Big Lot shares are sliding nearly 10% during this morning’s stock trading action following the release of its earnings report covering the second quarter of 2021 as the company missed analysts’ earnings estimates for the period while the management unexpectedly guided for a Q3 net loss.

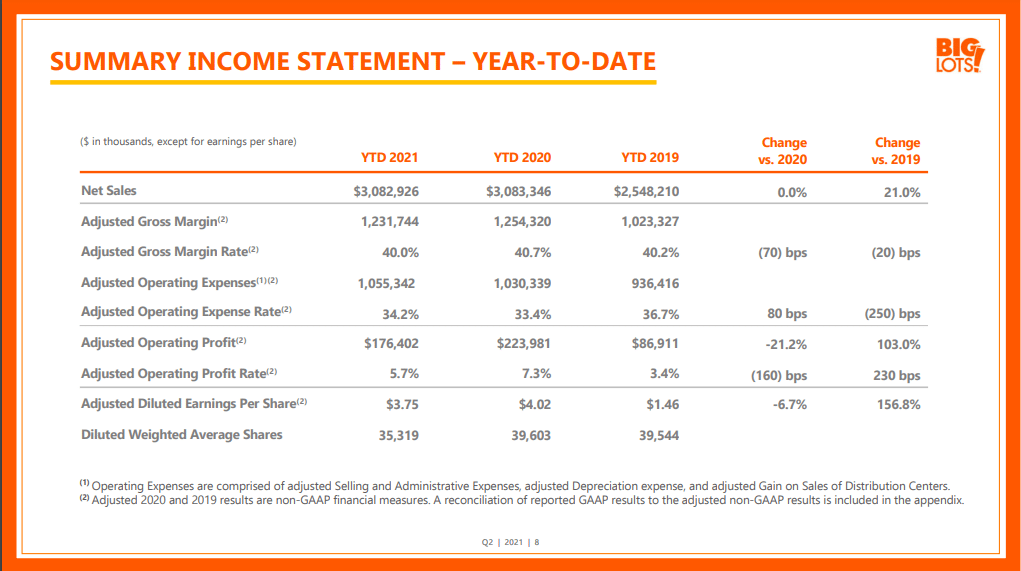

For the three months ended on 31 July, the Ohio-based discount retailer reported sales o $1.46 billion resulting in a 25% drop compared to the same quarter a year ago at a point when the company was experiencing above-average demand amid the pandemic. The figure was slightly higher than the $1.48 billion analysts had forecasted for the period.

The company reported a 13.2% decline in same-store sales, which was worst than what analysts expected, while e-commerce volumes experienced a 10% increase compared to the same quarter in 2020 and a 400% jump compared to the second quarter of 2019 – before the pandemic.

Gross margins for the firm also deteriorated as they dropped nearly 200 basis points while the company is expecting to swing to a loss during the next quarter. In this regard, losses per share are expected to land between $0.1 and $0.2 for Q3 2021 – a forecast that surprised analysts as Wall Street was expecting a positive EPS of $0.16 as per data from Capital IQ.

Finally, earnings per share for Big Lots (BIG) landed at $1.09 resulting in a 60.4% drop compared to a year ago but still 105.7% higher than the bottom-line figure reported during the same period in 2019, before the virus crisis stroked. The consensus estimate from analysts surveyed by Capital IQ pointed to earnings per share of $1.12 for the discount retailer.

The company cited “supply chain headwinds” as the primary reason for this downbeat report along with inflationary pressures. Moreover, the management is forecasting earnings per share between $5.9 and $6.05 for the entire 2021 fiscal year. This estimate was around 65 cents or nearly 10% below analysts’ forecasts for the period according to data from Refinitiv.

The Board of Directors of Big Lots declared a quarterly dividend of $0.30 on the company’s common stock to be paid on 24 September 2021 while it also informed investors about the progress it has made in regards to the share buyback program announced on 27 August last year.

By the end of the second fiscal quarter, the company had utilized $403 million of the total $500 million it initially earmarked for this purpose. Approximately 7.3 million shares have been bought since the program was announced at an average cost of $55.18 per share.

