Best Crypto ETFs To Consider In 2026

There are many types of crypto investment funds including exchange-traded funds (ETFS), indexes, venture funds that invest in crypto firms, crypto mutual funds, crypto hedge funds, cryptocurrency trusts, and crypto-adjacent funds. Investing in crypto through funds is a popular option because the stock market is regulated. If this type of crypto investment appeals to you, this article will look at the best crypto ETFs and how you can invest today.

Best Crypto ETFs list

ETFs are not available in the UK however you are able to trade them if you reside in other countries including the US. Let’s look at the best crypto ETFs to see what makes them a viable investment.

- Bitwise Crypto Industry Innovators ETF

- Purpose Bitcoin ETF

- Global X Blockchain ETF

- Bitwise 10 Crypto Index Fund

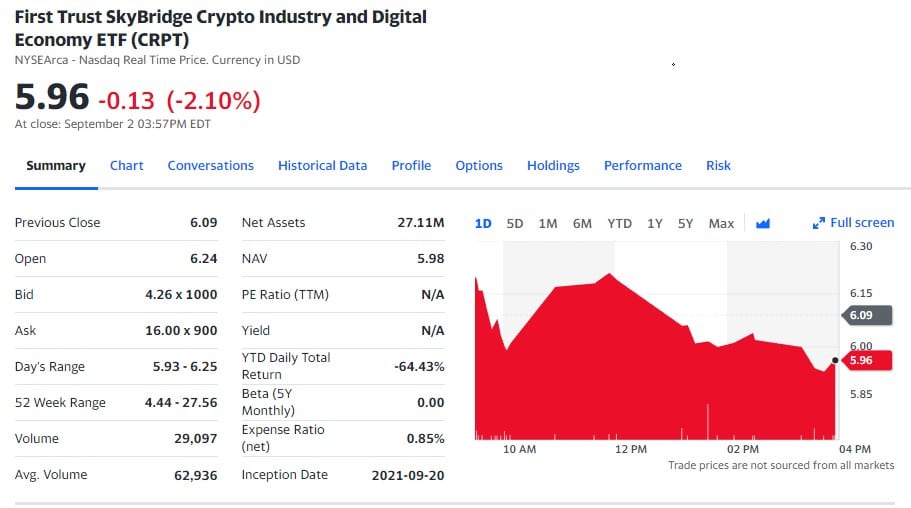

- First Trust SkyBridge Crypto Industry and Digital Economy ETF

Best Crypto ETFs- Reviewed

Before making any investment decisions, it is always a good idea to conduct thorough research. Let’s take a closer look at the best crypto ETFs as well as some great alternatives for UK investors.

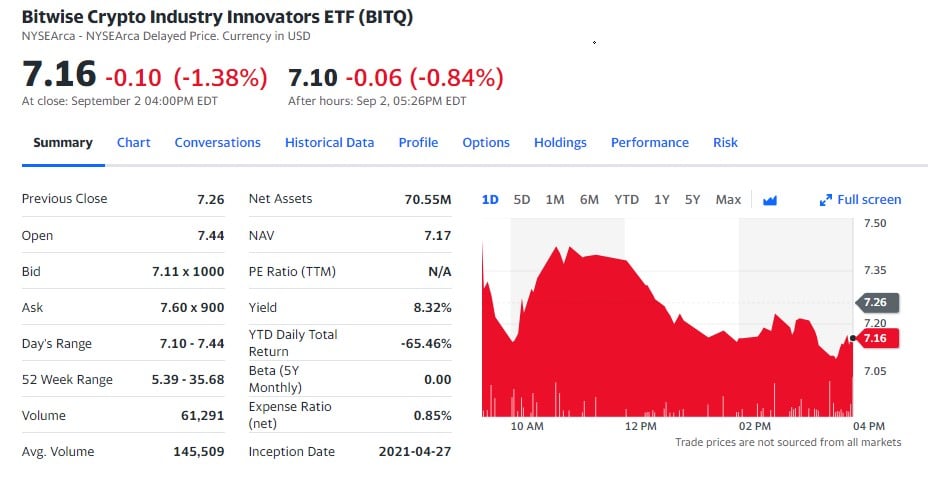

1. Bitwise Crypto Industry Innovators ETF

The Bitwise Crypto Industry Innovators ETF (BITQ) was launched in May 2021. The Bitwise Crypto Innovators 30 Index is one of the largest crypto asset funds in the world.

