How To Buy Greene King Shares – With No Commission

In the face of the global pandemic, businesses and companies have sought to generate multiple revenue sources. Despite all this, Greene King has managed to keep its head above water with smart business decisions and popular ale brands. With most of the world now getting a handle on the pandemic and most economies on the path to recovery,

Greene King could be on a bullish push as it opens up its 3,100 pubs to serve the thirsty public. In this how to buy Greene King Shares UK, we explore how the company works, and how to buy Greene King shares without paying a penny in commission.

How to Buy Greene King Shares UK – Quick Guide 2021

If you are pressed for time and want to buy Greene King shares immediately, then the following four steps should help you get started.

Step 1: Choose a Broker

Deciding on the broker, you want to invest in Greene King shares through is crucial as there are many of them in the market. Nonetheless, what should guide your decision is the fee structure and if the broker is regulated.

Research Greene King Shares

Every financial professional will recommend that you understand what you’re buying when you’re making investment decisions. In the case of stocks or shares, you will need to be familiar with the underlying company and what you’re investing in. Beyond its history, however, you need to also know a little about the company’s financial track record.

Past performances are always a great indicator of what is to come, so you need to do enough due diligence before making a share purchase. Before we consider how to buy Greene King shares, you will need also to have some information about the company. To make things easier, we’ve outlined some of the most significant events in Greene King’s past. The outline below includes details on acquisitions and mergers, investments, and more. You will also be able to gain insights into how the company has performed financially so far.

What is Greene King?

Greene King is the largest pub retailer and brewer in all of the United Kingdom. The company traces its roots back to 1799 when 19-year-old Brit Benjamin Greene founded it. Greene founded Greene King in Bury-St-Edmunds, a town in Suffolk, England. The company has maintained the town as its headquarters to this day. While Greene King started as a pub franchise, the company has expanded significantly in its 222-year existence.

