British Land shares are advancing 0.7% this morning at 487.2p per share in mid-day stock trading activity as the British developer stock keeps recovering for a strong intraday plunge seen on 21 December amid the discovery of a new COVID strain in the United Kingdom.

The price action of this real estate investment trust (REIT) has recently taken a pause after rallying strongly on 9 November amid the announcement of the efficacy of the Pfizer (PFE) vaccine, with the stock jumping nearly 22% on that day as investors saw a light at the end of the COVID tunnel for the century-old company.

However, the appearance of a new strain of the virus in England, which has led to the introduction of Tier 4 lockdown measures in the city of London, have instilled some jitters among market players, with shares now hovering between 470p and 500p as investors await further information before acting.

Meanwhile, the company announced this morning that it sold a 75% stake in a portfolio comprised of three buildings in the West End of the capital city to German firm Allianz Real Estate in a deal valued at £401 million, while the firm will retain a 25% stake in a joint venture formed with the acquiring party.

These buildings reportedly had a combined valuation of £508 million as of 30 September this year, which means that they were sold at a 5.2% premium, and they generate a total net rent of £21.1 million per year.

This would be the latest move from British Land as part of an ongoing ‘asset recycling’ effort that aims to revamp the company’s profitability by investing in more promising properties and developments with the proceeds of these asset disposals.

So far, the company has sold a total of £1.1 billion in assets during its 2021 fiscal year. Meanwhile, British Land recently decided to resume its dividend payments, which were halted as a preventive measure amid the uncertainty caused by the pandemic.

How have British Land shares performed this year?

