How to Invest in DeFi - Beginner’s Guide

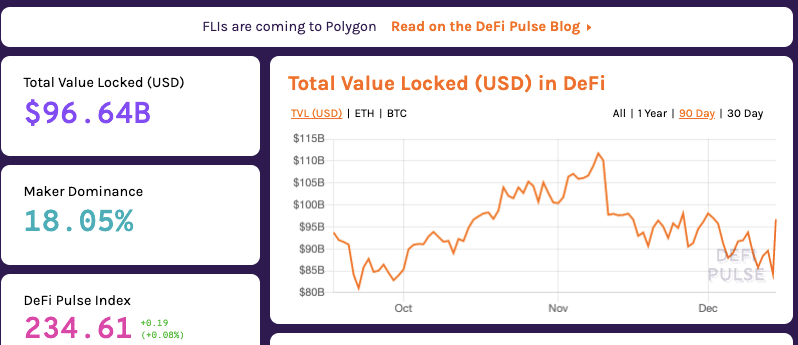

Looking to invest in DeFi or the decentralised finance (DeFi) market? The DeFi sub-sector has shot up from a tiny $700 million total value locked (TVL) in 2020 to over $96 billion in recorded value, reflecting more than a 500% increase in the past year.

This review gives a comprehensive overview of how DeFi works and the best DeFi projects to pick up.

Key Points on How to Invest in DeFi

- The crypto space has largely grown in value and led to the birth of novel ecosystems.

- One of the fastest-growing is the decentralised finance (DeFi) sub-sector which currently averages over $96 billion in total value locked.

- Foremost smart contract platform Ethereum commands over 97% of the global DeFi sub-sector.

How to Invest in DeFi – Quick Steps

- Research DeFi – It is important to acquaint yourself with the concept of DeFi before deciding to invest.

- Choose your investment – After doing substantial research on DeFi-related projects, you can go ahead to choose what type of investment strategy you want to employ.

- Choose an investment platform – An investment platform is important when investing in DeFi.

- Invest – Enter a buy order through your chosen investment platform.

What is DeFi?

Learning how to invest in DeFi won’t be possible without a basic understanding of what DeFi entails.

DeFi, short for ‘decentralised finance’, is a group of financial tools built and made available on a blockchain.

Since the blockchain can be likened to the private ledger of a traditional bank, where financial transactions are verified and stored, DeFi allows anyone with internet access to participate in the financial system in a decentralised format.

DeFi is automated into the blockchain protocol utilising smart contracts, which provides users with financial products such as obtaining a loan, trading and swapping or converting crypto assets.

All these economic activities can easily be accessed using a decentralised application (dApps) or exchange (DEX) without paying large percentages to intermediaries such as broker fees, bank charges etc.

DeFi utilises the same components that existing financial ecosystems use, requiring values to be transferred while introducing smart contracts into the mix. Smart contracts act as a framework for the proper functioning of dApps, providing the terms and conditions applicable for each financial activity.

DeFi protocols comprise multiple layers that combine to ensure the smooth running of the dApp.

The first layer is the Settlement layer, also known as Layer 0, because it is the first layer upon which other transactions are built. This layer usually comprises a public blockchain and native digital currency. Transactions made on the DeFi app will be settled using this currency and traded in public markets.

The protocol layer provides the standards and rules which govern specific tasks or activities.

The Application layer is where consumer-centric applications are usually found. Such applications include exchanges, lending services etc. The final layer, the aggregation layer, consists of aggregators that connect applications from one layer to another to provide services to investors.

Why Invest in DeFi?

DeFi offers users the freedom to participate in daily financial activities, devoid of the hassle associated with conventional banking systems.

By understanding the application of DeFi in everyday living, using a DeFi-enabled platform in place of the traditional financial institutions proffers a ton of benefits such as:

Accessibility

DeFi platforms are simple to operate and navigate. They only require an internet connection to carry out financial activities on the system. Users don’t have to carry out extensive know-your-customer protocols before accessing the services. Due to the basic requirement of the internet, DeFi platforms are highly accessible and are not restricted by many factors such as geographic location.

