Snapchat shares traded 16% higher in the after-market session yesterday after the company published its results covering the second quarter of 2021 as the social media platform reported above-expected revenues and a positive jump in user numbers.

The Santa Monica-based social app saw its revenues leap to $982 million during the three months ended on June 30, representing a 116% increase compared to the same period a year ago while beating analysts’ estimates of $846 million for the period according to data from Refinitiv.

Some of this growth was caused by a significant jump in the firm’s average revenues per user (ARPU), which jumped to $3.35, up 76% compared to the same period a year ago and 22% higher than last quarter’s reading.

Most of the firm’s new users came from outside the United States and Europe yet ARPU’s in North America displayed the strongest year-on-year advance as they landed at $7.37 per user for a 116% leap.

Moreover, the so-called “camera app” added 13 million new users, with its total global daily active users (DAUs) now landing at 293 million compared to 290.3 million the Street had estimated for this second quarter of the year.

Net operating losses for Snapchat (SNAP) were trimmed to $192.5 million, down from a $310 million figure it reported back in 2020, while net losses also shrunk to $151.7 million or less than half the previous $325.9 million in losses the firm reported during the second quarter of 2020 as well.

Despite trimming its negative bottom-line profitability, adjusted earnings per share (EPS) still came higher than analysts’ estimates as they landed at minus $0.10 or 9 cents above the consensus for the period.

For the third quarter of the year, Snapchat’s management expects to see a 60% increase in estimated revenues to around $1.09 billion while they also forecasted a positive adjusted EBITDA of approximately $120 million or more than twice what the company reported during the same period in 2020.

How has Snapchat performed so far this year?

Investors are reacting quite positively to the report as shares immediately leaped as much as 16% in after-market stock trading action at $73.73. These kinds of jumps are fairly common to Snapchat following the release of its earnings reports including one notable 28% single-day uptick that took place when the firm reported its financial results covering the third quarter of 2020 back in October last year.

So far this year, Snapchat shares are accumulating a 25.8% gain excluding today’s off-session uptick while that performance should accelerate to 48% if the stock opens at this morning’s indicated price.

These appealing gains are coming on top of the company’s eye-popping 206.6% advance back in 2020 as the pandemic provided a strong tailwind for the platform, with user growth accelerating tremendously during lockdowns.

What’s next for Snapchat shares?

Snapchat revenues have been growing at a remarkable pace since before the pandemic stroked, with top-line results rising at an average of 40% per year from 2018 to 2020 while estimates point to a potential 56% jump this year with revenues expected to land at $3.9 billion.

Based on this forecast, Snapchat is trading at a forward price-to-sales multiple of 25 despite the firm’s struggles to produce profits for investors. By the end of this quarter, the company held a long-term debt of $2.55 billion including multiple convertible notes issued at negligible interest rates lower than 1% per year.

It is important to note that the firm’s 2025 and 2026 notes are eligible to be converted and holders may decide to exercise them at any given point as conversion prices for the two issues are $21.7 and $22.8 per share respectively.

If that happens, a total of approximately 101.6 million shares might be added to Snapchat’s total float. This number represents around 6.5% of the firm’s total shares outstanding as reported this quarter.

Moving forward, if Snapchat manages to maintain an annual revenue growth rate of around 40%, we could see the firm’s top-line results landing at around $10.7 billion by the end of 2024. At that point, valuation multiples will determine the upside potential of the stock based on today’s market capitalization.

For example, a P/S multiple of 10 by then would result in a fairly limited upside potential of 8% while a P/S multiple of 20 – one that seems fairly stretched – could result in a 3-year upside potential of 116% for a 29% CAGR.

The long-term prospects for Snapchat stock largely depend on the firm’s ability to keep growing its revenues at the current pace. On the other hand, the short-term outlook appears to be bullish based on an uptrend in momentum readings.

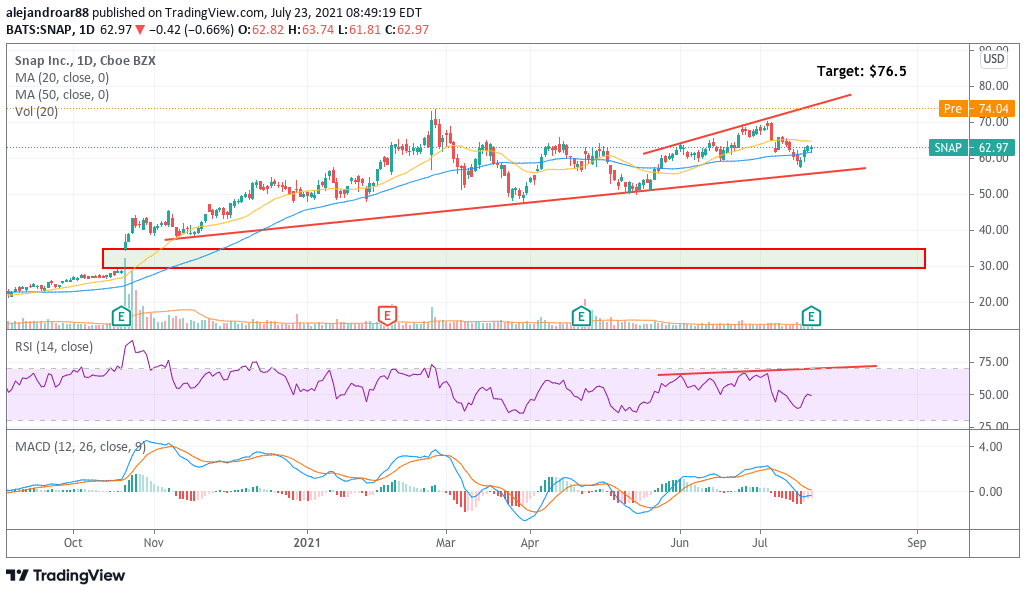

In this regard, today’s uptick could lead to another tag of the upper trend line shown in the chart with an intraday target of $76.5 per share for SNAP. The price action following that tag will likely determine if the stock is heading to new highs (if a break above occurs) or if a rejection could plunge SNAP’s valuation as a result of overly stretched valuation multiples.

Question & Answers (0)