The pound sterling is retreating today against most major currencies as a series of negative catalysts keep weighing on the British currency’s short-term outlook.

The pound to euro parity is leading the downtick today, as the European currency is advancing 0.4% so far in early forex trading activity while the pound to dollar parity is sliding 0.3% at 1.3421 – once again slipping below the 1.35 threshold that the British currency has repeatedly failed to clear over the past few months.

This would be the third consecutive red day for the pound, as the introduction of Tier 4 lockdowns in the UK capital city and the threat of a no-deal Brexit have instilled a pessimistic tone among traders – although an ongoing vaccine rollout in the country seems to be offsetting some of the selling in the past few sessions.

Meanwhile, yesterday’s session saw quite a high level of interest from buyers, as the pound managed to bounce from a 2.4% intraday loss to a milder 0.47% slide at the close.

However, the prospect of a countrywide lockdown remains a big risk for the pound’s current stand, as a new strain of COVID-19 seems to have emerged in the country, threatening to derail its economic recovery if stricter measures have to be implemented in other regions of the Kingdom.

Moreover, fisheries remain a sticky point in Brexit negotiations as the 31 December due date approaches. In this regard, analysts believe that this matter will be resolved while others – perhaps more impactful for the British economy – may not be addressed in a rushed agreement, leaving some major economic sectors unattended and possibly quite affected.

Data released by the Office for National Statistics today indicated that the country’s economy grew 16% during the third quarter of the year – compared to the last quarter – although it also declined 3.2% compared to the same quarter a year ago on a seasonally-adjusted basis.