Autonomous From Centralised Operations

Due to the decentralised nature of DeFi systems, the risk of bankruptcy or overdependence is mitigated. Since protocols are set in place to complete a transaction when certain conditions are met, there is no need for centralised institutions like banks or brokers to oversee transactions in the DeFi space.

Low Risk and High Returns

DeFi systems only require two parties to transact; since there are no intermediaries, transaction fees are at a minimal level. Also, the interest rates from lending on DeFi platforms are much higher than those obtained from conventional financial institutions.

Transparency and Security

Completed transactions on DeFi platforms are displayed for anyone to see or review. Smart contracts executed on the blockchain preserve the users’ privacy, and although transactions are made available for review, the identity of users is never revealed.

Is DeFi Safe?

DeFi technology is relatively new, and investors have incurred significant losses due to several lapses.

Some of these negative outcomes often stem from mistakes by programmers while setting up the platform. Malicious actors have exploited these security loopholes to steal investor funds.

Sometimes, early investment in some DeFi projects do not pan out favourably and can lead to loss of funds. A recent case is the hack of CREAM Finance which saw over $130 million stolen from its liquidity pool. Traditional financial institutions ensure the security of customer funds through the insurance of customer funds, whereas DeFi projects do not have contingency plans for such events.

However, there are developing DeFi applications geared at addressing these deficiencies. One of such applications is Etherisc, which aims to provide insurance for individuals to protect themselves from losses.

Ways of Investing in DeFi

There are several ways one can invest in DeFi UK. However, a simple option provides direct and general exposure to the DeFi ecosystem.

By simply buying the token of a DeFi-enabled protocol such as Ethereum (ETH), the digital asset allows exposure to the entire DeFi space. There are four primary ways to invest in DeFi and reap high returns.

- HODL: This is by far the simplest strategy one can apply when investing in the DeFi ecosystem. Hodl simply means to buy and hold the asset for a long time. This strategy solely relies on the crypto asset’s value rising over time. However, by tying down assets, investors may lose out on other DeFi income opportunities that are available and even more rewarding.

- Borrowing and Lending: One of the best ways to earn yields in a DeFi system is to supply tokens in a liquidity pool as a lender. When users seek crypto loans, the interest placed on their loan portfolio yields lenders passive income. DeFi protocols are usually over-collateralised, which means borrowers have to guarantee the system with a crypto amount worth more than the loan amount.

- DeFi Staking: Staking is also a simple way of investing crypto on DeFi-enabled platforms to earn. Staking involves locking idle assets to contribute to market liquidity and security. Users who stake their crypto assets can earn staking rewards in the form of governance tokens that can be kept as voting power or traded. The longer you stake, the higher your potential rewards.

- Yield Farming: Yield farming is a complex investment strategy that involves lending, borrowing, and staking to maximise profits. To earn yield farming rewards, users will take out a loan, swap the borrowed asset for a high performing token. Using that token, they will provide collateral for another token and stake the borrowed asset. Yield farming requires a large capital but gives a higher return on investment than any other strategy.

Investing in DeFi Coins

There are thousands of crypto assets in the DeFi space, so it is important to follow systematic measures when investing in DeFi. When investing in DeFi coins, there are many factors to consider before betting with funds, as users stand the chance of losing all their funds due to the risky nature of DeFi protocols.

It is important to research the DeFi protocol before investing. By learning more about the project and how it pales compared with others, investors can make better decisions.

Another factor to consider is how secure the platform is. DeFi-enabled platforms that do not have a high Total Value Locked (TVL) are usually very risky platforms to invest in. TVL is a measure of a DeFi project’s performance. So it is wise to pick coins with high liquidity rates and large staked amounts. The higher the coin’s market cap, the lower the investment’s risk.

