Shares of British publishing house Bloomsbury were sharply higher in early London price action today, after its fiscal year 2021 earnings smashed estimates and the company rewarded shareholders with a special dividend.

Bloomsbury reported record results in the year as people took to reading amid the crippling lockdowns. The Harry Potter publisher posted revenues of £185.1 million in the fiscal year which were 14% higher than the last fiscal year. Bloomsbury’s profit before taxes and exceptional items increased 31% to £17.3 million during the year.

Bloomsbury reported better than expected earnings

Incidentally, Bloomsbury had raised its earnings projections multiple times over the last year and the final earnings were ahead of its guidance. Expressing pleasure over the record results, CEO Nigel Newton said “The popularity of reading has been a ray of sunshine in an otherwise very dark year. In an outstanding year for Bloomsbury, we delivered record results.”

Newton also pointed that the company’s topline growth was way higher than the 2% industry growth. He added, “These performances demonstrate the strength and resilience of our strategy of publishing for both the general and academic market.”

Segment-wise performance

Bloomsbury operates its business under the Consumer division and the Non-Consumer division. The Consumer division’s revenues increased 22% to £118.3 million in the fiscal year 2021. The segment reported profits before taxation and special items of £14.2 million which was 61% higher as compared to the last year.

Looking at the different titles, Harry Potter sales increased 7% during the year while sales of Sarah J. Maas’ titles rose 129%. The company’s adult titles reported a sales growth of 17% during the year while the vertical’s profits before taxes increased 145%. The sales of children titles rose 26% to £74.6 million while the pre-tax adjusted profits increased 42% to £10.4 million. Bloomsbury termed the performance of children titles as “excellent.”

Management expects the fiscal year 2022 earnings to exceed estimates

The company expects its earnings in the current fiscal year to be ahead of estimates. “Considering the ongoing momentum and strength of our business, Bloomsbury expects revenue to be ahead and profit to be comfortably ahead of market expectations for the year ended 28 February 2022,” it said in the release.

Analysts were expecting the company to report revenues of £177.5 million and a pre-tax profit of £17.4 million in the fiscal year 2022. After the positive commentary by the Bloomsbury management, analysts might also upwardly revise their estimates.

Bloomsbury announces special dividend

Bloomsbury increased its final dividend to 7.58p per share and also announced a special dividend of 9.78p per share. The final dividend implies a dividend yield of 2.3% while the special dividend is a yield of almost 3%.

The company had cash and cash equivalents of £54.5 million at the end of the fiscal year 2021 which was 74% higher than the previous year. Also, its cash flow conversion was 142% in the year as compared to 111% in the previous years. Cash conversion is a key metric and tells us efficiently the company is managing its inventories.

Bloomsbury completed the acquisition of some assets

Yesterday, the company had announced the completion of some assets of Red Globe Press from Macmillan Education Limited for a total consideration of £3.7 million. The company has paid £1.8 million in cash and the remaining would be paid later subject to the assignment of some contracts.

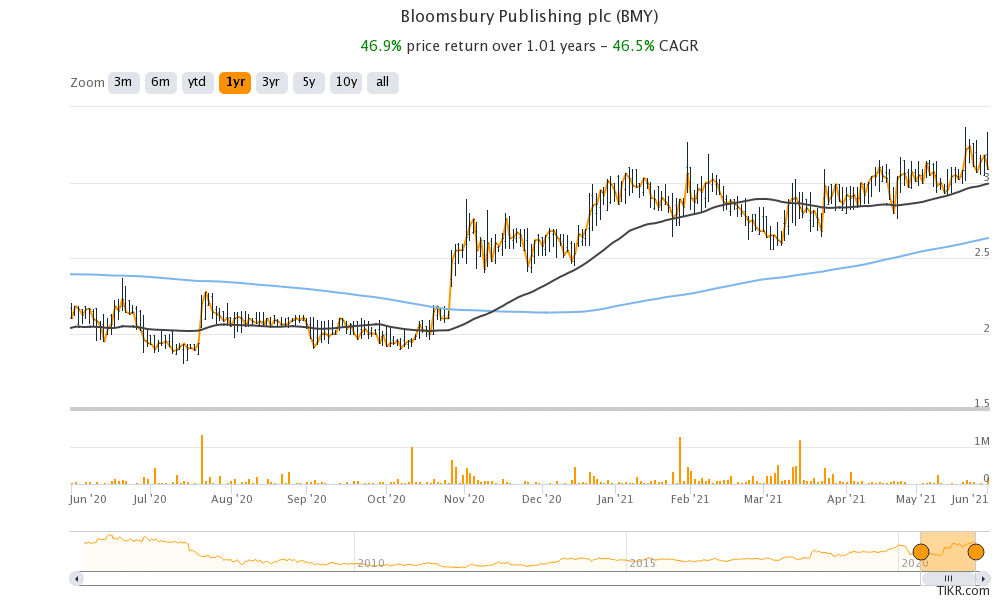

Bloomsbury shares trade above their 50-day SMA (simple moving average) and 200-day SMA which is a sign of technical bullishness. The shares trade at an NTM (next-12 months) enterprise value to EBITDA multiple of 9.82x. The multiple has averaged 10.55x, 9.1x, and 8.56x in the last one year, three years, and five years respectively.

Valuation multiples

The current valuation multiples look higher than the long-term multiples but are lower than what we’ve seen over the last year. While a lot of so-called “stay-at-home” shares got all the attention in 2020, Bloomsbury was among those companies that benefited as people stayed indoors.

Bloomsbury shares were up 8.7% at 336p at AM London time today. The shares are up 47% over the last year.

Question & Answers (0)