Companies included in the index have generated most of their profits from the cryptocurrency ecosystem. Therefore, most of the company’s profits must be in a liquid crypto asset.

BITQ held 30 holdings at the end of May 2022, and its net assets were just over $60 million. Its top three holdings were galaxy Digital Holdings, Microstrategy, and Coinbase Global. The management fee for BITQ is 0.85% per year.

A key benefit of Bitwise’s fund is that investors can invest in crypto companies without owning cryptocurrencies themselves. By doing so, you can avoid the cryptocurrency market’s volatility. In addition, by investing in BITQ, you can also participate in the crypto ecosystem by investing in mining companies and trading platforms.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

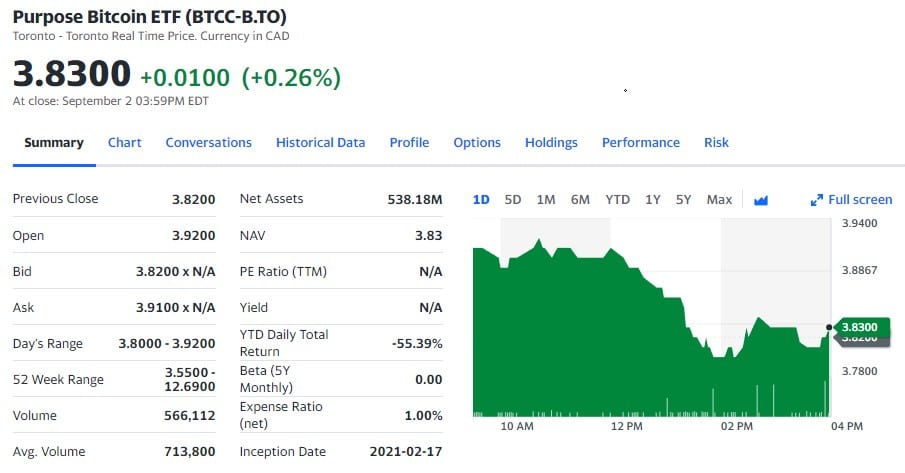

2. Purpose Bitcoin ETF

In February 2021, Purpose Bitcoin ETF (BTCC) was launched as the world’s first Bitcoin ETF. Because of its novelty, BTCC received a lot of attention, and the hype didn’t fade away. The company trades on the Toronto Stock Exchange and tracks the price of Bitcoin.

By investing in this fund, you own Bitcoin. As a result, you shouldn’t be surprised to see significant changes in your portfolio’s value due to Bitcoin’s volatility.

Registered accounts can use tax-free savings accounts (TFSAs) or retirement savings plans (RRSPs) to save on taxes. The management expense ratio (MER) of BTCC currently stands at 1%. If it falls below 1.50%, you pass on the savings.

At the end of May 2022, the fund had more than 36,000 Bitcoins slightly, and its net assets were valued at $810 million. It also offers another popular fund called Purpose Crypto Opportunities ETF, which specializes in crypto ETFs.

To rebalance your portfolio, Purpose has ensured that BTCC contains high liquidity.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

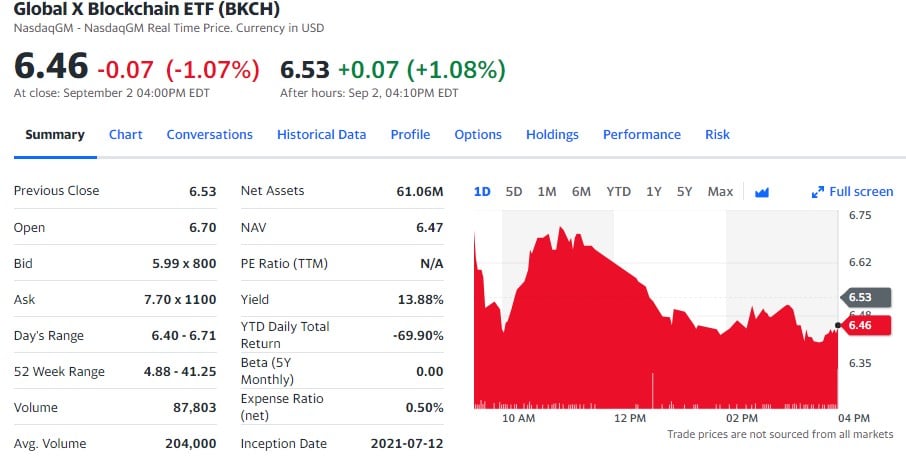

3. Global X Blockchain ETF

The Global X Blockchain ETF invests in companies across a variety of industries. Blockchain technology, the integration of digital assets, and digital transaction into the blockchain are the unifying themes of the fund.