In traditional banking systems, specific tax brackets apply to certain types of earners and several conditions that differentiate income tax from capital tax. In countries where crypto is taxable, it will be particularly difficult to follow up and document which process qualifies as income or capital tax.

For example, If an investor lends an asset and earns during the process, the earnings will be taxed at the ordinary income rate.

However, when native tokens known as liquidity pool tokens (LPTs) are issued, this earning might be treated as capital gains. This is because the process of adding or removing liquidity can be regarded as a trade. When the transaction is finalised and the LPTs are converted to the original crypto assets, any gains can be treated as a capital gain. So investors get taxed for several processes involving a single asset, which depletes the asset’s value in the long run.

Buying DeFi Stocks

Choosing the best DeFi stock to invest in can be a little bit of a task. However, there are a few trust funds that offer exciting DeFi stocks.

Grayscale Ethereum Trust Fund

As a result of the growing demand for Ethereum, Grayscale Ethereum Trust Fund is a platform for users to trade, and get massive returns on the number one alternative currency (Altcoin).

In the second quarter of 2020, the company saw the average weekly investment into the Grayscale Ethereum Trust rise to $10.4 million.

This resulted in a quarterly inflow amounting to $135.2 million. The Fund has continued to put measures in place to meet regulatory requirements. Grayscale Ethereum trust fund has already started regulatory processing with the Security and Exchange Commission (SEC) and is awaiting approval.

Osprey Polkadot Trust Fund

The Osprey Polkadot Trust offers investors a leeway into accessing and trading Polkadot for massive returns. Polkadot is a Web 3 blockchain known for its interoperability, scalability, security, and self-governance.

Osprey Polkadot Trust Fund does not charge any management fee until 2023, when it will begin charging the statutory 2.5% management fee. The company has a popular crypto exchange, Coinbase, as its fund custodian. The minimum investment allowed on the platform is $25,000.

Best DeFi Coins to Invest in

If you are looking at the best Defi coins to invest in, we have provided below a list of well-researched best DeFi crypto to invest in. Take a look;

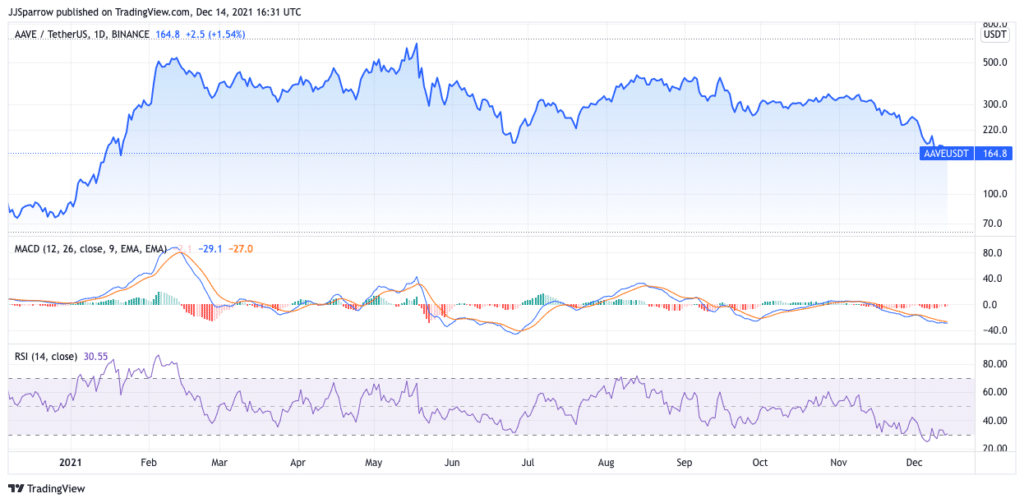

Aave (AAVE)

Aave is one of the best DeFi projects to invest in. AAVE operates as a bank and many crypto proponents refer to the digital asset as the world’s bank. Of all the crypto assets under DeFi category, AAVE holds the record for managing the most cryptocurrency on its platform by some margin. AAVE allows the deposit of crypto assets to savings accounts to earn interest. AAVE users can also take loans to increase their trading capital.

