The national debt of developed countries has been rising steadily and the US budget deficit soared to $366.8 billion in November which is 17% higher than November 2023 and a new record for the month.

In the first two months of the 2025 fiscal year, the US budget deficit soared to $624 billion which is 64% higher than the corresponding period last year and a record for the period. Meanwhile, the adjusted deficit was $286 billion in November and $544 billion in the first two months of the fiscal year which is still 19% higher than the corresponding period in the last year.

US budget deficit hit a new record in November

To be sure, the deficit soared to record highs in November despite record receipts of $302 billion, up 10% YoY. However, the outlay jumped 14% YoY to $669 billion.

The total government debt was $36.1 billion at the end of November and has long surpassed the national GDP. The rising debt pile has led to a massive increase in interest expense and the Treasury Department estimates that it will spend $1.2 trillion on interest payments this year.

While the Fed has cut rates twice and has embarked on a rate-cut cycle, interest expense continues to be a drain on the federal government’s budget. In November, the country’s interest on its national debt was $79 billion which brought the total for the first two months of the fiscal year to $160 billion.

Interest expense is now the fifth largest expenditure for the US government after social security, Medicare, defense, and health care.

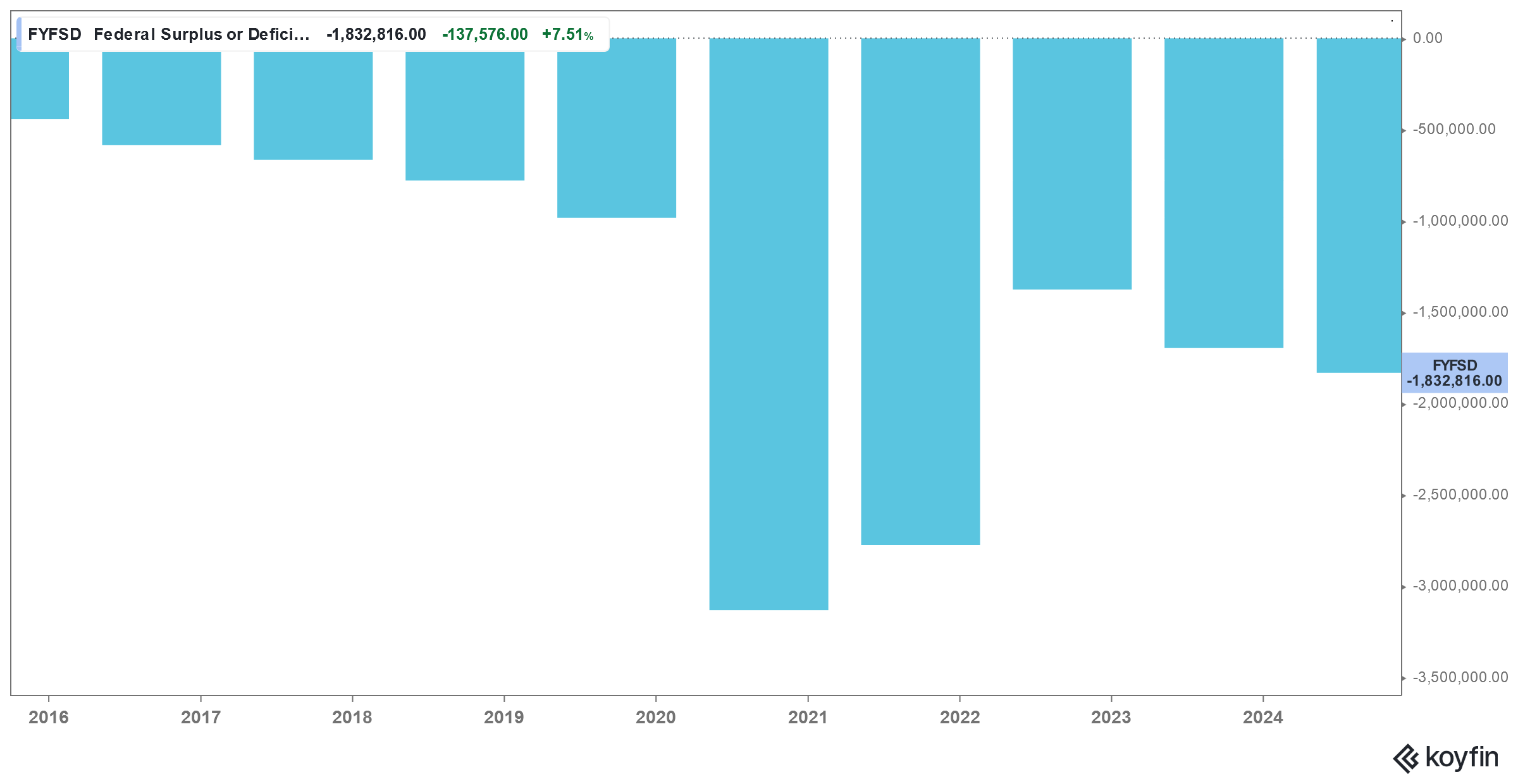

The US fiscal deficit has been climbing

Notably, the US fiscal deficit hit a record high of $3.13 trillion in the fiscal year 2020. The surge was understandable as the economy needed support during the pandemic. The deficit came down to $2.77 trillion in the fiscal year 2021. It fell further to $1.38 trillion in the next fiscal year and while it was much below the previous year, it was significantly higher than in pre-pandemic times when the deficit was contained below $1 trillion. However, in the fiscal year 2024, the budget deficit increases to $1.8 trillion.

Economists are concerned about the rising US budget deficit

Many fear that the fiscal path that the world’s biggest economy has been pursuing since the COVID-19 pandemic is unsustainable and the country needs to bring down its burgeoning fiscal deficit that has surpassed its national GDP.

In its report, ING said, “The US is not Greece. And we don’t at all anticipate a spiralling out of control. But at the same time, the markets will absolutely look for and require some comfort that we should not even be talking this way.”

The report added, “If the markets do not get that, we run the risk that on any given day, the Treasury market could decide that now’s the time to price in a material concession. And that’s how a 5% 10yr yield can threaten to hit 6%+.”

Jerome Powell warned on soaring debt pile

In his interview with CBS 60 Minutes earlier this year, Fed chair Jerome Powell said, “The U.S. federal government is on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy.”

He added, “I think the pandemic was a very special event, and it caused the government to really spend to ward off what looked like very severe downside risks. It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path.”

While Powell said that the Fed’s role is not to “judge” the fiscal policy, he warned, “we’re effectively — we’re borrowing from future generations. And every generation really should pay for the things that it, that it needs. It can cause the federal government to buy the things that it needs for it, but it really should pay for those things and not hand the bills to our children and grandchildren.”

US national debt under Trump

Now, there are two ways through which the fiscal deficit situation can be addressed. The first is through increasing receipts for which the federal government would need to raise taxes. The second way is through cutting down on the expenditure. President-elect Donald Trump has vowed to cut taxes which would further reduce the federal government’s receipts.

However, he is also looking to cut down excess government expenses and has set up a Department of Government Efficiency (DOGE) headed by Elon Musk and Vivek Ramaswamy. Meanwhile, it remains to be seen whether the cost cuts make up for the tax cuts that Trump has proposed.

All said, with the fiscal deficit now running at record levels under normal circumstances, it might be high time that politicians across the divide look at measures to address the situation. An unsustainable fiscal path in the US would not only threaten its economy but could also shake up the global financial system.

Question & Answers (0)