XM Trading Review 2026

XM is a well-established broker for forex and CFD trading in the UK. This broker offers nearly 60 currency pairs and more than 1,000 CFDs, plus commission-free account options. XM also gives traders access to the full MetaTrader software suite, which enables you to use automated trading, forex signals, and more.

In our XM trading review, we’ll take a closer look at this broker to highlight what you can trade and how the trading platform works.

What is XM Trading UK?

XM is a global forex and CFD broker founded in 2009. The broker is owned by Trading Point Holding, which also owns Trading.com. XM trading is fully available in the UK, and the broker boasts more than 2.5 million clients in 196 countries around the world.

XM is a global forex and CFD broker founded in 2009. The broker is owned by Trading Point Holding, which also owns Trading.com. XM trading is fully available in the UK, and the broker boasts more than 2.5 million clients in 196 countries around the world.

XM trading offers an online platform with a huge variety of assets to trade. In addition to offering dozens of currency pairs for forex trading, XM has over 1,000 stock, commodity, cryptocurrency, and index CFDs. The broker is also dedicated to offering exceptional customer service.

XM Trading Assets

XM offers UK traders access to a wide range of assets. Let’s take a closer look at all the markets you can trade with this broker.

Forex

XM has built its brokerage first and foremost around forex trading and it has earned a reputation as one of the most popular UK forex brokers. The trading platform currently offers 57 currency pairs with leverage up to 30:1. XM also has several different account types, which we’ll discuss in more detail below, that vary the size of a forex lot and your fees for forex trading.

Stocks and Indices

Although XM was founded for forex trading, it’s made huge headway as a stock broker as well. You can trade 1,240 stock CFDs (contracts for difference) at leverage up to 20:1. The diversity of stocks is very large, as XM allows trading for companies from the US, UK, Europe, Canada, Brazil, and Russia. Notably there are no stock CFDs to trade from Japan, Hong Kong, or China.

If you want exposure to markets in these countries, though, you can trade 28 different stock index CFDs. XM doesn’t offer ETF trading at this time.

Commodities

XM doesn’t have the widest selection of CFDs for commodity trading, although all of the most popular commodities are available. For instance, the broker’s 15 CFDs allow oil trading for Brent and WTI crude, gold trading, and futures trading for a variety of soft commodities like cocoa and wheat.

Cryptocurrency

One thing that UK traders will want to be aware of is that XM does not offer any cryptocurrency trading. However, nearly all of its major competitors offer CFDs for the most popular digital coins.

XM Trading Account Types

XM has three different account types for forex trading: Micro, Standard, and Zero. Which trading account you choose will affect the lot size for forex trades, your fees for forex trading, and what currency you can use for your account.

The Micro account is a commission-free account that treats one lot as 1,000 forex future contracts. It’s targeted at beginner and intermediate forex traders who would rather pay spreads than fixed commissions and who want to trade relatively small amounts of money.

The Standard account is almost identical to the Micro account, except that one lot is equivalent to 100,000 forex contracts. Both the Micro and Standard accounts support 11 different base currencies and have a minimum deposit requirement of £5.

The Zero account reduces spreads for forex trading to as low as zero pips but introduces fixed trade commissions of $3.50 per lot. The Zero account only supports USD, EUR, and JPY as base currencies and requires a $100 minimum deposit. So, expect to pay some additional currency conversion fees when using this account type.

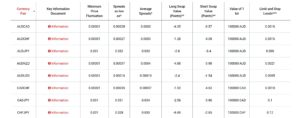

XM Trading Spreads

Spreads for forex trading and CFD trading at XM are competitive, which is one of the biggest reasons that this brokerage is so popular in the UK. XM charges just 1.7 pips for trading the EUR/USD forex pair during peak market hours. At its lowest, the spread can drop to 1.0 pips.

Note that if you have a Zero account, the spread can be even lower. During peak market hours, some major forex pairs can have no spread at all.

CFD trading is commission-free, but spreads can vary widely depending on what assets you are trading. For example, XM charges a spread of 0.7 pips for the popular S&P 500 index CFD.

XM Trading Fees

All XM trading in the UK is commission-free, with the exception of forex trading if you sign up for a Zero account. In that specific case, you will pay reduced spreads but a fixed commission of $3.50 per lot with a Zero account.

XM is relatively light on account fees. You won’t pay a deposit or withdrawal fee at this brokerage, and there is no monthly fee for having an account. XM does charge a withdrawal fee, set at £15 after one year of inactivity and £5 per month for every additional month of inactivity.

XM supports 11 different base currencies, including GBP. This reduces the amount that you’re likely to spend on currency conversion fees.

XM Trading Minimum Deposit

Micro and Standard accounted require a minimum deposit of $5, while Zero accounts have a $100 minimum.

XM Trading Platform

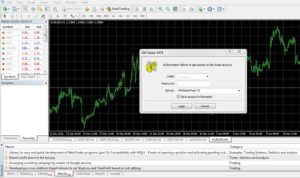

XM doesn’t offer its own proprietary trading platform. Instead, it gives traders access to the widely used MetaTrader 4 and MetaTrader 5 software packages.