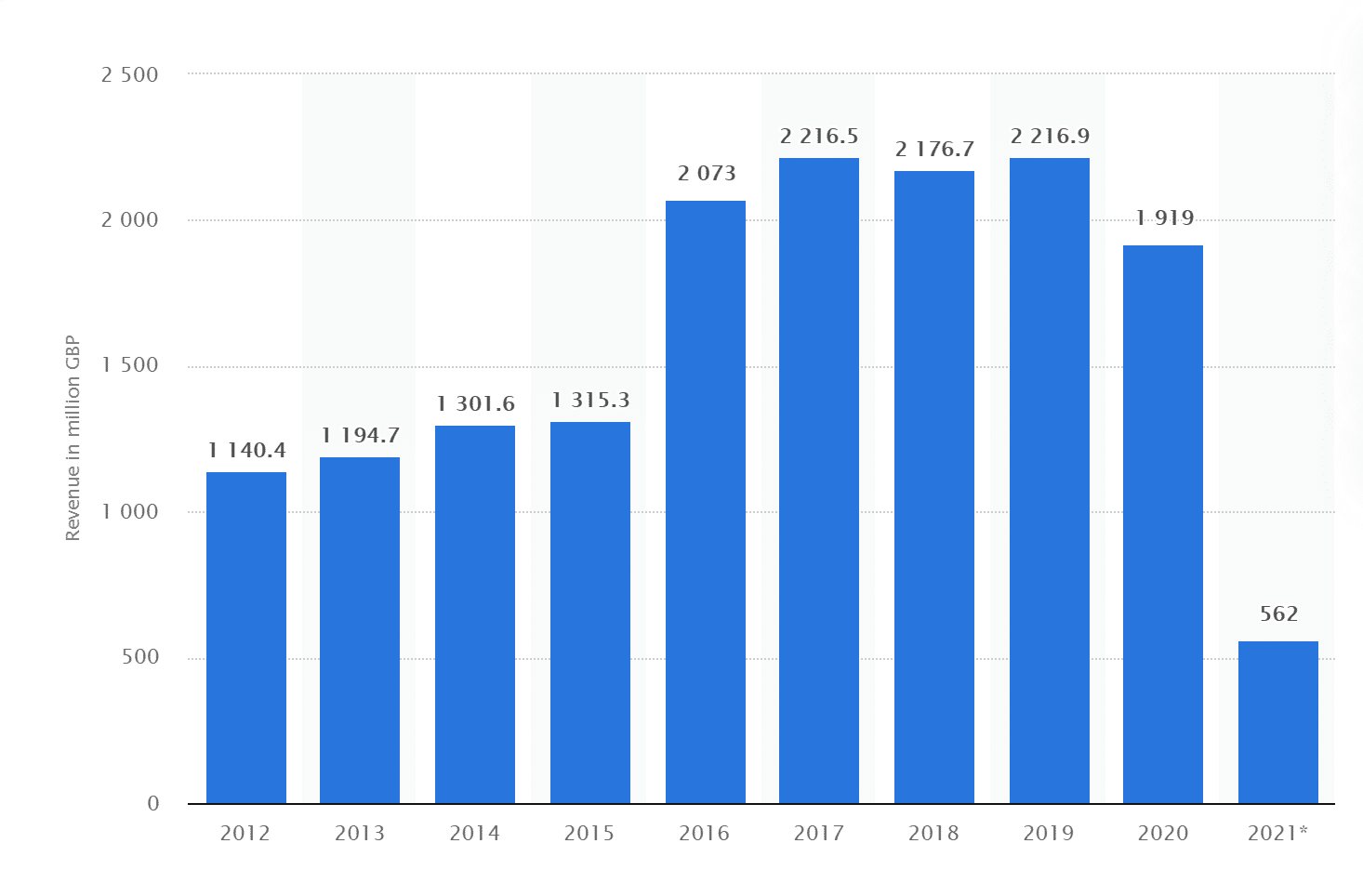

Today, Greene King owns restaurants and hotels as well. When it comes to hospitality in the United Kingdom, Greene King is the oldest – and arguably the biggest – brand name available. The firm achieved £1.9 billion in 2020, according to data from Statista. While that is a bit of a drop from the £2.2 billion it made in 2019, this is still pretty impressive, considering the effects of the coronavirus pandemic on the global hospitality business. The numbers are definitely encouraging for someone looking for how to buy Greene King shares.

Greene King had a primary listing on the London Stock Exchange (LSE). The company traded in the Travel & Leisure sector of the exchange under the ticker GNK. It had a market capitalization of £2.63 billion, according to official data. However, Greene King was acquired in 2019 by CKA Holdings, a multinational conglomerate based in Hong Kong. CKA Holdings is owned by Hong Kong’s richest family – headed by property tycoon and investor Li Ka-shing. According to reports, the deal put all of Greene King – including 2,700 restaurants, pubs, and hotels – under the CKA Holdings umbrella.

Greene King joined the likes of mobile operator three and pharmacy franchise Supedru under the CKA Holdings umbrella, with the deal valued at £2.7 billion at the time.

Greene King Share Price

You will also need to look into a company’s share price and previous performance before you make a decision on how to buy Greene King shares. You want to see how the market perceives the company and whether investors are holding its price up. Trading on Greene King has been canceled since the company was acquired by CKA Holdings. Its share price currently stands at £849.20, and it has been that way for the past year and a half.

As for company finances, we already pointed out that Greene King made a relatively impressive £1.9 billion in 2020. This is even though pubs and restaurants – two of its primary business ventures – were closed for most of the year due to the coronavirus pandemic and lockdown requirements. So, while the revenue numbers did drop, it is an understandable plunge.