As of Feb. 23, 2022, almost 96 million dollars were under management, making it relatively easy for investors to buy and sell shares. In addition, the fund has the lowest expense ratio on our list at 0.50%, equivalent to $5 for every $1,000 invested.

There is no track record for this fund, but that is true for many of the funds we list. In addition, since blockchain technology is relatively new, most funds focused on the area are also new.

As of Feb. 23, 2022, its top holdings are Coinbase, Riot Blockchain, and Marathon Digital.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

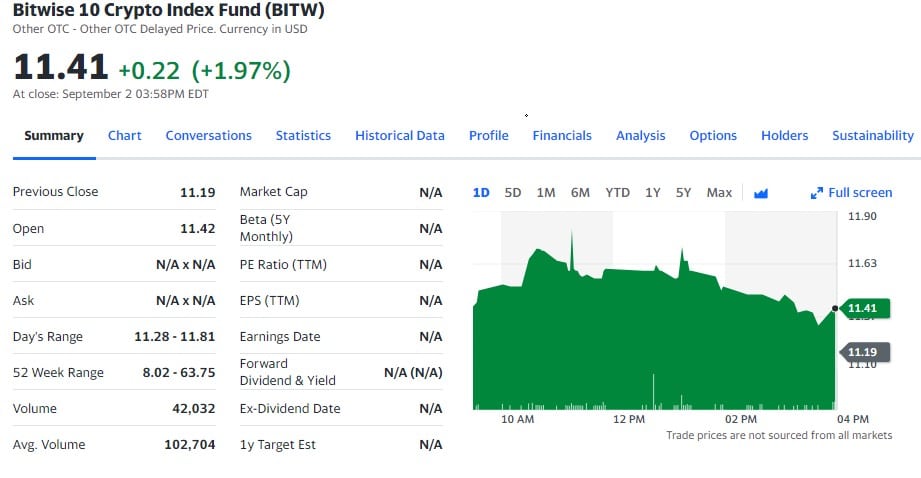

4. Bitwise 10 Crypto Index Fund

One of the unique offerings on this list is Bitwise 10 Crypto Index Fund. The fund was originally a private placement, but shares are now available over the counter. Since the fund is actively managed, its expense ratio is 2.5% (or $25 in annualized fees deducted from fund performance for every $1,000 invested).

Invest in the top 10 cryptocurrencies (as measured by market cap) and have the fund rebalanced monthly to reflect price changes. As the two largest cryptocurrencies by size, Bitcoin and Ethereum make up 61% and 29% of the underlying portfolio, respectively. Solana (CRYPTO: SOL), Cardano (CRYPTO: ADA), and Avalanche (CRYPTO: AVAX) are the next eight largest cryptos.

Over-the-counter funds like this can occasionally trade at severe discounts or premiums to underlying crypto prices, depending on demand. Due to this, investors must tread carefully. In contrast, if you’re interested in investing in the largest cryptocurrencies, this fund could be worth considering.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

5. First Trust SkyBridge Crypto Industry and Digital Economy ETF

First Trust Advisors L.P., a leading exchange-traded fund (“ETF”) provider and asset manager, today announced the launch of the First Trust SkyBridge Crypto Industry and Digital Economy ETF (NYSE Arca: CRPT). At least 80% of the fund’s net assets (plus any investment borrowings) will be invested in common stocks and American Depositary Receipts (“ADRs”) of crypto industry companies and digital economy companies under normal market conditions.

In addition, the fund will invest at least 50% of its net assets (plus any investment borrowings) in crypto companies under normal market conditions. Digital economy companies will receive the remainder of the fund’s net assets to satisfy the 80% test. SkyBridge Capital II, LLC (“SkyBridge”) uses their knowledge and expertise of cryptocurrencies and the digital economy to manage security selection and monitor changing market conditions.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Can I Invest In Crypto ETFs In The UK?

