UK-based food delivery company Deliveroo has reportedly priced its IPO at 390p, which is at the lower end of its price range. Earlier this week, the company lowered the IPO price range to 390p-410p, narrower than the previous range of 390p-460p. This price caution leads us to ask if the IPO party is over?

The Deliveroo offer is the largest to come to the UK market in recent years. However, 2020 was a record year for the US IPO market and it surpassed the peak that it hit in 1999 amid the height of the dot com bubble. Apart from traditional IPOs, SPACs (special purpose acquisition companies) were also popular in 2020 and they rivalled the dominance of traditional IPOs. 2021 is looking even better for SPACs and the number of SPAC IPOs this year has already exceeded that in 2020.

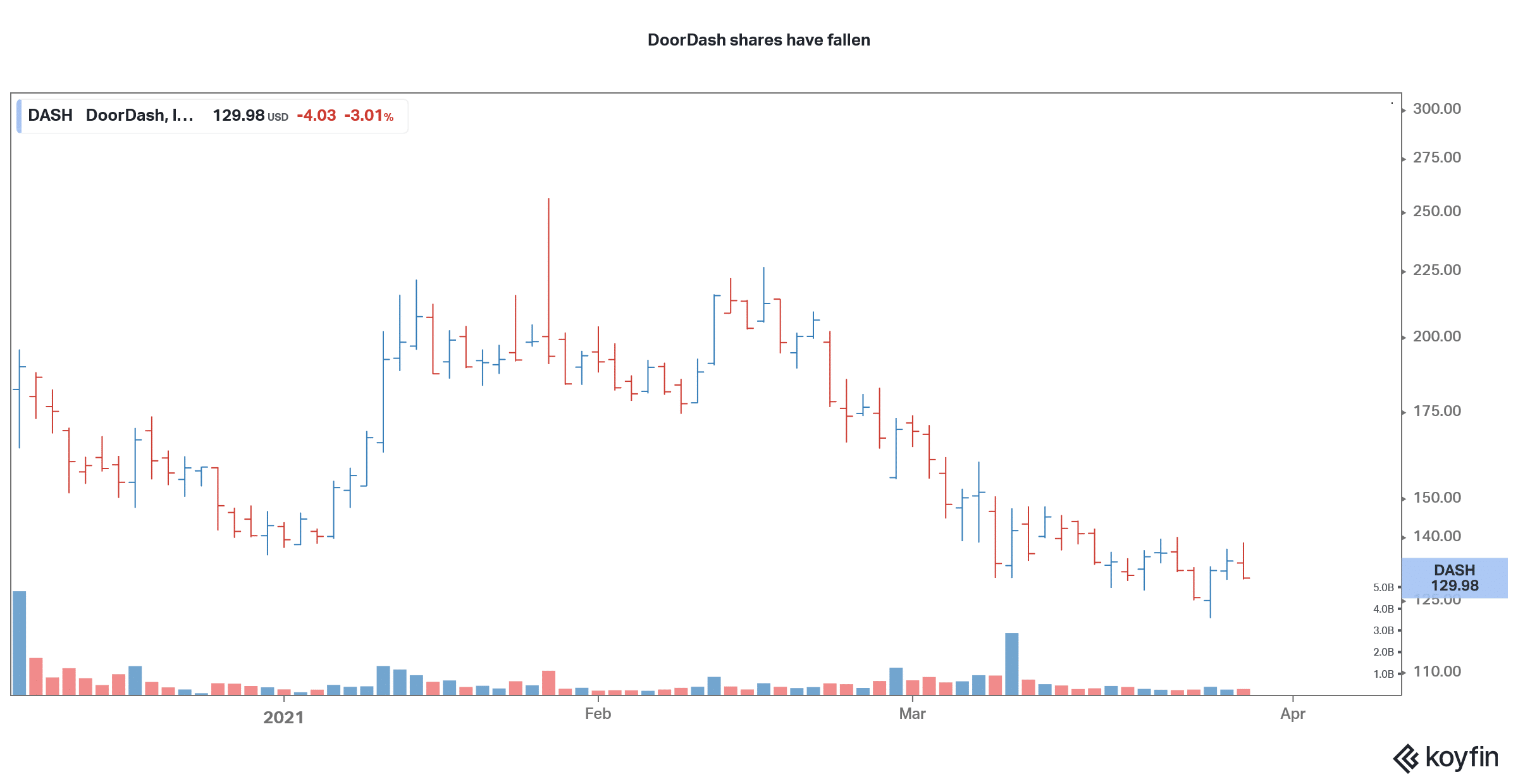

Talking of 2020, it looked that nothing could go wrong for the IPO market. Meal-delivery company DoorDash initially kept the IPO range at $75-$85, which was later increased to $90-$95. The company finally priced the IPO at $102 per share that gave it a valuation of $39 billion.

DoorDash IPO

Even as many analysts had raised concerns over the company’s weak financials, investors bought DoorDash IPO and it soared over 80% on a listing day. Airbnb IPO also soared after the listing which prompted fintech company Affirm and online gaming platform Roblox to delay their IPO to 2021 in a bid to rework (basically increase) the IPO price.

Snowflake, which was also listed in 2020 and even attracted investment from Warren Buffett’s Berkshire Hathaway, also bumped up its IPO price twice during the listing process. Meanwhile, things seem to be changing now, as is visible in the IPO pricing set by Deliveroo for its London Stock Exchange listing.

Why Deliveroo lowered the price range

To be sure, Deliveroo’s toned down valuation is also reminiscent of the broader market developments where there has been a sell-off in growth stocks, especially which are plays on future earnings and cash flows. The rising bond yields are negative for companies like Deliveroo whose cash flows are skewed to the future. Also, markets are apprehensive over the valuations of some of the growth names. There has been a sell-off in DoorDash stock also and it now trades at only about half of its 52-week highs.

The IPO market is facing troubles