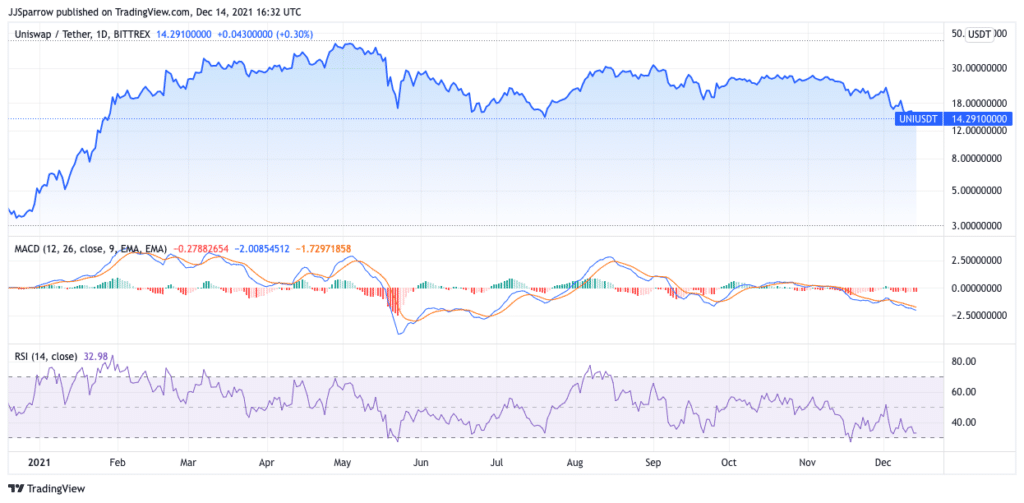

Uniswap

Uniswap, built on the Ethereum network in 2018, plays a great role in facilitating cryptocurrency swaps and exchanges. Uniswap is a decentralised crypto exchange (DEX) that differs from a centralised crypto exchange because it does not involve any intermediary (also known as peer-to-peer). The only transaction fees charged in DEX is the blockchain fees. These points make Uniswap one of the best DeFi crypto to invest in.

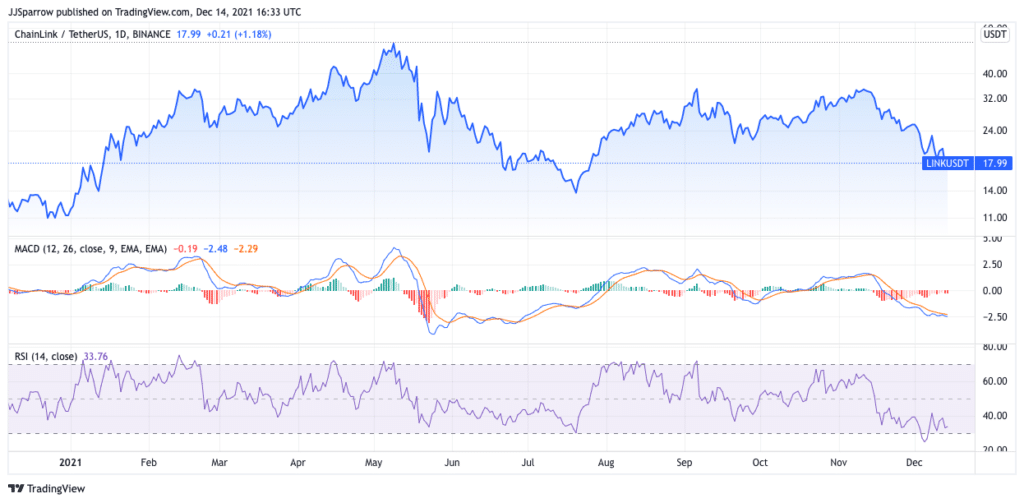

Chainlink

Chainlink is an Ethereum-based decentralised platform that was launched in 2017. Chainlink connects smart contracts on any blockchain to data providers, web APIs, enterprise systems, cloud services, and many more. Smart contracts are agreements between two parties written as a set of codes. Smart contracts are programmed to execute immediately if some predetermined conditions are fulfilled. An instance of a smart contract in real-world scenario is a receipt issued once payment is cleared for goods and services. Chainlink is no doubt one of the best DeFi coins to invest in.