The two versions of MetaTrader are similar in many ways, except that MetaTrader 4 only supports forex trading. MetaTrader 5 supports forex and CFD trading for stocks, indices, commodities, and cryptocurrencies. Both MetaTrader 4 and 5 are available on your computer as well as through mobile trading apps for iOS and Android.

The MetaTrader software comes with a steep learning curve, especially for first-time traders. The layout of the software is somewhat confusing, and it can be difficult to search for specific assets. The main way to find assets is to navigate through a drop-down folder structure, which isn’t all that efficient.

MetaTrader 5 comes with more than 80 built-in technical studies and dozens of drawing tools to help you analyze price movements. In addition, you can easily build your own custom indicators using the software’s purpose-built coding language.

The platform’s charts are flexible, too. You can switch between candlestick and other types of charts, such as Heikin-Ashi charts. MetaTrader 4 also supports tick-level price data as well, so you can see what the market is doing in real-time.

MetaTrader 4 and 5 each support forex signals and forex robots. You can create these using any of MetaTrader’s built-in indicators or by creating your own custom technical indicators. The software also provides all the tools you need to backtest a strategy to make sure that your signals will work as expected. You can access up to 10 years’ worth of historical price data for any currency pair that XM supports and see how your forex signal or robot would have triggered under past conditions.

XM Trading MT4

MetaTrader 5 isn’t simply a newer version of MetaTrader 4 – there are some important differences between them.

The most relevant to UK traders is that MetaTrader 4 primarily supports forex trading and only has charts and data for a limited range of CFDs. MetaTrader 5 has much more support for CFD trading, so it’s the better choice if you plan to trade stocks or commodities with XM.

Another thing worth noting is that MetaTrader 4 allows you to manage trades individually rather than in aggregate for an asset. This means, for example, that if you have three long positions for the EUR/USD forex pair, you can modify or close each specific position – they are not aggregated into one large position as they would be in MetaTrader 5.

Keep in mind that if you want to use both MetaTrader 4 and MetaTrader 5 with XM, you can. XM allows you to open multiple accounts, and you get to decide which trading platform you want to use for each.

XM Trading Tools

While XM doesn’t offer its own trading platform, it does have a variety of tools to help you make trading decisions. To start, the broker offers all the feeds you would expect from a popular broker. There’s a news feed that covers global forex, stock, and commodity headlines along with an economic calendar. Both can be filtered by the market that headlines or events are expected to impact.

XM also gives you access to technical research from its in-house analysts. These are typically focused on major and minor forex pairs, and take a closer look at the day’s price charts to identify potential trends or support and resistance levels. XM also typically releases several technical analysis posts daily.

The brokerage offers daily trade ideas that cover the forex, stock, and commodity markets. Most of these are sourced using Autochartist, an automated technical analysis software that identifies price patterns. These trade ideas also come with quality scores and well-defined price targets.

One other tool that’s worth highlighting is XM’s technical indicators for MetaTrader 4 and 5. There are more than 20 custom-built indicators that aren’t standard for these software packages. These indicators can easily be incorporated into your trading strategy as forex signals.

Is XM Trading Legit?

XM trading has been around for more than a decade and is under the authority of some of the most highly respected financial authorities in the world. In the UK, XM is governed by the Australian Securities and Exchange Commission. All UK trading accounts are protected by the UK’s Financial Services Compensation Scheme in the event that the broker runs into financial trouble.

The broker also provides negative balance protection. So, even when you’re trading with leverage, you cannot lose more money than you deposit into your account.

How to Start Trading – Beginner’s Guide

Ready to get started trading in the UK? We’ll walk you through how to set up an account and place your first trade:

Create a Trading Account

To create a trading account, head to the broker’s website and click ‘Open an Account’ from the menu. You will need to enter personal information like your name, email, and phone number. Then choose what type of trading account you want to open and whether you want access to the MetaTrader 4 or MetaTrader 5 platform.

You will also be asked to verify your identity in order to comply with government regulations. To complete your registration, upload a copy of your driver’s license or passport.

Fund Your XM Trading Account

Log into your new trading account and choose to deposit funds by credit or debit card, e-wallet, bank transfer, or wire transfer. Keep in mind that your broker may have a minimum deposit.

Place Your First Trade

Now you’re ready to place your first trade. All you have to do is go to your broker’s dashboard, search for the asset, and opt to trade. When the order box appears, enter your position size and confirm the transaction.

Conclusion

Our XM trader review found that this broker offers numerous trading tools that may help UK traders. The MetaTrader 4 and 5 software platforms can be hard to get started with, but they allow you to create custom indicators, backtest a new strategy, or apply forex signals to improve your trading. XM also has its own library of forex signals that you can copy or modify to jumpstart your account.

The selection of forex pairs and stock CFDs is also broad, although XM doesn’t offer any ETF trading or cryptocurrency trading. As always, it’s crucial to do your own research and choose a platform that suits your needs and investment goals.