Unlike last year, where almost all the companies ended up pricing their IPOs above the initial guidance, this year many companies are finding it harder to sell the high valuations to prospective investors especially given the tech selloff. According to CNBC, “Half of the tech IPOs in the U.S., and in Europe, the Middle East, and Africa, priced in the bottom third of their announced ranges last week.”

Coming back to Deliveroo, it is also facing a backlash from investors over worker rights as well as the share ownership structure which gives its CEO Will Shu more than half of the voting rights. Such differential ownership structure is quite common among Silicon Valley companies, because the founders want to retain the control even as they want to access the capital markets for funds.

Deliveroo riders held a strike

Some of Deliveroo’s riders held a strike in London over the weekend. Globally, workers in the gig economy have been raising their voice over low income and poor working conditions. However, gig economy companies like Deliveroo treat their riders as contractors and not employees, which would entail higher expense towards compensation and other benefits such as holiday pay for the riders.

Some of the institutional investors have boycotted Deliveroo’s IPO. EdenTree is among those who might skip the IPO, with the company describing Deliveroo as “best characterised as a race to the bottom with employees in the main treated as disposable assets – which is the very antithesis of a sustainable business model”.

Deliveroo denies any backlash

Meanwhile, Deliveroo has denied that its pricing of the IPO has anything to do with the strike or the backlash from investors. “Given volatile global market conditions for IPOs, Deliveroo is choosing to price responsibly within the initial range and at an entry point that maximises long-term value for our new institutional and retail investors,” said a Deliveroo spokesperson.

The company also added, “Deliveroo has received very significant demand from institutions across the globe. The deal is covered multiple times throughout the range, led by three highly respected anchor investors.”

All said, the party for IPOs as well as SPACs now seem to be getting long in the tooth. Many of the IPOs have fallen below their issue price, while some SPACs are trading below $10. After the euphoria of 2020, it may now be the moment of truth for SPACs as well as IPOs.

While there is still an appetite for IPOs and SPACs that are offered at reasonable valuations, markets seem unforgiving of companies that are seeking exorbitant valuations despite lacking a clear roadmap to profitability.

Question & Answers (0)