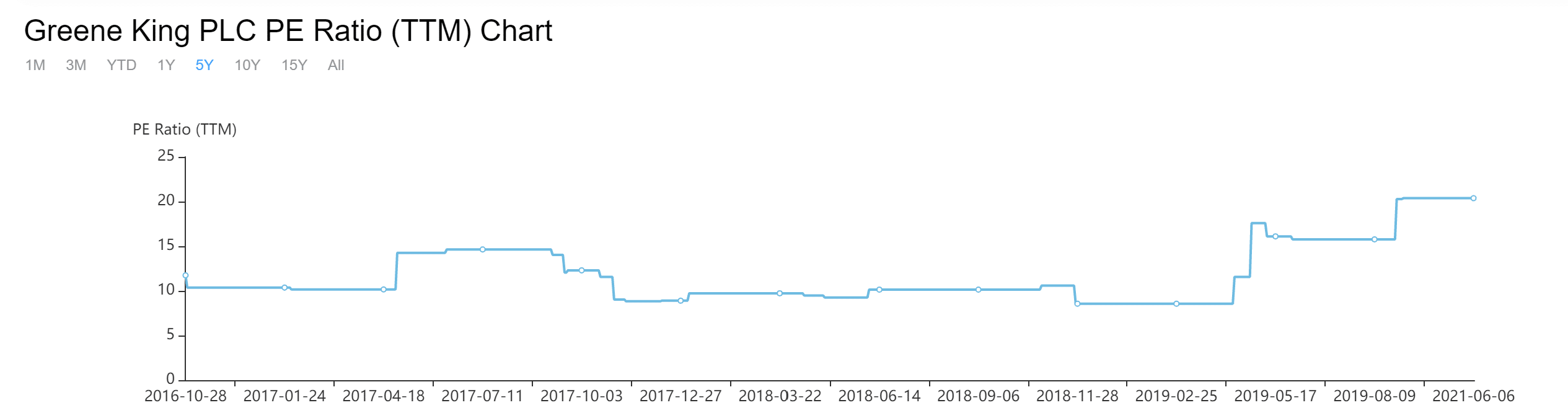

Beyond the base financials, you will also need to consider several other important metrics. One of such is the price-to-earnings ratio (P/E ratio), which measures a company’s share price relative to the price of its earnings per share. The P/E ratio is primarily used to determine the relative value of a company’s shares. It also helps to compare a company against its historical record. Official data shows that Greene King’s P/E ratio is £21.83. Another significant metric is the earnings per share (EPS). The metric is obtained by dividing a company’s profit by the number of outstanding shares that it has.

Data shows that Greene King has £38.90 in EPS, meaning that the company makes £38.90 for every outstanding share available.

Important metrics have stayed relatively constant for a while, showing consistent performance. However, given that these figures have been outdated for two years now, they might not be as accurate anymore.

Greene King Shares Dividends

Another metric that can highlight whether a company is a great purchase is its dividend structure. It is recommended that you consider how dividend payouts work for investors before you invest in Greene King. Greene King’s last dividend payout was for 24.4p per share, according to records. Greene King had been paying investors their dividends in June and November of every year. The records showed that the company was also maintaining a steady total dividend payout – another indicator that its financials had been performing steadily for years.

Are Greene King Shares a Good Buy?

If you’ve read this far, then you probably know enough to decide whether you want to invest in Greene King or not. We’ve examined the company’s financial and historical records, so it’s time to lay it all out and see whether Greene King is a solid company. As Greene King’s numbers show, the company had pretty solid financials when it operated. Now that it is a part of a larger company, we can expect an expansion plan and better performance overall.

However, from what we gather, 2020 wasn’t all too good for Greene King. According to reports, CKA Holdings published first-half results in 2020, revealing that Greene King had contributed to £190 million in losses as a result of the coronavirus pandemic.

We know now that Greene King has largely been able to rise above these doldrums. However, with the world still touchy as far as the coronavirus pandemic goes, it is worth sounding a cautionary note. All in all, there are positive signs for investors looking into how to buy Greene King shares. Some of the key points to note include:

Reopening for the United Kingdom

Investors will do well to note that the United Kingdom is moving full-throttle on the reopening process. The U.K. has already laid out a plan for easing the lockdown, thus allowing people to go back to their daily lives. A full reopening will definitely be music to the ears of Greene King. It will mean that the restaurants and hotels that are part of the company’s franchise will finally be able to open at full capacity and resume profit-targeted activity.

