How to Buy Beyond Meat Shares Online in the UK

As plant-based meat has proven to be a great alternative for meat products and a pretty lucrative business, many investors are looking for new exciting opportunities. Beyond Meat is the most well-known company that produces synthetic meat and the company’s stock is just booming right now. This can be attributed to good earnings performance and Beyond Meat’s expansion into many regions in the world. At present, products of the California-Based startup are available in more than 75 countries at 94,000 retail and foodservice locations.

As Beyond Meat’s share soars to incredible heights, we’ll help you find the best way to buy shares of Beyond Meat in the UK. We’ll also discuss the best stock brokers in the UK offering investors to buy and sell Beyond Meat shares and analyze the Beyond Meat stock performance.

To help you choose the right broker, below you will find two of the most well-known UK stockbrokers that allow you to buy and sell Beyond Meat shares.

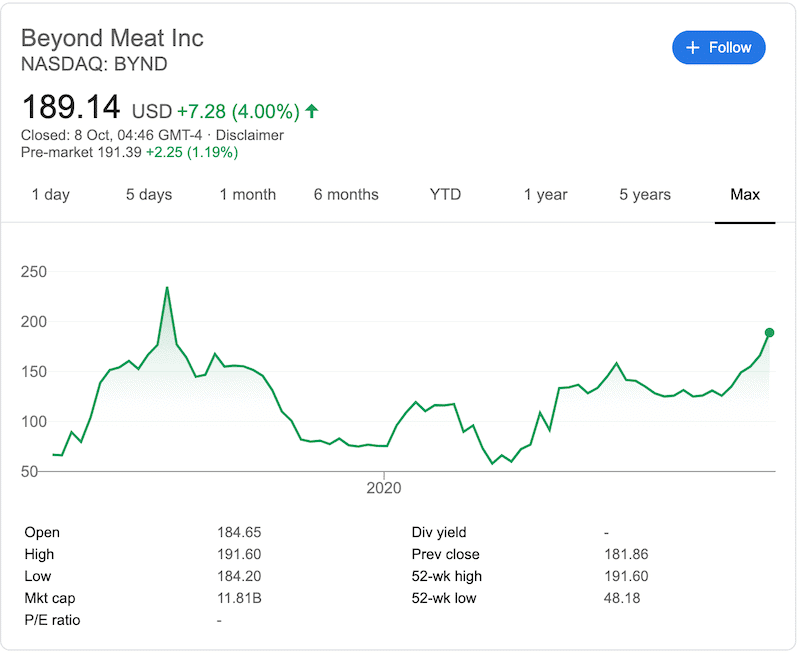

Going into the details, Plus500 does not charge any trading fees except a spread of 0.5 when buying and selling Beyond Meat shares. UK investors can also trade shares at Plus500 with a leverage ratio of 5:1. In other words, you can leverage five times the value of your position. Another useful feature available on Plus500’s platform is the market sentiment tool they offer. This can be a powerful tool for any investor as it shows you what percentage of investors are bullish or bearish on a certain asset. Plus500 also has a user-friendly stock trading platform that is available on any web browser or on your smartphone. Moreover, it has a lot of features to offer including special orders like the guaranteed stop order and the trailing stop order, and a price alerts service. To create an account, you will have to meet a minimum requirement of £100, which you can do with a debit/credit card, Paypal, or bank account. Pros: Cons: 72% of retail investor accounts lose money when trading CFDs with this provider. Beyond Meat has performed extremely well since its IPO in May 2019, and early investors have been rewarded as the share reached an all-time high of $234.90 per share. But this does not necessarily mean Beyond Meat is a good investment opportunity right now as it may be overvalued or very least due for a pullback. As such, it is crucial to do your own research into Beyond Meat shares and the company’s fundamentals in order to determine if this is the right investment for you. Beyond Meat was founded in 2009 by Ethan Brown in El Segundo, California, US. In the first years of operation, the company has managed to raise funds through various venture capitals and big investors like Bill Gates and Biz Stone. Eventually, the company released its plant-based meat products to retails stores in 2012, and since then, Beyond Meat has developed an industrial-scale production of synthetic meat. With the hype surrounding Beyond Meat, the company went public in May 2019 at a price of $25 per share. It was the most successful IPO in 2019 as shares spiked 170% on the first trading day. As a matter of fact, the share price has exploded in the months following its IPO, reaching an all-time high of $234.90 on July 26, 2019. However, between 2019 and March 2020, beyond meat shares dropped to $59.91, largely because of increasing competition in the industry and the Covid-19 pandemic that widened its Q2 loss. But since March 2020, BYND share is on an epic run and is, once again, one of the best shares to buy in the market at the moment. The Beyond Meat share price has since recovered to $189 per share following an impressive sales in the second-quarter report of $113.3 million, up 69% from the previous year. On top of that, investors were particularly excited after the company announced that it’s building up a presence in China with two main facilities outside Shanghai. Beyond Meat does not currently offer a dividend or a dividend reinvestment program to shareholders. As with any company that is still growing rapidly, Beyond Meat won’t pay dividends because it prefers to invest revenues into further growth. Beyond Meat share has been swinging up and down since its IPO and though the vegan meat company was hit by the coronavirus pandemic and other several factors, its share recovered dramatically in 2020, with a year-to-date return of 140.56% and a one-year return of 30.51%. As such, most analysts are confident that Beyond Meat will remain a dominant player in the vegan meat market. With that in mind, let’s take a look at some of the key points why you should consider adding Beyond Meat to your portfolio. In September, Beyond Meat’s management announced its plans to expand to China. The American company will not only start producing plant-based meat in China later this year but will also partner with several food distributors such as the Chinese Sinodis, KFC, Pizza Hut, and Starbucks. Shares of the plant-based meat company obviously spiked following the announcement as investors realize that Beyond Meat lays the