How have Big Lots shares performed so far this year?

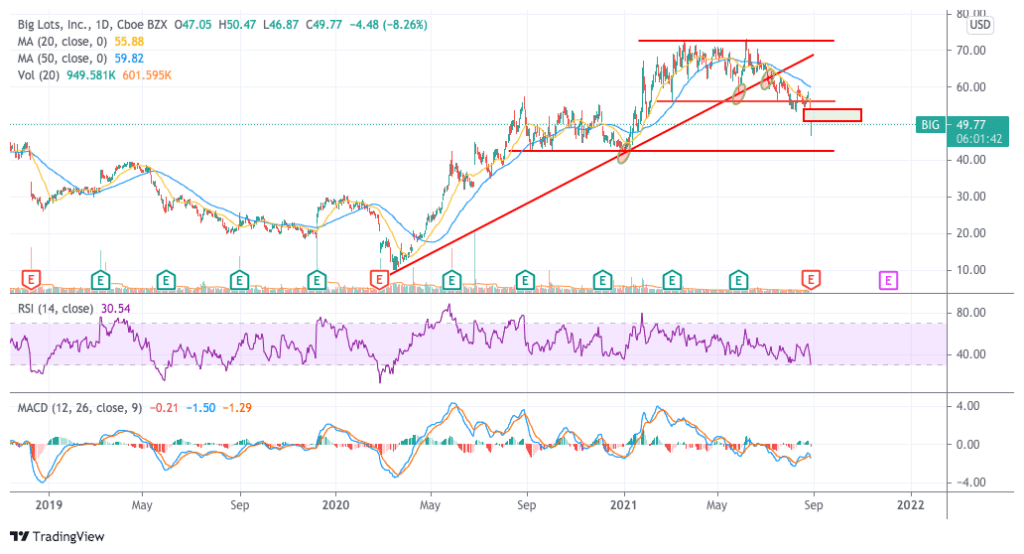

The performance of Big Lots shares had been suffering even before today’s pronounced downtick as the market probably anticipated that the company will be hit by these supply chain headwinds.

However, the stock remains above water, still delivering gains of nearly 17% for investors since 2021 started on top of last year’s sizable 57% advance.

It remains to be seen if analysts will take action following this downbeat report but, for the time being, the consensus recommendation for the stock is Hold based on the ratings extended by 10 analysts as per data compiled by Seeking Alpha.

Only 3 analysts currently have a bullish outlook on BIG while 2 are rating the stock a sell. Meanwhile, the consensus price target for Big Lots stands at $63.8 per share with the highest estimate sitting at $80 and the lowest at $40.

What’s next for Big Lots shares?

The latest price action in Big Lots shows that today’s downtick has “sealed the deal” for the definite break of the stock’s $56 horizontal support while the price could be heading to retest the $43 support area soon.

Momentum oscillators are currently reinforcing this view as the Relative Strength Index (RSI) is just entering oversold territory – meaning that pain may just be starting for BIG stock. Meanwhile, the MACD has just crossed below the line on a pronounced negative histogram reading. All of these factors are pointing to a bearish outlook.

Moreover, today’s drop is leaving behind a sizable bearish price gap that could serve as resistance for any short-term rebound in the price.

From a fundamental standpoint, shares of Big Lots are trading at around 8 times the firm’s forecasted adjusted EPS for this year. Moving forward, analysts seem to be expecting a mild deceleration in the firm’s earnings growth rate for 2022 but bottom-line results are expected to jump in 2023 – possibly once these supply-chain related headwinds are put to rest.

Before the pandemic stroked, Big Lots business was fairly stalled as revenues were growing very slowly while net income remained fairly volatile. If the business slows down significantly to a point that it moves back to pre-pandemic levels, chances are that the stock could shed a sizable portion of the gains that it has seen since the March lows. Before the pandemic, shares of Big Lots traded at around $25 – $30 per share.

All things considered, the outlook for Big Lots is bearish from both a technical and fundamental standpoint and investors should be careful as the stock could be the textbook definition of a value trap.

Question & Answers (0)