As a result of the hotly anticipated launch of a bitcoin ETF in the US, the UK remains out of step with some other major markets.

US regulators follow countries like Canada and Germany in approving exchange-traded products linked to cryptocurrencies, which supporters claim are safer ways for retail investors to access volatile crypto markets.

FCA has blocked access to this type of fund for UK retail investors, saying that it would not authorize a fund with exposure to crypto until it was satisfied with the integrity of the underlying market.

Despite the extreme volatility and lack of a solid foundation for the value of cryptocurrencies, the FCA has repeatedly expressed concerns about them.

It is unclear whether the FCA’s reluctance to approve regulated vehicles for crypto investment has led retail investors to turn to riskier avenues to access popular digital assets. As a result of UK restrictions on these funds, other jurisdictions have attracted billions of dollars.

As it stands. crypto ETFS are not authorized in the UK.

What Are The Best Alternatives To Crypto ETFs?

While crypto ETFs may not be legal in the UK, it is still possible to add crypto investments to your portfolio. There should be caution when approaching the cryptocurrency market, as it is relatively new. Here are a few ways you can invest in crypto if you’re excited about it and feel like your portfolio needs some pizazz:

- Direct cryptocurrency investments: Using Bitcoin is becoming more common – you can even buy things on Amazon with it. It is possible to choose from a variety of cryptocurrencies to add to your portfolio. Bitcoin is the most established and largest cryptocurrency player, but that doesn’t mean it’s safe. Adding a new investment to your portfolio should be done with caution.

- Crypto-related investments: If you don’t want to buy crypto tokens but still want to invest in the industry, you could by crypto-related stocks. For example, cryptocurrency exchange Coinbase has a stock that is available for purchase. Additionally, blockchain ETFs are available. Cryptocurrencies are based on blockchain technology, and numerous companies are involved in their development and implementation. As a result, investors can gain exposure to crypto technology without investing directly in currencies by investing in ETFs made up of those companies.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

What Is a Crypto ETF?

Similarly to company stocks, an ETF tracks some other underlying asset (or basket of assets). During the trading day, authorized stock exchanges process ETF transactions.

The concept of ETFs is quite similar to mutual funds, which invest pooled money. However, unlike mutual funds, ETFs trade throughout the day freely and are subject to most of the same rules as stocks.

Various ETF products are exposed to cryptocurrencies, blockchain technology stocks, digital assets, cryptocurrency futures contracts, and other ETFs.

In terms of products, the most basic one is a Bitcoin ETF, which tracks the price of Bitcoin. Some may be based on a basket of different cryptocurrencies. Another type of cryptocurrency ETF is based on the stocks of blockchain companies.

Complex cryptocurrency ETFs may combine other crypto ETFs, stocks, cryptocurrencies, crypto futures, and more.

Crypto ETF Pros and Cons

The ETFs attract interest from investors and crypto enthusiasts alike, but why is everyone so excited? Investing in these funds has several advantages.

Pros:

1. Exposed to Cryptocurrency Outside of Exchanges

If you want exposure to cryptocurrency without these funds, you’ll need to use a cryptocurrency exchange. Unfortunately, many security risks are associated with these unregulated exchanges.

Bitcoin ETFs allow you to gain exposure to changes in Bitcoin’s price without dealing with unregulated exchanges.

2. No Storage or Security Hassles

In the blockchain industry, storage and security are hot topics. Every week, there’s a new story about a new scam draining cryptocurrency wallets. The underlying digital assets are never actually held by you, so theft is unlikely.

3. Tax Implications Clearer Than With Cryptocurrency Ownership

In regards to cryptocurrency and the gains made by trading these digital assets, there are more questions than answers. The securities tax laws, however, are cut and dried and will govern taxes on these funds.

4. Ability to Short Sell

Cryptocurrency markets don’t allow short sales. Short selling is a great way to profit from assets you expect to decline in value in the stock market. It’s finally possible to bet against digital tokens’ value growth with Bitcoin ETFs hitting the market.

5. No Wallet Password Mishaps

To access your cryptocurrency wallet, you’ll need a password. Unfortunately, since the industry is decentralized, no authority or institution can help you manage your password if you forget it. Likewise, you cannot recover your password if you lose it.