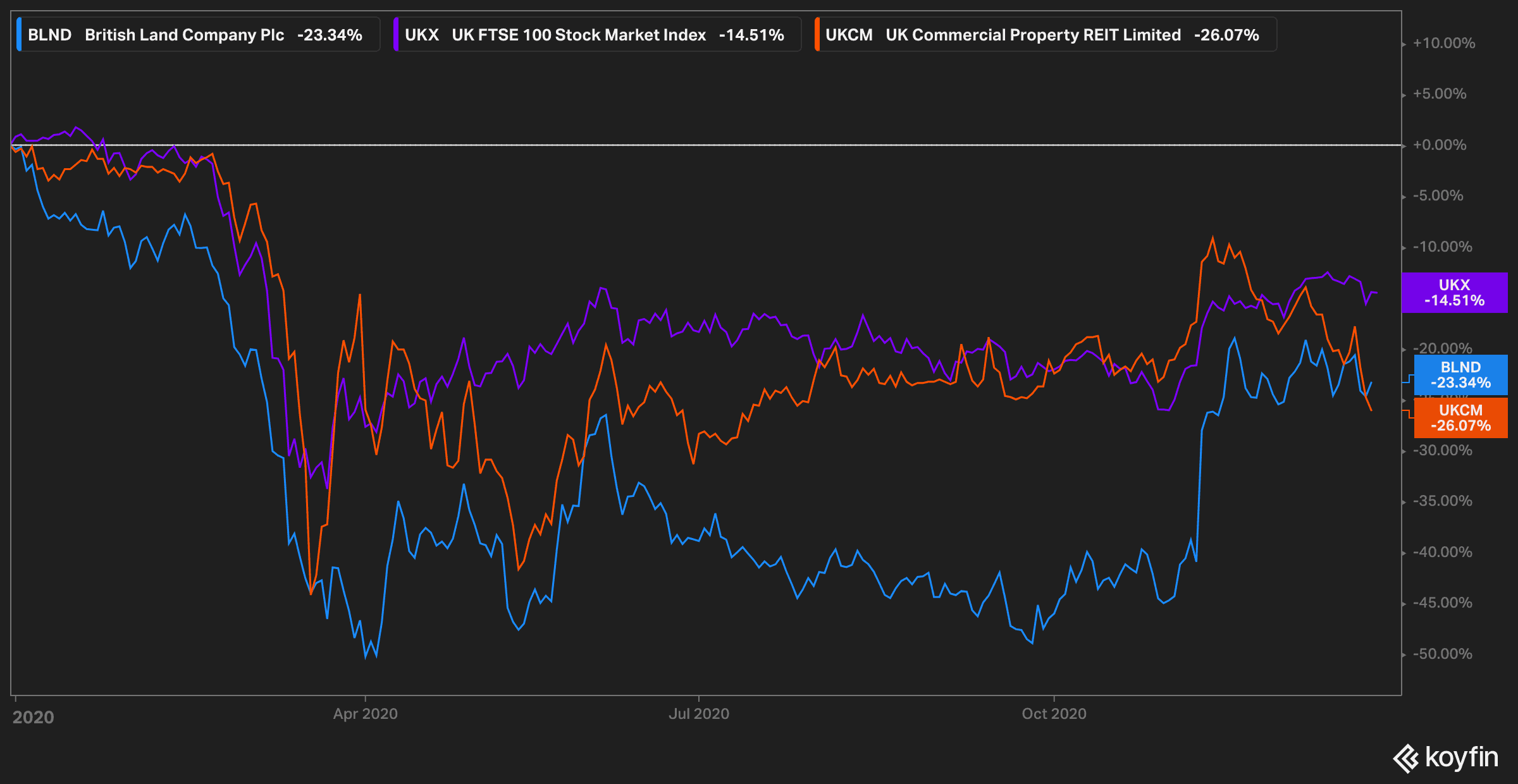

The real estate market in the UK has been severely affected by the disruptions caused by the pandemic – a situation that has plunged the valuation of most real estate investment trusts including British Land (BLND) and UK Commercial Property Trust (UKCM), with both of these stocks underperforming the FTSE 100 by 8.5% and 11.5% respectively.

According to the latest trading update released by British Land, the percentage of rents collected from offices and retail properties during the September quarter stood at 92% and 53% – with the latter reflecting the deteriorating conditions in which retail landlords are currently operating amid the economic downturn caused by the virus.

In response to the situation, British Land has granted retail tenants a series of relief measures including extensions, partial settlements, and full pardons on a case-by-case basis as a way to assist them during this unprecedented scenario.

As of 8 October, the total amount collected during the quarter ended on 30 September stood at 69%, which represents a significant improvement from the 36% the company collected during the quarter ended on 30 June.

What’s next for British Land shares?

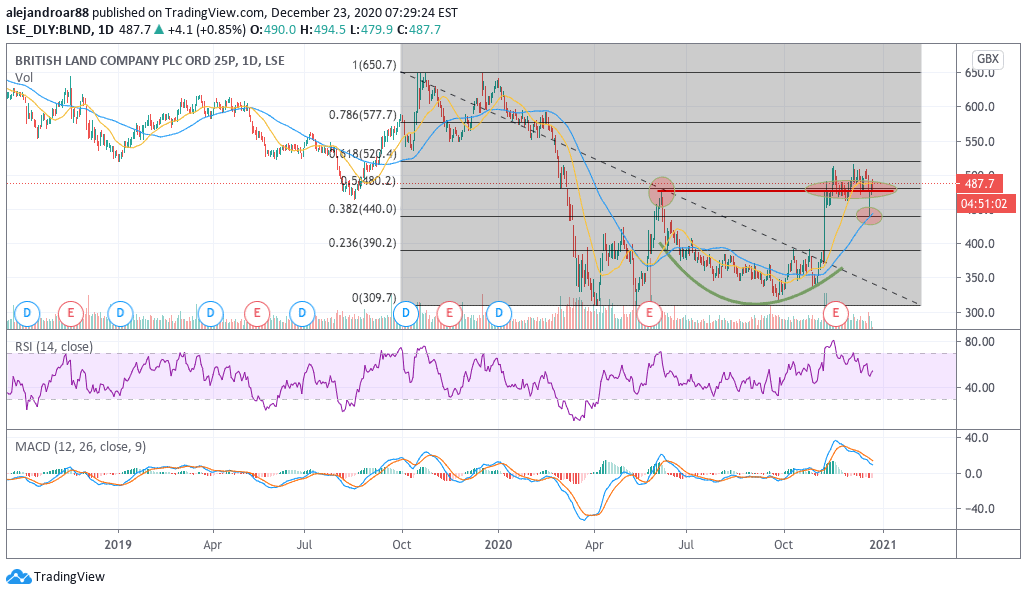

British Land shares have been posting quite an interesting price action lately, as the stock seems to have entered a consolidation phase while struggling to clear the 520p threshold.

The chart above shows how BLND has been trading between the 0.5 and 0.382 Fibonacci while crossing the 476p post-pandemic high multiple times in the past few weeks.

Meanwhile, the 21 December action was quite interesting as well, as bulls overturned an 8% intraday plunge to a milder 0.7% loss at the closing, which goes to show that there is significant interest out there to buy strong dips on British Land shares.

This move could support further upward movements over the coming days, as the stock strongly bounced off the 0.382 Fibonacci – which coincides with its 50-day moving average.

This move could have served as a floor for further bullish activity, although the MACD line remains below the signal for now.

For now, the 520p level seems like a plausible short-term target, while a move above that threshold could end up pushing the stock to fresh post-pandemic highs.

Question & Answers (0)