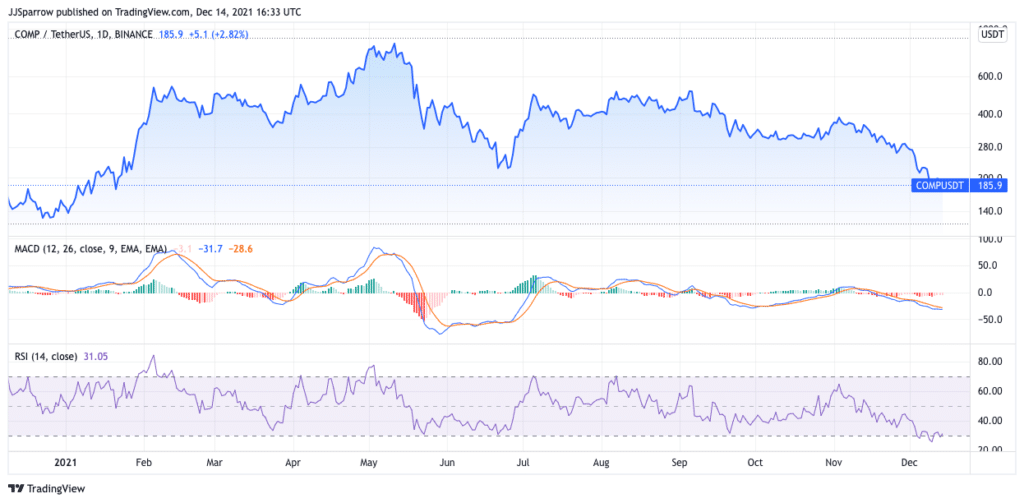

Compound (COMP)

Compound is a decentralised lending platform built on the Ethereum blockchain. COMP broadens the use of cryptocurrency beyond payments into other financial aspects like loans, savings accounts, and a lot more. Compound recently announced a Gateway chain that enables cross-chain collateral beyond the Ethereum network.

If you want to invest in DeFi in the UK, Compound is a very good coin. Investors on the Compound network earn interest on their digital assets by depositing tokens into a select pool and receiving cTokens in return. cTokens is the native digital coin of the Compound economy.

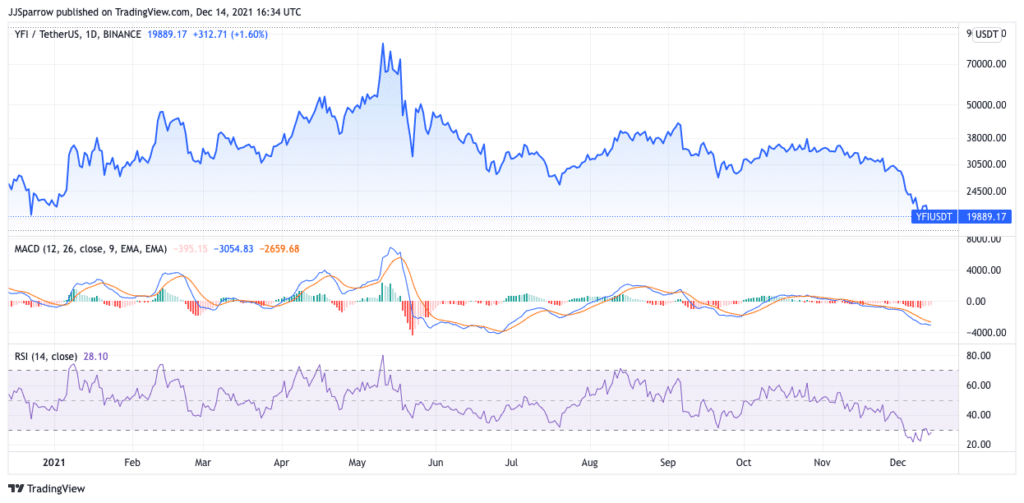

yearn.finance (YFI)

