using an example, Musk said during the fourth-quarter 2020 earnings call that Tesla can generate as much revenue from robotaxis and FSD as it does from selling cars. He also said that such revenue would be gross profit and add to its net income.

Taking the example of annual revenues of $60 billion, he said, “So, and the pace you get 20 PE on that, it’s like $1 trillion, and the company is still in high-growth mode. So, I think there is a way to sort of like justify the valuation of the company where it is using just the cars and nothing else, the cars with FSD.” Musk added, “And I suspect at least some number of investors are taking that approach.”

Tesla cut the FSD price to boost adoption

While Musk once said that FSD would cost $100,000 someday, the company raised the price from $10,000 to $15,000 in two tranches and eventually lowered the price to $8,000. Tesla has historically stated that the price of FSD would increase as the feature set improves and the system gets closer to true autonomy. However, with Chinese automotive companies offering self-driving features either for free or at a significantly lower price, it remains to be seen whether Tesla can raise FSD prices substantially higher.

TSLA’s automotive business is facing a slowdown

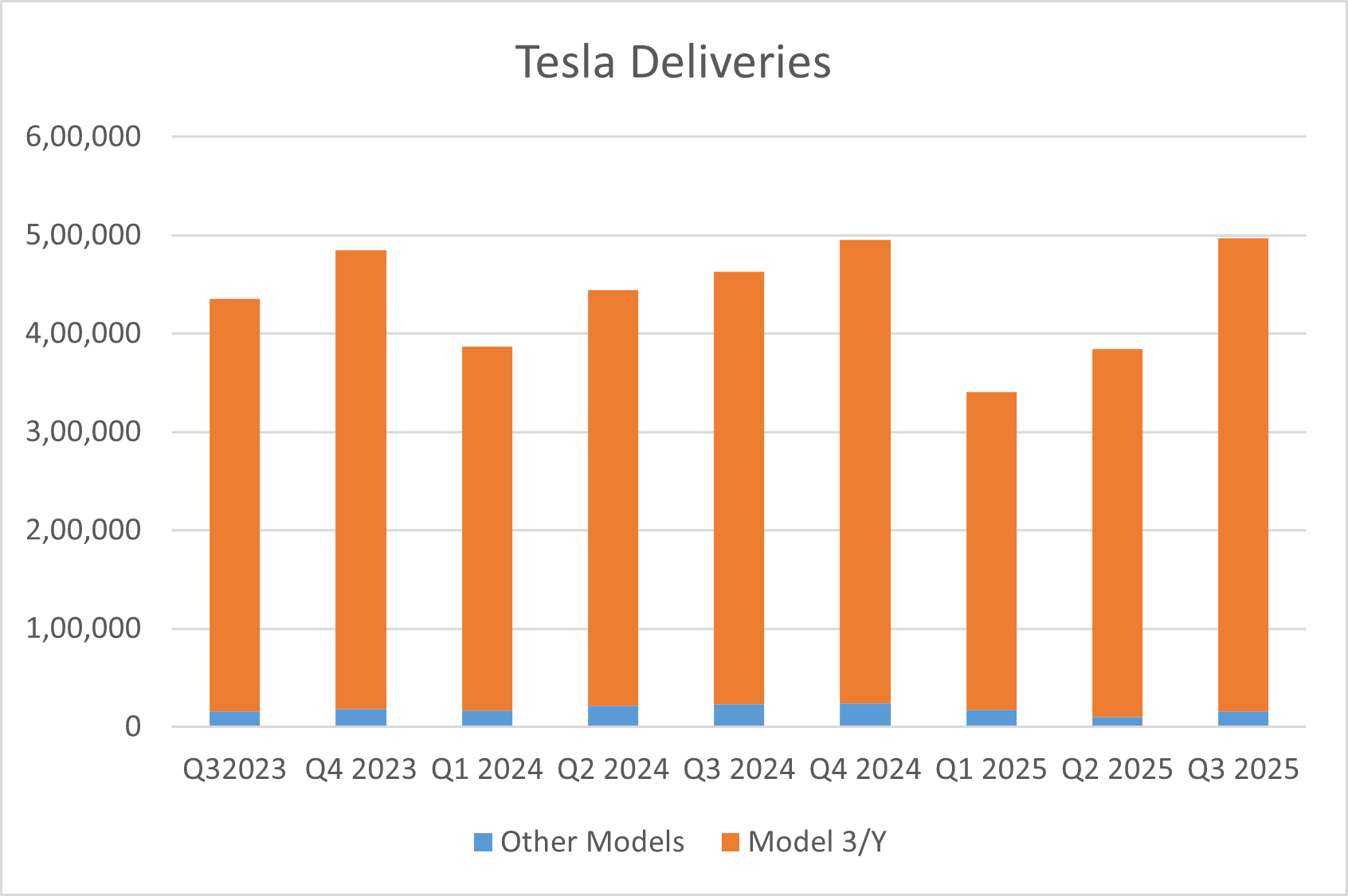

Meanwhile, FSD and products like robotics would become all the more important for Tesla as the company’s core automotive business is slowing down and deliveries are expected to decline year-over-year in 2025, which would mark the second consecutive year of degrowth for the company that once predicted a long-term delivery CAGR of 50% – a forecast it has all but withdrawn.

Tesla is particularly facing an erosion in market share in Europe over Musk’s political activities, and BYD has outsold the Elon Musk-run company for two consecutive months in the region.

While the Elon Musk-run company has been in Europe for quite some time now and also has one of its Gigafactories in Berlin, BYD entered the region only in late 2022. Moreover, BYD cars face tariffs in the EU, while the cars built by Tesla at its Germany Gigafactory are exempt from these tariffs.

Tesla is facing boycott calls over Musk’s politics

Several funds and institutional investors have either stopped investing in Tesla or have significantly reduced their holdings for reasons mostly due to Musk’s public behavior and political involvement. The company’s financial performance, intense competition in the electric vehicle market, and issues related to union rights have been among the other reasons why some institutions have shunned Tesla shares.

Question & Answers (0)