ground for future growth in China and Asia. One of the key strengths of successful investors is to identify revolutionary products. In this case, there’s no doubt that Beyond Meat has a unique product in a rapidly growing market. Plant-based meat can presumably reduce greenhouse gas emissions and animal suffering as well as reduce the high consumption of meat in our diets. Basically, Beyond meat’s meat-free burgers are mostly based on a variety of plant proteins like Soy Protein, Potato Protein, Pea, Mung Bean, Faba Bean, and Brown Rice. As many people prefer environmentally-friendly products and the rise of veganism is at its peak, it is only inevitable that Beyond Meat will continue to grow. Finally, in a very short time Beyond Meat has become a profitable company. The company has reported one profitable quarter in 2019 with a net profit of $4.1 million in the third quarter. Then, early on this year Beyond Meat surprised analysts with another profitable Q1 report despite the negative impact caused by the Covid-19 pandemic. The second-quarter results were mixed as Beyond Meat reported a net loss of $10.2 million but also net sales of $113.3 million, an increase of 69% from the previous year. Beyond Meat share skyrocketed more than 140% during 2020, and is potentially a great investment opportunity right now due to several factors. As such, most analysts agree that Beyond Meat share price could eventually hit $240 and beyond. The expansion to China and new partnerships in the U.S. prove that Beyond Meat pushes towards global production and distribution of plant-based meat. For a long-term investment, Beyond Meat is is definitely a buy. The exponential surge in price simply reflects investors’ expectations for the company’s future growth. And as we have seen with companies like Tesla, investors’ sentiment may play a huge role in determining the share price. Even though BYND share is a buy at this point, there’s an option to short sell the stock if the price increases beyond the fundamental value and you simply believe the stock is overvalued. Moreover, if you plan to engage in active day trading or high-frequency trading (HFQ), you should find a platform that allows you to short sell shares. For that purpose, you may find many brokerage firms allowing you to short sell stocks using a margin account, which is an account type that allows investors to borrow money in order to buy securities. The vegan meat market is expected to grow across the world, in particular following the coronavirus pandemic that should push people towards building a better food system. Beyond Meat is a pioneer company in the plant-based meat (also known as PBM) category and its most well-known product, the Beyond Burger, is an essential product for the world as well as for Beyond Meat investors. If you are ready to buy Beyond Meat shares, simply click the link below to get started!

Beyond Meat is listed on the NASDAQ stock exchange in the US under the ticker symbol 'BYND'

No, Beyond Meat does not currently pay dividends.

Yes, Beyond Meat products are available in several stores in the UK including Tesco, Sainsbury, and Ocado. Additionally, according to the Vegan Food UK, Beyond Meat products will soon appear in McDonald’s in the UK.

Unlike many high-growth companies, Beyond Meat has reported a net profit on the third quarter of 2019 and the first quarter of 2020. However, the plant-based meat producer has never yet reported an annual profit.

Beyond Meat (BYND) went public on May 2, 2019, on the NASDAQ exchange at a price of $25 per share. The IPO was one of the most successful in recent years as the opening trade was priced at $46 per share, nearly twice its IPO price. WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. Buyshares.co.uk provides top quality insights through financial educational guides and video tutorials on how to buy shares and invest in stocks. We compare the top providers along with in-depth insights on their product offerings too. We do not advise or recommend any provider but are here to allow our reader to make informed decisions and proceed at their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. By continuing to use this website you agree to our privacy policy. Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. BuyShares.co.uk © 2026 All Rights Reserved. UK Company No. 11705811.

Step 1: Find a UK Stock Broker That Offers Beyond Meat Shares

1. Plus500 – Buy and Sell Beyond Meat CFDs with Tight Spreads

Step 2: Research Beyond Meat Shares

How Much Are Beyond Meat Shares Worth? Beyond Meat Share Price History

Beyond Meat Shares Dividend Information

Should I Buy Beyond Meat Shares?

Beyond Meat Expands to China

Beyond Meat is the Largest Producer of Revolutionary Plant-Based Meat

Fundamentals Are Positive

Beyond Meat Shares Buy or Sell?

How to Sell Beyond Meat Shares

The Verdict

FAQs

What stock exchange is Beyond Meat listed on?

Does Beyond Meat pay dividends?

Can you get beyond meat in the UK?

Is Beyond Meat a profitable company?

How much were Beyond meat shares when the firm first went public?

Tom Chen