However, it is also worth noting that there are talks of possible delays. Reports have confirmed that civil servants are also working on a contingency plan amid fears of the Delta variant of the coronavirus – which was discovered in India earlier this year. A surge in cases was also recently reported, making authorities more cautious of the virus in general.

CKA Holdings Raising Capital

CKA Holdings has also done relatively well enough for investors to be confident in its ability to shore up its many subsidiaries – including Greene King. In March, Bloomberg confirmed that the Hong Kong-based conglomerate had raised HK$17 billion (£1.55 billion) in capital after selling off four of its subsidiary companies. Beyond the fact that CKA Holdings was able to raise so much capital, the fact that the conglomerate is still holding on to Greene King shows that it believes in the 222-year-old company’s ability to bounce back fully. Long-term investors will definitely be pleased.

How To Buy Greene King Shares UK

Now that you know what Greene King Shares does let’s consider how you can invest in them. To get started, you will need an account with a trusted broker. This section will show you how to buy Greene King Shares without paying a penny in commission. In the five quick steps below, we’ll show you how to invest in Greene King shares – without paying commissions.

Step 1: Open an account

To do this, visit the broker official website and click on ‘Join Now’ in the top right-hand corner. You will be redirected to a signup page to provide a valid email address, alongside a username and a password. There is also the option of signing up with your Facebook or Google account at the bottom of the page.

Step 2: Verify your Identity

This is standard protocol for any regulated broker, and you need to do this to continue to the next stage. Upload a copy of your official passport or your driver’s license alongside proof of residence (you can find this easily on a recent financial statement or utility bill). Once the upload is complete, the broker will verify your documents within minutes.

Step 3: Make a Deposit

Next is to make a deposit. The broker requires a first-time deposit of $200, which comes up to £141. Subsequent deposits will be just $50, and you can pay through the following payment methods:

- Bank wire transfer

- Credit/debit card

- PayPal

- Skrill

- Neteller

- Klarna

- Trustly

Step 4: Search for Greene King Shares

Click the search bar on the top of the The broker dashboard and type “GNK.L.” In the drop-down menu, click on ‘Trade’ in the first result that pops up.

Step 5: Buy Greene King Shares UK

The final step on how to buy Greene King Shares is for you to invest a minimum of $50 in opening a position. After you must have put in the amount, you want to invest in Greene King Shares, double-check everything and remember to put in your stop-loss to reduce your exposure to the financial instrument. Congratulations! You just purchased Greene King shares without paying commission.

Greene King Shares Buy or Sell?

In conclusion, is Greene King shares a good investment option in the UK? In our opinion, adding Greene King to your investment portfolio could provide growth in the long term. This is because the services the company offers are still in demand and with the world slowly coming out of the pandemic, Greene King shares will spike with time.

Greene King has certainly grown in its 200-year history due to great managerial decisions and key acquisitions spread across restaurants, breweries, and hotels. With most companies folding under the impact of the pandemic, an acquisition by Greene King could see it become the UK’s top services provider.

Buy Greene King Shares UK With 0% Commission

FAQs

How much does it cost to buy Greene King shares?

At the time of writing, one share of Greene King shares goes for 849.20p. Usually, some brokers will charge you a commission in addition to the share price, which is shown as a percentage of your position size. All you need to do is pay the share price.

Does Greene King pay dividends?

Yes – they paid a high yield dividend of 6.31% annually before they were acquired. Greene King’s payout ratio was at a healthy and sustainable level. Dividend payments were made every quarter.

What is the minimum number of Greene King shares that I can buy?

Most traditional stockbrokers will require you to buy at least one share when investing in Greene King.

Is Greene King a Good Buy?

Analysts have said that Greene King is one of the best buys in the market. Despite the Covid-19 restrictions on public gathering, Greene King has been performing well. With the leading UK pub retailer considering expansion, now that it's under new ownership. Greene King is one investment you can't let slip by.

Where is the best place to buy Greene King shares in the UK?

There are several platforms to buy Greene King shares.