yearn.finance happens to be one of the foremost DeFi cryptocurrencies. Besides decentralised lending, YFI is also known to offer decentralised insurance and yield farming products. Yearn.finance invests users’ funds in other DeFi protocols in an attempt to continually offer the highest interest rates possible on the market. YFI is a great way to invest in DeFi.

What to Consider Before Investing in DeFi

It is advisable that before you begin your journey into investing in DeFi that you consider a few things carefully. Below, we have highlighted some relevant points that we think you should consider before delving into the world of DeFi investments. Take a look;

Risk vs Reward

While it is true that a lot of funds are flowing into DeFi protocols, and many seem to be making huge profits from this category of cryptocurrency, you also have to carefully consider the risk vs the returns you will get before you invest in DeFi.

Investors have injected a lot of funds into DeFi ecosystem and it is growing at a very rapid rate. However, much consideration is needed before hastily joining the bandwagon to invest in DeFi. Thus the onus lies on you to thoroughly and properly educate yourself and understand how DeFi investment works, the risks involved, and ways by which you can mitigate such risks before committing your funds to such investments.

So, you need to understand how yield farming works. You also need to understand that DeFi investments pose higher security risks, despite promising higher returns on investment (ROI). A critical analysis of all these factors is what is needed before you can invest in DeFI.

Research

Research is one vital thing that is needed before committing your funds to any DeFi projects. To put it more accurately, there might be quite a few sham projects here and there; attempting to rip you off your hard-earned money. To avoid this, you should commit time to research before you invest in DeFi projects. This will save your money from going down the drains.

Security of the DeFi platform

DeFi investments are still in the early phase and as such, there are bound to be a few glitches. However, some DeFi platforms are much more secure than others. Thus, we advise that you only trade with DeFi platforms that are security conscious.

Smart Contract Security

Smart contracts are crucial to the developing sub-sector and are the embodiment of the new financial force sweeping the world. When searching for DeFi projects to invest in, look out for platforms that have put sufficient security measures in place to combat hackers gaining access to their platform. Many DeFi platforms are vulnerable, and soft targets for hackers, so, avoid them completely.

Governance of the DeFi platform

It is very important to know how the decision-making process on a Defi platform operates. While some DeFi platforms are solely run by the developers, some other platforms subject critical decisions to votes by community members using decentralised autonomous organisations (DAOs).

It is very important that community members are not left out of key decisions involving fees and network upgrades. If these areas are not community-governed, you might have to be wary of such a platform so that you do not become a victim of a rug-pull.

Historical Data

Going over the historical data available on the DeFi network might offer some guidance and insights that may help in making an informed decision. However, this data may not be readily available as the DeFi ecosystem is still a fledgling industry. Moreover, the available data may not be sufficient to make informed decisions with. Thus, it is advisable to combine it with other factors and indicators before reaching a decision to invest in DeFi.

Invest in DeFi

DeFi is a goldmine that has remained relatively untapped by a lot of investors. However, the industry is relatively new, and might be having some security challenges, but there have been a lot of improvements in terms of security.

The DeFi sector is expected to undergo numerous changes that would make the sector more structured, secure and safer for users.

Before choosing to invest in DeFi, you have to consider your risk appetite and do your due diligence by researching the DeFi project thoroughly before parting with your money. It is also advisable to invest in DeFi only through recommended trading platforms.