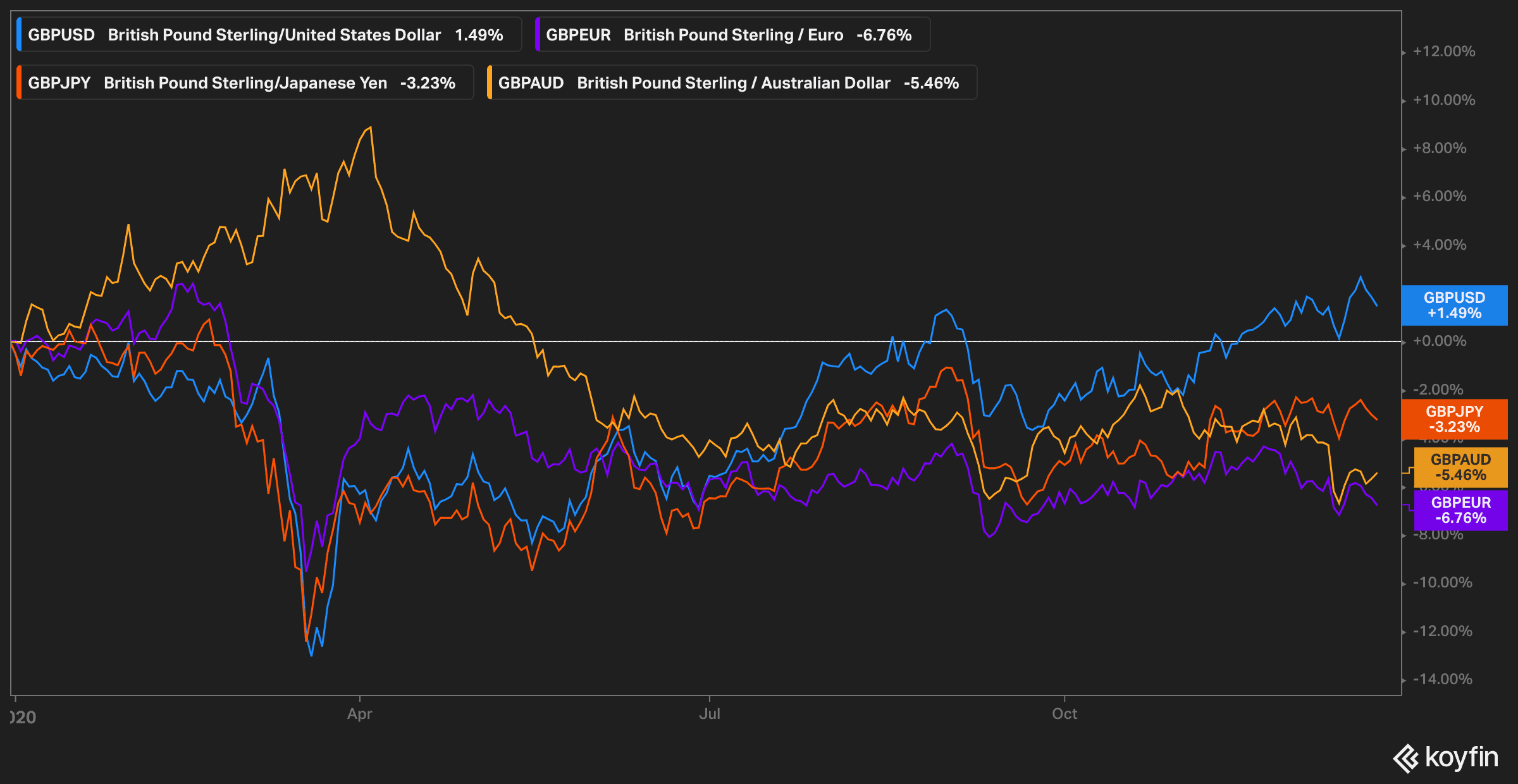

How has the pound sterling performed so far this year?

As of today, the pound sterling has advanced 1.7% against the greenback while retreating as much as 6.8% against the euro amid the uncertainty surrounding Brexit negotiations and the impact that the pandemic has had on the British economy.

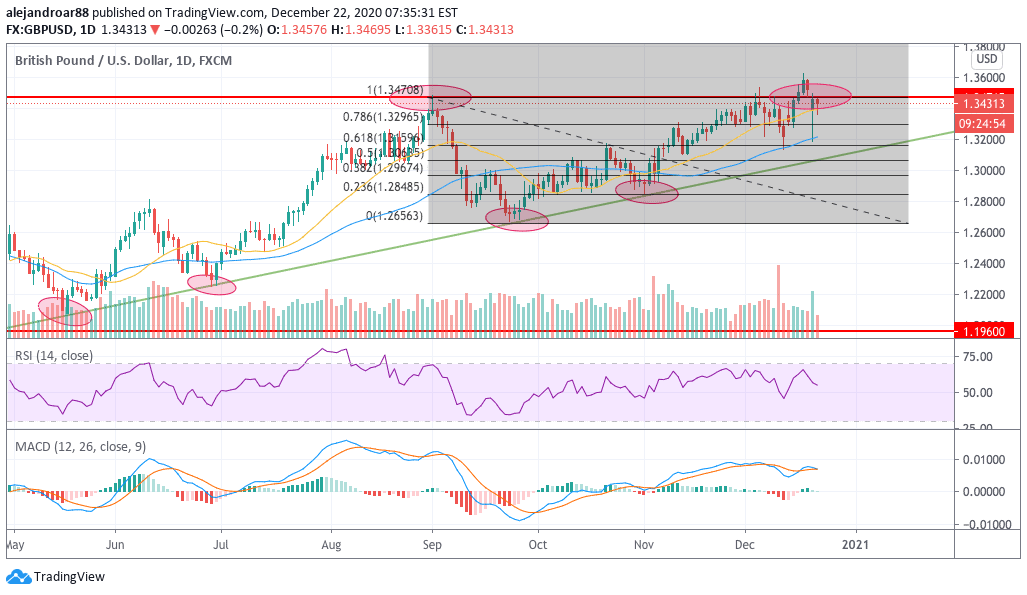

Meanwhile, the pound has struggled to clear the 1.35 barrier against the US dollar for the third time in the past 12 months, as traders remain skeptical about the impact that Brexit could ultimately have on the country’s economy.

A recent breakout above this level on 17 December, following the approval and subsequent rollout of the COVID-19 vaccine developed by Pfizer (PFE) and BioNTech in the country, was greeted by a quick plunge as sellers took control over the price action the day after.

What’s next for the pound sterling?

Yesterday’s candle was quite interesting as buyers showed up to buy a big dip in the pound resulting from the implementation of Tier 4 restrictions in London.

Meanwhile, today’s bearish activity has also been welcomed by bulls, with the British currency currently approaching breakeven despite the looming risks.

It seems that traders have grown optimistic about the pound’s futures amid the prospect of en-masse vaccinations in the country by the first quarter of 2021 – a situation that could finally put the virus threat in the rearview mirror while clearing the path for a more stable economic recovery.

For now, the 1.35 hurdle remains a stronghold that bulls need to clear before any move higher can be expected.

Achieving this would involve significant firepower as bears have successfully taken control every time the price has moved above this mark. However, the fact that this resistance has been crossed three times already indicates that bullish activity is growing and could ultimately lead to a breakout.

In this regard, the outcome of Brexit negotiations – whatever that is – could be the catalyst that ends up triggering this particular move.

Question & Answers (0)