You won’t have to worry about losing track of a password when you invest in Bitcoin funds. The brokerage can help you reset your password if you forgot it, so log into your account to access your funds.

There is no such thing as a perfect asset in the financial market, even if these funds seem great at first glance. Moreover, there are some disadvantages to investing in these funds, including:

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Cons:

1. Lack of Regulation

Bitcoin is largely unregulated, unlike futures. Therefore, a lack of regulation can result in fundamental problems with Bitcoin itself, ultimately affecting future returns if investors lose interest in the currency.

2. Highly Speculative

Blockchain technology, which underpins Bitcoin, is relatively new. Despite digital currencies’ proponents hailing them as the pivotal change in the monetary system that the world has been waiting for, there are still major bugs to work out and no guarantee of widespread adoption among consumers.

Therefore, any investment in Bitcoin or a Bitcoin derivative is highly speculative.

3. Volatility

The value of Bitcoin fluctuates widely over short periods because it is a highly volatile asset. Consequently, there is a high level of risk associated with this volatility.

4. Liquidity Issues

When you decide it’s time to sell your Bitcoins, you may have difficulty finding a buyer if the masses don’t embrace the concept. Moreover, because they’re so new, it’s unclear how much trading volume any particular fund will see.

5. Management Fees

All investment-grade funds charge management fees, but Bitcoin-related funds tend to charge higher fees than traditional ETFs.

6. No Dividends

Digital currencies, such as Bitcoin, are not companies. As a result, investors cannot expect dividends as part of their return on investment.

7. Lack of Diversification

Investing in Bitcoin futures is all that bitcoin funds do. In contrast, most other ETFs invest in a diverse group of securities or an entire market index, while Bitcoin ETFs lack diversification.

What Are The Best Crypto Funds To Invest In?

Over 800 cryptocurrency funds have been established since the first bitcoin fund was launched in 2013. As a result, the fund management industry is experiencing rapid growth in this new market segment.

According to PWC research, the AUM of cryptocurrency funds nearly doubled between 2020 and 2021, from $2 billion to $3.8 billion. The median fund return has also increased from +30% in 2019 to +128% in 2020.

Best Crypto Fund for Large Investors

Investors looking for overall consistency should consider 500 Global. More than 30 tech unicorns and 120 startups valued at more than $100 million have been nurtured by their Global Fund. However, they are not a “pure crypto” fund.

The clear winner is Grayscale if you’re looking for a crypto-focused investment firm. Numbers speak for themselves. Globally, they are the largest and most respected digital asset investment firm with over $50 billion in assets under management.

In both cases, accredited investors are high-net-worth individuals with at least $1 million in assets (excluding their primary residences) or with a minimum of $5 million in assets/all beneficial owners.

Best Crypto Fund for Smaller Investors

Individual investors from modest backgrounds also have plenty of options. Below are our top picks for smaller investments in crypto and digital tokens:

Bitcoin and Crypto ETFs: An exchange-traded fund (ETF) tracks the value of an underlying asset. A commodity like gold or oil, a basket of stocks, or a major index is usually an asset. ETFs can be bought, sold, held, and traded like stocks. A crypto ETF tracks the price of a cryptocurrency (or multiple currencies). This way, individual investors can access cryptos without learning how to use bitcoin wallets, etc.

Bitcoin and Crypto Stocks: Blockchain startups are numerous these days. Many publicly traded firms also have strong ties to the cryptocurrency market. Block stocks are stocks of such companies that benefit from blockchains and cryptos. They offer investors indirect exposure to cryptos. Visit our Block Stocks page to learn more.

There are many crypto ETFs

Crypto Mutual Fund Alternatives

and stocks but no mutual funds directly linked to cryptos. This is because mutual funds are prohibited from investing in high-risk assets like cryptos due to strict regulatory constraints. Apart from ETFs, there are other exchange-traded investment products, crypto hedge funds, and tokenized funds that can be used as alternatives to mutual funds. (See our page on Top Crypto Mutual Fund Alternatives.)

Best Crypto ETF- Conclusion

Crypto ETFs are starting to gain traction amongst blockchain enthusiasts. However, the exchange-traded-funds are not currently authorized in the UK.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.